28 January 2026

With another stellar year for CLOs now behind us, what will 2026 bring to this asset class known for its resilience? Interest rate paths and trade policy volatility could all impact the next 12 months. And what are the refinancing/reset trends? flow’s Will Monroe reviews Deutsche Bank Research analysis to find out

MINUTES min read

For some years, flow has underlined the resilient nature of collateralised loan obligations (CLOs) as an asset class and, despite the macroeconomic uncertainty and volatility that characterised economies in 2025, the CLO market continues to demonstrate ongoing resilience both in the US and Europe.

“As the market continues to expand, it is critical for service organisations to make client-informed technology investments while maintaining talent acquisition and retention strategies,” reflects Herb Schofield, Global Head of CLO Product Management, Trust and Securities Services at Deutsche Bank.

The market expansion is partly due to its structural features such as diversified underlying loan portfolios and credit enhancements, which are designed to absorb some level of stress. In particular, senior tranches of CLOs – typically rated AAA – have performed well during times of stress over the years. This is because they have first claim on the cash flows from the underlying loans and benefit from single credit enhancements.

As outlined in flow’s ‘Collateralised loan obligations explained’, a key feature of CLOs that distinguish them from other types of securitisations is that they are actively managed by a CLO manager that seeks to optimise the performance of an underlying collateral pool of leveraged loans across a diverse array of industry sectors. In addition, unlike most other securitised asset types, CLOs are predominantly floating-rate assets – in other words their coupon payments adjust with benchmark rates such as SOFR (Secured Overnight Financing Rate).

“2025 was a record-breaking year for CLO deal activity across US and European markets”

In the first of two updates in 2026, this article, extracting from published Deutsche Bank Research insights by analysts Jamie Flannick and Conor O’Toole, provides an update on CLO markets in the US and Europe.

Overview of 2025 CLO market

2025 was a record-breaking year for CLO deal activity across both US and European markets, and credit metrics remained broadly constructive, despite the rapid shifts seen in global trade policy and divergencies in interest rate policy paths across the Federal Reserve, European Central Bank and Bank of England. Although most industry participants and strategists anticipated 2025 would be a strong year, few would have predicted just how robust the end numbers would ultimately be across both markets.

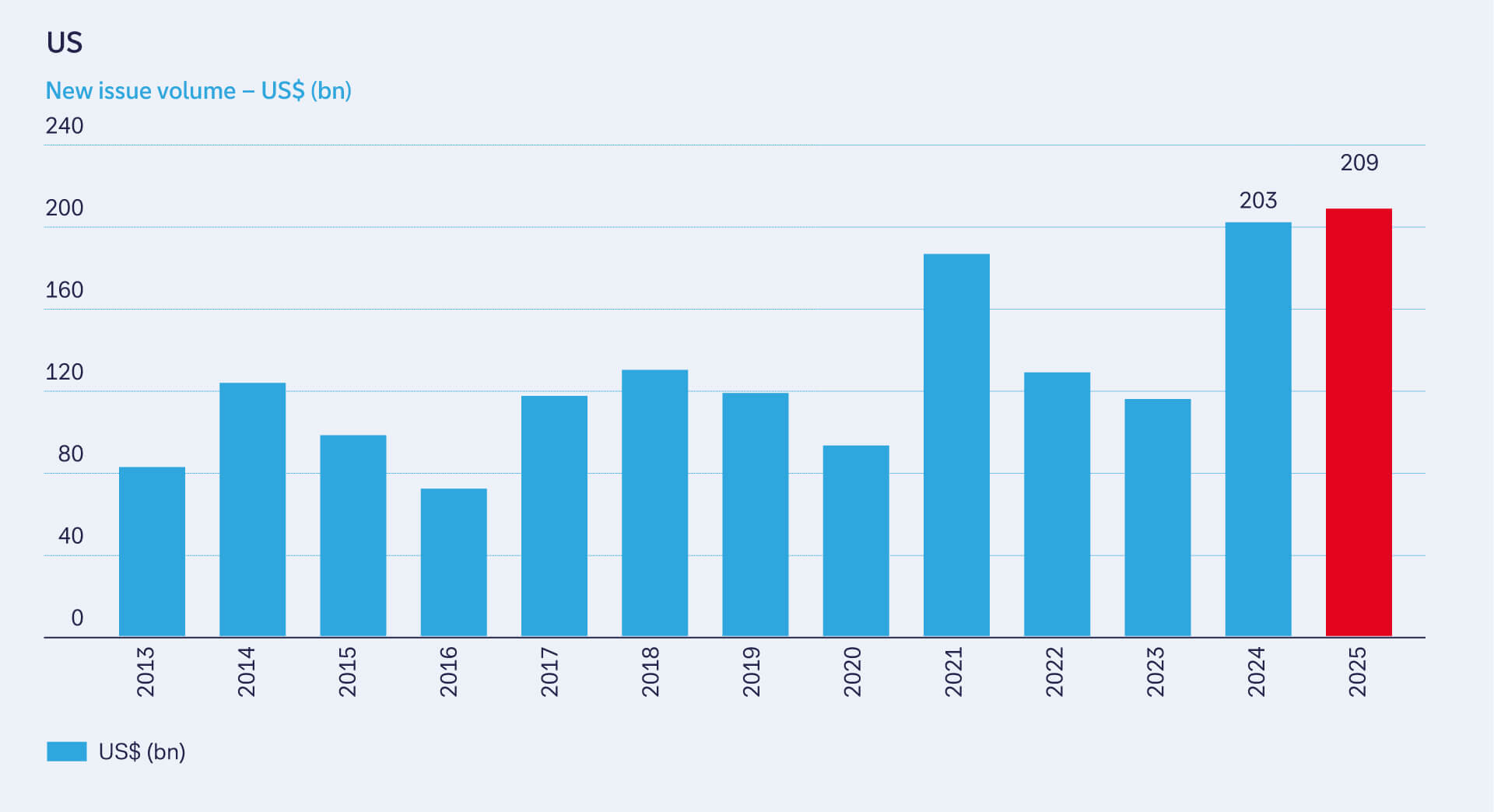

US primary issuance volumes

In the US, new issue deal volume ended 2025 at US$209bn, a 3% year-over-year pickup from the US$203bn logged in 2024. As predicted in our 7 October update, Deutsche Bank Research’s Flannick anticipated the split to be near the final tally of US$165bn for broadly syndicated loan CLOs and US$40bn for private credit/middle market CLOs.

Refinancing/reset volumes finished at US$337bn – north of the US$308bn recorded at the end of 2024. By way of background these are CLO transactions which allow a deal, which has already been issued and is trading in the secondary market, to refinance its coupon rate across either all (reset) or a portion (refi) of its CLO bonds.

For context, CLO refi/resets are deployed to optimise the financial performance and extend the useful life of a CLO, primarily benefitting equity investors by improving the CLO’s funding costs and management flexibility. Existing debt tranches are refinanced (paid off and reissued) to take advantage of prevailing market conditions (for example lower interest rates). In a reset, the duration of the CLO’s non-call and reinvestment periods are also modified, extending the maturity date.

A healthy refi/reset market, as seen in 2025, is a fundamental positive for the CLO market – reduced interest expense on the debt tranches with new debt issued at lower spreads leaves more cash available for the equity tranche and a longer reinvestment period gives the CLO manager more time to actively manage the portfolio and generate returns.

Figure 1: Primary annual US CLO issuance volumes

Source: PitchBook, Deutsche Bank

US secondary trading volumes

2025 was not just a standout year for the CLO primary market – the US secondary market also saw a record amount of deal activity, with TRACE (Trade Reporting and Compliance Engine) volume ending at US$219bn, well ahead of the US$183bn seen in 2024, a 19% YoY pickup. Deutsche Bank’s US CLO trading desk accounted for around US$30bn of the US$219bn, roughly 15% of the total. These levels point to the growing level of liquidity in the secondary market, emblematic of what is now a US$1.2trn market in the US.

Investment grade (IG) trades accounted for 79% of the total volume compared to 73% at the end of 2024. As Flannick notes, “The uptick in the percentage of IG traded in secondary last year was a function of there being far greater uncertainty in the market compared to 2024. IG can be more attractive to investors when conditions are less stable.”

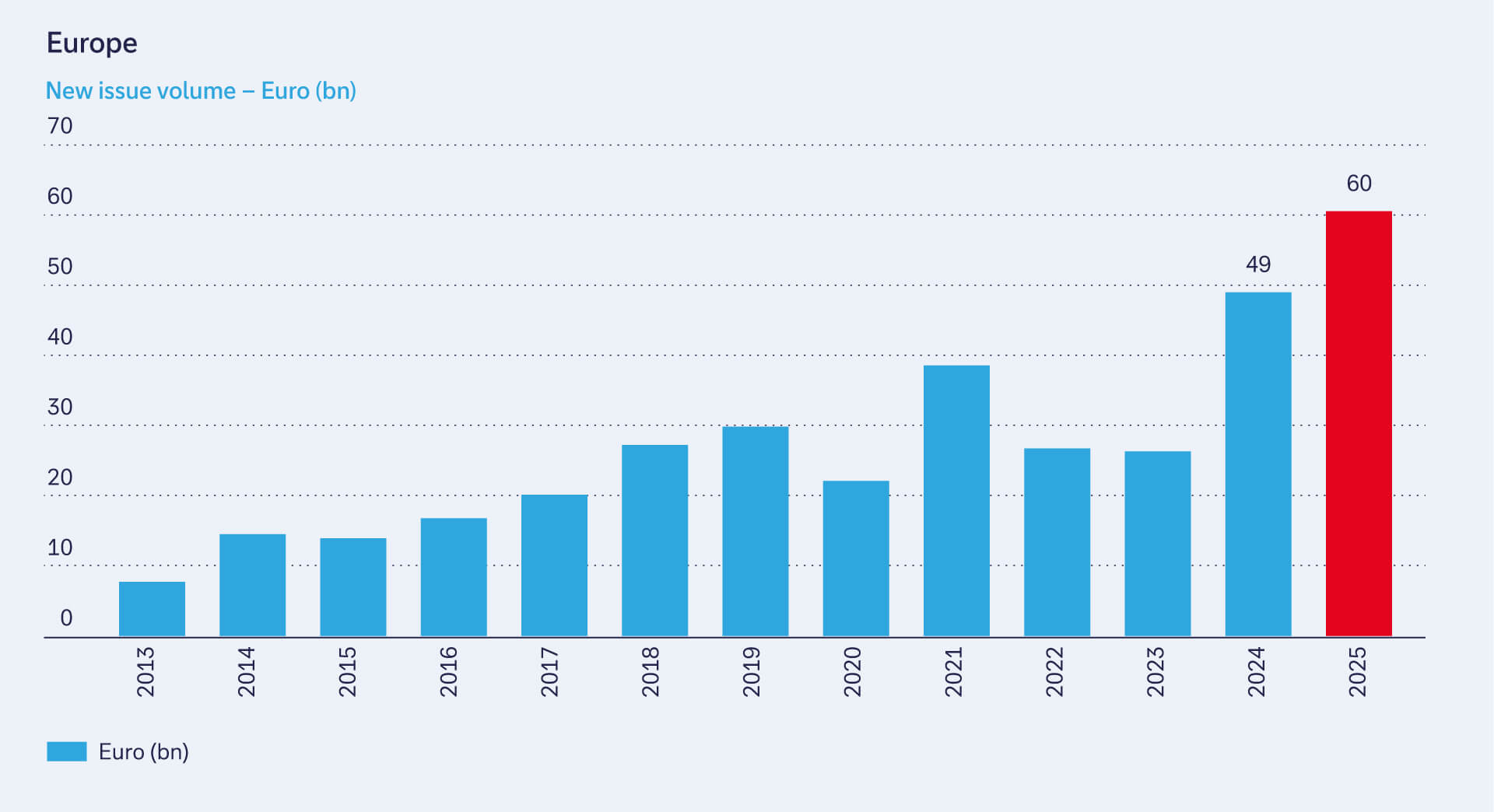

European primary issuance volumes

In Europe, the year-over-year change in primary deal activity was even more impressive – €60bn (US$68bn) of new issue volume in 2025 compared to €49bn (US$52bn) in 2024. According to Conor O’Toole, Head of European Securitisation Research and Global Head of CLO Research at Deutsche Bank, “2025 has given rise to another record year for European CLO issuance.”

The upsized deal volume occurred against a backdrop of a still challenging new money loan issuance environment and what O’Toole refers to as “a more challenged CLO arbitrage” climate than previous years. This is where managers create a highly leveraged portfolio of leveraged loans and fund them through the issuance of tiered debt tranches, with the aim of generating returns for equity investors by capturing the spread between asset yields and funding costs.

Like in the US, refis/resets were a vibrant part of the European primary market, accounting for €66.4bn (US$75.8bn) in deal activity – a significant pickup on the previous year’s €34bn (US$36.5bn). And like new issuance, the combined level of refi/reset activity reached a record level in 2025. As in the US, European CLO spreads remained historically low for much of the year, which provided the impetus for equity investors to reset deals at more favourable debt costs.

Figure 2: Primary annual European CLO issuance volumes

Source: PitchBook, Deutsche Bank

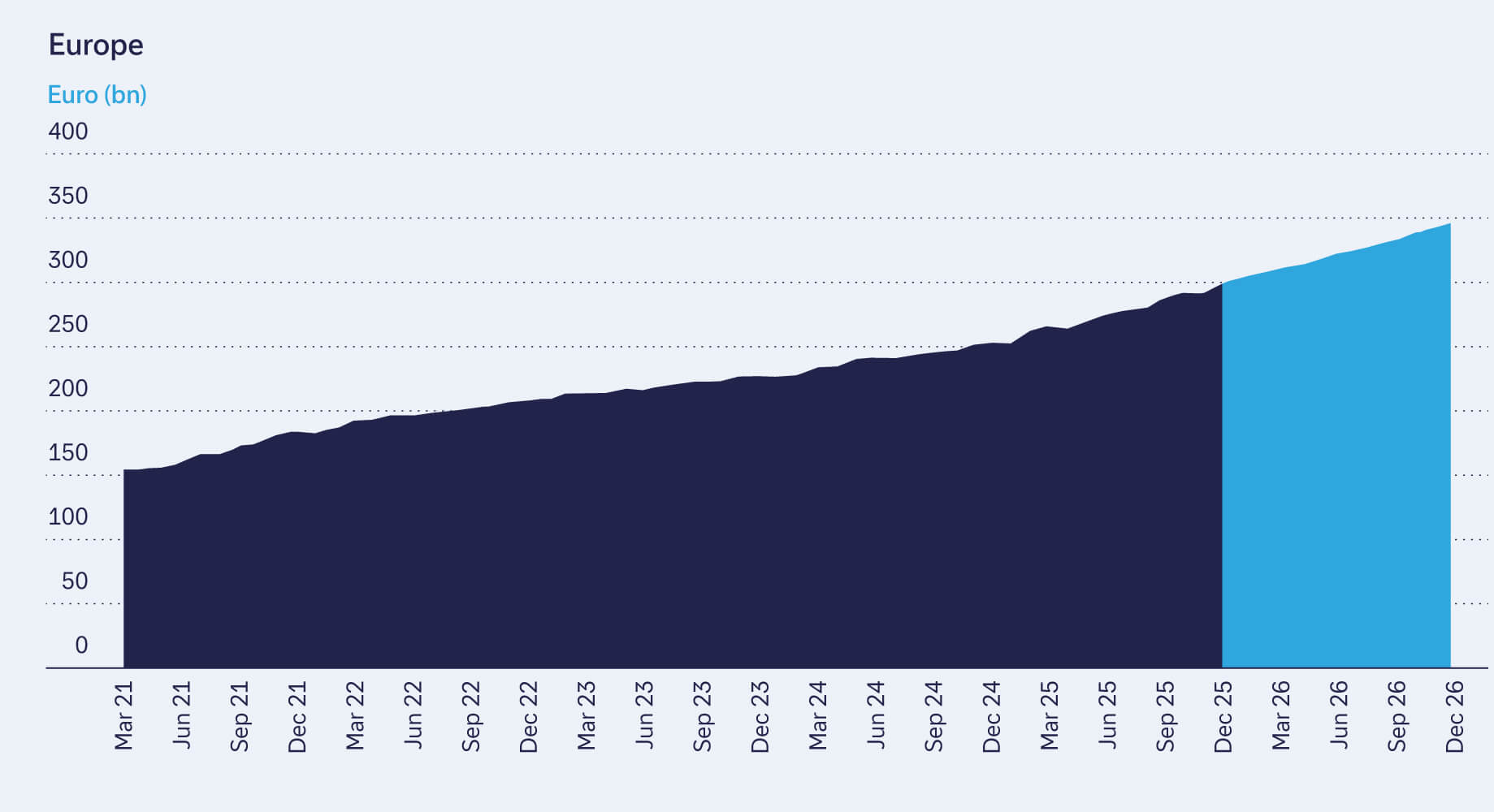

European secondary trading volumes

Secondary trading volumes were constructive in Europe, with Deutsche Bank secondary trades in line with 2024’s US$10bn+ level. The level of activity reflects the growing size of the European market, which has now reached roughly €300bn (US$352bn).

Investors seemed to focus mostly on either shorter duration bonds (those that are past their reinvestment period and have started to amortise), accounting for roughly 25% of trades, or on longer duration bonds (3+ years till end of reinvestment), which accounted for roughly 35% of deal activity. These duration profiles were also popular in the US market and pointed to two separate strategies for a relatively volatile 2025 market context.

Outlook for 2026

Turning to 2026, the path ahead for interest rates is one of the key determinants of the 2026 CLO market. The US saw the 25bps interest rate reduction from the Federal Open Market Committee (FOMC) on 10 December 2025,1 bringing the benchmark to 3.5%–3.75% for the first time since October 2022. However, as Flannick points out, “With a new Federal Reserve Chair set to be appointed, as well as the dual challenges of a stagnant and likely softening labour market combined with an elevated inflation rate near 3%, where rates go from here is far from certain.”

If a further 25bps rate cut at the June 2026 FOMC meeting happens once the Committee has a new Chair, this would deliver a “pro-growth” set up for the US CLO market, notes Flannick.

Overall, his team anticipates new issue volumes in 2026 to slightly contract to US$190bn. Although strong market fundamentals should persist over the next 12 months – such as relatively high all-in base rates, continued annuity and exchange-traded fund inflows, and constructive corporate balance sheets – the CLO market will contend with broader late-cycle macro conditions expressed in sluggish economic growth, which will present a headwind.

And while a number of factors could lead to another record-breaking year for CLO new issuance – such as an acceleration of leverage buyout and mergers and acquisition activity following the Fed rate cuts, and a further reduction of trade and fiscal policy uncertainty – downside risks also exist which could dampen deal activity, such as a slowing labour market or an increase in headline leveraged loan defaults.

Turning to Europe, the team is forecasting €65bn in gross new issue CLO supply (an 8% uplift on 2025) with net issuance at €45bn. As for resets, the team estimates around €53bn in potential reset/refinancings if current spread levels are maintained. They note that “reset economics are more sensitive than [at] any point in the last few years”.

The European market has grown 16% to €294bn since the end of 2024, and the team expects the market size to reach €300bn by the end of 2026 (see Figure 3).

Figure 3: CLO market size evolution

Source: Deutsche Bank

Overall, they warn that “proactive CLO management will be crucial for buffering against potential credit downgrades and defaults, especially as manager and deal performance tiering, already stark, is set to sharpen further”.

As with the US, downside risks include the threat of policy uncertainty. “Should trade tensions flare up once again, potentially leading to widespread increases in tariffs, the ripple effects would be considerable. This would further strain already affected sectors, increasing input costs for businesses and ultimately lead to higher prices for consumers, dampening overall economic activity and demand.”

The other risk is an increase in headline leverage loan defaults. “A material uptick in defaults or renewed credit fears, particularly among larger borrowers or across multiple sectors, would undoubtedly cause greater concern regarding the overall credit health of the leveraged finance market,” says O’Toole.

The macro context will be highly influential for both markets. However, given these growth forecasts and the strong underlying fundamentals where both markets are starting from, the CLO market in 2026 should once again be vibrant in terms of deal activity and offer investors a variety of opportunities to gain exposure to the growing US$1.5tn asset class.

For further information on Corporate Bank CLO services please visit Collateralised Loan and Debt Obligations – Corporates and Institutions

Deutsche Bank Research reports referenced

- US CLOs – three questions for 2026 – rates, defaults, dispersion by Jamie Flannick and Conor O’Toole, Deutsche Bank Research (15 December 2025)

- European CLO Outlook 2026 – Navigating a bifurcated loan market by Conor O’Toole and Vinit Raj, Deutsche Bank Research (19 November 2025)