June 2020

The Indian government has pledged to make the country a US$5trn economy by 2024. Janet Du Chenne talks to Sundeep Sikka about Nippon Life India Asset Management’s plans to capitalise on the growth story by offering long-term savings plans and leveraging education and new technologies

In secondary cities and towns in India, the number of Google searches for systematic investment plans (SIPs) on mobile phones increased by 1,600% between 2015 and 2018. This compares with just a twofold increase for the same search in India’s top 15 cities.

Using the wealth of information easily accessible on a smartphone, Indians in these Tier-2 cities are currently seeking new channels for their household savings, beyond physical assets such as real estate. SIPs offer them opportunities to grow investment amounts over the long term by investing as little as 100 rupees (Rs), equivalent to US$1.40 per month, based on the principles of compounding to help wealth grow at an increased rate. And, with the country aiming to become a US$5trn economy by 2024,1 these instruments are likely to be a good fit for people looking to enter long-term private savings markets as their wealth increases.

This projection excites Sundeep Sikka, Executive Director and CEO of Nippon Life India Asset Management (NAM India), who notes the potential to reach more people in secondary cities, where 90% of Indian households are located. “The fact that, as a country, we sell around 17.5 million two-wheelers and motorcycles every year, and yet there are only 20 million investors, tells you there is clearly a long way to go to further educate the population about mutual funds,” he says.

Sikka plans to extend the company’s distribution network further into Tier-2 cities and towns and with the backing of Japan’s Nippon Life Insurance Company, along with application programming interface (API) partnerships with Deutsche Bank, he believes the company has the right ingredients to succeed.

Dawn breaks for NAM India

When Nippon Life Insurance Company bought a 75% stake in Reliance Nippon Life Asset Management from India’s Reliance Capital in September 2019, the fund management industry looked on sceptically. India has a reputation as a graveyard for foreign fund houses that have tried to penetrate an already saturated investment market. Naysayers expected that it would not be long before the Japanese group met the same fate.

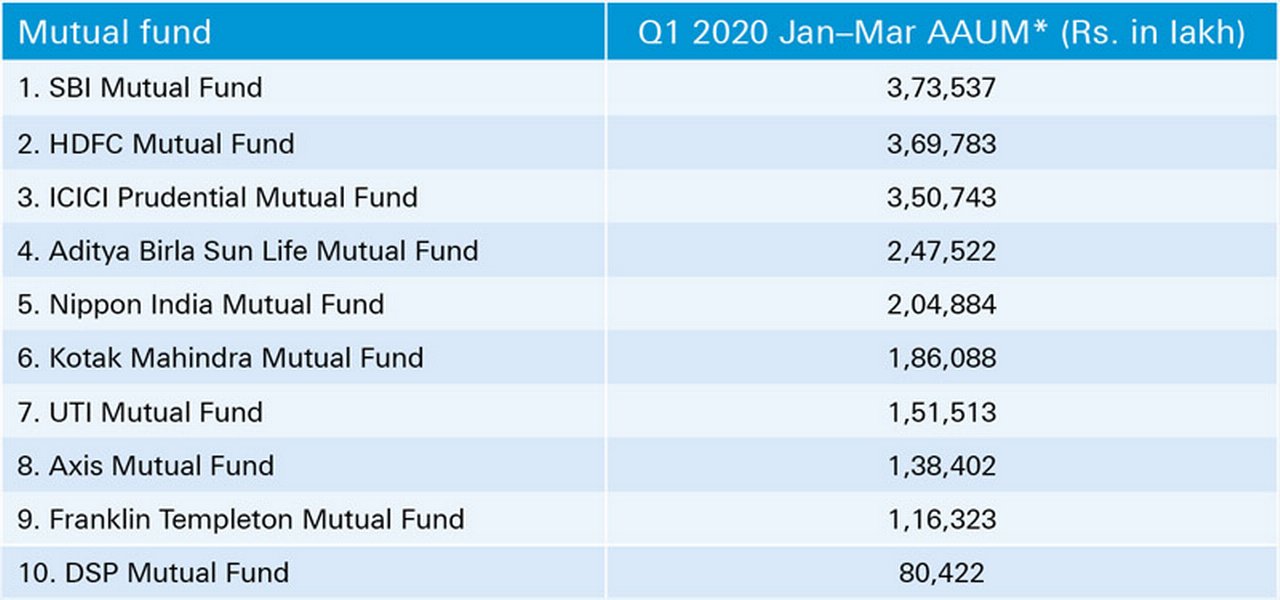

However, by increasing the stake it already had in the company (26%, acquired in 2012) and renaming and rebranding Reliance Mutual Fund as Nippon India Mutual Fund in October 2019, the 130-year old conglomerate, which manages total assets worth more than US$700bn,2 set out to prove to the market that it meant business. With the acquisition completed back in September 2019, Nippon is now focusing on ascending the ranks of mutual funds in India (see Figure 1).

Figure 1: Top 10 mutual funds in India

Source: AMFI

*Average assets under management

Sikka reports that the rebrand and renaming of the company have already had a positive impact. “The transition has gone well and we have received positive feedback from corporate investors, high-net-worth individuals and retail investors,” he says. “After losing market share in the domestic mutual fund market for the last four quarters, since the brand change there has been very positive growth of approximately 10% and we activated more than 170 institutional investors during this quarter.”

"The fact that there are only 20 million investors tells you there is clearly a long way to go to further educate the population about mutual funds"

This revival has begun to be reflected in the performance of NAM India, with its latest quarterly results in March 2020 showing all-round improvement. The asset management company reported assets under management (AUM) of Rs2.6 lakh crore (US34.0bn) as of 31 March 2020.* After the transaction, the company witnessed a recovery in AUM growth after four quarters of decline. AUM during Q4 2019 rose to Rs2.04 lakh crore, compared with Rs2.03 lakh crore as of 30 September 2019, an increase of 0.8%.3

With this change of ownership, NAM India is also emulating the risk management habits of its new parent, which has weathered several ups and downs, including minimal or zero interest rates in Japan for more than 20 years. “Given we are now owned by a Japanese company, investor expect a lot more,” says Sikka. “In India, managing chaos is always very important and you cannot plan to perfection every time. In Japan, long-term planning and risk management are hugely important and I think we can learn a lot from this.” For example, Sikka notes that some planning appointments for 2021 are already in the calendar, which has not happened before.

Adopting a loyal team

Nippon has adopted a loyal management team from Reliance and worked closely with its members to guide the transition. “The entire team has stuck together, having had the comfort of doing so for the past eight years,” says Sikka, who has himself been with Reliance for 18 years. The management team also brings an entrepreneurial flair to the new structure. “We manage it like it’s our own company. So the passion with which we run the company and the passion with which Japanese people run theirs is very similar.”

In addition, Nippon has gained a firm foothold in the market with the most untapped potential in the world. Since 2011–2012, household savings in financial assets have hovered around 7% of GDP.4 However, average savings, which amount to 20−30 lakh crore (according to 2018 data),5 are set to increase in line with the country’s growth ambitions. As the economy expands it will also become more complex, triggering further demand for banking and other financial products.

Seizing the opportunity

US$650m

The Indian mutual fund industry has already grown in leaps and bounds; its AUM increased by over 40% in barely two years, from Rs17.5 lakh crore in March 2017 to Rs24.5 lakh crore in July 2019. During the same period, contributions per month to SIPs almost doubled, from 4,335 crore to 8,324 crore, according to the Association of Mutual Funds in India (AMFI).6

While this is remarkable, in the global context it is still miniscule. India is ranked seventh in terms of nominal GDP, yet in terms of mutual fund AUM it ranks 17th. In a country of 1.3 billion people, fewer than 2% invest in mutual funds. “For a country that does not have a social security system and where a very small percentage of the population is covered by organised pension schemes, that number is low,” says Sikka. “We believe the mutual fund industry in India has great potential and has a long way to go.”

Tapping into India’s potential

Sikka’s enthusiasm is in line with a mutual fund vision document, prepared by the Boston Consulting Group for the AMFI, that aims to set up “guardrails and give the industry focused direction to work towards” in increasing the size of the population invested in mutual funds. The report, titled Unlocking the Rs100 trillion opportunity,7 reveals that nearly 90% of Indian households are located in its Tier-2 cities and beyond.

It concludes that increasing the reach of mutual funds beyond the metro and Tier-1 cities will be critical in expanding the investor base fivefold, from 2% to 10%. To tap into this potential, Nippon is focused on local execution and on distributing its products in Tier-2 cities and towns. “We believe that with our track record and distribution platform, we are in a very strong position to capitalise on this opportunity in the near future,” asserts Sikka.

Increasing awareness in mutual funds

In extending its reach into Tier-2 cities and beyond, NAM India is contributing to an industry-wide financial inclusion effort to introduce middle-income households (those with a household income of Rs3–10 lakh) into the mutual fund ambit via a diversified product proposition to suit diverse financial needs, and by simplifying technical jargon and enhancing investor awareness.

The company conducts investor awareness programmes, seminars and workshops on mutual funds and other investment vehicles across targeted sectors of India’s workforce, including army personnel, Central Industrial Security Force employees, police officers, doctors, bankers and chartered accountants.

Acknowledging the need for financial literacy and investor awareness, the Securities and Exchange Board of India (SEBI) has also mandated the allocation of a certain portion of a fund’s total expense ratio towards investor education. However, more needs to be done to increase people’s awareness of mutual funds, says Sikka.

“Increasing awareness will also require a shift in the mindset among the majority of Indians who have traditionally preferred to invest in real estate and gold,” he adds. “Investing in financial assets is a relatively new phenomenon, particularly post-demonetisation in 2016, when high denomination notes were stripped of their legal tender to combat black market activity and counterfeit currency.”

As asset managers face continuing margin and cost pressures, our technologies enable them to focus on their core business and offer more products and services

In order to help drive this transition in mindsets and to boost financial literacy, NAM India runs a learning academy called Edge, which is powered by a team of financial literacy trainers who conduct educational camps nationwide.

“We believe education is the key, not because it’s important to sell, but because it’s important for people to know why they need to invest, why beating inflation is necessary and how investing through mutual funds can help them achieve their financial goals,” says Sikka. “They also need guidance on which type of products to invest in, and to understand risk, the importance of asset allocation and how to behave prudently during market volatility. So education remains a very important part of that journey, and as a company we remain committed to that.”

Building on strong foundations

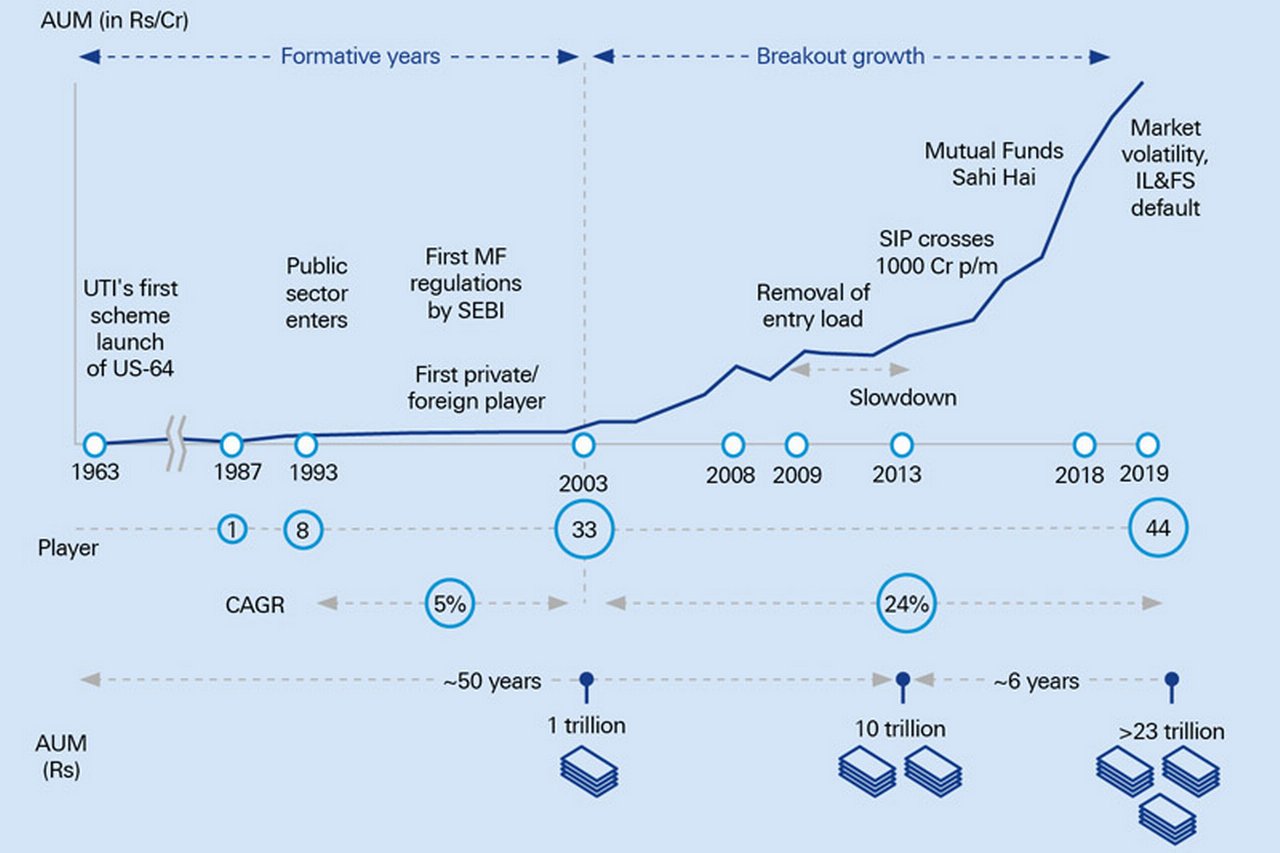

This journey is built on strong foundations established 25 years ago by the launch of the government’s own mutual fund, UTI. Private sector mutual funds came into play in the mid-1990s and the industry saw a major upturn following the demonetisation of 2016 (see Figure 2 below).

Figure 2: Evolution of the mutual fund (MF) industry in India

Source: AMFI, industry research

Notes: AUM values correspond to financial year

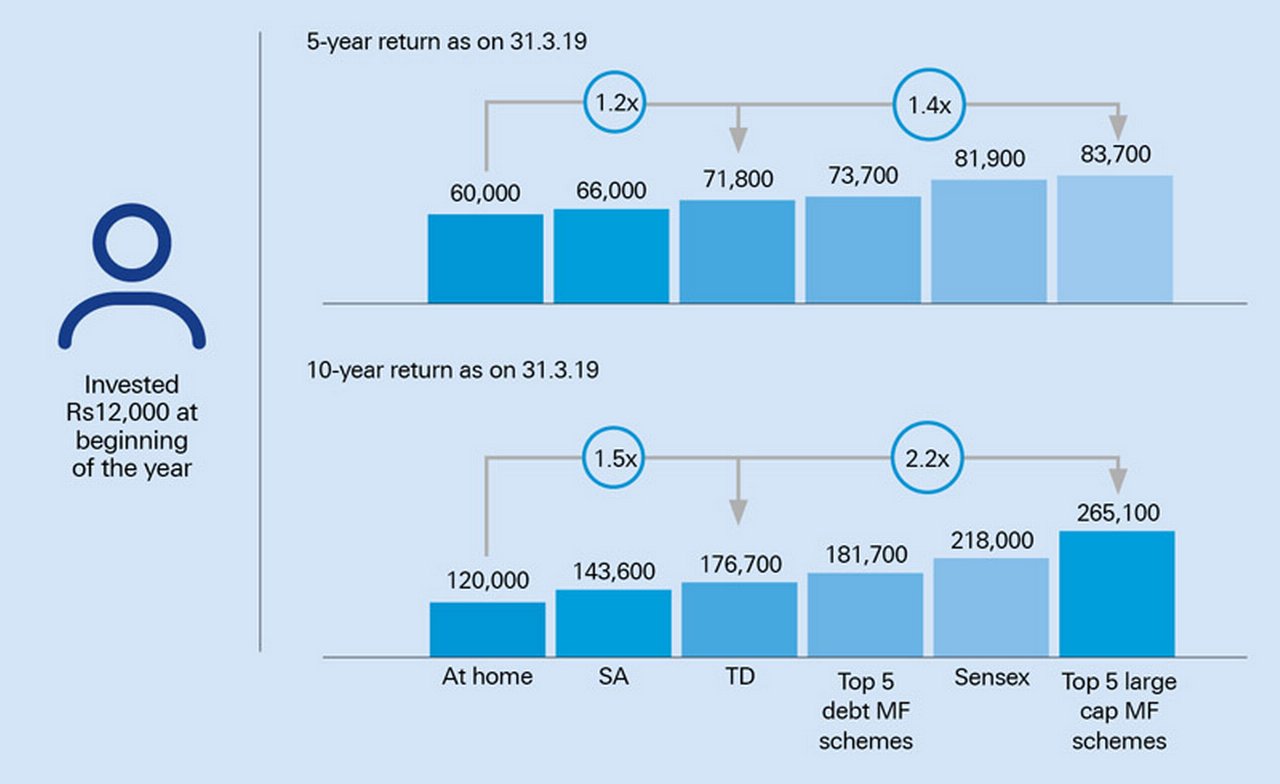

A strong track record of performance has also helped the cause (see Figure 3). “If you look at the data, mutual funds have done a good job in consistently delivering absolute returns over a longer period of time,” says Sikka. “Again, it’s a journey and we have a long way to go, but I am confident that in the next 15 to 20 years we will have every Indian household investing in mutual funds.”

To support this goal, NAM India offers both value- and growth-style funds tailored to suit investors’ needs and exchange-traded funds (ETFs) to deliver absolute returns to them. “We are a supermarket with multiple products and we will let the financial advisor decide the appropriate product for the investor based on their risk appetite,” says Sikka.

SIPs complete NAM India’s portfolio of products that are marketed to investors in 300+ locations (as of 31 March 2019) across the country. SIPs today constitute roughly US$1.2bn on a monthly basis, and about US$15−20bn per annum. “We believe SIPs have the potential to multiply by three to four times over the next five years,” says Sikka. To capture the market, SIP ticket sizes start from as low as US$20, and are designed to entice retail investment away from real estate and gold and into the capital markets, followed by gradual increases. "The idea is that investors enter the market evenly at different points of time, so that investing at intervals becomes a regular habit,” he adds.

Sundeep Sikka and Hiroshi Shimizu, President of Nippon Life Insurance Company, at the announcement of the acquisition

Completing the product basket

To complete its product basket, NAM India is also launching more ETFs and multiasset allocation funds for retail investors and ultra-high-net-worth investors. “With retail investors we keep things simple, with products that are transparent and easy to understand,” says Sikka. "Whereas with alternate investment funds, we will keep launching more and more exotic products."

Domestically, he predicts that mutual funds will become the preferred investment for retail investors. “Interest rates are coming down and Indians are reducing their investments in real estate and gold,” he says. “We believe that with the entry barriers being as high as they are, it’s not easy for new management companies from across the globe to come over and penetrate this market.”

Figure 3: Mutual funds (MFs) deliver consistent returns

Sources: Value Research, Moneycontrol, SBI, RBI, BSE

Notes: Tax rates for each instrument have been taken as follows: SA – 20.6%; TD – 20.6%; Sensex(LTCG) – 10%; Large cap MF(LTCG) – 10%; Debt MF (LTCG) – 20%; Tax on debt MF schemes adjusted for indexation benefit in return calculation; A constant return of 4% has been assumed for savings account (SA); Top 5 MF schemes considered basis AUM as on March 2019; Direct growth plans of top 5 MF schemes considered for return analysis; Medium to long duration schemes considered for debt MF schemes

Leveraging technology

To support its distribution capability, NAM India embarked on a digital transformation, leveraging technology that fuelled retail investor access in these markets. With India boasting around 346 million smartphone users – outnumbered only by China – and the figure rapidly growing, it is not surprising that 41% of NAM India’s new business transactions come from digital interfaces; every 20 seconds, the fund sells an online SIP through digital means. “Digital is a very important part of the industry now and we believe that, in India, you will need both physical and digital distribution, so we have been trying to build up both pillars,” says Sikka.

While extending its distribution reach, NAM India has worked closely with Deutsche Bank, its custodian bank in India, to explore APIs that increase productivity by speeding up transactions in the mutual fund space. “In the asset management industry, cost is a key issue and the fees we charge to investors will always come under pressure,” says Sikka. “It’s important to keep leveraging technology, so that the cost per transaction reduces and efficiency and productivity keep going up.

“We’re very happy with the APIs we are working on with Deutsche Bank. Not only do they help us with productivity, but they also enable us to be pioneers in the mutual fund industry by adopting an interface that helps us to focus on our core, which is fund management and distribution. Meanwhile, many of the other things are left to Deutsche Bank to support us and allow us to increase market share.”

With its presence in India spanning 40 years, the bank is now leveraging these new technologies with clients, taking them to the next level of efficiency. “We’re very excited to be partnering with NAM India on APIs to speed up its mutual fund transactions,” says Michaela Ludbrook, Global Head of Securities Services at Deutsche Bank Corporate Bank. “As asset managers all over the world face continuing margin and cost pressures, our technologies enable them to focus on their core business and offer more products and services.”

Learning from the NBFC crisis

While it is increasing market share, NAM India is at pains to learn lessons from India’s non-bank financial company (NBFC) crisis, which was triggered in September 2018 by Mumbai’s Infrastructure Leasing & Financial Services (IL&FS) defaulting on its high-yield products. When the company failed to meet its payment obligations, the industry sat up and took note, sparking rumours of a systemic liquidity problem in the NBFC space.8

“Whenever the industry tries to run the product on high yield there can be accidents,” says Sikka. “I always maintain that the core for the asset management industry is not only fund management, but also risk management. It’s critical for all of us to understand that it’s not only about working on the risk that can be seen, but also to keep focusing on risks that cannot be foreseen. There will always be risk, but the core comes back to how you create a portfolio and what the risk framework is.”

Future-proofing mutual funds

Going forward, NAM India will continue to focus on profitable growth, both domestic and international, using investments, penetration, reach and systems that together ensure they get a lot more operating leverage. With the asset base of mutual funds as a percentage of GDP at just 11%, compared with the world average of 62%, Sikka believes India offers a unique opportunity. “As we move towards a US$5trn economy, we are talking about a per capita income of US$2,000 increasing to US$5,000 as people save for the future, not only for themselves but also for the next generation.”

And, with structural changes including demonetisation and the requirement for a unique identification number to cover the population who the government deems as those who should be paying taxes, these all bode well for India’s growth story and the development of long-term savings. “Despite the recent slowdown we have seen, we will continue growing at 7−7.5% over the next five to 10 years,” says Sikka. “And with more than 50% of the population below the age of 25 supporting growth, and increasing their wealth, we are very confident that these years ahead will be the best for India and its mutual funds industry.”

*Note: Lakh, crore and lakh crore are commonly used terms within the Indian numbering system to express large numbers, in particular when referring to major monetary values of Indian rupees (Rs). Lakh is equivalent to 100,000 (100 thousand), crore is equivalent to 10,000,000 (10 million), while lakh crore is equivalent to 1,000,000,000,000 (1 trillion). For example: in India, Rs100,000 will often be referred to as 1 lakh rupees; Rs20,000,000 referred to as 2 crore rupees; and Rs5,500,000,000,000 (Rs5.5 trillion) as 5.5 lakh crore rupees.

Sources

1 See https://bit.ly/3slEt7m at indiabudget.gov.in

2 See https://bit.ly/3bqMHlD at mf.nipponindiaim.com

3 See https://bit.ly/3cwdVrg at asianage.com

4 See https://bit.ly/3cCifFm at livemint.com

5 See https://bit.ly/2VoCTmU at thehindubusinessline.com

6 See https://bit.ly/2LsNhYu at amfiindia.com

7 See https://bit.ly/34UNw3Z at amfiindia.com

8 See https://bit.ly/3ezjtmB at economictimes.indiatimes.com

You might be interested in

SECURITIES SERVICES

Building future foundations Building future foundations

With origins dating back to 3000 BC, Athens is one of the oldest cities in the world and the ‘cradle of Western Civilisation’. It is also believed to be the birthplace of democracy and debate and to have tried every form of government known to this day. Against this fitting backdrop, more than 400 securities services industry senior leaders convened in Athens from 11 to 13 June for the Network Forum Annual Meeting to debate its future foundations

SECURITIES SERVICES

Hacking for good Hacking for good

With the right amount of camaraderie and energy, hackathons can quickly identify common client pain points that can be remedied with small pilot projects. flow looks at how this form of collaboration is driving a digitalisation and innovation culture in Deutsche Bank

SECURITIES SERVICES

Securities services in 2025 Securities services in 2025

How is the securities services industry using a business mindset to harness the power of data and digitalisation while co-operating with industry partners to build platforms for the future? Janet Du Chenne reports from The Network Forum in Vienna