October 2018

Consumers have had, for some time, the ability to shape service provision and get instant access to information within their personal lives. How do these changing expectations and dynamics impact the securities services environment? flow’s Janet Du Chenne explains how post-trade processes are being transformed by robotic process automation and data analytics

In today’s fast-moving digital world, consumers are being provided with personalised, data-enriched services and becoming accustomed to having more actionable information when and how they want it. It is only natural that such expectations are being translated into the services they require in their professional lives. As a result, financial institutions are working with their corporate and institutional clients to deliver the same level of service by bringing them closer to their data to improve the end user experience.

Deutsche Bank’s Securities Services team began this process by unbundling its products into components, providing clients with only the services they require and pioneering new solutions such as the Asset Servicing Only model. With this initial step successfully delivered, the team is now embracing an agile approach to provide deeper insights into service related data and further enrich the client’s settlement experience.

Embracing a new approach

The Securities Services team has adopted a collaborative and agile delivery approach to ensure focus on projects that deliver benefits to our clients in the near-term.

To drive this effort, we have embraced the following three steps:

- Working closely and collaboratively with the client to understand the real problems encountered in their day-today business, as well as by their end user clients.

- Identifying a contained problem with the client to solve through focused, small pilot projects rather than a wholesale change that takes longer and may not keep pace with technological change.

- Bringing together business knowledge and technical specialists across locations to ensure we have the experts working on solving the true problem in the right way.

Jeslyn Tan, Global Head of Product Management, Securities Services Deutsche Bank, explains that this approach has enabled the team to problem-solve in a way that allows multiple users with similar issues to benefit from the same solution.

“This also means less investment is required, which means we can deliver at least one tangible benefit without the need to ramp up resources,” she says.

This three-step approach has already led to two successful project deliveries in 2018.

- Partnering with a global custodian client to achieve greater efficiency by addressing problems related to trade settlement status,cut-off times and market deadlines; and

- Collaboration between Securities Services and the Deutsche Bank Data Labs in Dublin to build insights into cash liquidity usage, from both a client and an internal treasury perspective.

Improving the efficiency of trade settlement status

In June 2018, a collaborative partnership between Deutsche Bank Securities Services and BNY Mellon was announced. This has resulted in the streamlining of settlement status queries for the Global Custodian’s end clients. End client queries that required conversations between the Global Custodian and Deutsche Bank staff as well as information from multiple systems can now be answered in seconds, providing an enhanced client experience and a more cost-effective process.

At the start of the partnership, Deutsche Bank engaged with the client to achieve a common understanding of their pain points and identify a priority pilot problem: obtaining timely trade settlement status updates for the Hong Kong market.

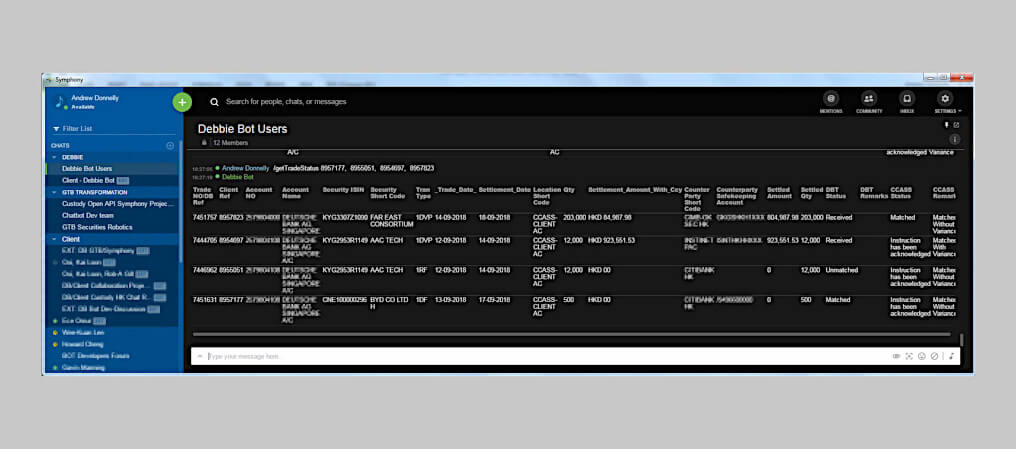

To tackle this particular problem, Deutsche Bank leveraged Symphony, a widely used, secure, cloud-based financial markets messaging and collaboration platform, and application program interfaces (APIs), to create a chatbot solution (‘Debbie’) that streamlined access to the required information. By integrating this new Deutsche Bank chatbot with the one developed by the Global Custodian, manual intervention into the query process was removed and data from multiple systems was combined into a single response.

In the former process, which can take several minutes:

- An asset manager calls their global custodian to check their trade settlement status for multiple trades in the Hong Kong market to know if they have been matched.

- The Global Custodian calls Deutsche Bank, its sub-custodian in the local market, who checks its internal systems and central depositary system for the most up-to-date information.

- Deutsche Bank then responds with the status, either over the phone or by email, which contains a file that shows the required information.

- The Global Custodian then updates their end client.

This process meant that the end client had to wait for the response, depending on the number of trades in the query.

"The insight gained from analysing and condensing large data sets into actionable insights enables effective decision-making and delivers tangible benefit"

In the current process, which takes a matter of seconds:

- The asset manager can ask their trade settlement query within the Symphony platform.

- The Global Custodian’s chatbot recognises the query and automatically triggers a request to Debbie for the trade statuses.

- Debbie checks the query with Deutsche Bank and the Central Depository’s systems for the latest status information and then passes this back to the Global Custodian’s chatbot.

- The Global Custodian chatbot combines this information with other required information and responds directly to the end client.

This new process removes all manual intervention and enables a response to the end client query in a matter of seconds, regardless of the number of trade queries.

It was launched in June 2018, when Deutsche Bank successfully connected Debbie with the Global Custodian’s chatbot within Symphony. This integration has now replaced previously manual responses for status updates on their securities trades in the Hong Kong market. As a result, the end client now receives a much faster turnaround time to their queries, which is particularly important to help them manage trades near market settlement cut-off time and prevent trade failures that could potentially lead to financial loss or reputational risk.

Providing data insights in Securities Services related cash liquidity

The second project addresses the heightened focus on cash liquidity within the financial services industry. Treasurers need visibility into their company’s cash positions globally to optimise their available liquidity, reduce funding costs and maximise return on cash. Furthermore, financial institutions are having to prove to regulators that they know their available sources of liquidity and have adequate capital reserves in the event of a crisis.

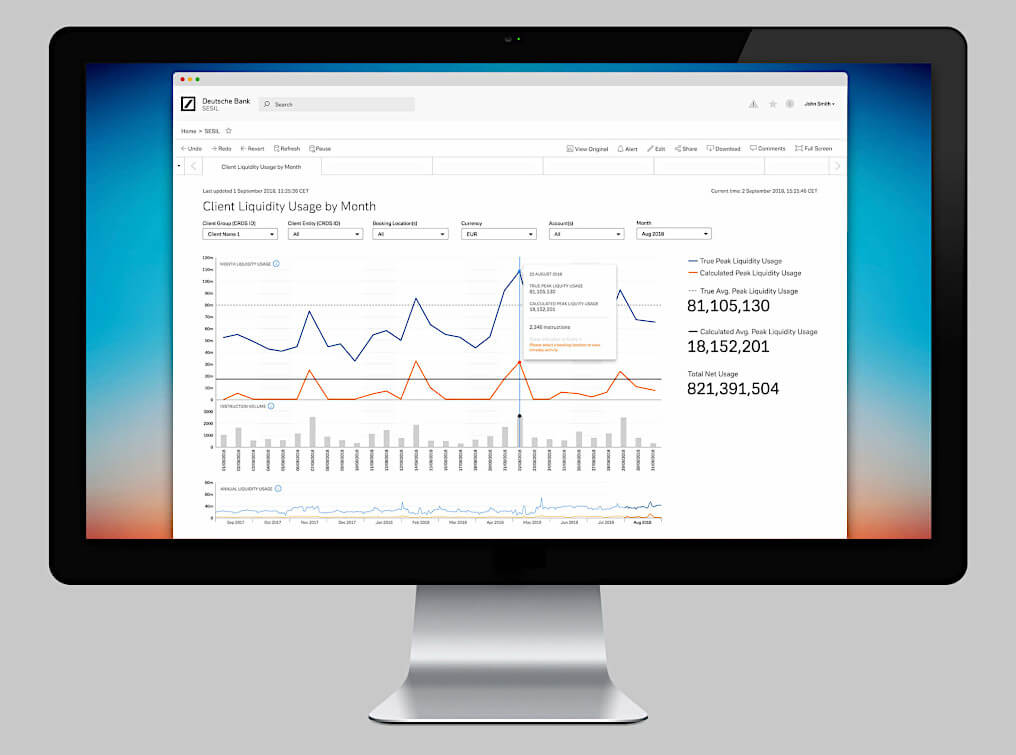

Deutsche Bank’s Securities Services partnered with the bank’s Data Labs to develop a data analytics model on their Enterprise Analytics Platform that graphically shows clients’ cash liquidity usage and how this corresponds to Deutsche Bank’s funding provision in the market. As a result, Securities Services is able to provide more detailed liquidity insights at the client level and review its market funding allocations to ensure they are appropriate to cover these needs.

In an initial 12-week proof of concept, 18 months of cash and securities settlement information for a selection of European markets was brought together, analysed and presented via dashboards to provide insights into client settlement activities that can be viewed by, for example:

- Currency of settlement;

- Place of settlement;

- Time period; and

- Cash account.

Figure 1. Example of support from Deutsche Bank's chatbot, Debbie

This data transparency enables clients to better understand when in the day their peak liquidity usage occurs, empowering them with the opportunity to modify their cash account funding behaviour and ensure adequate capital is reserved.

From an internal perspective, managing intraday liquidity is a complex and critical activity for the treasury functions. The output of this proof of concept highlights areas for potential resizing of treasury funding required in the market to support securities settlement and, subsequently, optimise the usage of cash within the organisation.

Figure 2. Example output for intraday liquidity usage

According to Mike Clarke, Product Management, Securities Services at Deutsche Bank, “The insight gained from analysing and condensing large data sets into actionable insights enables effective decision-making and delivers tangible benefit.”

What are the next areas of focus?

Having successfully deployed these two example solutions, the focus now shifts towards widening the scope to cover more markets and clients, as well as address further problem statements through collaborative opportunities.

As an example, settlement efficiency will continue to be a key focus area for data analytics to assist in understanding the impact of the penalty regime of the Central Securities Depositary Regulation(CSDR). Under the penalty regime, failing transactions in the market will be subject to fines and a mandatory buy-in introduced after a trade has failed for four days. By providing data insights into patterns in pending or failed transactions, clients will be able to identify the key drivers behind failures and directly address the root cause, avoiding the potential penalty impact.

The future is now

While the wider financial services industry continues its exploration of new technologies, these project examples illustrate a collaborative approach to solving problems using data analytics and automation techniques that can help to deliver cost savings and ensure regulatory compliance.

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

SECURITIES SERVICES

Asia’s growth: pause or detour? Asia’s growth: pause or detour?

The second event in the series “The future of Asset Servicing Leadership”, organised by The Asset magazine in collaboration with Deutsche Bank, considered whether growth in Asia is experiencing a pause or a detour

SECURITIES SERVICES

Hacking for good Hacking for good

With the right amount of camaraderie and energy, hackathons can quickly identify common client pain points that can be remedied with small pilot projects. flow looks at how this form of collaboration is driving a digitalisation and innovation culture in Deutsche Bank

SECURITIES SERVICES

Could a chatbot help resolve the speed and accuracy need in trade queries? Could a chatbot help resolve the speed and accuracy need in trade queries?

For custodians, dealing with multiple clients across multiple markets, and a high volume of transactions, handling inquiries can be a challenge especially when it gets close to market cut-off time. The current manual process for receiving, resolving and responding to trade status queries can be slow, cost-inefficient, and lead to human error.