December 2020

How are digital assets reshaping the traditional securities business in Asia? The latest in the webinar series “The Future of Asset Servicing Leadership, organised by The Asset magazine in collaboration with Deutsche Bank, offered an in-depth review

The emergence of digital securities – as supported by blockchain and distributed ledger technology (DLT) – is heralding a new era in asset management. As digital assets gain traction, regulators are launching initiatives to support the development of the market, and traditional investors and asset managers are slowly pivoting their business models towards the digital realm. But who is driving these developments, who stands to benefit and what exactly are the advantages?

These questions were addressed on 22 October as participants from across 25 countries came together to participate in the third and final webinar in The Asset’s “The Future of Asset Servicing Leadership” series. Leaders from across the industry discussed how digital securities are shaping the future of capital markets and countries where they have already been implemented.

Regulatory state of play

The session began with Paroche Hutachareon, senior expert on bond market development, Public Debt Management Office Thailand covering the latest developments in the country. “The Bank of Thailand has been very active in the digital asset space, having leveraged DLT to reduce bond settlement times from 14 days to just two,” he told delegates.

More recently, he has been involved in a project that saw the Thai government launch a savings bond using blockchain technology1. “Savings bonds are traditionally sold to people over 60 who are sitting on a lot of wealth and are wanting some extra reward,” he explained. “We thought blockchain technology could help promote financial inclusion, allowing us to lower the unit for investment to encourage the younger generation and those in lower income groups to also have access to this financial asset.”

Developments in Singapore were covered by Alexandre Kech, CEO & co-founder of Onchain Custodian, a custody and open finance service for digital assets, who noted that the city state’s regulators have been relatively favourable and forward looking. He added that “the Payments Service Act has been enabled2, which stipulates that entities, such as crypto exchanges or custodians dealing with digital payment tokens or E-money in the form of stable coins, will need to obtain a licence and will have to comply with stringent procedures.”

On the securities token side, the Monetary Authority of Singapore’s (MAS) stance is that a digital security remains a security, which reflects no real change to existing regulation. Meanwhile, the Singapore Exchange (SGX) issued its first digital bond using blockchain technology in September 2020, with the objective of making it a pilot programme3.

Alessio Quaglini, CEO of digital asset custody platform Hex Trust, agreed the webinar’s dominant theme is that regulation is fast becoming clearer. In Hong Kong “we’ve seen the Securities and Futures Commission granting the first licences to broker dealers, as well as exchange platforms in principle, and they are also putting together a framework for asset managers operating in the space.”

For Samar Sen, Global Head of Digital Products and Client Connectivity, Securities Services, Deutsche Bank, now is the perfect time to be discussing digital assets. In July 2020, the Office of the Comptroller of the Currency (OCC) in the US issued a letter4 outlining how US banks can interact with cryptoassets. In Switzerland, the Swiss Financial Market Supervisory Authority (FINMA) is already trying to build a secondary market for tokenised securities, while, in Germany the financial regulatory authority, aka BaFin, has started giving guidance on how to be a licensed crypto custodian. So, he concludes, “we are seeing a lot of movement in this space – not just in Asia, but around the world”.

Reflecting on the current state of play, Avaneesh Acquilla, Chief Investment Officer, Arrano Capital, referenced the very unregulated Initial Coin Offering (ICO) boom of 2017, which was driven by a number of bad actors and tarnished the industry’s good name. “I think that needs to be cleaned up a little, and I think the move forward in regulation is certainly helping in this respect,” he commented.

Future potential

So regulatory momentum is building, but who stands to benefit from these developments in the digital asset space? Sen reported that clients tell him they are excited about digital assets for a host of different reasons. “Some of the early adopters were in wealth management, so that is one potential area, where customers already hold these assets but maybe want to do so in a trusted, insured way.

“Beyond that, and in view of some of the regulatory announcements, we’re seeing many other client types emerge. Some of our traditional asset managers, for instance, are starting to open digital asset desks or funds within their portfolios – so this could be an interesting pilot client for us. I have also spoken with sovereign and pension funds who are looking to this space, though many face investment committee challenges in getting this allocation right. Finally, we are now even seeing opportunities with corporates, such as PayPal, as well as a number of fintechs.”

Deutsche Bank’s policy, he explains, is to be agnostic to the different standards or marketplaces emerging: “We want to be able to connect our customers with these various new digital asset classes and safely keep them at the same time.”

For Hex Trust’s Quaglini, two main categories are relevant to his business. One group is the digital asset native players, which have a defined idea of what they need in terms of custodial services and know exactly what kind of services they want from the ecosystem in terms of trading, lending and borrowing. On the other side of the spectrum, financial institutions, central banks and non-bank financial institutions are all looking to the space. For them “it is going to take a little bit more time” he suggested.

Onchain Custodian’s Kech broadly agreed, adding that, for him, there is also a third and fourth category. Third is the more traditional players, such as trustees, who want to offer digital custody services to their customers but, whether due to lack of knowledge or lack of technology, cannot. In these cases, he explains, Onchain Custodian can almost play the role of sub-custodian. He identifies the fourth category as “the platforms that want to offer cryptocurrency access to their customers but do not want to deal with the complexity of setting up a wallet solution that is secure, insured and robust – and as a result, they are looking at us to do this for them.”

"We want to be able to connect our customers with these various new digital asset classes and safely keep them at the same time"

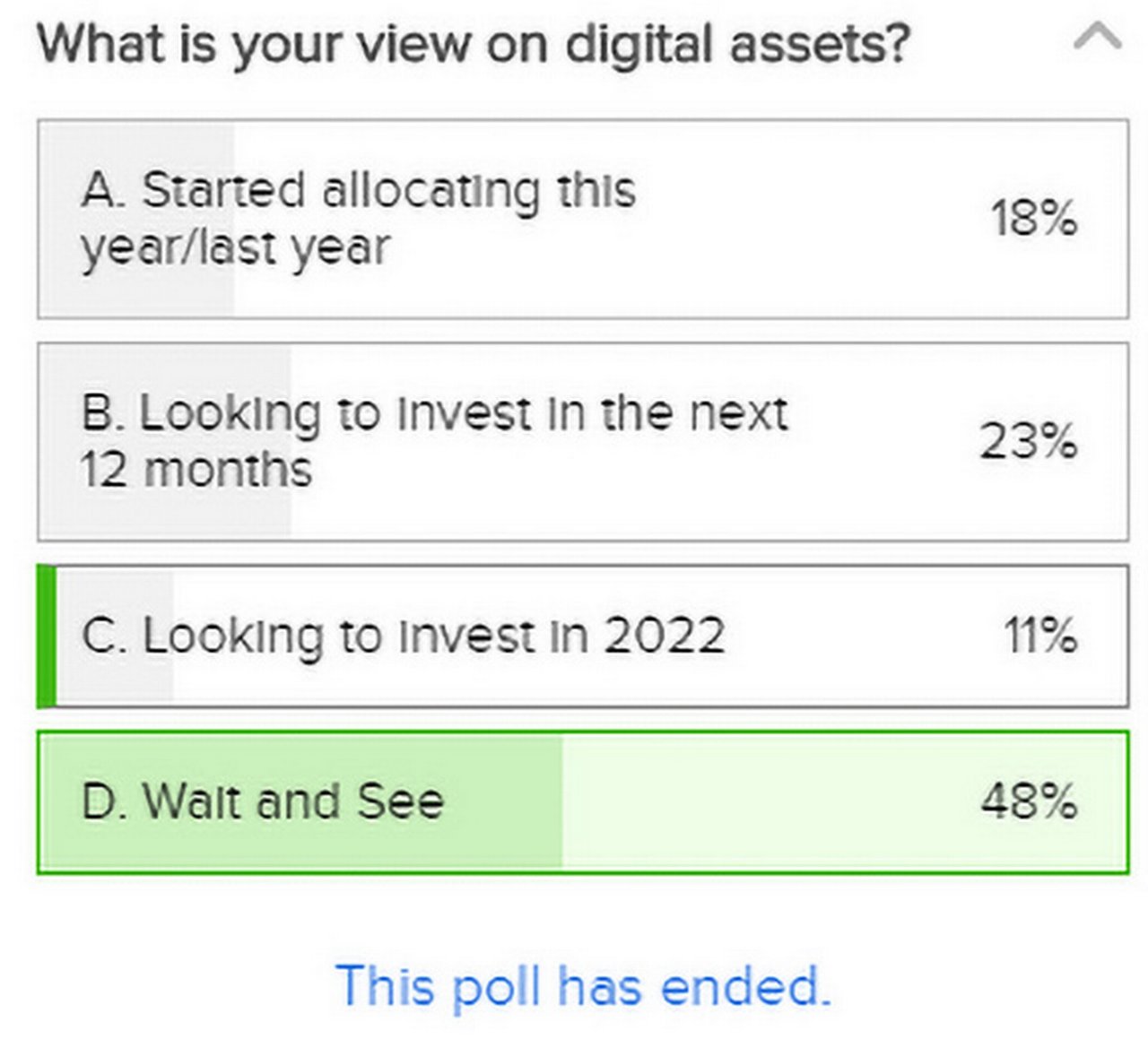

Not everyone is yet so bullish on these developments, however. Attendees’ responses to a poll asking “what is your view on digital assets?”, suggested that the panellists still had their work cut out when it came to convincing clients to invest in digital assets – with 48% stating that they would ‘wait and see’. That’s not to say that there isn’t momentum: the majority of attendees indicated they have some form of plan to invest in this nascent market in the near future, with nearly one in four indicating they would look to do so in the next 12 months.

Overlooking DLT efficiencies

Sen suggested that in discussions on how DLT is used to create new types of digital assets, the potential of the technology to improve the speed, efficiency and transparency of some of “our old financial plumbing” often misses the attention it deserves. Yet there are many exciting projects underway that could enable E-voting, instant settlement, more efficient tax processing and cross-border payments and transparency over beneficial ownership.

For example, Sen reported that experiments underway up and down the value chain address the challenges of trust between multiple counterparties. “Take a typical investment lifecycle: it goes from investor to asset manager to global custodian to custodian to broker to exchange and so on – there are a lot of participants. Often, even when you are trying to perform something trivial, such as identifying the beneficial owners, the process can be quite painful, as each party is storing the same information all the way up and down the value chain.” By creating a trusted exchange of information, DLT can dramatically improve these processes.

Kech concedes that there are opportunities to use DLT for exchanging information that is currently, as Sen outlined, duplicated across the chain. Nonetheless he believes that “the error of the industry has been to decouple DLT from digital assets. I think the maximum power of distributed ledger is when it's used to exchange value – when it's used to exchange assets in a transparent, efficient and easily auditable way.”

Looking to the future

Before the webinar concluded, panellists had an opportunity to offer their thoughts on the future of digital assets. Acquilla said that he is keen to see how blockchain technology can be used to eliminate information asymmetries. “We live in a world where really there should be close to perfect information. Yet every day we are confronted with transactions where this information is imperfect.

“For example, when buying a car, you can't really trust the owner on a number of basic aspects – when was it last serviced, has it ever been in an accident, are all the components original.” If, however, you could represent a car in a token form, this information could become immutable fact. So, he concludes, being able to make these kind of transactions without intermediaries and with minimal friction, is the future he is excited for.

Hutachareon agreed, adding that he wanted to see better information flow, better consolidation of information, and lower cost for raising funds, while Quaglini looks forward to seeing more traditional financial institutions entering the space.

For Kech, “the future will be us as individuals or as companies being able to use different types of tokenised assets – whether cryptocurrency, tokenised commodities, securities in the form of digital assets – interchangeably to purchase items and perhaps even pay your taxes.”

Sen closed the session with his vision for the future: a world in which we are able to solve historically entrenched problems within society, such as providing underbanked populations with access to many different types of assets, such as land, through fractional ownership.

Sources

1 See https://bit.ly/3owGBpY at fintechfutures.com

2 See https://bit.ly/33Nak6c at mas.gov.sg

3 See https://bit.ly/3lYQDPi at finextra.com

4 See https://bit.ly/39Nm2S3 at occ.gov

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

SECURITIES SERVICES

SRD II affects us all SRD II affects us all

Adhering to the spirit of the directive and going beyond the minimum requirements will benefit all parties in the securities post-trade value chain, explain Deutsche Bank’s Steven Hondelink and Mike Collier

SECURITIES SERVICES {icon-book}

Dashboard dynamics Dashboard dynamics

Consumers have had, for some time, the ability to shape service provision and get instant access to information within their personal lives. How do these changing expectations and dynamics impact the securities services environment? flow’s Janet Du Chenne explains how post-trade processes are being transformed by robotic process automation and data analytics

SECURITIES SERVICES

Demystifying ESG in securities lending Demystifying ESG in securities lending

Regulators and market practitioners have introduced multiple initiatives to drive the adoption of ESG in securities lending. flow reports on market enthusiasm and what will boost the integration of sustainability in the market