8 November 2023

Despite the volatility and certain high-profile collapses, cryptocurrencies and digital assets are here to stay, report Deutsche Bank Research analysts Marion Laboure and Cassidy Ainsworth-Grace. In the first of their three-part ‘The future of money’ report series they argue that crypto is edging towards business as usual. flow’s Clarissa Dann provides some key takeaways

MINUTES min read

Almost a year on from the collapse of cryptocurrency exchange FTX, crypto assets have been quietly edging towards mainstream adoption. Despite the asset class’s users having become more negative in 2023, a Deutsche Bank dbDIG Primary Research survey conducted in September 2023 found that a third of its respondents “still believe it remains an important asset class and transaction payment method”.

In the first of a new three-part series, The future of money, Deutsche Bank Research analysts Marion Laboure and Cassidy Ainsworth-Grace provide an update to the findings summarised in the 29 March 2023 flow article, Digital assets – from exuberance to utility. Here, they underlined why finding a balance between “learning from the casualties of the crypto fall-out, while maintaining readiness for market developments” was essential to financial system participants. Their new report, published 24 September 2023 (so all data shown in the Figures is as at that date and may well have changed since then) demonstrates this is more important than ever – the world’s largest asset manager, BlackRock filed for a spot Bitcoin exchange traded fund (ETF) in June 2023.1

Bitcoin and Tinkerbell

With both Bitcoin and its nearest rival Ethereum outperforming traditional assets in 2023 so far even if less spectacularly than in the years before – now it is on the rise again, a could this be down to what the duo call “the Tinkerbell effect “where “the more people believe in something, the likelier it is to happen”?

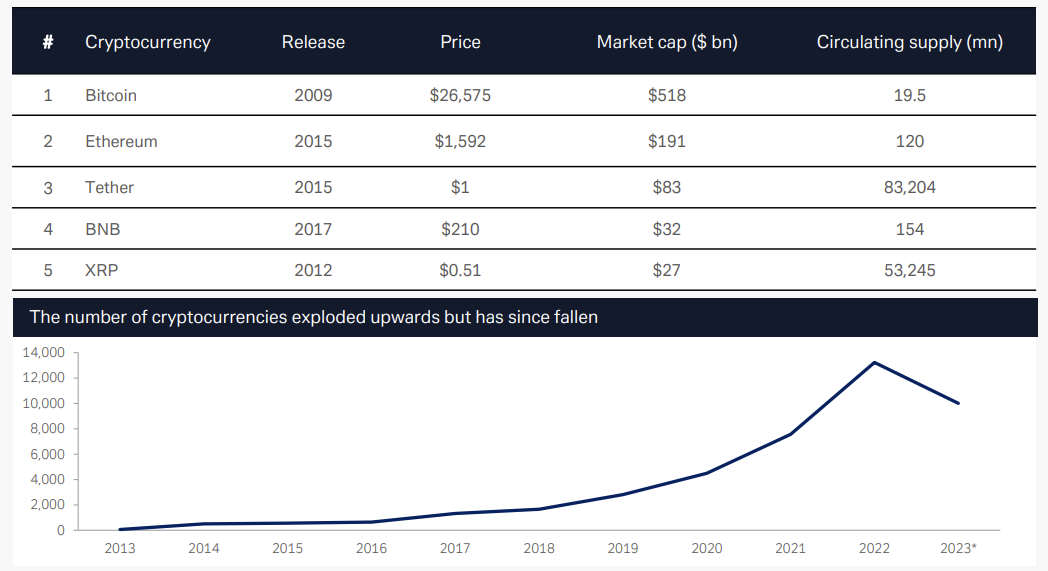

Figure 1: Bitcoin was the first successful crypto-asset and is the largest

Source: Deutsche Bank, CoinGecko, https://99bitcoins.com/ Statista, Updated 24 September 2023.

*As of September 2023

Please note that this is simply to denote a direction of travel. Crypto prices and market capitalisation totals are highly volatile and pricing will have changed since this figure was first published. The current position can be found at https://www.statista.com/statistics/326707/bitcoin-price-index

Laboure and Ainsworth-Grace explain that as with more traditional asset classes, cryptocurrencies have benefited from recent loose monetary policies characterised by low rates, high liquidity – as the US Federal Reserve’s balance sheet reached a peak in May 2022 of nearly US$9trn – and the search for higher yields as central bank rates hit zero during the pandemic.

But they fell back to earth last year as resurgent inflation, monetary tightening, and slowing economic growth put downward pressure on the crypto ecosystem. By last December the cryptocurrency market cap had declined to US$880bn from its US$2.9trn peak reached in November 2021 and this year has seen a modest recovery to around US$1.1trn.

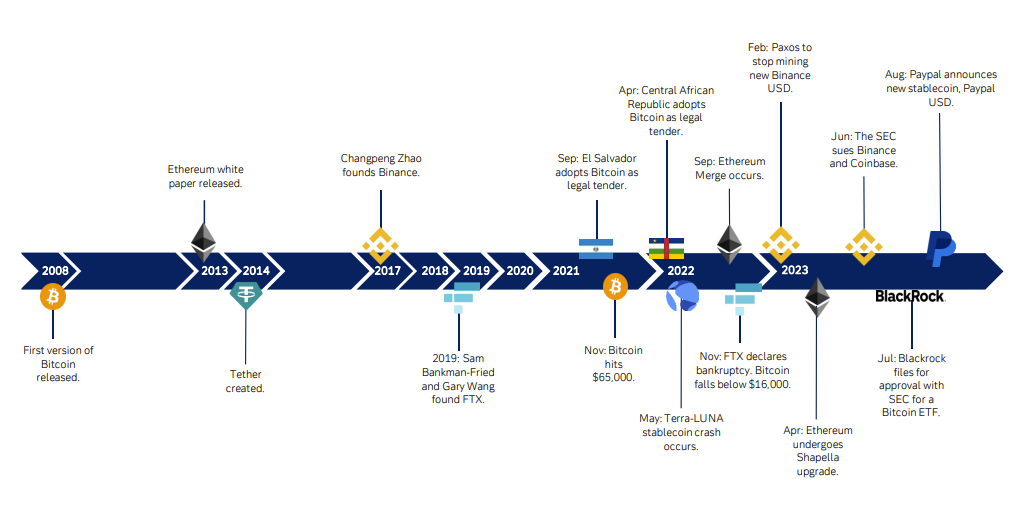

Very likely limiting the bounce back, 2022 and 2023 have been marked by bankruptcies and negative news as well-known structural issues in the crypto ecosystem. “This ‘crypto winter’ was a net positive, edging the crypto ecosystem closer to the established financial sector,” Laboure and Ainsworth-Cassidy note. The US Securities and Exchange Commission (SEC) has instigated action against key crypto players while the European Union’s (EU) Markets in Crypto-Assets regulation (MiCA) will come into force in early 2024 and will be in full effect by next autumn.

In October 2023 Sam Bankman-Fried, the former CEO of FTX (“another castle built on sand” noted Laboure and Ainsworth Grace on 14 November 2022 in a report examining the effects of market speculation), went on trial and the background to the firm’s bankruptcy in November 2022 revealed. “The FTX crash spotlighted well-known structural issues: insufficient reserves, conflict of interest, a lack of regulation and transparency, and unreliable data. Market concentration is greater than ever, with Binance being the biggest beneficiary,” they reflect. “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here… compromised systems integrity and faulty regulatory oversight,” said John J. Ray III, the liquidator for FTX in bankruptcy court documents filed in November 2022.2

Despite these vicissitudes, Laboure and Ainsworth-Grace have consistently argued that cryptocurrencies and digital assets are here to stay, with Bitcoin’s value set to continue rising and falling depending on people’s perceptions. “The Tinkerbell effect looks to have returned, and Bitcoin and Ethereum have outperformed traditional assets this year,” they observe.

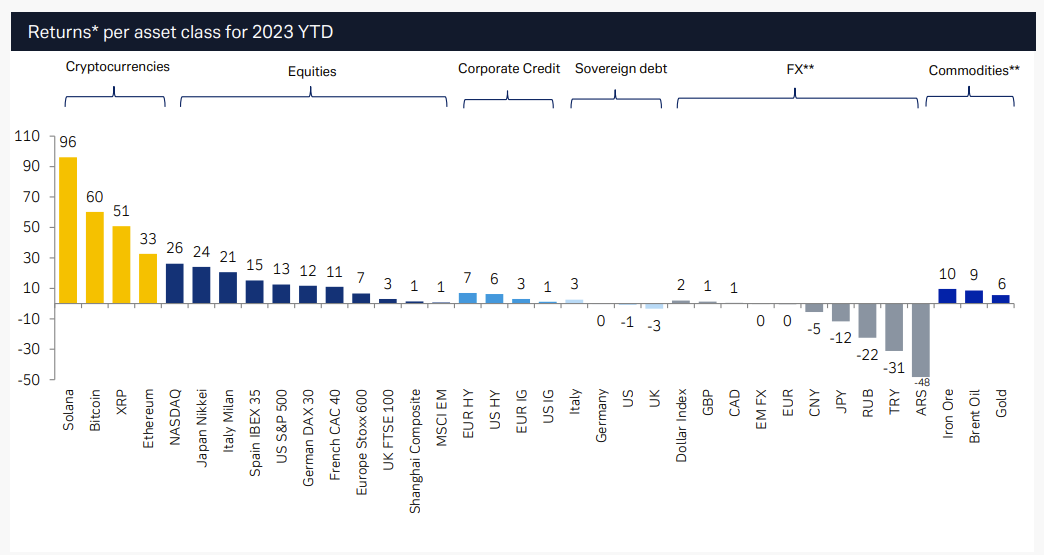

Figure 2: Cryptocurrencies have outperformed relative to other major asset classes in 2023 YTD

Note: (*) Total return accounts for both income (interest or dividends) and capital appreciation. (**) FX, Commodities are spot returns.

Source: Deutsche Bank Research, Bloomberg Finance LP, Data is for the year 2023 YTD. Updated 24 September 2023

At the same time, a sense of realism is evident after years in which many regarded Bitcoin as “digital gold” and a hedge against inflation. Were Bitcoin a company, at its peak it would have been part of the 10–15 largest corporates by market capitalisation. It’s a view “that now seems to have been debunked”.

“Cryptocurrencies did see price increases as inflation picked up in 2021, but this was due to excess liquidity that also drove tech stocks higher,” the report explains. “When the Federal Reserve turned hawkish and prospects of higher rates deflated valuations, cryptocurrencies followed suit, and prices are now largely range bound.”

The change has also seen Bitcoin volatility on a long-term downward trend over past three years, with the cryptocurrency’s average 90-day volatility moving down from 67% on average in 2019 to 40% so far in 2023.

Figure 3: Timeline - crypto 2008–2023 YTD

Source: Deutsche Bank, Tether, Ethereum, Binance, Reuters, The Financial Times, Bloomberg Finance LP, PayPal.

In addition to volatility Bitcoin and its peers come with other negatives; for example – despite the hype – daily trading volume remains very limited and the majority of Bitcoins are held by a few addresses known as “crypto whales”. Its consumption of energy is prodigious – one Bitcoin transaction boasts an e-waste footprint larger than 10,000 Visa transactions and its climate impact is likewise out of all proportion.

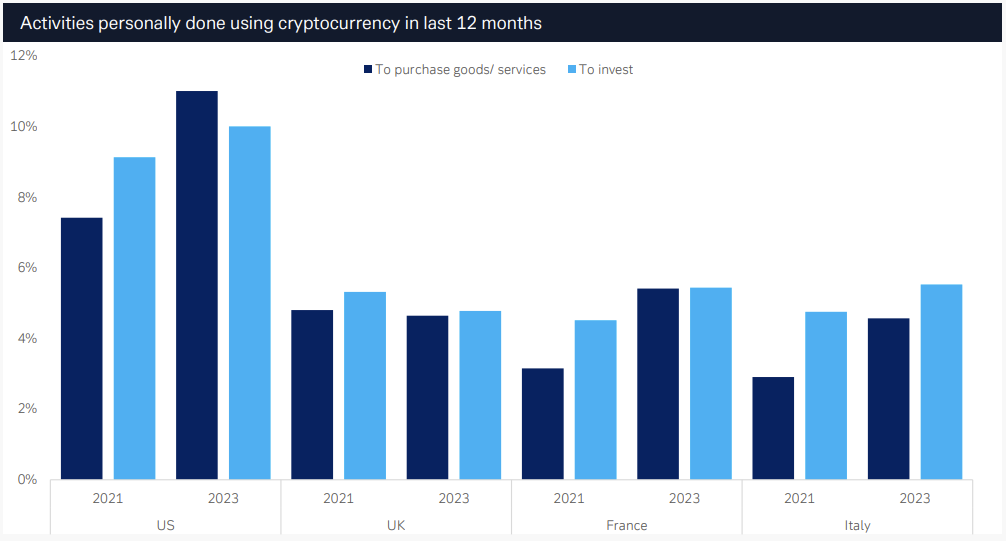

Figure 4: Americans are three times more active in using crypto to buy goods/services or to invest than Europeans

Source: Deutsche Bank dbDIG. Note: In the last 12 months, which if any of these financial activities have you personally done? Please select all that apply. Survey ran September 2023

The jury is out on whether its popularity will grow. The dbDIG survey found that “Americans are three times more active in using crypto to buy goods/services or to invest than Europeans.” But the research also showed that across the US, EU and the UK, the three biggest barriers to the wider adoption of crypto were that the asset class is too risky, highly volatile and not regulated.

In September 2021, El Salvador became the first country to make Bitcoin legal tender, with all businesses required to accept it as payment. The government gave citizens financial incentives to download a special cryptocurrency app and half of its households downloaded it, yet two years later “interest in Bitcoin has fallen substantially” with a small elite group likely to be banked, educated, young and male the main users.

Are stablecoins the future?

Are stablecoins – digital currencies pegged to a “stable” reserve asset such as the US dollar and designed to reduce volatility relative to unpegged cryptocurrencies such as Bitcoin – a better alternative? “Stablecoins are the lubricant of the crypto ecosystem, but are not without a trade-off,” suggest Laboure and Ainsworth Grace. They were designed, they explain, with the intention to:

- Offer price stability;

- Offer exposure to the underlying asset without exiting the crypto market; and

- Be posted as collateral in leveraged trades.

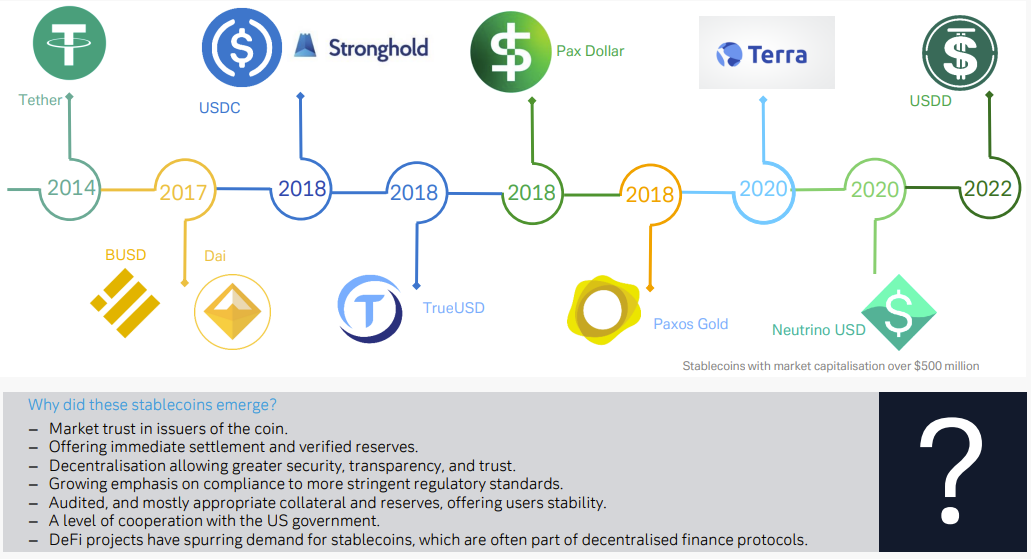

Since 2014 there has been a series of failed stablecoin launches from causes ranging from failed algorithms to flawed price security. But over the same period there have been notable successes as shown in Figure 5.

Figure 5: Stablecoins which have successfully emerged since 2014

Source: Deutsche Bank, Coinbase, new bitcoin.com

Of the above the leading names are:

- Tether: Largest and the most traded stablecoin in the world

- USDC: Created by the fintech Circle to speed up funds transfer times and reduce volatility associated with Bitcoin and other cryptocurrencies

- DAI: currently battling for the position as the third largest stablecoin after a regulatory crackdown on…

- BUSD: Founded in 2019 as a joint venture between cryptocurrency exchange Binance and blockchain developer Paxos, but has now fallen out of favour, and will likely end in the near future

Since January 2021, the market capitalisation of stablecoins increased from ~3.1% to ~12.5% at the end of 2022 of the total cryptocurrency market cap and stood at 11% when the report was published in September 2023.

But Laboure and Ainsworth-Grace strike a note of caution. “Stablecoins may witness a fate similar to foreign exchange pegs that succumbed to capital flights and depleting reserve coffers, like those in Latin America and Asia,” they note. “Macro liquidity withdrawal and rate hikes by major central banks coupled with regulatory pressures will test confidence.”

Institutional adoption

Underlining the fact that cryptocurrencies and digital assets are here to stay, institutional players are increasingly interested in the crypto space. For example, BlackRock filed for a spot Bitcoin exchange traded fund (ETF) in June 2023.3 The application triggered several other applications for similar ETFs by the likes of VanEck, WisdomTree and Invesco, while Ark Invest and 21Shares have also applied for a spot Ethereum ETF.

Three months later in September, Deutsche Bank announced a new partnership with Swiss crypto firm Taurus to provide custody services for institutional clients’ cryptocurrencies.4 This will be the first time the bank will be able to hold a limited number of cryptocurrencies for its clients.

And in August PayPal announced its own stablecoin, PayPal USD, which will be fully backed by dollar deposits, short-term Treasuries and similar cash equivalents. PayPal USD will be able to be used to buy and sell other cryptocurrencies offered on the platform and PayPal expects use of the stablecoin in payment transactions to be a revenue generator.5

Back in mid-2019 PayPal was an original participant in Facebook’s Libra stablecoin project as part of the Libra Association but withdrew its support the following October. After several projected launch dates came and went Libra, soon after known as Diem, was shut down in January 2022.

Deutsche Bank report referenced:

The Future of Money – Part 1: Cryptocurrencies: The return of faith, trust and fairy dust by Marion Laboure and Cassidy Ainsworth Grace