July 2019

With origins dating back to 3000 BC, Athens is one of the oldest cities in the world and the ‘cradle of Western Civilisation’. It is also believed to be the birthplace of democracy and debate and to have tried every form of government known to this day. Against this fitting backdrop, more than 400 securities services industry senior leaders convened in Athens from 11 to 13 June for the Network Forum Annual Meeting to debate its future foundations

In a founding partners video, James Cox, head of Securities Services, EMEA, Deutsche Bank heralded the Forum as “a great opportunity for the bank to spend time with clients, partners and peers and for us as an industry to discuss the topics of the day, such as regulation, digitalisation and the future of post-trade more broadly”.

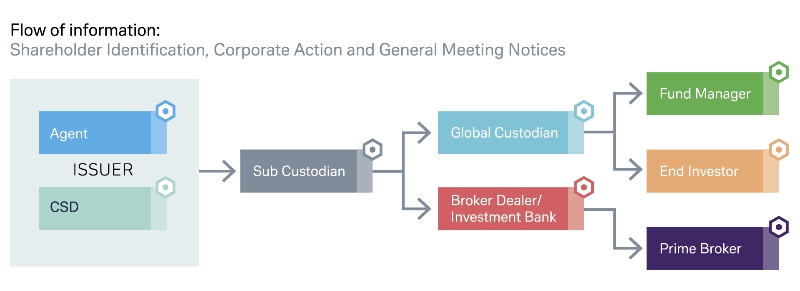

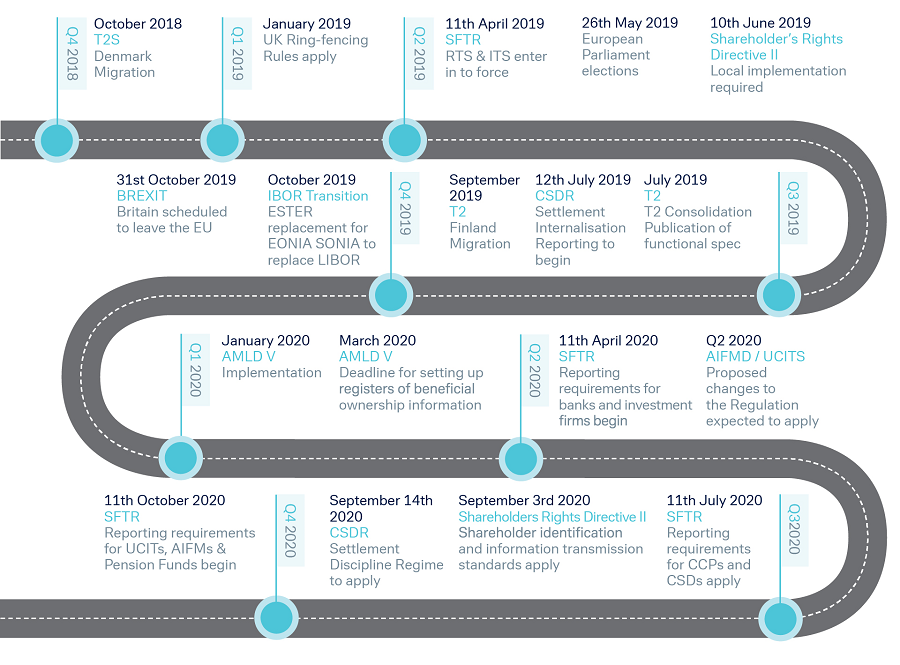

Deutsche Bank provided thought leadership on these topics, including how regulations such as the central securities depository regulation (CSDR) and the Shareholder Rights Directive II (SRD II) (see box out below) are providing opportunities to transition to the future of securities post-trade. CSDR has guidelines aiming to further harmonise the implementation of CSD regulation in Europe, while SRD II makes custodians the conduit of real-time information between issuers and investors and fosters more efficient capital markets. And, with Target2-Securities (T2S) harmonising post-trade settlement processes, this has created the flexibility to manage settlement directly on the T2S1 platform infrastructure or via CSD.

New rules, new roles

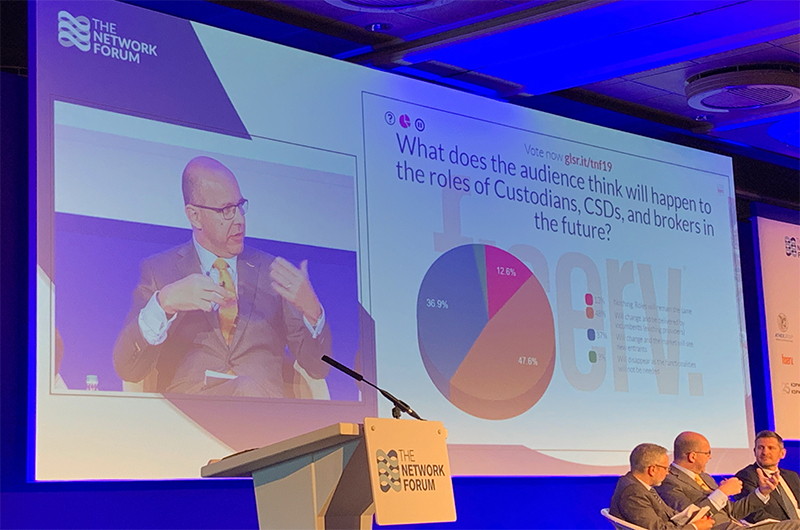

The harmonisation aims of these initiatives have created opportunities to streamline securities post-trade, bringing processes more in line with what consumers experience when placing an order online and getting it delivered to their door the next day. A panel on the first day of the event discussed the impact of these harmonisation initiatives on the future state of the industry and how the roles of market participants will change over the years to embrace these new realities and develop sustainable business models. In an audience poll, more than half believed roles would change and services would be delivered by incumbents and a significant number of new entrants.

In the new landscape, with settlement centralised, custodians would become distributors of information and value added services. They would be appreciated less for their securities vaults and more as databases of information and as conduits for real time data and information flow between issuer and investor to meet the requirements of SRD II (see Figure 1). Similarly, with T2S harmonising settlement, this gives regional CSDs in Europe the ability to move further along the value chain and to offer investor CSD services in addition to pure settlement. Given this movement, custodians have unbundled their services in order to give clients a choice between investor CSD or issuer CSD, and can pick and choose the components that matter to them most.

Figure 1

Improving the customer experience

During the panel, Mike Clarke, head of product management, EMEA, Deutsche Bank, commented that an improved customer experience should be at the heart of the unbundling of service models. “It’s that view of having a range of components similar to the apps on your phone that you can bring together and access through a single gateway and a single trusted provider that I think will become much more important as we move forward,” explained Clarke.

The unbundling of services not only affords the customer a greater choice of the best components from each provider, but also reduces risk and increases efficiency. “It’s recognising that we need to change the way we provide the service, in order to provide cost efficiency and deliver things in a more Amazon-like way where it's much quicker and I’m not waiting two days for my securities to be delivered,” stated Clarke. “That means changing the pace by changing the experience that sits around that, solving real client problems, enhancing service and at the same time reducing risk and increasing efficiency by using technology.”

Sustainable securities services

Solving client problems should be a key driver of the much needed change in business models, according to the panel. This can be achieved by working with clients to understand where it is that securities services providers need to simplify processes for them and the end beneficiary and making those processes as streamlined as possible, with zero manual intervention, given the cost pressures that the industry is under.

"Fundamentally, what we are providing in the market is a trusted partner and a coverage of risk in many ways"

It’s in changing those business models that the industry can build a sustainable future, where custodians can be seen as distributors of value added services who can use technology to make things better for clients2.

During the Forum, several members from the custodian community agreed that a change in fee structures to cover risks is necessary for a sustainable future.

“It's about changing the cost model through to the end investor,” explained Clarke. “That means paying for the value that is received and the risk that is being covered. As we unbundle these specialised services and become more digitalised and transparent, we do need to have an adult conversation as an industry around what people are willing to pay for. And I think people are willing to pay for quality and value.”

Choosing the right projects

That value does not immediately come from large scale projects but rather investing in those that solve client problems, investing in the right technology to solve that problem, and delivering it in a way that’s quick and in a faster time to market, asserted Clarke. The value is generated by delivering a small piece, and taking a small amount of time to uncover one issue and developing a solution to solve for it with the aim of using the same solution in other markets.

For example, Deutsche Bank developed a chatbot Debbie and integrated it with the client’s chatbot to deliver real time settlement status in the Hong Kong market. The successful project was subsequently rolled out to other markets where clients have similar issues in order to return value much quicker whether through efficiency, risk reduction or enhanced client experience.

Mandatory vs discretionary spend

An additional silver lining from the regulatory and infrastructure change seen over the 10 years and the harmonisation of settlement is that industry participants can now balance mandatory spend in complying with those projects with discretionary investment in the platforms and services they offer. It's about trying to be smart as well, in terms of how to respond to the regulation, which creates opportunities to think about things differently, added Clarke. With custodians sitting with client accounts in one spot, they can take a deeper look into the data underlying that to understand client behavior. The additional value comes from giving clients access to that information.

“Embracing the Shareholder Rights Directive is a great example of regulation that is making us really think about how we pass on information, serving as a conduit between investor and issuer,” proclaimed Clarke. “This means being smarter about how we process and enhance our services, while introducing efficiency at the same time as complying with the regulation.”

Collaboration for sustainability

With this call to arms for innovation, financial services research and advisory firm Aite Group presented the findings on new research on digital transformation in the custody industry. Virginie O’Shea, research director, revealed that client lifecycle management, data analytics, user experience and operational efficiency are the hotspots of transformation if delivered in a strategic and well-governed manner. The one piece of technology cited as having the most transformational impact is open source3 technology. Currently being embraced by Goldman Sachs and other large investment banks, it’s something that other institutions could benefit from engaging in, proclaimed O’Shea. Custodians were seen to be at the bottom of the curve on open-source adoption.

Digital transformation of client lifecycle management could solve the problem of clients having to interact with multiple individuals from the same institution, and being asked the same questions in the onboarding and new client acquisition process. There has been a degree of complacency here, according O’Shea, but “the unbundling of services is changing things quite a lot. And the mine field of other types of regulations across the globe are forcing that change.”

It’s getting more complicated for people in KYC, because they're often facing data privacy issues, and in trying to meet their KYC obligations, they’re often in direct contact with each other [sharing data]. So that’s one of the issues that came up clearly from my discussions - people are really worried about the lack of joined up focus on data privacy and compliance issues.

The other area of transformation, data analytics, could also create new services, however the industry underestimates the scrubbing required before the information goes into the data lake, warned O’Shea, who also added that basic cyber hygiene is an area that needs improvement.

The joining up of multiple entities in organisations and how they work together is another area that is needed to improve client service. “Obviously, we need to think about how we better develop products and services going forward,” said O’Shea. “We may have siloed views of what clients are asking for, from a business this perspective…so the industry needs to think about developing products and services that meet the actual requirements, rather than building something, and hoping people will actually use it.”

Another key ingredient for digital transformation highlighted by the research is an understanding of the objective of new projects from outset. Unless they are measured and proven, that financial and operational support would disappear with the C suite when they leave. “So we really need to think about retaining key metrics and governance to make sure that we keep that support for the projects across the different individual stakeholders,” stated O’Shea. “The purchasing cycle for FinTech is sometimes longer than start-ups can actually survive in the market so we need to get better at making sure that we get on board with these guys much faster.”

Cloud is another big part of the change that is often underestimated, according to the research. “The average tier one financial institution has less than 10% of its stack in a public cloud environment,” revealed O’Shea. “And many have less than 1%. If we think about the drivers for investment in cloud, often people focus on cost reduction. And it’s no surprise that it doesn't really reduce your costs that much to begin with. What it does do is allow providers to scale up and with current data storage issues, deployment on the cloud is much quicker and enables access to the next gen technology capabilities of the future.”

The research also showed that while services such as data management and reconciliation have fully embraced the cloud, the area of post-trade, with its legacy systems, will take the longest to adopt it since there are many mainframes providers need to think about. In conclusion, the research provided some recommendations on where the post-trade industry should focus in order to leap frog transformation: data analytics, open source development and the hiring and retention of new talent.

Tech versus talent

This last point was elucidated by Julia Streets, CEO of Streets Consulting and producer of the DiverCitypodcast.com, who suggested that diversity lay at the heart of innovation. In her presentation on the Innovation Conundrum, Streets proclaimed that technology is delivered at speed when there is a diverse group of people who are encouraged to fail fast and without bias. “This is achieved when you have diversity of experience and background sitting around your table,” she said. Streets highlighted how reverse mentoring programs are proving to be an effective tool in driving greater alignment, communication and collaboration between the five generations that work in the financial services industry today. Key to the programs' success, lies the need to mentor employees who are truly unlike the leaders doing the mentoring, despite a natural temptation to want to mentor more like them. “These can have an enormous impact – suddenly you have a constant feedback loop for ideas, a culture of open lines of two way communication, healthy challenge to traditional thinking, all of which are components of high performing teams,” she said.

Solving the client problem

Keeping the client at the centre of exploring new technologies and talent was discussed during a panel debate titled “What is the problem we actually need solved?” Disruption vs collaboration – what is the current state of play now? An audience poll during this session revealed that Fintech disruption is still the biggest change agent in securities services, with 35.8% of the audience agreeing that external Fintech offerings will have the greatest impact on accelerating the pace of corporate change. However, internal innovation initiatives were almost equally noticeable (31.7%), while industry bodies/ working groups (21.3%) and established vendor engagements (11.2%) were also changing the game.

SWIFT’s global payment innovation (gpi) initiative was cited as a successful example of how industry collaboration on clients’ common payments issues can mobilise the industry to move forward at pace. GPI, which launched in 2017, is now moving beyond its successful implementation in the correspondent banking space to become the ‘new norm’ across the network, expanding its relevance to all financial institutions, including capital markets.

“The issue is not just around technology, but equally around agreeing expectations in service levels and phased roll out. The technology is one piece. SLA alignment is the other.”

Highlighting its potential to deliver benefits including intraday liquidity and reductions in operational cost and risk, SWIFT’s senior market manager – capital markets, Matthew Cook cautioned that the key to success is enabling the industry to move forward together.

This remains the case as the organisation moves to explore APIs and their application in capital markets, where Cook highlighted “a continued need and willingness for collaboration on standards” and “interoperability is required in order to succeed”.

Cook warned that cyber security should be front and centre of technological innovation in 2020. “It’s important that the industry analyses how it handles and protects its own and its clients’ data,” said Cook. “More data means more governance and responsibility.”

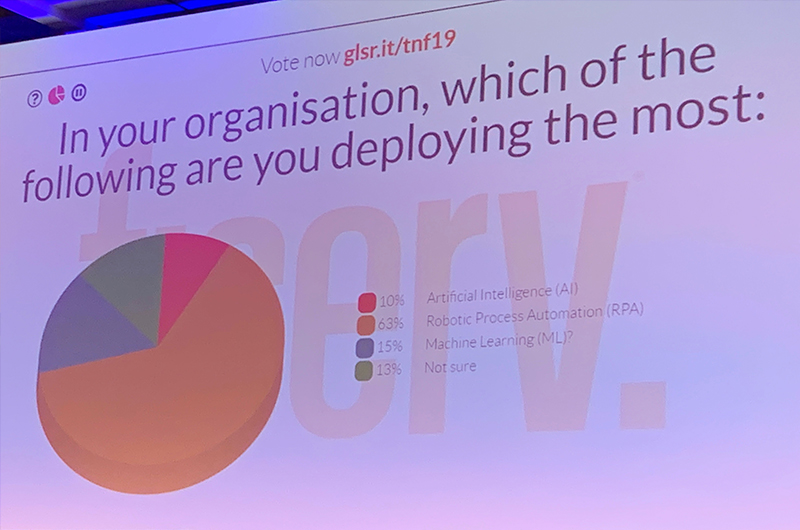

Data Dynamics

Another example of where industry collaboration has the greatest potential for change in the community and the wider custody world is in AI, which can lead to an efficient client experience and where getting the data right can deliver risk management insights to clients. This innovation comes through collaborating on common problems and solving them in a real time way, bringing together the custodians as data aggregators and Fintechs as idea generators, noted Ralph Achkar, Managing Director – Digital Product Development and Innovation team at State Street. “It’s about co-investing and making our investment money work for the same purpose,” he commented. “We need to ensure the environment is there for AI to grow, by understanding its capabilities and having the governance around it.”

Edwin de Pauw, head of data services and innovation at Euroclear agreed, but stressed that some level of control is still needed: “We need to let go and let the computer make some of the decisions but we need to keep some of the audit trails,” urged De Pauw. “We need to start looking at the data that goes through the lifecycle of a security and use it to build insights from which humans can build tools.”

"Freeing that data from the legacy enables you to do more with it, for example in getting information between issuers and investor in SRD II compliance. It’s a great way of making the process more efficient by using the data more effectively."

Panellists agreed that data will come into its own over the next 12 months as the industry focusses on continued regulatory compliance with SRD II and CSDR. They consented that since most clients settle overnight, machine learning and data analytics tools can be used to analyse the transaction history and to find anomalies and provide insights into why certain trades are failing thereby enabling them to take action. So the conversation becomes cost-to-value oriented as it’s more sustainable.

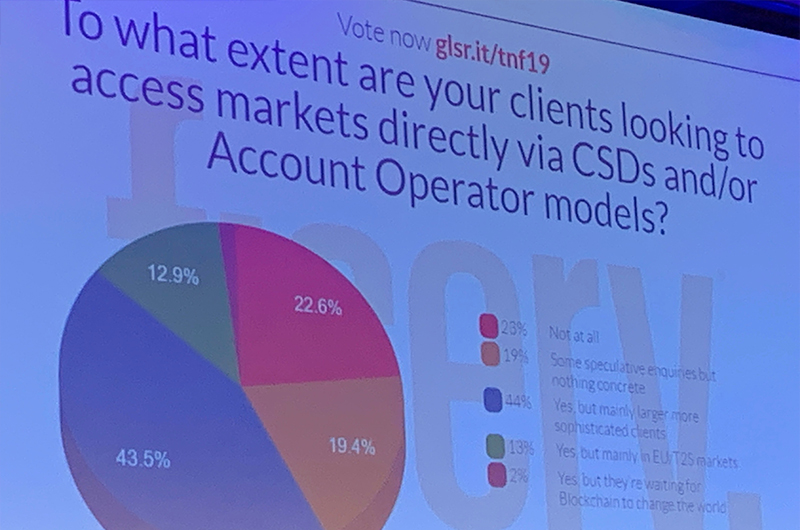

Unsurprisingly, the topic of sustainability through delivering value flowed into day two, with a discussion about how much of that is driven by collaboration between the CSD and custodian community. With T2S and CSDR driving greater choice and flexibility, clients can operate their securities account at the CSD, with variations of the account operator model (i.e. the investor CSD4 and the issuer CSD5 model). Experts from the sub-custody and ICSD community shared their experiences of this, with Kristian Stangberg, head of securities services at Handelsbanken, describing a model whereby the client operates the account themselves and bank provides the asset services.

Models such as these help clients reach economies of scale while avoiding having too much activity concentrated with one provider. In addition, while the account operator solution allows clients to have a direct connection to the market infrastructure, it’s the sub-custodians who can insulate them from the complexity of operating in several markets for asset servicing. For example, with T2S the unbundling of services is becoming more commonplace and is enabling the sub-custodian to take on the role of local market expert and provide asset servicing, remarked Mike Collier, director – EMEA product management, Deutsche Bank Securities Services.

He highlighted tax reclamations as a key component of where such expertise is required and where providers need to be agile and mobile.

While industry participants are aligned on settlement mechanics post-T2S, the standardisation of cross-border mechanisms is still lacking. “That’s when you need your market experts to know the market nuances and operate that account,” said Collier.

Going forwards

In conclusion the panellists predicted that industry participants would have more impetus to re-engineer their operating models and choice of providers once the regulatory dust has settled in September 2020 (see Figure 2). “I think after September next year, once the dust settles with CSDR and SRD II, people will start to engage the different models out there,” concluded Collier.

Figure 2

SRD II affects us all

Adhering to the spirit of the directive and going beyond the minimum requirements will benefit all parties in the securities post-trade value chain, explains Deutsche Bank’s Securities expert Mike Collier.

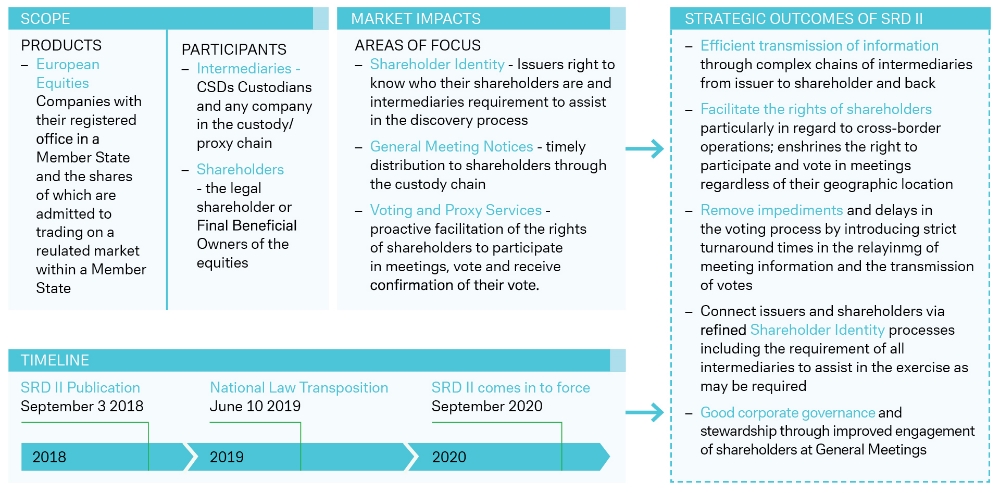

Shareholder Rights Directive II lays down the minimum requirements as regards shareholder identification, the transmission of information and the rights of shareholders. The directive aims to improve the dialogue and long-term engagement of Shareholders with Issuers to stimulate good corporate governance and company stewardship thereby combating a key market failing identified by the EU Commission as an agent of the last financial crisis.

In order to achieve this the industry, via several task forces, is going beyond the minimum requirements of the directive to harmonise the shareholder identification process and the flow of both corporate action and general meeting information. The industry is striving to achieve this through standardising the process from the Issuer, their agent, the Issuer CSD and the chain of intermediaries until the ultimate shareholder.

How will SRD II impact you?

SRD II will impact participants in two ways:

- Shareholder identification: The directive imposes deadlines for identifying the shareholder for each intermediary. The directive also outlines the information intermediaries are required to disclose. The industry is advocating that Issuers send their discloser notices via the Issuer CSD to ensure the information is disseminated through the holding chain.

- Corporate action and general meeting information: The directive also outlines deadlines and the minimum requirements for the flow of information. Again the industry is advocating that the flow of information comes from the Issuer CSD to ensure the information is disseminated through the holding chain and the deadlines imposed are adhered to.

The Opportunity

By introducing the measures outlined the industry will harmonises and standardises the process and allow all parties to adhere to the distinct set of rules that need to be apply (see Figure 3).

For shareholder identification there will one process (today there are several) and the Issuer will be able to have a clear reconciliation of the positions held through the chain of intermediaries.

From a corporate action and general information perspective, there is a realistic opportunity to use the Issuer CSD as the ultimate source of the Golden Record and to also mandate the Issuer to disclose all information from the date of the announcement. Here the industry is assisting Issuers by formulating event templates and who the reasonable party is for disclosing the information.

From September 2020 we may finally see major barriers being removed in the post-trade industry.

Sources

1 See focus topic Smarter Custody at corporates.db.com

2 See Dashboard Dynamics at flow.db.com

3 Open source software is software with source code that anyone can inspect, modify, and enhance. https://red.ht/2L3ahN7 at opensource.com

4 An investor CSD – or a third party acting on behalf of the investor CSD – opens an account in another CSD (the issuer CSD) so as to enable the cross-system settlement of securities transactions (Source: ECB)

5 A central securities depository (CSD) in which securities are issued (or immobilised). The issuer CSD opens accounts allowing investors (in a direct holding system) and/or intermediaries (including investor CSDs) to hold these securities. (Source: ECB)

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

SECURITIES SERVICES

Accelerating technology-led transformation in Asia Accelerating technology-led transformation in Asia

The first event of “The future of Asset Servicing Leadership Series”, organised by The Asset magazine in collaboration with Deutsche Bank, looked at how Covid-19 is accelerating digital transformation of the securities services industry in Asia

SECURITIES SERVICES {icon-book}

Regchecker Regchecker

In this latest brief, Boon-Hiong Chan, Global Head of Market Advocacy, Securities Services at Deutsche Bank, highlights key digital assets and data regulatory developments in 2020

SECURITIES SERVICES

Digital securities: the future of capital markets Digital securities: the future of capital markets

How are digital assets reshaping the traditional securities business in Asia? The latest in the webinar series “The Future of Asset Servicing Leadership, organised by The Asset magazine in collaboration with Deutsche Bank, offered an in-depth review