15 January 2024

With Asia-Pacific a major sourcing hub for global supply chains, multinational companies need to ensure that their ESG targets in the region are met. flow’s Desirée Buchholz reports on how German industrial sensor manufacturer Pepperl+Fuchs established a sustainable factory in Vietnam that could serve as an ESG role model

MINUTES min read

While Europe is taking the lead in shaping regulation around environmental, social and governance (ESG) factors, Asia-Pacific largely determines whether multinational companies (MNCs) can meet their sustainability commitments.

APAC continues to be the premier global manufacturing hub with 43% of global exports of intermediate goods – those used in producing a finished product – coming from the region in 2021.1 At the same time, South-East Asia is increasingly attracting foreign direct investment (FDI) thanks to the region’s relatively low wage costs, fast-growing markets, and proximity to industrial clients.

According to an estimate from Deutsche Bank Research the EU’s overseas direct investment in the 10 member countries of the Association of South-East Asian Nations (excluding Singapore), aka ASEAN, rose by about 20% from 2021 to 2022.2

“As companies are expanding their operations in Asia, they need to ensure that these investments are in line with their global ESG targets”

“As companies are expanding their operations in Asia, they need to ensure that these investments are in line with their global ESG targets,” says Kamran Khan, Head of ESG for Asia Pacific, Deutsche Bank. He continues, “Supply chains can only become sustainable if local production adheres to global ESG requirements.”

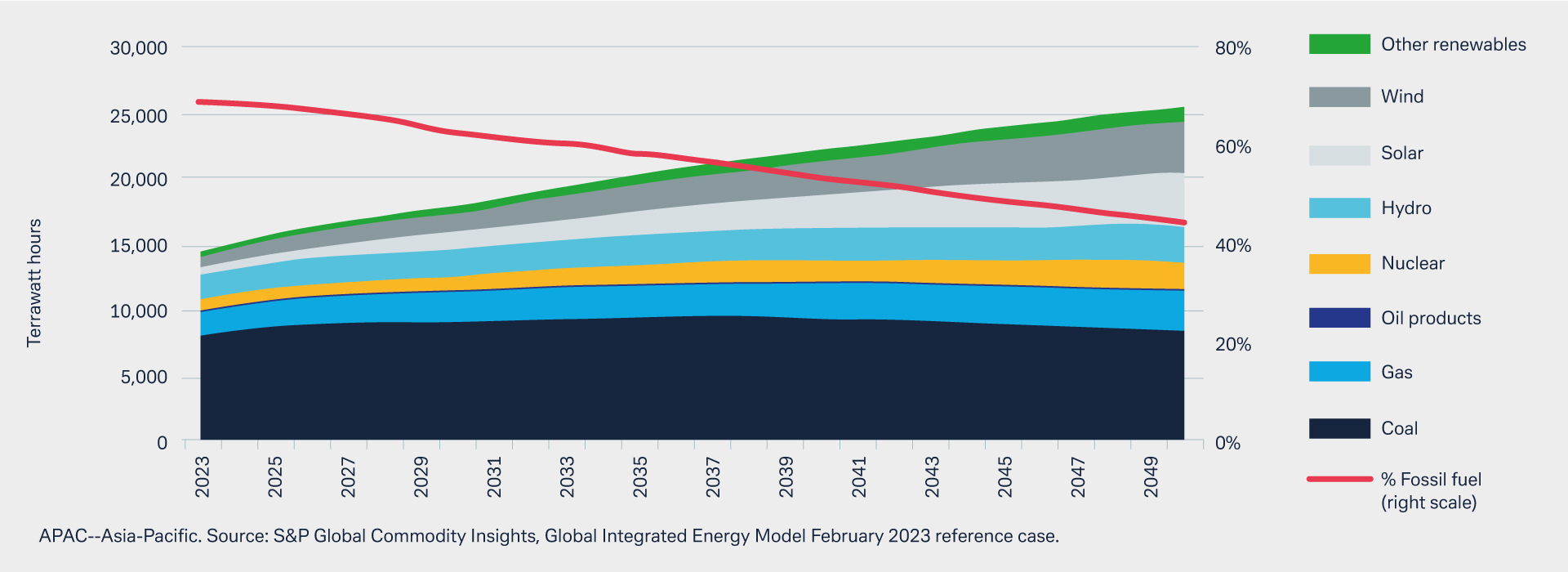

Yet this goal is particularly challenging in APAC as the region still generates 70% of its power from fossil fuels, making energy transition imperative – especially as robust economic growth is expected to drive increased power demand over the years to 2050 (see Figure 1).3 This provides huge potential for financing renewable energy projects in the region: According to data from HIS Markit, renewable capex in APAC is expected to reach US$720bn over the period 2021 to 2025. “There is a growing need for ESG-compliant financing and advisory services for low-carbon operations in Asia,” Khan observes.

Figure 1: Expected evolution of APAC electricity mix

Source: S&P Global, https://www.spglobal.com/_assets/documents/ratings/research/101574780.pdf

Vietnam invests in clean energy

Indonesia and Vietnam, which have committed to reach net zero by 2050, are among the front runners in the region. As part of its decarbonisation strategy, Vietnam has pledged to phase out coal by the 2040s. “The country has huge renewable-energy potential, as it is the most naturally suited country in Southeast Asia to develop wind and solar energy,” consultancy McKinsey writes in a recently published analysis, calculating a technical potential of 650 gigawatts (GW) for wind power and 380 GW for solar power.4

To finance its transition away from fossil fuels to clean energy, Vietnam sealed a US$15.5bn deal with nine developed countries and the European Union in December 2022. As part of the so-called Just Energy Transition Partnership half of the funding was committed by private financial institutions including Deutsche Bank.5 A similar deal was agreed with Indonesia in November 2022.6

Pepperl+Fuchs opens sustainable factory in Vietnam

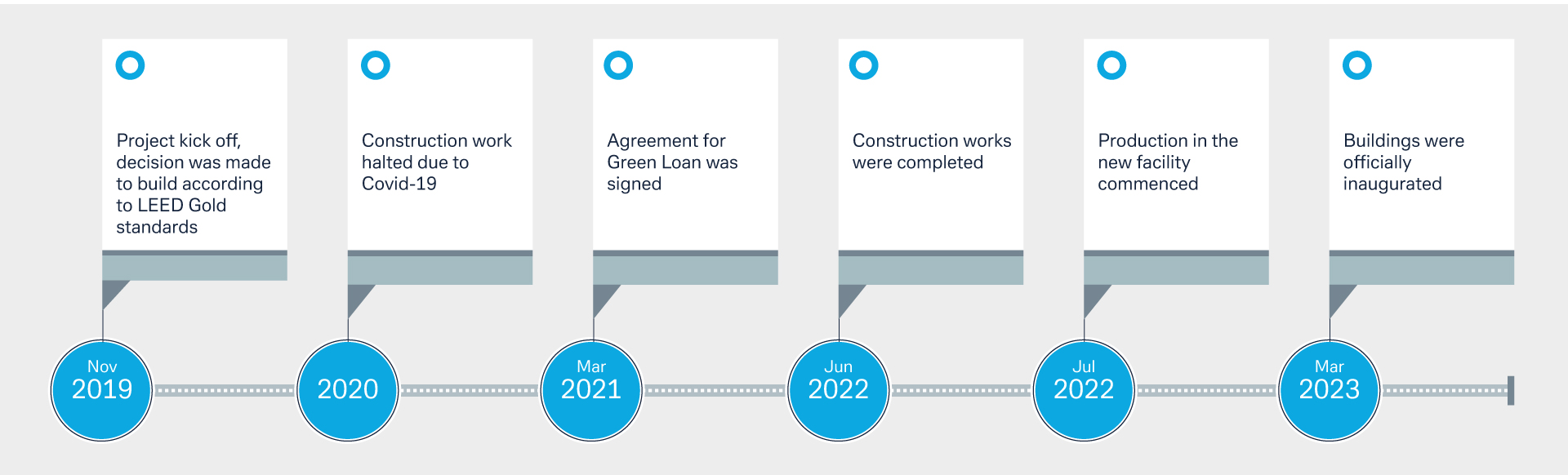

Vietnam’s government also aims to attract ESG-compliant investments from companies. An example of how sustainable finance is put into action in Vietnam is the case of German industrial sensor manufacturer Pepperl+Fuchs (P+F). In March 2023, the company opened a new manufacturing facility in Ho Chi Minh City, aka Saigon, which was financed with a US$15m green loan from Deutsche Bank (see Figure 2).

The bank’s loan and associated advisory services enabled P+F to meet international green building standards. The new manufacturing facility has obtained a LEED (Leadership in Energy and Environmental Design) Gold certification, which is a green building certification programme developed by the US Green Building Council and a globally recognised benchmark for sustainability in real estate. Building projects earn points for addressing carbon, energy, water, waste, transportation materials, health, and indoor environment quality issues to achieve corresponding levels of certification; after platinum, gold certification is the second highest level.7

“In the medium term, the new facility in Vietnam will be our largest site”

To appreciate the importance of this transaction for Pepperl+Fuchs requires knowing the company’s operations. Founded in 1945 in the town of Mannheim, Germany, P+F operates two divisions – factory automation and process automation (see box out) – and in 2022, for the first time in its history, exceeded the revenue threshold of €1bn, one third of which originates from Asia. This share is expected to increase over the next few years given the region’s growth prospects.

APAC is already by far the company’s most important region based on production share. It opened its first production site in Singapore as early as 1979 and – as of today – 80% of the company’s entire manufacturing volume originates from APAC, Jürgen Seitz, Executive Vice President Production Asia at P+F explains: “In the medium term, the new facility in Vietnam will be our largest site.” In addition to Singapore and Vietnam, P+F also has plants in Indonesia and India – as well as Germany, Hungary, the Czech Republic, and the US.

Business areas Pepperl+Fuchs operates in

Division 1: The company produces industrial sensors for factory automation technologies including signal transmission devices and printed circuit board assembly which form an integral part of the Internet of Things (IoT). Clients come from various sectors, including automotive, robotics and assembly, logistics and material handling, print and paper industry, packaging, electrical industry, entrance automation, mobile equipment, process equipment and renewable energies.

Division 2: The company produces explosion protection for process automation. Clients come from oil and gas industry, offshore and marine, chemical industry, pharmaceutical industry, mining and metals, aviation, water and wastewater, food and beverages and power industries.

Putting ESG measures into place

Given Asia’s strategic importance for the company’s business – and that it exports 100% of its Vietnam output – P+F must ensure that its local operations comply with global sustainability standards. As part of its sustainability agenda, the company has committed to three goals around ESG best practice, the P+F representatives explain during the interview:

- decarbonisation;

- meeting human rights along the entire supply chain; and

- fostering diversity.

The company is currently developing concrete Key Performance Indicators (KPIs) and timelines for these overarching goals. As P+F falls under the Corporate Sustainability Reporting Directive (CSRD) of the EU8, it will need to disclose data on its sustainability performance from 1 January 2026 onwards. Moreover, these KPIs will also be used for the companies’ finance strategy, Andreas Bouche, Executive Vice President Global Finance at P+F, explains: “We want to showcase our employees, customers, suppliers and investors that we are a green company and sustainable finance instruments help us to do so.”

“We want to showcase our employees, customers, suppliers and investors that we are a green company and sustainable finance instruments help us to do so”

While the work around defining sustainability KPIs and fulfilling ESG reporting requirements is still ongoing, “we didn’t want to wait to put the right measures in place,” Seitz says. “So, when we decided in 2019 to build a new manufacturing plant in Vietnam, it was clear that we would do this according to green building standards.” In parallel, the existing facility was refurbished to also adhere to those standards.

Representatives of Deutsche Bank and Pepperl+Fuchs during the opening ceremony of the new factory in Vietnam

Seeking funding and guidance, P+F turned to Deutsche Bank which has been the company’s housebank in Vietnam for more than 10 years. “With the longstanding partnership and understanding of our business in Vietnam, we have chosen Deutsche Bank to be our green loan provider,” says Bouche. “During the selection process, Deutsche Bank convinced us with their green loan facility expert who could explain and support us throughout the entire LEED Gold application and qualifying process which definitely helped to smoothen the process.”

Figure 2: Timeline for P+F’s sustainable factory in Vietnam

Source: Deutsche Bank

“We are delighted to have supported P+F with the financing to support construction of this LEED Gold certified factory,” says Bernd Starke, Head of German, Austrian and Swiss MNCs in APAC at Deutsche Bank. By opting to strive for the highest standards in environmentally friendly, socially responsible manufacturing, P+F have made clear that they take sustainability in their worldwide operations seriously.

Building an energy-efficient factory

What does it take for a new factory to be sustainable? “When strolling through the two facilities in Vietnam, one can see clearly the evidence why we have obtained a LEED Gold certification,” says Hong Han-Thanh, General Director of P+F Vietnam. To ensure energy efficiency, the construction workers used high quality insulation material as well as double glazing and a hi-tech membrane. Moreover, a 1,200m2 solar system with a capacity of 240KWp provides about 10% of green energy. “This reduces our power demand from the local provider and has led to an annual reduction of 126t CO₂ emissions,” he adds.

“When strolling through the two facilities in Vietnam, one can see clearly the evidence why we have obtained a LEED Gold certification”

To reduce waste, the company no longer issues plastic single use water bottles to its 850 employees in Vietnam and its visitors. “Instead, we have installed drinking water systems providing fresh cold and hot waters on every floor,” Han-Thanh says.

Added to environmental goals, the two facilities also reflect social aspects. “Vietnam is one of the most competitive labour markets in our industry,” Han-Thanh explains. “In order to continue to attract and retain talent and ensure a healthy work-life balance, we provide a 500m2 social recreational area equipped with table tennis, billiard table, football, stationary bike, treadmill, and steppers where employees can exercise before, during or after work.” P+F Vietnam also offers young mothers breastfeeding room facilities and a flexible telecommuting working policy which helps to reduce CO₂ emissions.

Pepperl+Fuchs factory in Vietnam with solar panels on the roof

Source: Pepperl+Fuchs

On the back of these investments, P+F has won several awards in Asia. Amongst others, P+F was voted Best Company to work for in Asia (Vietnam Chapter) in 2023 by HR Asia, a leading publication in the human resources industry.9

How IoT helps to reduce CO₂ emissions

While P+F now operates a sustainable factory in Vietnam, the products manufactured at the plant also contribute to initiatives against global warming, Seitz says: “Our products help our customers to achieve climate neutrality as automation and digitalisation are drivers for energy efficiency.”

The German city of Freiburg for example is using the company’s sensors to reduce costs, traffic and CO₂ emissions when emptying glass-recycling containers. Previously, the containers, which are spread over a large area, were emptied in a fixed order at set time intervals. “Now, the sensors enable the local waste management company to check the fill level of each container and plan the route of the vehicles accordingly,” Seitz explains.10

In another application, the sensors help to deal with the consequences of climate change as they monitor fill levels of rivers, lakes, and flood basins helping to better protect against flooding. The factory in Vietnam also produces rotary encoders, used to control the rotation speed of wind turbines. “Here, our products directly contribute to the energy transition,” he adds.

Outlook

With the new Vietnam production unit up and running, P+F is now revamping its existing facilities in APAC based on the experience. Most prominently, the entity in Singapore has just commissioned a solar system to generate green energy as well.

And the sustainable factory in Vietnam could act as a role model for other companies in the region. “We get many visitors who want to learn from our experience,” Han-Thanh recalls. “Just recently we welcomed a group from the German chamber of foreign trade whose participants were surprised by the high sustainability standards.”

If more companies were to invest in renewable energy and sustainable manufacturing capacities, this would also be in the interest of the Vietnamese government. Ensuring “a sustainable, green growth economy that balances economic and social development”, is what the country is aiming for, Vietnam’s Minister of Planning and Investment, Nguyen Chi Dung calls it.11 Thus, attracting ESG-compliant capital is crucial for the country.

Sources

1 See wto.org

2 Deutsche Bank Research Report Supply-chain diversification: Europe's investment patterns in Asia published on 6 June 2023

3 See spglobal.com

4 See mckinsey.com

5 See ec.europa.eu

6 See ec.europa.eu

7 See usgbc.org

8 See finance.ec.europa.eu

9 See en.prnasia.com

10 See pepperl-fuchs.com

11 See vietnam.un.org