2 December 2025

Drawing on the Deutsche Bank Research annual next-year World Outlook, flow looks forward to a year of cautious optimism, with growth accelerated by AI adoption, clearer trade strategies, fiscal stimuli, and investment in security and infrastructure

MINUTES min read

“2026 promises to be anything but dull,” declared Deutsche Bank Research’s Jim Reid and David Folkerts-Landau in their annual global macroeconomic World Outlook, published on 24 November 2025.

In a year where one would be forgiven for thinking the main narrative would be around trade tariffs given the announcements from Washington on 2 April, it is actually the rapid investment and adoption of artificial intelligence (AI) that continues to dominate market sentiment.

“Given the pace of technological advancement, it is difficult to believe this won’t translate into meaningful productivity gains ahead. However, the ultimate winners and losers will depend on a complex interplay of evolving factors, many of which may not become apparent until after 2026,” they continue.

Shifting sources of growth

Reid and Folkerts-Landau note that “global growth in real terms is expected to mirror 2024 and 2025, but the sources of that growth are shifting”. The US is projected to re-accelerate as trade uncertainty fades, household incomes benefit from tax cuts, and growth broadens beyond AI-related capex.

After years of stagnation, Germany is positioned for one of the most meaningful rebounds among major economies thanks to newly unleashed fiscal stimulus. Europe excluding-Germany should slow slightly off a strong 2025, but momentum is expected to firm through the year. China’s growth is set to moderate as “anti-involution” reforms reshape supply-side behaviour, while India continues its structural ascent – likely surpassing Japan as the world’s fourth-largest economy in 2026 and on track to become the third-largest by 2028.

Inflation continues to normalise across major economies, though not fully back to pre-pandemic norms. As a result, central banks remain cautious. Deutsche Bank Research economists expect the Federal Reserve (Fed) to deliver only two further cuts before pausing, while the European Central Bank (ECB) is expected to stay on hold until a hike in mid-2027. The team’s strategists see upward pressure on yields as equilibrium rates rise and global term premia rebuild, with 10-year US Treasury yields projected to end 2026 at 4.45%. And the equity strategists expect the earnings cycle to broaden beyond mega-cap tech, with S&P 500 earnings per share reaching $320 (+14%) and a year-end target of 8000.

This article pulls out the main points of interest in the Deutsche Bank Research World Outlook for 2026 and, as in previous years, includes snapshots from the country specialists within the team.

US

After a tumultuous year, US Chief Economist Matthew Luzzetti and his team see the US economy on a more solid footing in 2026: “With some headwinds fading (e.g., trade policy uncertainty) and tailwinds strengthening (e.g., tax cut boost to household income), we expect growth to pick up next year, helping to stabilise the labour market and allow the unemployment rate to decline marginally. Lower tariff rates should help disinflation, which along with a dovish shift in Fed leadership will lead the Fed to cut rates below 3.5% by year-end.”

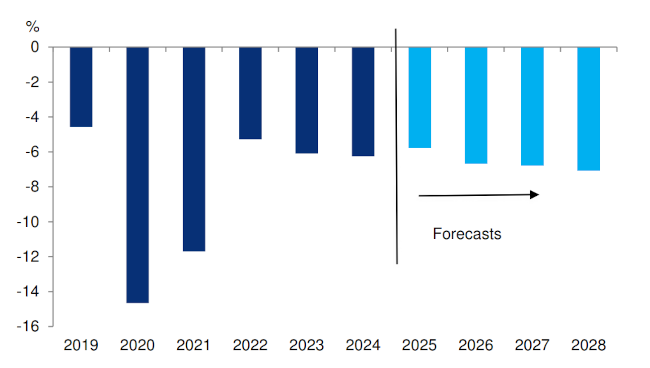

Figure 1: Federal budget deficit as share of nominal GDP set to remain elevated over coming years

Source: CBO, BEA, Haver Analytics, Deutsche Bank

Targeted tariff relief and possible legal restrictions to further tariff raising under the International Emergency Economic Powers Act (IEEPA) look set to result in lower tariff revenues with the effect of widening the federal budget deficit, which the team now anticipates “will rise to around 6.7% as a share of GDP”.

Recession is not out of the question, however. “Downside risks include a pickup in layoffs, which would undermine consumer spending. Upside risks involve AI replicating the 1990s productivity boom, with plausible estimates of a 0.5-0.7pp annual boost to growth. Policy risks include a more severe impingement on Fed independence, or the return of market concerns around the fiscal trajectory, which could be triggered by less tariff revenues or a distribution of those revenues to provide targeted fiscal relief,” they conclude.

Euro Area

Despite the external headwinds, Chief European Economist Mark Wall and his team note that Euro area GDP growth is “proving resilient”. Helped by fiscal tailwinds, Q4/Q4 growth is expected to rise from 1% in 2025 to 1.5% in 2026.

While ECB rates cuts will be debated, the team expect policy rates to “remain on hold at 2% through 2026”. As for inflation, they continue to see a risk of this rising in the medium term because of German fiscal easing and a tightening labour market. “However, with the ECB likely to tolerate some deviation of inflation from target in both directions, we have pushed the first ECB hike back six months to mid-2027.”

Given the EU’s structural vulnerabilities, the confidence bands around the point of estimate forecasts are wide. Among other things including market stability, the team note:

- Uncertainty from the impact of the counter-veiling internal/external forces;

- The EU’s dependency on and exposure to the US and China; and

- The need to increase defence spending when deficits are high, and solve a large, multifaceted competitiveness problem when EU politics is fragmented.

The team point out that “domestic demand has been improving since mid-2024, supported by recovering real incomes, a robust labour market, the impact of ECB rate cuts, public investment (NGEU) and less fiscal tightening than originally anticipated. AI spending is also contributing to the positive trend”.

“Trade policy uncertainty is high, new trade frictions between the EU and US cannot be ruled out”

They anticipate that German government spending on defence and infrastructure in 2026 will “lift the Euro area economy” because “a greater-than-expected share of defence orders is going to domestic producers, boosting the defence multiplier and benefiting the entire euro area”.

However, the direct cost of US tariffs to the bloc is estimated at 0.5% of GDP, likely impacting H2 2025 and H1 2026. “Trade policy uncertainty is high, new trade frictions between the EU and US cannot be ruled out,” they caution.

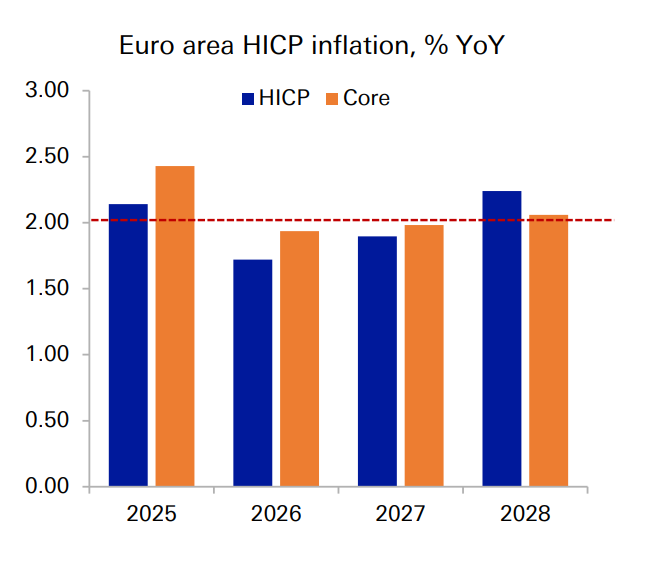

Figure 2: Inflation on target in 2027, above in 2028

Source: Deutsche Bank

A tightening labour market (the ageing population creates a persistent negative supply shock) continues to limit the bloc’s business. This, along with fiscal easing, will “keep inflation underpinned” and in the medium term (2028) the team see the core harmonised index of consumer prices (HCIP) moving above 2% (see Figure 2).

As for the EU policy outlook, they note that the European Commission will continue the Draghi agenda, with incremental progress on competitiveness and defence, weaving between external pressures (China, US, Russia) and internal political constraints. Key initiatives in 2026 include:

- The first disbursements from the €150bn Security Action for Europe (SAFE) loan programme for defence;

- A new roadmap to close defence gaps by 2030;

- Progress in reducing Single Market barriers – cutting red tape; and enhancing economic security with a Critical Raw Materials Centre;

- Stronger ESMA and revisiting pan-European pension products will move the Savings and Investment Union/CMU forward, but they think major pension, tax, or insolvency reforms are “unlikely”; and

- To close the innovation gap with the US, the EU is addressing scale-up financing, computing infrastructure, and AI adoption.

Germany

After stagnating in 2025, Deutsche Bank Research economists Marc Schattenberg and Robin Winkler expect the German economy to recover in 2026 and forecast GDP growth of 1.5% in both 2026 and 2027. “This will be primarily driven by a markedly expansionary fiscal policy and increased public spending, as well as a pickup in private consumption as the labour market recovers,” they explain.

In foreign trade, the growth-dampening effects of strong imports are likely to continue to dominate in the coming two years, albeit with declining momentum, they add. “Exporters continue to face headwinds from higher trade barriers, stiff Chinese competition and structural disadvantages, but all these headwinds are likely to abate somewhat in 2026.”

UK

“We expect UK GDP to remain healthy into 2026 but slowing from 1.4% this year to 1.2% in 2026,” notes Sanjay Raja, Deutsche Bank Research’s Chief UK Economist. He adds that 2025 external geopolitical headwinds will give way to domestic headwinds. “Lingering weakness in hiring, weaker pay growth, and protracted uncertainty around fiscal policy and politics, we think will at times through the year, dampen spending and investment appetite.” On the bright side, he sees policy remaining “supportive” and expects both fiscal and monetary policy to help grease the wheels of the UK’s growth engine, despite political uncertainty looking set to remain elevated into the New Year.

In response to the UK Chancellor’s Budget, delivered on 26 November, Raja said in his same-day Budget Recap – the aftermath this was “better than expected”. He summarised: “A second straight historic tax raising exercise is now complete. The Chancellor's fiscal buffers have increased meaningfully. Borrowing remains on a downward trajectory – though a little stickier than in the Spring Statement. Tweaks to the gilt issuance projections remain modest – a positive for the market. And with debt to GDP falling, the Chancellor has also introduced a meaningful amount of disinflation for next year. In the end, gilt markets were satisfied with the Chancellor's efforts to raise fiscal buffers and keep issuance projections tight.”

Asia

Japan

“The Japanese economy is expected to maintain moderate growth in 2026,” notes Deutsche Bank Research Chief Economist for Japan, Kentaro Koyama. He explains that while the impact of US tariff policy on Japan is anticipated to be limited, “rising wages and decelerating inflation are likely to support household consumption”.

Headline inflation is projected to fluctuate significantly due to upcoming government measures to curb price increases, but core-core inflation is forecast to slow to around 2% by mid-2026. Fiscal policy faces increasing risks of expansion, and monetary policy exhibits a stronger bias towards continued easing. Future risks include a weaker yen, a fiscal risk premium, and geopolitical uncertainties.

“Chinese leaders have become more confident in the country’s technological capabilities and economic resilience”

China

According to Deutsche Bank Research Chief Economist for China Yi Xiong, China’s economic growth is projected to slow to 4.5% in 2026 due to “anti-involution” policies and diminishing returns from consumer stimulus, though inflation is expected to improve with consumer price inflation reaching 1.5% and producer price inflation) turning positive in H2 2026.

His takeaway from the 15th Five-Year Plan, which set policy priorities for 2026–30, is that Chinese leaders have become more confident in the country’s technological capabilities and economic resilience, despite observing a more challenging external environment for the coming years.

He notes three new priorities that stand out:

- Accelerating technological application/commercialisation by industries;

- Strengthening economic ties with the outside world; and

- Improving people’s wellbeing through increased public spending.

“We think these policies will benefit innovative private firms in emerging industries and boost domestic consumption, especially in the services sector.” Monetary policy, he adds, “will remain stable with continued fiscal expansion”. Robust external demand – driven by strong exports, easing US-China tensions, and accelerated RMB internationalisation – is also anticipated.

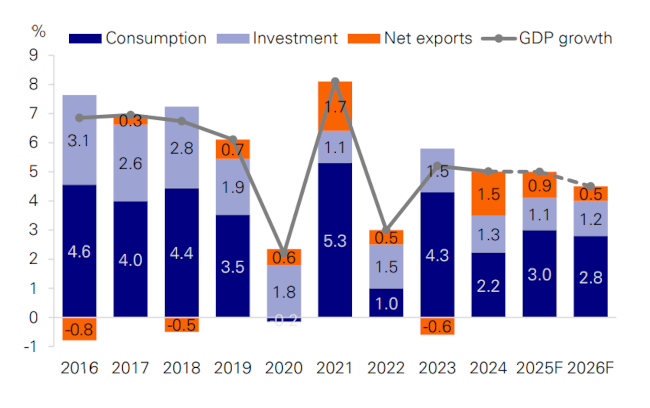

Figure 3: China’s GDP growth is projected at 4.5% in 2026

Source: Deutsche Bank

India

While India’s growth momentum has held up better than expected in 2025, despite the tariff and other geopolitical risks, it is not as strong as what is reflected by the headline GDP growth trend, notes Deutsche Bank Research’s India Chief Economist, Kaushik Das. Real GDP growth looks set to moderate to 6.4% year-on-year (yoy) in 2026, from what is looking like a 7.3% outturn in 2025 – and then rise back to 6.7% yoy in 2027. CPI inflation – while heading for a 2.2% outturn in 2025 is forecast to rise to 3.9% yoy in 2026 and a further 4.4% yoy in 2027.

Given this growth-inflation mix, the team expect one more 25bps rate cut from the Reserve Bank of India (RBI) in this cycle, with an extended pause thereafter through 2026. Das explains, “If growth momentum slips sharply, then the RBI could consider cutting rates by another 25bps in 2026. We expect the RBI to start rate hikes from Q2 2027, taking the repo rate back to 6.25% by H1 2028. We forecast the fiscal deficit to stabilise around 4.5% of GDP for the full years of 2027 and 2028 at the central government level and around 7.5% of GDP on a consolidated basis.”

While a favourable trade deal may result in some appreciation of the rupee in the near term, the team expects the rupee to maintain a depreciating bias, likely ending 2026 at 90 vs. the USD and then depreciating further to 92 by the end of 2027. But overall, they expect the underlying momentum to improve over the next few years, “aided by a supportive US-India bilateral tariff deal (which should see US tariff coming down below 20%, from 50% currently) and lagged favourable impact of generous fiscal and monetary support announced in 2025.

Deutsche Bank Research reports referenced

World Outlook: 2026 – Anything but dull by Jim Reid, Global Head of Macro and Thematic Research, and David Folkerts-Landau, Group Chief Economist and Global Head of Research, Deutsche Bank Research (24 November 2025)

Country contributors quoted: Matthew Luzzetti and Team (US); Mark Wall and Team (Euro Area); Marc Schattenberg and Robin Winkler (Germany); Sanjay Raja (UK); Kentaro Koyama (Japan); Yi Xiong (China); and Kaushik Das (India)

Budget Recap – the aftermath by Sanjay Raja, UK Chief Economist, Deutsche Bank Research (26 November 2025)