11 June 2025

Corporate treasurers will have to embrace innovative technology to meet new challenges facing their departments and rising expectations from the C-suite. Dr Tobias Miarka draws on Crisil Coalition Greenwich research to explain the practical implications

MINUTES min read

The combination of an accelerating set of macroeconomic challenges and rapid advances in technology has expanded both the mission and the capabilities of corporate treasury departments far beyond their traditional cash management responsibilities.

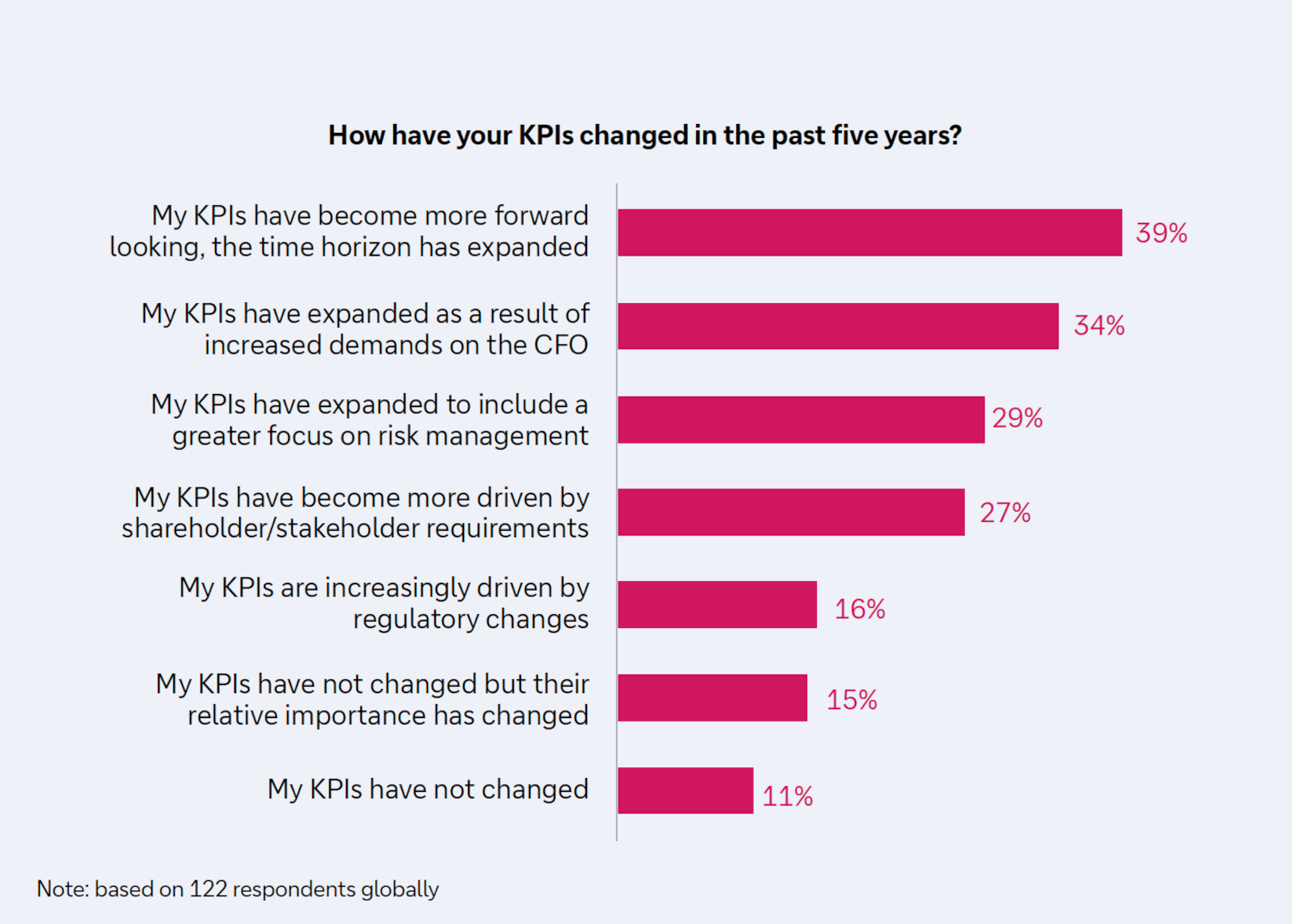

In Q2 2024, Crisil Coalition Greenwich conducted interviews with more than 120 corporate treasury professionals in Europe, North America and Asia with sales turnover of more than US$500m.1 The goal was to understand how the corporate treasury function and the role of the corporate treasurer was changing. More than 80% of respondents said the KPIs used to evaluate their performance have expanded in scope over the past five years.

Figure 1: Change in treasurer KPIs over the past five years

Source: Coalition Greenwich 2024 Corporate Treasurer Study

We conducted a follow-up study in April 2025 asking ca. 160 treasurers across Europe, North America and Asia how often they participate in C-suite strategic discussions. Between half and three-quarters said they are frequently involved in conversations on topics that fall directly under their remit, and are occasionally included in C-suite discussions on other topics, such as corporate financial performance and metrics, geographic expansion and digital transformation.

Why are KPIs changing, and why are treasurers being brought into C-suite discussions more frequently?

First, the business environment has become more complicated. Companies today face a continuously evolving set of economic and geopolitical issues, including wars in the Middle East and Russia, disruptions in supply chains, fast-changing regulations, and uncertainties about economic direction associated with trade policies implemented by the Trump administration in the US. This seemingly permanent ‘poly-crisis’ requires a heightened focus on risk management and strategic agility in which corporate treasury is expected to play a key role.

Second, the systems powering the modern treasury function available today provide a level of accurate and up-to-date data about companies’ liquidity, accounts payable and receivable, inventories, funding situation and financial risks never before available to business leaders.2

In short, companies are facing tougher challenges, and corporate treasurers have acquired new capabilities that put them in a unique position to advise the C-suite on how best to address them.

“Companies are facing tougher challenges, but corporate treasurers have got new capabilities that put them in a unique position to advise the C-suite”

In the short term, with tariffs roiling global markets and inflation remaining above central bank targets in key regions, treasurers can expect to see an increased focus on cash flow forecasting accuracy, days of liquidity available, cost of capital and other measures.

Over a longer timeframe, automation KPIs will likely take centre stage. Key metrics like the percentage of processes handled automatically and the reduction in manual adjustments will serve to highlight the extent to which treasurers are able to minimise manual intervention, increase efficiency and optimise their workflows as companies move towards an emerging ‘real-time’ treasury model.

Treasury and technology

Few, if any, of the corporate treasurers participating in our research indicated they had any form of relief from their core responsibilities to make room for these new demands. So how can they meet new expectations from the C-suite while also fulfilling their traditional duties? In short: technology.

Technology innovation within companies, on bank digital platforms and across the fintech universe is accelerating the transformation of both treasury departments themselves and the corporate treasury function. It’s now up to individual treasurers to use new tools and analytic capabilities to generate efficiencies, data and analysis that both enhance the effectiveness of the treasury department and support strategic conversations.

Practical steps to treasury efficiency

Here are eight practical steps culled from our research, and from conversations with treasurers and treasury staff, that treasurers can take to leverage technology to meet rising expectations:

1. Harness treasury data

Our April 2025 research indicates that 70% of treasurers globally say that real-time treasury data has become critical to improving the treasury function. However, tapping into high-quality data can be a challenge.

Corporate financial data is frequently housed in multiple legacy computer systems that may not interact and sometimes store data in different formats. To some extent, treasury departments need their organisations to eliminate the inefficacies this causes, but there are steps they can take on their own. AI applications are available that allow companies to source data from different systems, reconcile the data by converting it into a standard format, and aggregate it into a single file or system.

2. Move away from spreadsheets

The use of spreadsheets often contributes to increased data fragmentation, with data existing in multiple local spreadsheets in differing versions. This increases risks of error, inconsistencies and out-of-date data and makes the process of harnessing data for use in enterprise systems and new AI solutions difficult.

There are levers treasurers can pull to move workflows out of spreadsheets, most of which harness some form of AI. These fall into three main categories:

- Data extraction: Treasury departments have access to a host of tools that can help them extract data from spreadsheets. These range in sophistication from simple Excel add-ins to basic robotic process automation (RPA) applications, and finally to more sophisticated machine learning (ML) platforms like Google Cloud AI Platform, Microsoft Azure Machine Learning, or Amazon SageMaker that can be used to build custom ML models for data extraction and integration.

- Data transformation: Treasury departments can use a variety of specialised AI tools to convert extracted data into a unified, consistent and interoperable format. These include platforms like Talend, Informatica and Microsoft Power BI, all of which provide AI-powered data integration and analytics capabilities, as well as dedicated accounting and finance automation solutions like BlackLine, FloQast and Fides that often include data extraction and integration tools.

- Data loading: Once the data has been extracted from spreadsheets and normalised, the next step is to move it into enterprise software and other technology solutions. Traditionally this task would have involved basic batch processing techniques. Today, APIs and other data connectors can streamline and accelerate the process.

3. Automate relentlessly

Once companies have secured a reliable stream of treasury data, the real efficiency gains can begin. The first step is to identify the routine, repetitive tasks that consume the time of treasury staff and seek opportunities to automate them. RPA, which uses rule-based software to automate repetitive tasks without the need for human intervention, is now a standard tool in the business world, and treasurers should be using it at every possible opportunity.

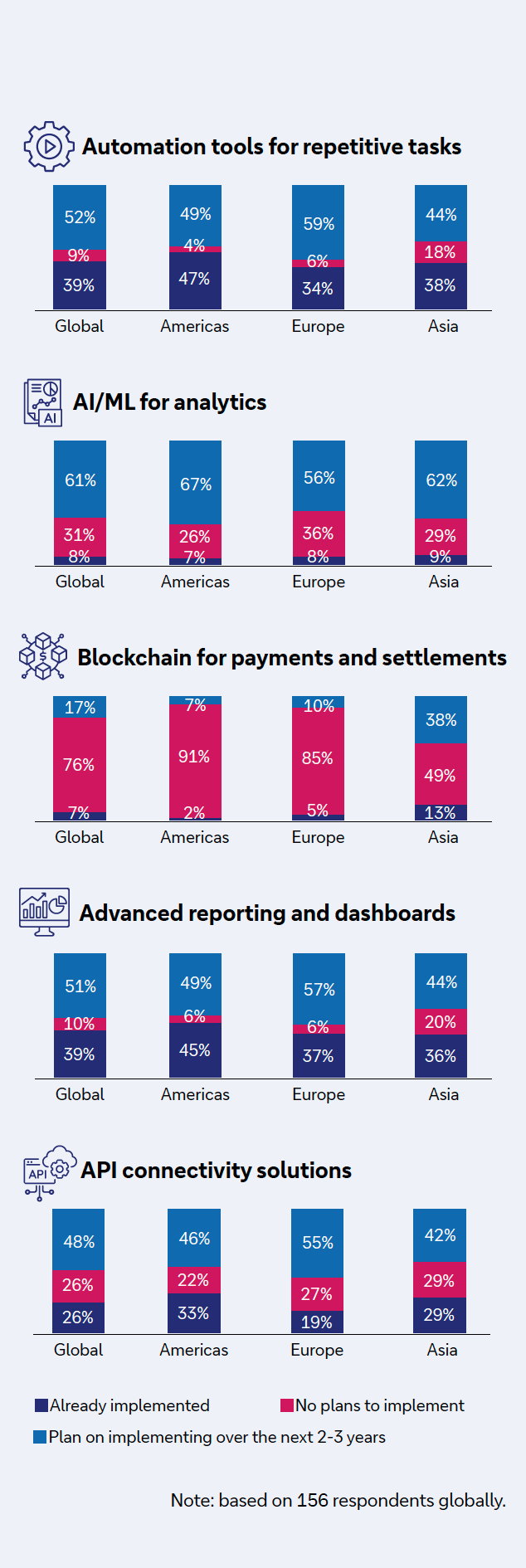

As shown in Figure 2 [below], nearly half of corporate treasury departments in the Americas are already using some form of automation, and more than half of treasury functions globally have plans to implement automation tools within the next three years.

Figure 2: Organisations' plans for implementing new technologies

Source: Coalition Greenwich 2025 Corporate Treasurer Study

4. Lean in on advanced dashboards

Another relatively easy efficiency enhancement is to switch to advanced reporting systems and dashboards that provide up-to-the-minute updates and allow for real-time analysis. Ask TMS providers and banks if they provide dashboards that can be customised. About half of corporate treasury departments around the world plan to be using advanced reporting and dashboards within three years.

5. Embrace AI- and ML-powered analytics

Analytic systems powered by ML and other types of AI provide unprecedented levels of transparency into cash, liquidity, inventory, funding, hedging, risk management and other core treasury functions. These systems will become increasingly powerful and useful in decision-making as banks and fintech vendors roll out sophisticated predictive analytic models. Existing solutions can analyse huge volumes of data to help identify and quantify credit, market and fraud risks, to run complex scenarios, and to probe correlations in business factors that in the past could not be examined due to constraints on data and analytic power.

Fewer than one in 10 treasury departments worldwide have implemented these solutions, but more than 60% of companies globally expect to implement some form of AI/ML-powered analytic solution in the next three years.

6. Push hard on real-time payments

Although most companies are still building out the infrastructure to process real-time payments, treasurers see them as increasingly essential. More than 90% of study participants from Asia rate “the ability to make real-time payments” as a valuable treasury capability, as do 80% of those in Europe and 71% in the Americas. By accelerating liquidity movement and enabling same-day payments, implementing robust digital payment capabilities can significantly enhance efficiency in cash management.

7. Insist on APIs

Digital platforms alleviate many of the traditional pain points companies experience around onboarding and reduce the time it takes to accomplish basic tasks in cash management and trade finance. To take advantage of these features, treasury departments need seamless connections that support real-time transaction data. In most cases, that will come from API solutions. About a quarter of companies we interviewed globally are already using APIs, and nearly half intend to be doing so in three years’ time.

8. Take a hands-on approach to technology and talent

Some treasurers looking for efficiency gains have been disappointed with initial results of technology upgrades. Often, those disappointments stem from the perennial challenge of implementing new technology to replace or enhance legacy systems without disrupting day-to-day workflows. Treasurers must commit to proactively managing technology development strategy and implementation, and play a prominent role in ensuring that treasury staff actually adopt new technology tools and integrate them into workflows.

Moreover, roughly a third of treasurers interviewed globally say they are almost never involved in conversations with senior leadership about talent management and organisational development. This needs to change. Treasurers must be fully engaged in the company’s human capital strategy to ensure that the fast-changing treasury function is supported by professionals with the skills and competencies required to meet new expectations and balance operational excellence with strategic insight.

Dr Tobias Miarka leads Crisil Coalition Greenwich Corporate Banking research globally and advises international as well as domestic banks on strategic client service and product issues that result in profit-enhancing and sustainable solutions. He is also affiliated with the ESCP Business School where he teaches Banking and Fintech related subjects as part of the school’s Master in Management programme.

Lead image: © iStock/woraput

Sources

1 See greenwich.com

2 One example being the SAP ‘digital boardroom’ featuring in the flow article, ‘Heart of the enterprise’ (2019)