29 July 2025

Maintaining control over national payments infrastructure is part of Europe’s wider strategy to improve security, ease of doing business and competitiveness. Treasury writer Helen Boyd takes a closer look at the bloc’s recent implementations.

MINUTES min read

The past two decades have given rise to an explosion of innovative payment systems, both for individuals and businesses, revolutionising the way that we pay and receive money. Few of us now count out coins for a morning coffee or dig around for a card from our wallet to pay online. But what characterises the majority of payment methods, with the exception of those with a predominantly domestic focus such as Bizum in Spain, is that they originate outside Europe. In an increasingly precarious global landscape, many national governments and central banks are considering the importance of sovereignty in key infrastructure, including payments.

The risk of globalisation to national infrastructure

The speed with which geopolitical tensions can spiral into conflict, as current events continue to illustrate, emphasises the importance of security and control over national infrastructure, whether this is energy, water, food security, digital or financial systems. As countries become more reliant on digital financial infrastructure, the risks presented by a lack of harmonised, regional payment methods that are owned and controlled by regional players are becoming apparent.

For example, there are conceivable – and as the outbreak of conflict in Ukraine demonstrated, very real – scenarios where countries such as the US, China or any other could impose restrictions on the way that banks or payment providers headquartered in the country operate in other jurisdictions. Given the predominance of some payment schemes, such actions could cripple economies – and particularly consumer spending – very quickly. The European Central Bank notes, for example, “the excessive dependence on foreign entities in the European payments sector threatens the autonomy and resilience of European payment services”.1

From risk to reward

While achieving greater sovereignty over payment flows is a growing priority to achieve government and central bank objectives, there can also be benefits in terms of convenience, efficiency and cost-effectiveness. A high-profile success is Unified Payments Interface (UPI) in India. Over the past decade, UPI has quickly demonstrated the value of a common payment method across an area with diverse payment cultures to drive efficiency and economic growth. When UPI was launched in 2016, 78% of point of sale (POS) transactions were made in cash. In 2024, 58% of POS and 64% of e-commerce sales were made via digital wallets such as PhonePe and Google Pay using UPI. Cash use has already fallen to 15% in 2024 and is forecast to halve to 7% by 2030.2

Part of UPI’s success has been convenience for the consumer, but this has also been backed by regulation and government pressure to reduce tax evasion, improve financial inclusion and build trust and confidence in India’s financial system.

Diversity in European payment priorities

In the case of Europe, with financial inclusion higher and the use of cards more prevalent, the challenges and drivers of payments innovation are different. For example, consumers and businesses have been able to take advantage of fintech-initiated innovations from outside their home region, such as PayPal and Apple Pay in the US, which has reduced the need to develop payment methods locally.

This is not to say that European countries have been lagging behind in payments innovation. The Single Euro Payments Area (SEPA) project and initiatives such as the Second Payment Services Directive (PSD2) play a vital role in providing a harmonised framework in which payment innovation can flourish without compromising transparency, security or consumer protection. One such example is Request to Pay (R2P), a digital messaging service that allows the payee to request payment from the payer, who then chooses to accept or decline in real time. R2P is not a settlement method, but a secure communication layer using payment rails such as SEPA, UK Faster Payments or India’s UPI.

Innovative domestic payment methods have also emerged. In Spain, Bizum was founded in 2016 as a joint initiative between 24 Spanish banks, initially to support instant peer-to-peer payments methods using phone numbers. The service quickly expanded to exceed one million users within the first year, with ongoing innovation to support ecommerce, QR code payments and in-store payments. There are now 26 million active users in Spain (more than 50% of the adult population, and up to 90% among some segments) and 38 affiliated banks,3 of which only a few, including Deutsche Bank, are headquartered outside Spain.

However, in some cases, domestic payment methods were developed before ecommerce became prevalent, such as Girocard, a local debit card in Germany. Furthermore, differences in payments culture across Europe have led to diverging priorities and preferences.

Made in Europe: European payments alignment

These differences in payment behaviour, and typically ample choices within each country, have made it difficult to justify the value of a new payment method that is Europe-owned, led and controlled. The increased focus on national infrastructure and recognition of an efficient payment method as a driver of positive economic change both within countries and regionally is changing this perception.

“It's always the payer who chooses the payment method”

To be successful, however, a new payment method would need to be at least as convenient, cost-effective and secure as other alternatives. As Corina Metternich, Deutsche Bank's Head of Business Product Management Payment Methods Europe, Merchant Solutions Acceptance, notes, “It’s always the payer who chooses the payment method. Payment methods should be set up to support the payer, and help them in their daily life, not because the bank prefers it. And if you create a payment method which does not achieve this, it will not be successful, particularly given that people often have several choices in how they pay.”

Wero – the pan European digital wallet

This combination of sovereign, bank and consumer objectives has led to the development of Wero, a new payment system for Europe. Launched in 2024, Wero is a pan-European digital wallet that is part of the European Payments Initiative supported by 14 major banks,4 including Deutsche Bank, and major PSPs. Already live in Belgium, France and Germany, consumers can send and receive money instantly using a phone number, directly debiting their bank account.

The benefits of a pan-European payment method, that is described by Wero as “simple, seamless and made in Europe”5 accrue to consumers, merchants, banks and governments alike. Consumers gain access to an instant payment method via their own bank app or the Wero app to make P2P payments. Next will be to extend to enabling account-based payments at POS, as an alternative to cards or cash. Metternich continues, “People typically have great trust in their local bank and this model has already proven very successful in countries around the world.”

Merchants also benefit, as they receive immediate value while also reducing their costs significantly, as they do not incur card processing fees. Oliver von Quadt, Deutsche Bank’s Global Head of Merchant Solutions – Acceptance comments, “The use of Wero for high-value payments, for example, is particularly attractive to merchants, given that the cost of card payments is usually a percentage of the total transaction size, often 1% or 2%. For an auto manufacturer, with narrow margins of, say 6–12%, card fees represent a huge cost.”

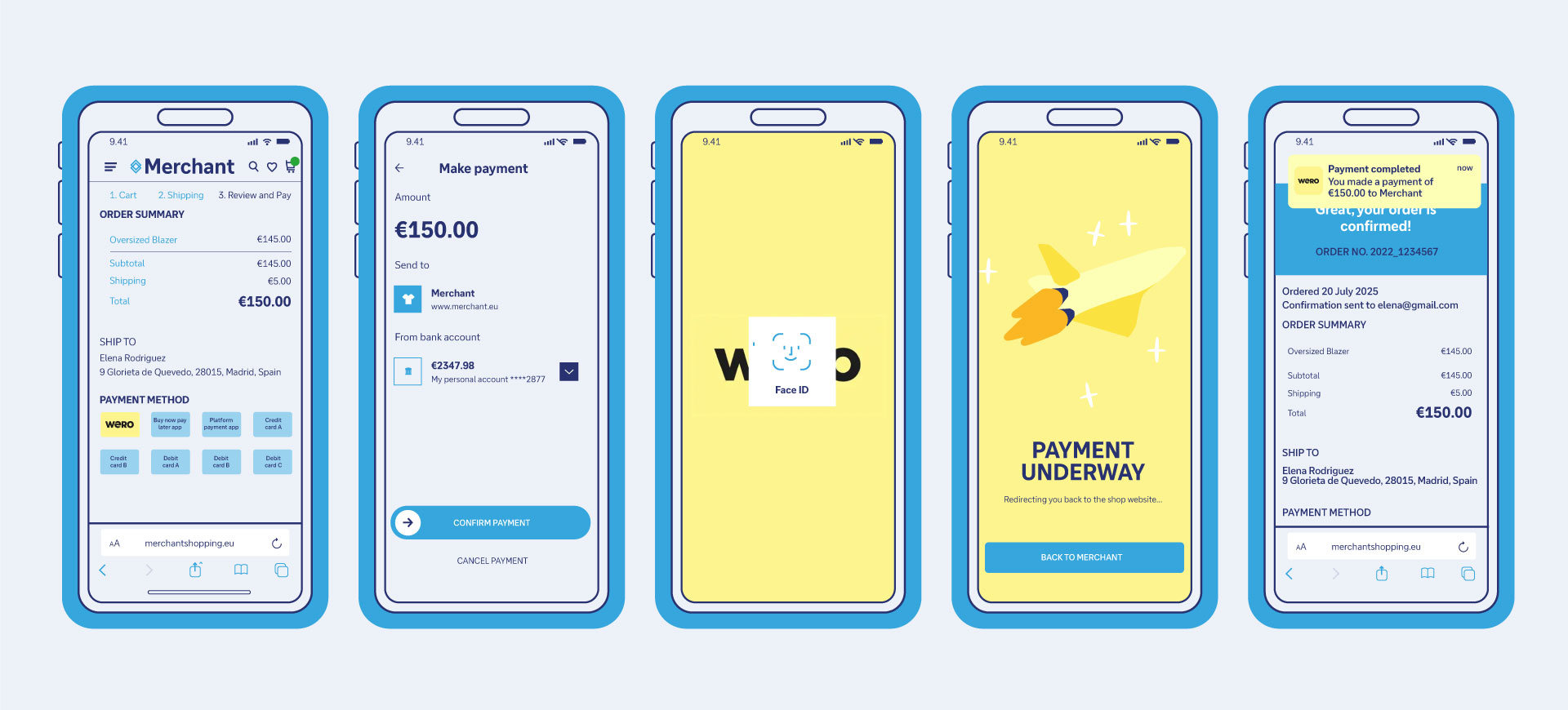

Figure 1: User experience with the Wero stand-alone-app in context

Source: Deutsche Bank

The success of Wero and other initiatives in the future will depend on gaining rapid traction among consumers, merchants and banks. Metternich says, “As with Bizum, where Deutsche Bank was the first adopter bank from outside Spain, and one of the only adopter banks from outside Spain today,6 we are committed to helping our customers to take advantage of new payment methods such as Wero and RTP, whether they operate in a single country or on a pan European basis. This includes helping to streamline their systems and processes via a single gateway.”

Von Quadt continues, “Merchants that offer consumers an early opportunity to pay using Wero are likely to gain competitive advantage by increasing margins and offering greater consumer choice. We could, for example, see different pricing emerging for using more or less expensive methods of payment, which will help to fuel consumer adoption as well as driving down costs.”

Although Belgium, France and Germany are introducing Wero ahead of other countries, we can expect to see its rollout across the region. Furthermore, as von Quadt comments, “R2P is also a strong alternative, particularly until Wero has expanded its country coverage and adoption of acceptance and issuing services has become prevalent.”

From a consumer, business, government and financial services perspective, the birth of a strong European, instant, bank account-based payment method builds on innovation already achieved locally, but also draws on experiences globally, particularly in Asia where payment innovation has flourished. By leveraging these experiences, Europe can fast track to a new era of payments, while offering convenience, cost efficiency and safety in a volatile world.

Helen Boyd is an independent treasury and transaction banking editor

Sources

1 See ecb.europa.eu

2 See Worldpay, Global Payments Report 2025

3 See bizum.com

4 See wero-wallet.eu

5 ibid

6 See bizum.com