11 February 2026

The newly signed India-EU trade deal is the latest in a series of agreements that India has inked with major trading partners to both maintain economic growth and protect itself from geopolitical uncertainty. Drawing on Deutsche Bank Research analysis, flow’s Clarissa Dann examines the details

MINUTES min read

On 1 February India's Finance Minister, Nirmala Sitharaman, presented her annual budget for 2026–27, which generally received a favourable reception. “This budget reflects sustained policy continuity and a clearly articulated economic vision shaped by resilience, structural reform and measured responses to evolving global and domestic conditions,”1 notes KPMG in India Union Budget 2026–27. The report continues, “It signals a steady, confidence driven approach to long term growth and fiscal governance.”

The budget aims to keep India on course to becoming a US$5trn economy – a target that the government once asserted would be hit by 2025, but according to widespread interpretations of the October 2025 World Economic Outlook2 now looks more likely to be reached by 2028–29.3

It was issued five days after representatives from Europe and India concluded their free trade agreement (FTA) negotiations after nearly two decades of on-off negotiations. The resulting deal was announced at the 16th India-EU Summit by India’s Prime Minister Narendra Modi and European Commission President Ursula von der Leyen.4

What do its terms mean for Europe and India?

“Freer trade unlocks capital – and India’s ambitions will require global investment at scale”

“The India-EU trade deal, along with India’s FTA with the UK and the European Free Trade Association (EFTA)5 effectively opens up the entire European market for Indian businesses, exporters and entrepreneurs,” explains Kaushik Das, Chief Economist India at Deutsche Bank Research in his report India-EU FTA: ‘Mother of all deals’, published on the same day.

Chintan Shah, Deutsche Bank’s Head of Corporate Bank Asia Pacific and Middle East, Deutsche Bank added, “In a rapidly shifting global landscape, the India-EU FTA is a landmark commitment to deeper partnership and long term, rules based growth. Freer trade unlocks capital – and India’s ambitions will require global investment at scale.”

Impact of the deal

The European Union becomes India’s 22nd FTA partner, marking one of the most significant geoeconomic developments of the decade. The deal opens the full European market to Indian exporters, deepens access across 144 EU services sub-sectors, and positions Germany and other major EU economies as key beneficiaries. “With tariffs on US$33bn of Indian exports set to drop to zero and a calibrated auto framework balancing access with domestic manufacturing ambitions, the agreement represents a strategic liberalisation without compromising politically sensitive sectors,” writes Das.

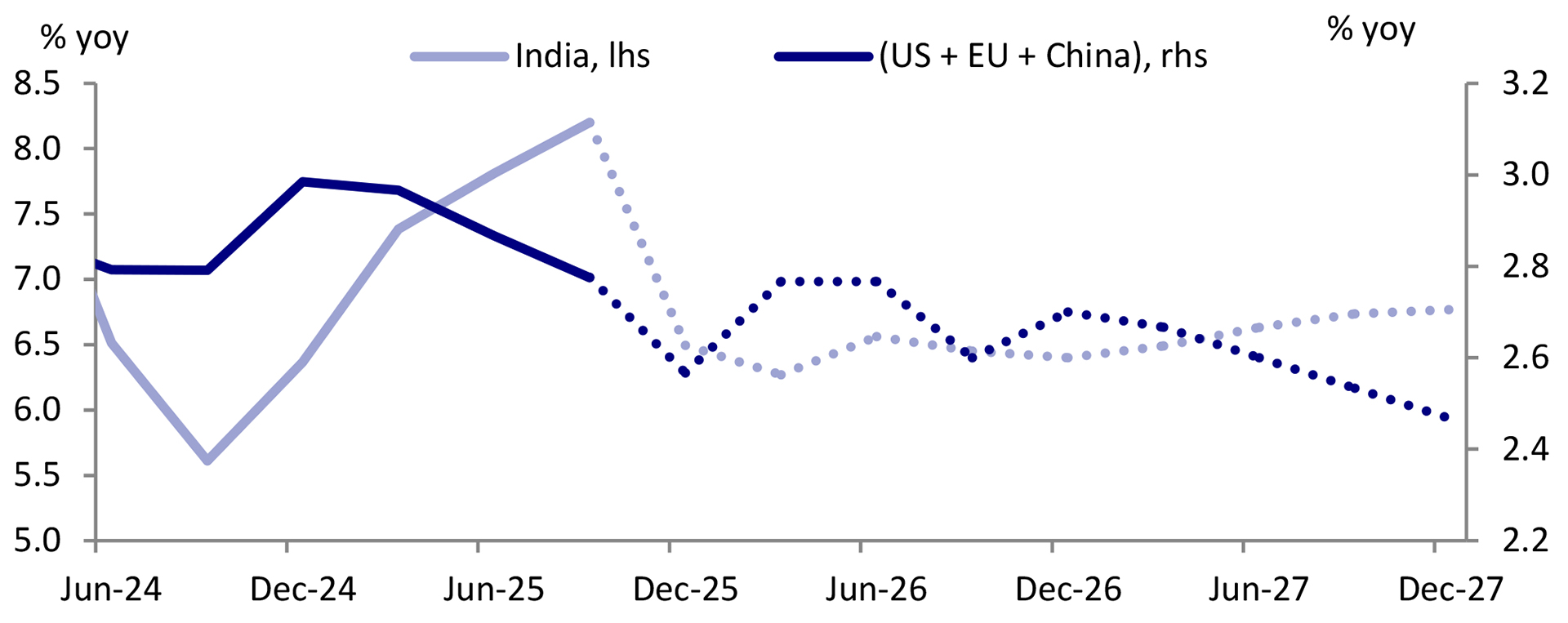

Furthermore, the India-EU FTA is strategically important and signals confidence between two large, complementary economies (India is the world’s fourth largest economy, the EU bloc its second largest, representing 25% of global GDP) as trusted partners. India offers scale, growth (likely to reach 6.5–7.0% annually in real terms for the next several years), and a rapidly maturing industrial ecosystem; Europe brings capital depth, advanced manufacturing, and strong regulatory frameworks.

“We have created a free trade zone of two billion people, with both sides set to gain economically. We have sent a signal to the world that rules-based cooperation still delivers great outcomes,” said von der Leyen.6 Importantly for Europe, the deal demonstrates the bloc’s strength with bilateral trade agreements of this magnitude, swiftly following on from the EU-Mercosur trade agreement signed on 17 January 2026 after 25 years of negotiations.7 Such strength is very timely, given Europe’s challenges about competitiveness compared with US banks.

“As a bank deeply embedded in both regions, Deutsche Bank is ready to connect international capital to the India opportunity, strengthen markets, and support the next phase of India’s growth,” reflects Shah.

Given the sheer might of Europe as a trading partner, the catalyst effect of the deal cannot be underestimated – both for foreign capital inflows and the shaping of other trade agreements. On 2 February, as part of ongoing trade agreement discussions, the US announced that the 25% tariff on Indian goods would reduce to 18% given that India had agreed to stop purchasing Russian oil.8

Effect on India’s businesses

Published on 29 January, India’s Department of Economic Affairs, Ministry of Finance Economic Survey 2025–26 sets the tone for the government's economic approach. This paper projects real GDP growth in FY27 in the range of 6.8 to 7.2%.9

India’s labour-intensive sectors such as textiles, apparel, leather, footwear, marine products, gems and jewellery, handicrafts, engineering goods, and automobiles will see current tariffs of up to 10% on almost US$33bn of exports reduced to zero. Beyond enhancing competitiveness, the FTA will empower workers, artisans, women, youth, and micro, small, and medium-sized enterprises, while integrating Indian businesses more deeply into global value chains and reinforcing India’s role as a key player and supplier in global trade.

Figure 1: India vs. US+EU+China GDP growth

Source: CEIC, Deutsche Bank. Note: Dotted lines refer to Deutsche Bank forecast

India’s multipolar approach to trade

India's trade strategy is undergoing a structural shift as the global economy moves toward a multipolar system anchored by the US, the EU, China and a rising ‘Global South’, notes Das in India's Trade Dynamic in a Multipolar World (21 January).

Historically, India's trade has been relatively concentrated, with exports directed toward the US, EU and the Middle East, and imports being dominated by China and other energy suppliers. However, in the past decade there has been a policy shift, targeted toward partner diversification – including increasing trade with ASEAN, Africa and Latin America – and deepening engagement with Middle Eastern hubs as logistics, energy and capital partners.

The India/US trade deal is another example of how the country is “rapidly finalising bilateral and regional deals to reduce over-reliance on any single market” continues Das in a follow-up report, Macro Implications of India-USA Trade Deal (3 February 2026).

Over the past five years, India has signed seven FTAs and Comprehensive Economic Partnership Agreements with key global partners including Australia. In 2025, new deals with the UK, Oman and New Zealand were concluded, while the EFTA (Switzerland, Norway, Iceland, Liechtenstein) trade pact came into effect from October. In addition to the just-signed EU agreement, negotiations are actively progressing and expected to conclude later this year with the US, Peru, Chile, Bahrain and the Gulf Cooperation Council.

Relationship with Germany

Currently ranked the world’s third and fourth-largest economies respectively, Germany is India’s largest trading partner in Europe, its ninth-largest investor and has consistently been among India’s top 10 to 12 global partners with cumulative foreign direct investment (FDI) inflows.

Das believes that Germany therefore stands to be a key beneficiary of the India-EU FTA. India ran a trade deficit with Germany of US$15bn between April 2000 and December 2024, with imports (industrial machinery for aircraft and spacecraft, scientific instruments and auto parts) exceeding the items that it exports (medical instruments, electric machinery and cotton).

“Expect more ‘dual shore’ production, more design in India components, and more resilient supply chains serving global demand”

In 2024–25, India’s bilateral trade with Germany reached US$29bn, with Indian exports at US$10.5bn and imports at US$18.6bn. In FY25, India's trade deficit with Germany widened to US$8bn, against US$6.8bn in FY24, and US$6.5bn in FY23.

“This is a catalyst for co-innovation,” notes Kaushik Shaparia, CEO, Deutsche Bank Group India & Emerging Asia. He continues, “European Mittelstand strengths in advanced manufacturing and sustainability meet India’s scale, digital public infrastructure and engineering talent. Expect more ‘dual shore’ production, more design in India components, and more resilient supply chains serving global demand.”

Investment flows

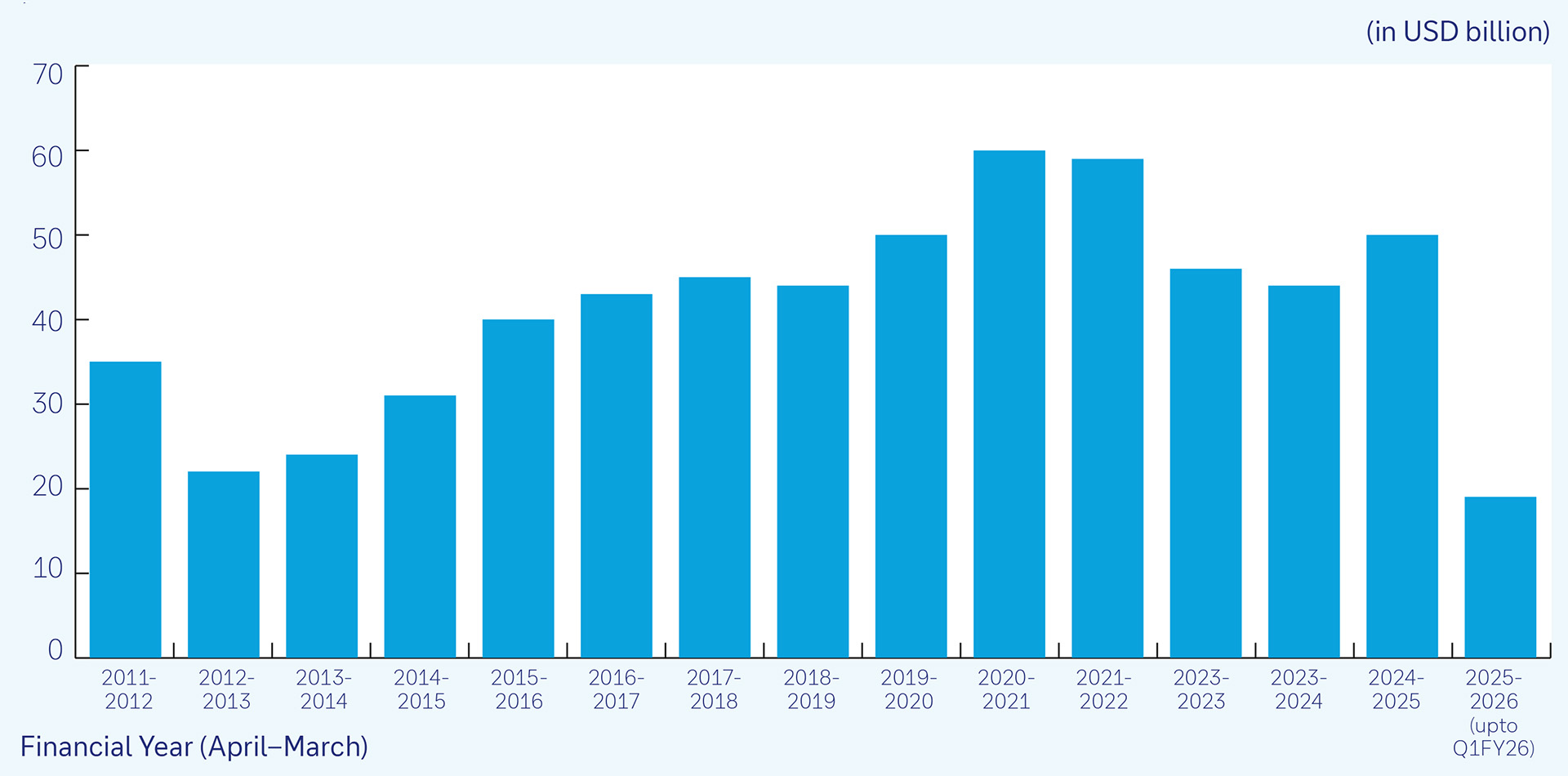

Deutsche Bank Research analysis calculates that India will need US$75–100bn in annual inflows to sustain its stated growth path – making trade clarity and diversified partnerships central to achieving this goal.

India’s FDI and foreign institutional investor (FII) flows have fallen in recent years, due to tariff-related uncertainty, repatriation of capital and high valuations in equity markets. However, Das now believes that “India is close to turning a corner; as and when that happens, it should lift sentiment and attract foreign capital inflows”.

In his view, the India-EU FTA offers a positive trigger at a crucial time, and sentiment could be further boosted if the bilateral trade deal with the US is also signed over the coming months. Adding to this, the government's ongoing focus on supply-side reforms (the recent example of plans to ease regulatory burdens on business is a case in point) should also generate a macro dividend and help to attract strategic growth-critical foreign capital inflows into India's capital markets.

Reflecting on the conclusion of the India-EU FTA, Kaushik Shaparia sees it as a pivotal inflection point – one that lifts the economic partnership between India and Europe into a new strategic orbit. “By reducing friction and embedding greater predictability into the trading environment, the FTA creates the conditions for a powerful re-acceleration of long term FDI and a deepening of FPI flows into India, strengthening market liquidity and fuelling investment across infrastructure, manufacturing, and the energy transition.”

He explains, “As global capital searches for clarity amid a fracturing geopolitical landscape, the agreement establishes a durable, rules aligned framework that can translate investment intent into lasting capital formation. When combined with the renewed ESMA-RBI cooperation framework – restoring confidence in cross-border clearing and regulatory coordination – these developments reinforce market stability and broaden the financial bridge between the two regions. Together, they signal a shared commitment to shaping an open, resilient and future-ready economic ecosystem”.

As Shaparia emphasises, “Deutsche Bank stands ready to connect global investors to the India opportunity and support the next chapter of the country’s economic transformation.”

Deutsche Bank Research has forecast US$45bn of capital flows into India for 2026 but, adds Das, “this should increase in 2027 and beyond, as net FDI and FII flows (both debt and equity with both combined constituting around 55% to 60% of total capital flows) pick up meaningfully in the coming years”.

Figure 2: Net FDI into India

Source: Namaste India

Investment flow types

Deutsche Bank’s handy Namaste India provides a step-by-step guide for investors in India. It sets out how entities established or incorporated outside India (i.e., foreign investors) can invest in securities issued by Indian companies through the following routes:

- Foreign portfolio investor (FPI). Portfolio investments are permitted in listed equities, fixed income instruments and exchange-traded derivatives on Indian stock exchanges. Investors are required to obtain FPI registration from a Designated Depository Participant (DDP) prior to making investments. The US is by far the largest source of these investments with more than US$4bn in assets under Indian custody.

- Foreign Direct Investment (FDI). Strategic investments in Indian companies can be made under the automatic route or the Government-approval route, depending on the sector of the investee company. Approvals for investments under the Government route are granted by the relevant ministry or department of the Government of India.

- Foreign Venture Capital Investor (FVCI). Here, investments are permitted in venture capital undertakings and start-ups in specified sectors. Foreign investors can invest under this route after obtaining a license from the Securities and Exchange Board of India.

- Non-Resident Indian/Overseas Citizen of India (NRI OCI). Indian citizens residing abroad for employment, business or vocation or non-resident foreign citizens of Indian origin, are permitted to invest in Indian securities under both portfolio investment and strategic investment (FDI) route.

Outlook for India

While the US$5trn GDP target might be taking a little longer, the IMF still expects India to be the world’s fastest-growing major economy, with real GDP growth around 6.2-6.6% in 2025–26, even after modest downgrades – although in January 2026 the government projected growth of 7.4% in the fiscal year ending March 2026, higher than last year’s figure of 6.5%.10

Alternative markets have been found for goods impacted by US tariffs such as textiles, marine products, gems and jewellery, motor components, and leather items subject to tariffs since August. Now that discussions of a bilateral trade agreement between the US and India have got underway, and this critical export market looks like coming back on stream again, India is in a very strong position for growth indeed.

Deutsche Bank Research reports referenced

Macro implications of India-USA trade deal, by Kaushik Das, Chief Economist India, Deutsche Bank Research, 3 February 2026

India-EU FTA: ‘Mother of all deals’, by Kaushik Das, Chief Economist India, Deutsche Bank Research, 27 January 2026

India's Trade Dynamic in a Multipolar World, by Kaushik Das, Chief Economist India, Deutsche Bank Research, 21 January 2026

Sources

1

See

India Union Budget 2026-27 at kpmg.com

2

See

2025 Oct world economic outlook

at imf.org

3

See

India's delayed $5-trillion dream: What IMF’s new timeline means

for your wallet

at indiatimes.com

4 See India-EU Joint Statement on the State Visit of H.E. Mr. Antonio Costa,

President of the European Council, and H.E. Ms. Ursula von der Leyen,

President of the European Commission, to India, and the 16th India-EU

Summit (25–27 January 2026) at consilium.europa.eu

5 Established in 1960 and comprises Iceland, Liechtenstein, Norway and

Switzerland and serves as an alternative trade bloc for European nations

that are not part of the European Union (EU) and aims to facilitate trade

with both EU and non-EU countries

6 See

EU and India conclude landmark Free Trade Agreement

at ec.europa.eu

7

See

The EU-Mercosur trade agreement

at commission.europa.eu

8

See

India-U.S. trade deal updates: Sensitive sectors of agriculture and dairy

have been excluded from the U.S. deal, says Commerce Minister Piyush Goyal

at thehindu.com

9

See

Economic Survey 2026 Highlights: Growth steady, inflation anchored,

external risks persist

at indiatimes.com

10

See

World economic outlook international monetary fund update

at imf.org