September 2020

The second event in the series “The future of Asset Servicing Leadership”, organised by The Asset magazine in collaboration with Deutsche Bank, considered whether growth in Asia is experiencing a pause or a detour

In December 2019, ahead of the World Economic Forum’s annual January meeting in Davos, it was forecast that Asia would have the world’s largest GDP in 2020, and, by 2030, will account for 60% of the global total. Now, with more than two-thirds of the year elapsed a series of headwinds, most notably Covid-19 and the escalation of the US-China trade dispute, have hit the region – challenging the narrative that Asia will continue to be the world’s growth engine. So what does the future hold for the region’s economies?

On 25 August, 415 industry professionals from 25 countries came together to watch the second webinar in The Asset’s “The future of Asset Servicing Leadership” series. Industry leaders from three European asset managers and two Asian asset managers, joined Dr Michael Spencer, Deutsche Bank’s Chief Economist and Head of Research, Asia Pacific, to debate whether Asia’s growth will undergo a pause or detour in the coming years.

A lasting impact?

Dr Spencer kicked off proceedings with a keynote address that delved into the potential long-term impact of Covid-19 on the region.

He noted that “Asian emerging market economies have grown phenomenally since the 1980s on the back of wonderfully complex, multifaceted, regional supply chains. But today, as borders remain closed, and with the US-China trade dispute continuing to intensify, these complex, far-flung supply chains are becoming a liability.

“We are also seeing that social distancing – a policy that shrinks demand – is likely to stay with us for the foreseeable future, and will severely impact a host of sectors, including restaurants, bars, sporting events, entertainment venues, conferences, healthcare, manufacturing and tourism. At the same time, governments everywhere have introduced stimulus measures to help prop up aggregate demand, consumption and employment.

“This means that, as social distancing policies are being used to restrict supply, governments are simultaneously propping up aggregate demand with fiscal stimulus.” The result, Dr Spencer suggested is that “inflation is going to be a significant risk in 2021 and 2022”.

Looking forward, Dr Spencer also noted three long-term economic trends arising from the global pandemic. The response from North Asian countries, including China, South Korea and Taiwan, has been far more effective than that of the West. China’s economy, for example, is forecast to grow by 1.6% this year, while US and European economies are expected to still be smaller at the end of 2021 than they were in 2019. There is also regional inequality, with the ASEAN countries faring far worse than those in North Asia both India and the Philippines saw double digit GDP declines in in the first half of this year.

The Asian Development Bank said that “Developing Asia”, which groups 45 countries in Asia-Pacific, is expected to contract 0.7% this year, as the organisation forecasted the first negative quarterly figure since 19621. The ADB’s previous forecast in June had reckoned on 0.1% growth.

In addition, evidence is mounting of worrying inequality problems within economies. “Working from home is not an option for all industries, such as construction or manufacturing,” Dr Spencer explains. “As a result, in poorer countries, where governments are less able to provide fiscal support, we're seeing enormous increases to the unemployment rate and significant declines in household incomes.

We are seeing rising inequalities between North Asia and the G8 economies, and North Asia and South/Southeast Asia, and, in every economy in the world, we are seeing greater inequality within their populations.

“We are seeing rising inequalities between North Asia and the G8 economies, and North Asia and South/Southeast Asia, and, in every economy in the world, we are seeing greater inequality within their populations.”

As social disparities widen, political risks are becoming a much more significant threat in the region both domestically, with dissatisfaction over government responses to the Covid-19 pandemic driving internal political conflicts, and internationally, with the US-China trade war intensifying.

“So while most countries will get back to the end of 2019 level of GDP, maybe in the first half of next year there will be a permanent loss of income as a result of the Covid-19 pandemic,” Dr Spencer predicted. “This permanent loss of income is going to exaggerate the economic differentials across the region and is going to play into an increasingly divergent market performance. As it does so, I think it will tend to exaggerate the underlying political discourse in a number of economies in this region.”

Pause or detour?

With the context set, attention turned to the primary question of the webinar: will Asia see a pause to its growth, or will its growth continue, albeit along a different route?

Manraj Sekhon, Chief Investment Officer, Emerging Markets Equity, Franklin Templeton Investments, began by arguing that Asia’s growth is more a pause than a detour, as the medium- and long-term prospects are still strong. “The main drivers of growth in Asia are still very much intact. In fact, some of these drivers, such as digitalisation and technology, are even being accelerated as a result of Covid-19,” he argued. “We know that these have had a huge influence on Asia’s growth in the past, and I think that puts Asia in a very strong position going forward.”

Arthur Lau, Co-Head Emerging Markets Fixed Income and Head of Asia ex Japan Fixed Income, PineBridge investments, agreed that there was a pause, but suggested that we might also be seeing a simultaneous detour. “The pandemic is a pivotal moment for many industries and sectors. And there is a pause in the sense that some sectors may see a fundamental change to their way of doing business,” he explained, “and a detour (or a major shift), in the sense that some sectors will adapt to a post-pandemic world by; for example, putting a greater emphasis on digital platforms.”

Covid-19 has, without a doubt, accelerated a host of digital trends – and that is something that we, like most, have been focusing on recently.

“Covid-19 has, without a doubt, accelerated a host of digital trends – and that is something that we, like most, have been focusing on recently,” added Mike Sell, Head of Asian equities, Alquity Investment, but thought it was not the full picture: “Take India for example – every day the Covid-19 headlines are negative. But we must remember that India is on a very different path, and their pause will be a very different kind of pause to what we’ve seen in the West. In fact, India’s rural economy, which is linked to 45% of its GDP, has seen very strong growth – with tractor sales up over 50% and crop sowing up over 10%. So I think there are pockets of what you perhaps call the old traditional economies that are actually doing very well.”

Thomas Wilson, Head of Emerging Markets Equities, Schroders, was in broad agreement with many of the points made by panellists. He did, however, note that “you need to separate the market outlook from the economic outlook. While I do very much see this as a pause in growth, what I would say is that the markets have priced in the reality and where we currently sit is a period of rebalancing.” Reflecting this, he added that while Schroders will remain exposed to some of the key emerging themes, such as ecommerce and technology, from a trading perspective he is “conscious that at some point there could be a meaningful rotation into more depressed areas of the market.”

Arnab Das, Global Market Strategist, Invesco looked at the issue from a more granular perspective – considering how the impact on individual countries would impact economic growth. He explained that “across the world, there has been a mixed bag of responses to the Covid-19 pandemic. Some countries, such as those in North Asia, have handled the crisis well, while others, such as India, Brazil the US and the UK have been less successful in containing the outbreak.” In his view, the message that comes out of this is “one of enormous diversity in responses, and I think this diversity will be reflected in the cyclical and structural stories we are going to see for many years to come”.

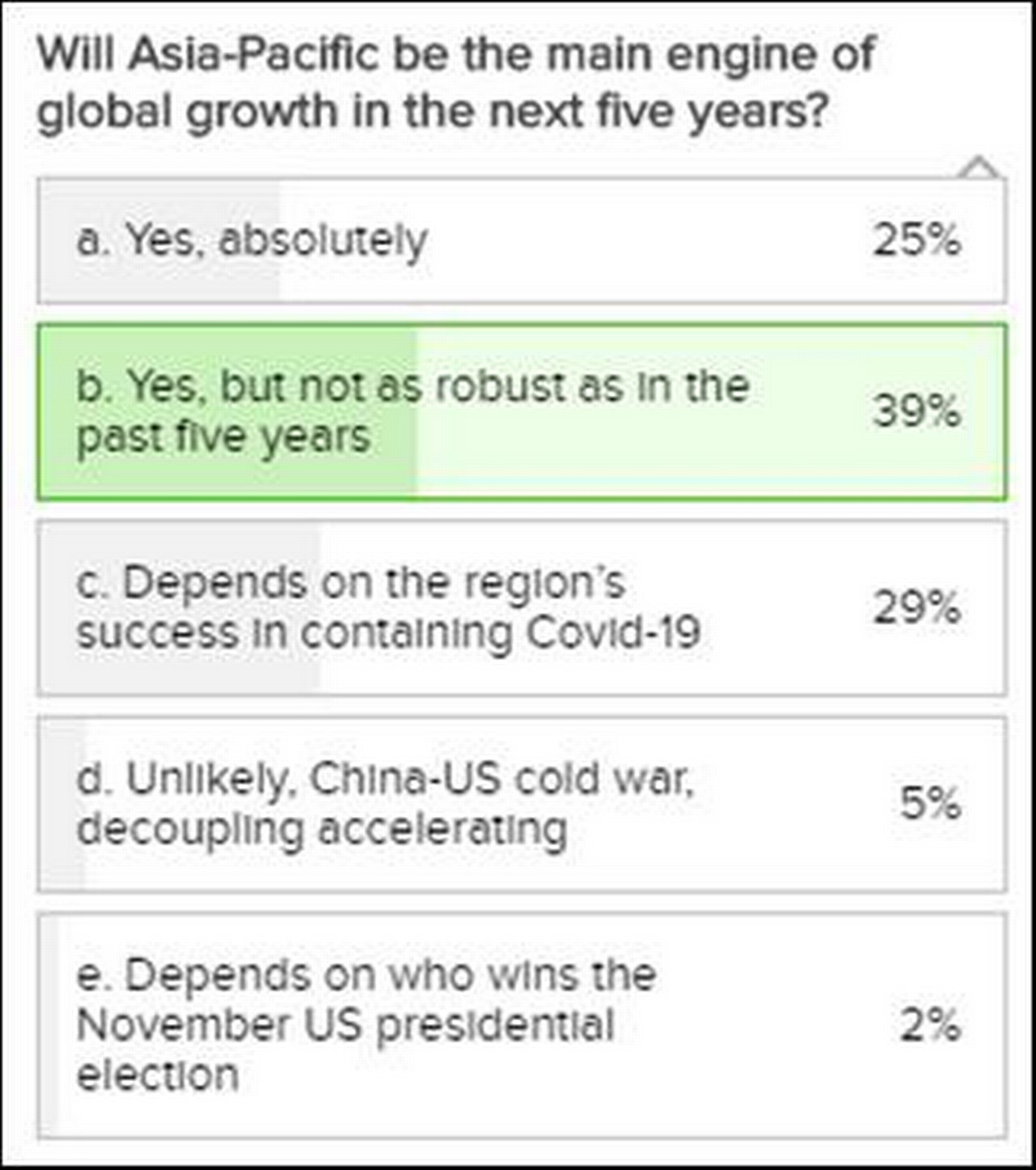

In an online poll, the 415-strong audience was asked whether Asia Pacific would be the main engine of global growth in the next five years. The results were interesting and broadly in line with the panellist discussions, with 25% answering “Yes, absolutely” and 39% answering “Yes, but not as robust as in the past five years”. A sizeable 29% of the audience thought that the answer will be contingent on the region’s success in containing Covid-19.

Where to invest?

So amid the headwinds, where exactly are the opportunities for investment in Asia?

Opening the discussion, Sekhon said “If you look at India, from a risk reward point of view, real rates are negative for the first time in a long time and a lot of the bad news in terms of what's happening in the financial sector, such as the moratorium on loans, is being reflected in the price. Crucially though, the long-term drivers of growth in India remain intact and I would say India is a relative standout in terms of investment – not in the short term, but in the medium term.”

Schroders’ Wilson responded that he “always finds the Indian market relatively expensive and, for us, it is a consistent underweight. So while we believe that there is a medium term structural growth opportunity, it is often priced too high.”

Alquity’s Sell concurred, adding that “the domestically driven economies have been and continue to be very exciting. While valuations are never cheap in India – due to the growth potential over the next 10 or 20 years – there are typically pockets of value.

“In ASEAN, the domestic story has been ignored by investors – particularly somewhere like Indonesia, where meaningful reform could be a positive market driver. Another major market for us is Vietnam, which is a massive beneficiary of companies moving away from China – with foreign direct investment typically accounting for around 8% of GDP.”

And the consensus picks? Each panellist was asked to provide their top three countries for investment at this time and, in doing so, they picked out five hot prospects for the near future: China, South Korea, India, Indonesia and Vietnam. Stay tuned.

The next webinar in the ’The future of Asset Servicing Leadership series’ will take place on 22 October. For more information on this webinar please register your interest at www.db.com/flow

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

SECURITIES SERVICES

Could a chatbot help resolve the speed and accuracy need in trade queries? Could a chatbot help resolve the speed and accuracy need in trade queries?

For custodians, dealing with multiple clients across multiple markets, and a high volume of transactions, handling inquiries can be a challenge especially when it gets close to market cut-off time. The current manual process for receiving, resolving and responding to trade status queries can be slow, cost-inefficient, and lead to human error.

SECURITIES SERVICES

Accelerating technology-led transformation in Asia Accelerating technology-led transformation in Asia

The first event of “The future of Asset Servicing Leadership Series”, organised by The Asset magazine in collaboration with Deutsche Bank, looked at how Covid-19 is accelerating digital transformation of the securities services industry in Asia

SECURITIES SERVICES

Hacking for good Hacking for good

With the right amount of camaraderie and energy, hackathons can quickly identify common client pain points that can be remedied with small pilot projects. flow looks at how this form of collaboration is driving a digitalisation and innovation culture in Deutsche Bank