19 February 2026

Copper is up, oil down, but amid the uncertainty and volatility that characterises the current geopolitical landscape there is one constant – China. As the world’s second biggest economy enters its year of the Fire Horse, flow’s Will Monroe shares key updates from Deutsche Bank Research’s Commodities Outlook, where supply and demand is clearly linked to what China might do next

MINUTES min read

An uncertain geopolitical environment is expected to support higher commodities prices this year, according to the Deutsche Bank Research Commodities team in their 26 January Commodities Outlook for 2026.

The report’s authors note that a “fragmented global operating environment” and “the likelihood of structurally higher geopolitical volatility” – realised in factors such as resource stockpiling and a changed US foreign policy – may have more important implications for the global commodities market in 2026 than a healthy “macroeconomic climate where the US and Germany re-accelerate, China moderates and India continues its structural ascent”.

Great-power competition and resource nationalism are driving the need for redundant supply networks, while geopolitical tensions are also constraining downside risks in energy markets, the analysts said.1

Drawing on the team’s insights, this article offers a snapshot of what may lie ahead for industrial metals and crude oil, which are important barometers of economic growth in both developed and emerging markets.

“Great-power competition and resource nationalism are driving the need for redundant supply networks”

Copper

Copper prices have had a strong start to 2026, driven by factors including supply disruptions (mine supply in 2025 was heavily disrupted2) the spectre of US tariffs, demand related to the infrastructure and hardware required to support AI, and investment flows. The threat of US tariffs on refined copper is expected to lead to continued metals flows to the US, but copper demand in China has slowed sharply since Q3 2025, with high prices acting as a headwind to short-term domestic demand.

As one of the key energy transition metals, as well as an essential component of the digital revolution, copper’s strategic value for corporates is firmly baked into the global economy – see our flow case study on how multinational producer KME’s copper is fuelling the digital age.

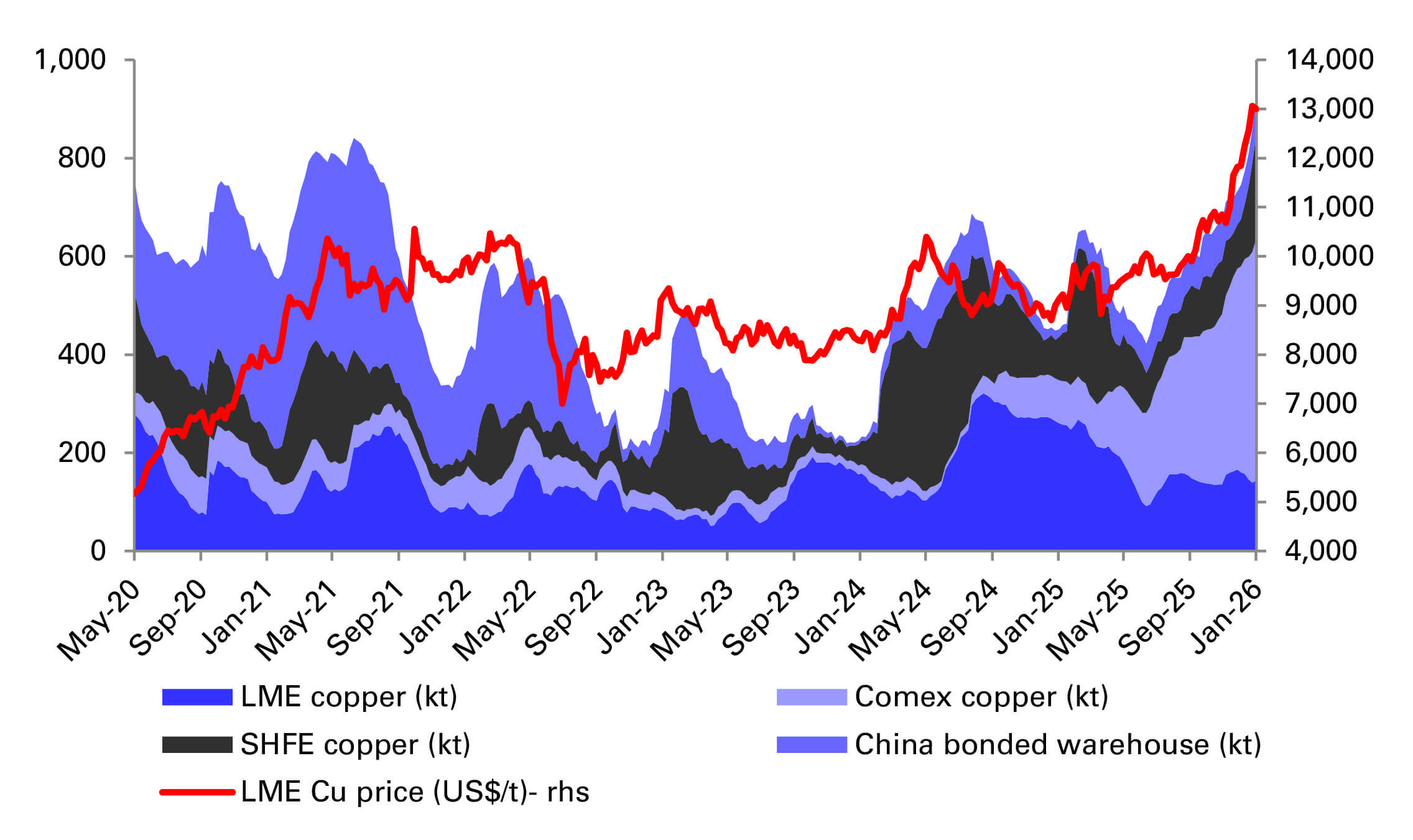

Due to its strategic importance, Deutsche Bank Research expects further sector consolidation in the year ahead. Average prices of US$12,125 per metric tonne (/t) are forecast for 2026, peaking at US$13,000/t in Q2. See Figure 1 for a summary of inventory levels and the impact on the price.

Figure 1: Global copper inventories and LME pricing

Source: Deutsche Bank. Bloomberg Finance LP

Aluminium

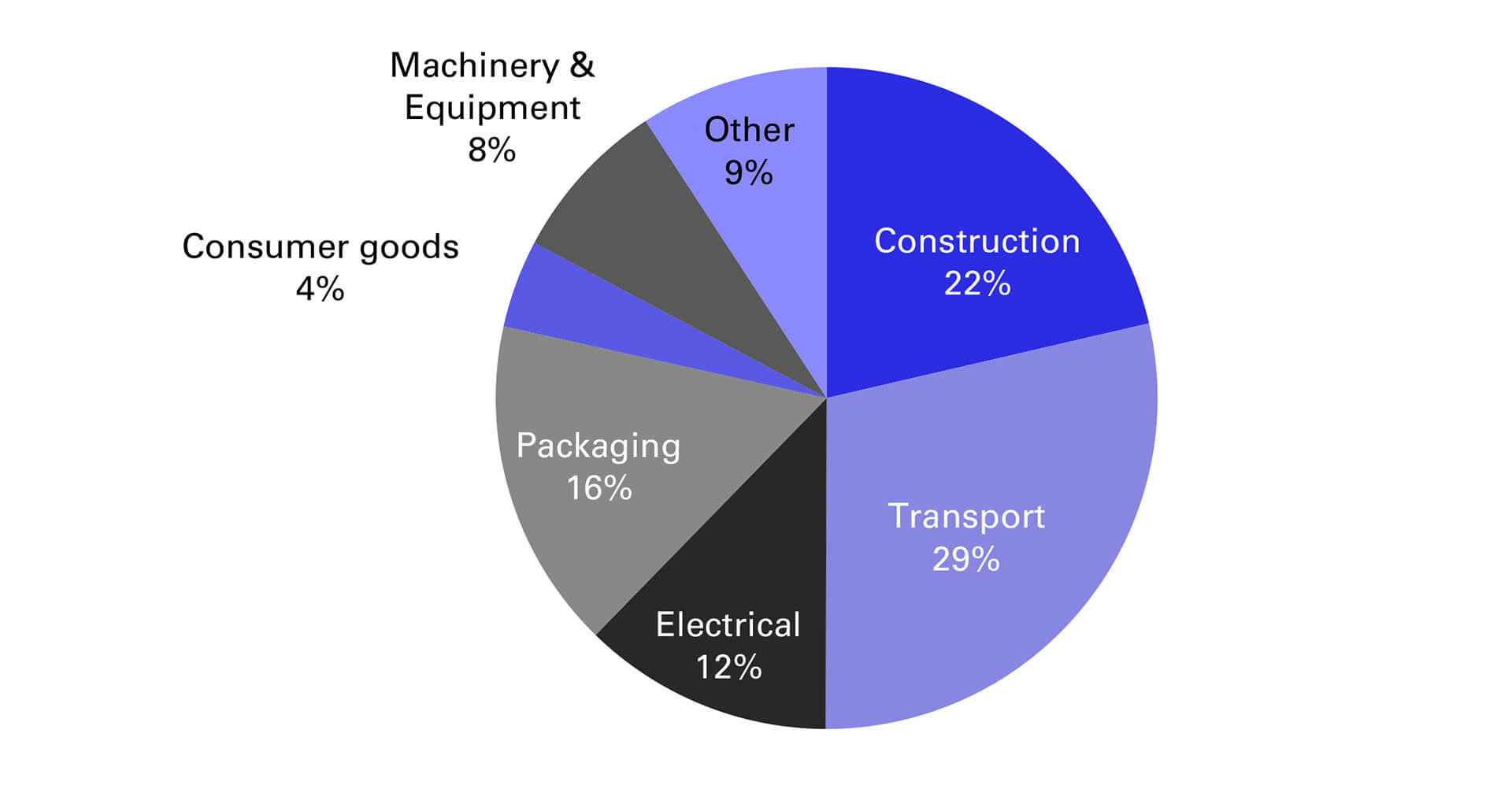

The Commodities Outlook notes that the global aluminium market is undergoing “a significant transition”, in the wake of China’s long-standing annual production cap of 45 million tonnes (mt) first set in 2017. Aluminium is an important and highly versatile metal, used in sectors ranging from construction and transport to packaging and electrical – see Figure 2.

Deutsche Bank Research analysts believe current market conditions – including a recovery in demand outside of China and slowing primary output from China – are supportive of higher prices, forecasting a 2026 average of US$2,925/t, with a potential high of US$3,100/t in the second quarter. Price volatility in the coming months could arise if a Russia-Ukraine ceasefire is struck, and if trade negotiations between the US and China, and the US and its neighbour, Canada, come into play.

Figure 2: Global 2024 aluminium demand by end use

Source : Deutsche Bank. Wood Mackenzie

Iron ore

With iron ore having outperformed bearish expectations in H2 2025, Deutsche Bank Research analysts expect prices to remain supported in the first half of 2026, forecasting averages of US$106/t in Q1 and US$102/t for 2026 as a whole.

When it comes to supply and demand, the report notes a “balanced market, with a bias towards surplus in H2; iron ore port inventories climbed through most of 2025 and currently sit at the highest level since 2022”. The state of the Chinese property market has a direct bearing on iron ore/steel demand and prices, and analysts expect domestic steel demand to continue to contract due to ongoing property market weakness.

Potential steel production regulation in China (management of overcapacity, export quotas and environmental impacts3) remains a theme, but the analysts point out that the same was noted a year ago, “yet Chinese exports reached record levels in 2025”.

All eyes will be on China’s policy measures for steel and iron ore – particularly for those supporting growth through further infrastructure or property investment, given construction uses huge amounts of iron and steel (iron ore being the core metal for both cast iron and steel – an alloy of iron, manganese chromium and nickel).

“Capacity optimisation and elevation of steel products to a higher value have been key themes for the steel industry in China”

According to Deutsche Bank’s Kok-Leong Lee, Head of Trade Finance and Lending Greater China, “Capacity optimisation and elevation of steel products to a higher value have been key themes for the steel industry in China”.

He explains how the resilience of China’s manufacturing sector today, particularly in new sectors such as electric vehicles and renewable energy (particularly wind and solar) have provided “some level of support and diversification to the demand for steel products”. He concludes, “However, more is still expected in terms of policy measures considering the significance of the construction sector and infrastructure investment.”

Crude oil

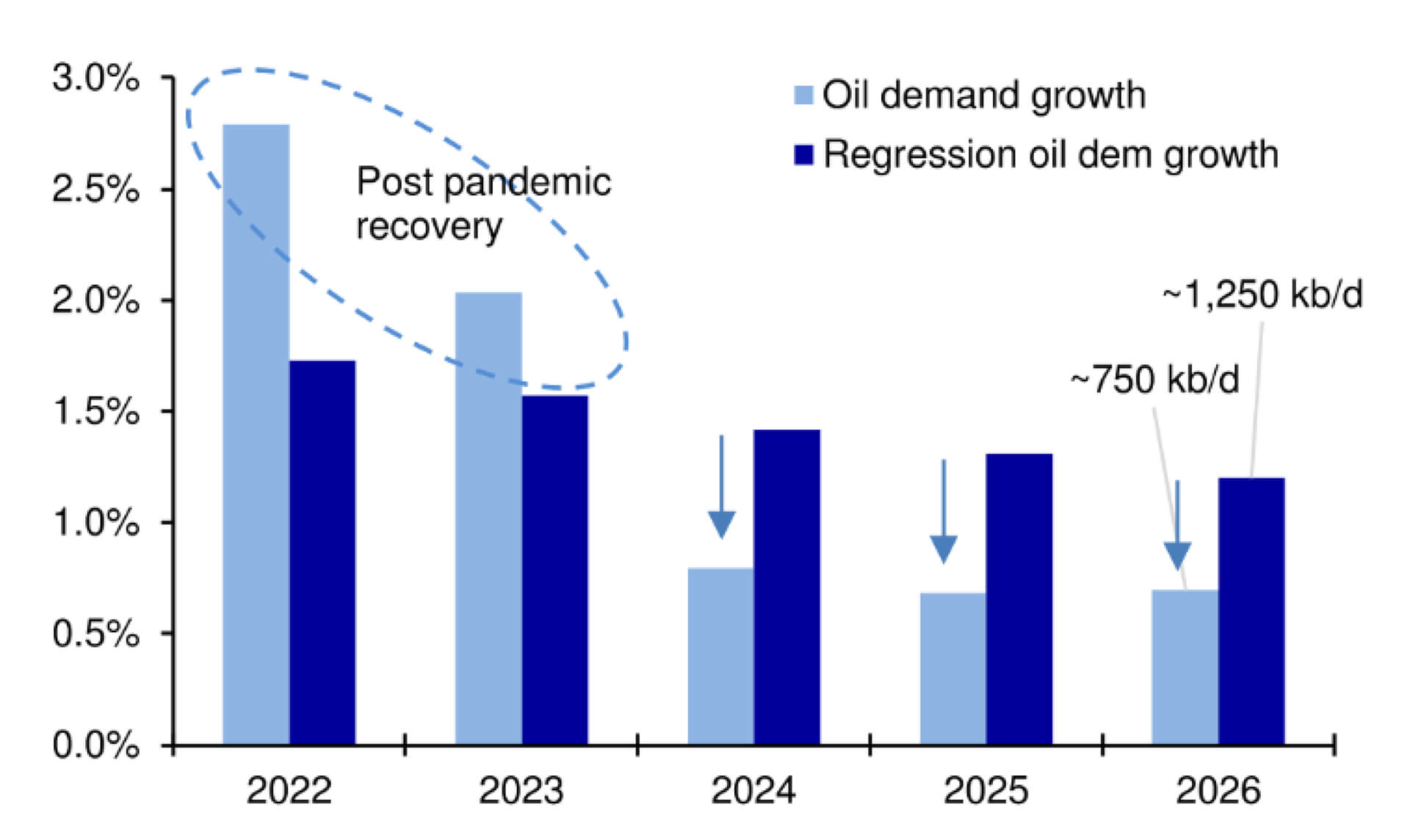

In 2025 crude oil prices fell more than 18% – the steepest drop seen since the pandemic in 2020 – amid growing oversupply concerns.4 Downward oil price pressures look set to continue over the next two years, as global production exceeds global demand. In a follow-up chartbook Deutsche Bank Research Analyst Michael Hsueh demonstrates how oil demand growth is expected to remain subdued – see Figure 3. Growth in oil demand is slower than what a statistical model (regression) would predict, based on global GDP growth.

Figure 3: Oil demand growth below GDP regression

Source: World Bank, IEA data from Monthly Oil Data Service O OECD/IEA 2025, www.iea.org/statistics, Licence: www.iea.org/t&c; as modified by Deutsche Bank

The US Energy Information Administration’s (EIA’s) Short-Term Energy Outlook, published on 13 January 2026,5 forecasts that the Brent crude oil price will average US$56 per barrel (/b) in 2026 – a 19% year-on-year decline, and US$54/b in 2027. The authors of Deutsche Bank Research’s Commodities Outlook predict a 2026 average of US$61.5/b in 2026, and an uptick on the EIA forecast of US$65/b for 2027.

The EIA anticipates that global production of liquid fuels will increase by 1.4 million barrels per day (b/d) in 2026 and 0.5 million b/d in 2027. This year’s growth will likely be driven by OPEC+ countries, while 2027 growth is expected to be fuelled by non-OPEC+ countries, primarily in South America.

Supply threats identified by the Deutsche Bank Research team include a volatile geopolitical context. US foreign policy is likely to come into focus, with lower oil prices in Q4 2025 giving the US more policy room, should it wish to take some form of military action against Iran.

It remains to be seen whether China will opt to renew the building out of its strategic oil inventory in 2026 – if it does, storage accumulation is likely to take place in the second quarter of the year, according to the Deutsche Bank Research analysts.

Impact on natural resources finance

Yann Ropers, Global Head of Natural Resources Finance for Deutsche Bank confirms that sourcing minerals and metals has become increasingly strategic in the US and Europe, “reducing reliance on China”. He notes an uptick in risk appetite to “meet defence and transition megatrends needs”.

“Macro changes generate more opportunities than concerns for natural resources finance”

In addition, he reflects, “Macro changes generate more opportunities than concerns for natural resources finance.” There was limited exposure to tariffs introduced in 2025. “There is increased reliance on structured debt products and increased capital needs for new supply chains and security of supply,” concludes Ropers.

Deutsche Bank Research reports referenced

Commodities Outlook, 26 January 2026, by Michael Hsueh, Liam Fitzpatrick, Bastian Synagowitz, Corinne Blanchard, Cody Hayden; Research Analysts at Deutsche Bank Research

Commodities Chartbook, 30 January, by Michael Hsueh, Research Analyst at Deutsche Bank Research

Sources

1 See Weaker dollar could push gold prices to $6,000 this year: Deutsche Bank at investing.com

2 See 2025 Copper Supply Crisis: Disruptions Soar as Major Mines Cut or Halt Production [SMM Analysis] at metal.com

3 See China issues new regulations for exports of steel products at steelorbis.com

4 See Crude oil prices fell in 2025 amid oversupply at eia.gov

5 See Short-Term Energy Outlook at eia.gov