28 January 2026

Headquartered in Hong Kong SAR, First Pacific is one of Asia’s leading investment holding companies. How does it keep its own investors engaged and loyal? flow’s Will Monroe talked to John W Ryan, Group Chief Investor Relations Officer, to find out

MINUTES min read

When investors put their money into an enterprise, reassurance that their money is both safe and working as efficiently as possible with listings on the selected exchanges is just one of the responsibilities assumed by a proactive investor relations manager.

As John W Ryan, Group Chief Investor Relations Officer and Chief Sustainability Officer at First Pacific puts it, “people look for dividend growth and profit growth”. And just in case a good run by the share price could deter new investors, he reflects “it’s not too late for non-holders to join us and, given our success in getting meetings with fund managers who don’t yet own us, I think people are willing to sit down and hear the case we can put to them.” He does this, bearing in mind that First Pacific is a holding company and possibly a little daunting for would-be investors assessing it for the first time. For this reason, the corporate strategy is to stick to one geography (Asia Pacific) and the core industries with sufficient control of cash flows.

We caught up with Ryan at the end of 2025 to hear more on First Pacific’s story, and its relationship with the Deutsche Bank Depositary Receipts team that supports him.

Foundation and growth

Armed with an MBA from Wharton (where he was a Procter & Gamble Fellow) and more than a decade’s experience at mainstream investment banks, Filipino-born and raised Manuel (‘Manny’) Velez Pangilinan co-founded the Hong Kong-based First Pacific in 1981, together with the duo of Chinese-Indonesian father and son Sudono and Anthoni Salim.

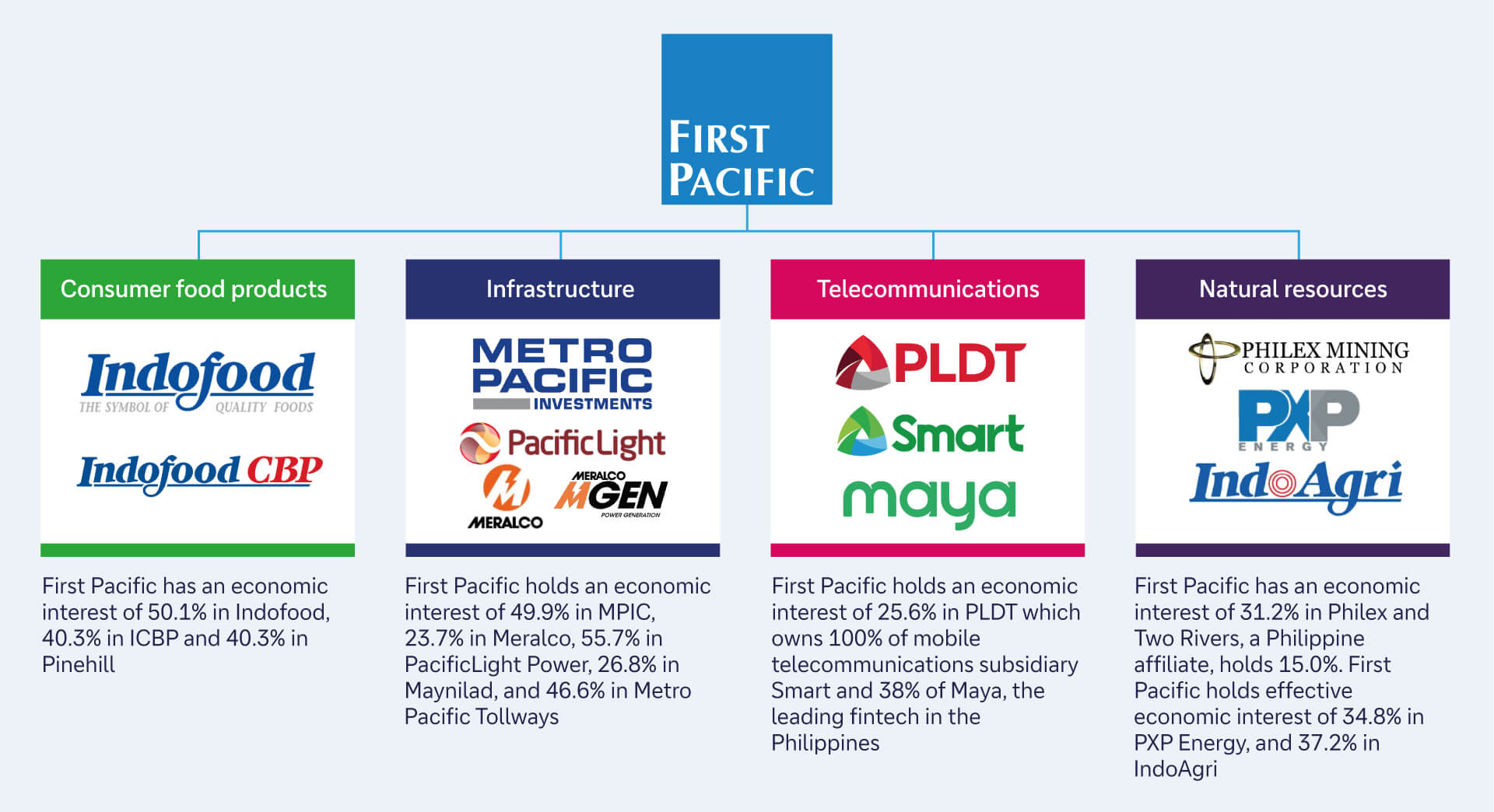

First Pacific typically acquires strategic stakes in established companies, often in emerging markets and sectors expected to benefit from economic growth and increasing consumer demand.1 The company then works to enhance their value through active management and operational improvements, via its four segments:

- Telecommunications, which offers wireless, fixed line, and business process outsourcing services;

- Infrastructure, which focuses on infrastructure development services;

- Consumer Food Products which covers the manufacture, processing, and distribution of food and agribusiness products, including cocoa, cooking oils, dairy, flour, food seasonings, margarine, noodles, nutrition and special foods, pasta, shortening, snack foods, sugar cane, tea and rubber;

- Natural Resources, which engages in the exploration, development, and management of energy and mineral resources in the Philippines.

Figure 1: Summary of First Pacific operations

Source: First Pacific

Growth – both organic and by acquisition – runs through the ‘DNA’ of First Pacific and its companies. The dial is set for growth, whether this is transforming Meralco from the Philippines’ largest private sector electricity distributor into one of the largest generators too (producing now 55% of the country’s output),2 or driving revenue growth from higher traffic volumes on existing roads.

Operating fast-growing companies in fast-growing economies is enough of a handful, and First Pacific’s focus is therefore not to branch into new business sectors – with the notable exception of Philippine fintech and digital bank Maya. This opportunity exists thanks to First Pacific’s PLDT being its largest shareholder. Maya is both majority-owned by a telco (its other shareholders include Tencent, KKR, and the IFC arm of the World Bank) and has a banking licence. With Maya’s earnings increasingly meaningful to PLDT, any future exit – whether via a trade sale or IPO for example – would release significant value for First Pacific.

ADR programme

First Pacific’s global capital markets footprint began in 1988 with its IPO on the main board of the Hong Kong Stock Exchange, where its ordinary shares still trade under ticker 0142.HK.3 It expanded its offering to investors via American Depositary Receipts (ADRs) in 2012. ADRs are dollar-denominated negotiable securities that represent that of a foreign company, whose shares can thereby be traded in the US financial markets just like regular stock – and whose dividends are also paid in USD.

ADRs are therefore attractive to those investors who prefer – or are restricted by their investment charters – to buy ADRs, rather than the underlying Hong Kong-listed stock that the ADR represents. Ryan recalls that soon after he joined, Deutsche Bank took over the role of ADR Depositary Bank for First Pacific’s sponsored Level 1 ADR programme (which trades on the OTC market in the US),4 adding that the bank does “a very, very good job”.

As a Hong Kong-listed holding company with pan-Asian interests, First Pacific’s investors are essentially buying a hard currency (US dollar) asset, with simple and sound access to the fast economic growth of South-East Asia. For many years the region has featured prominently in rankings of the world’s fastest-growing economies, a trend that looks set to continue.5 However, some member countries also feature prominently in corruption rankings conducted by the likes of Transparency International.

“Governance is very important and is something that we insist on doing well”

First Pacific explicitly markets itself as an entity in a good governance jurisdiction, committing to its shareholders that it offers robust governance while accessing growth and mitigating the risk of corruption. Ryan emphasises that “governance is very important and is something that we insist on doing well”.

The company’s main lever with its portfolio companies is through the annual budget process. Usually, the operating companies propose the budget, but this is worked out with First Pacific, which has a particular focus on capital expenditure. First Pacific alumni are installed across most of these companies which, added to the close contact between their colleagues from CEO and ‘dealmaker-in-chief’ Manny Pangilinan downwards, means that the First Pacific ‘DNA’ runs throughout the organisation.

The publicly-stated metrics to avoid over-extension reassure investors that First Pacific is adhering to – for example – interest coverage ratios (ICRs) that are significantly more cautious than those found in some of its lending covenants. Ryan observes that “if the cash is not there, First Pacific will not go out and buy something”, knowing well that “if one borrows too much and spends it badly, one can hurt oneself for quite some time”. As such, First Pacific’s recent ICR of 4.5 (far above the 1.5 required by several of its lenders) is something the company was “quite happy with”.

Investor outreach

An Oxford-trained Russian speaker, Ryan started his career as a financial journalist and set up Bloomberg News’ Moscow bureau in the late 1990s. He served as Bureau Chief and then transferred to Hong Kong for Dow Jones, before moving to a corporate communications role at HSBC. Attracting the attention of First Pacific, he was headhunted in 2010. Although the company has been constantly evolving in the years since, staff turnover has been “extraordinarily low”, with many employees having served for more than 30 years.

But while the structure and composition of First Pacific’s four-strong investor relations (IR) team might not have changed much, their remit, workload, and impact certainly have. Ryan explains that 15 years ago the investor handout was typically 10 pages long, while today – with appendices – it runs to 59 pages.6 “The answer to nearly every question that I have ever had in 15 years is somewhere in those 59 pages,” smiles Ryan. And it is not just IR, but also “a ton of ESG”, as reflected in Ryan’s dual job title. Most of what the team produces is for the benefit of all stakeholders – external as well as internal.

“Having personal relationships with people in places of interest is a very important aspect of doing this job right,” he explains. For example, since he joined Ryan and CFO Joseph Ng have spoken daily, and frequent travel to Jakarta and Manila enables the team “to know immediately where to go for an answer if you don’t have it already inside your head”.

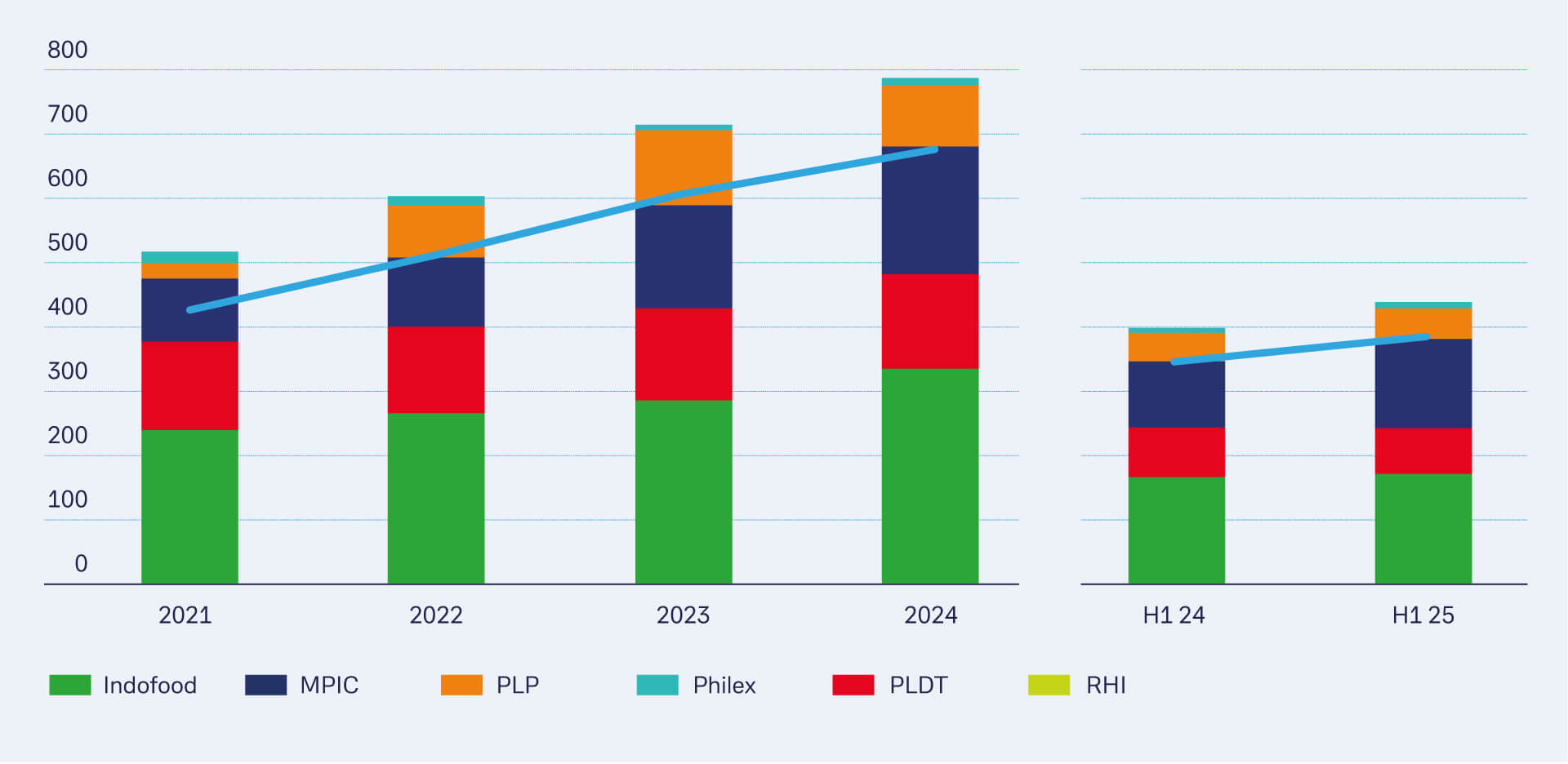

Such internal interactions have been vital on several levels. For example, liaising with independent directors at the half-dozen board meetings each year helped inform the evolution of First Pacific’s dividend policy. In March 2023 dividends were unhitched from reported recurring profit in favour of a broader progressive policy. Now First Pacific commits to increase it year-on-year as a general intent. Ryan believes this change in dividend policy “has been pretty crucial to our share price performance”.

Figure 2: Contribution from operations and recurring profit 2021–H1 2025

Source: First Pacific Investor Presentation

With a market capitalisation of less than US$4bn, First Pacific does not feel the urge to splash its news all over social media platforms. However, the Deutsche Bank ADR Virtual Investor Conference (known as dbVIC) is a key differentiator in depositary receipts service provision.

These conferences began running in 2012 and provide contact with the full spectrum of stakeholders in May and November each year.7 Ryan says these are events he does not want to have to live without and notes that “return on investment [for First Pacific] is massive”. He also appreciates the regular DR events the bank arranges for First Pacific, which enable his IR team and colleagues to meet the bank’s partners and other clients – an offering that is “a very valuable CRM tool”.

The IR team is also busy responding to equity analysts covering First Pacific.8 “Maintaining good relations with them is very high on the list of priorities” says Ryan – as well as the team’s own twice-yearly road shows and other investor conferences.

First Pacific increasingly fields investor queries from several of the new ‘hotspots’, such as hedge fund capital from Dubai and the wider Middle East, and pension funds from Australia. Ryan and his team are, he reflects, “very open to roadshows and meetings offering new areas of investment, whether by source of capital or geography”.

When asked if First Pacific would move its primary listing to, say, Singapore (closer to where its portfolio businesses are located) Ryan explained that this is a possibility First Pacific considers regularly, alongside a potential secondary listing there. However, the dilution risk given its market capitalisation and typical trading volumes currently yield a ‘wait and see’ approach. Ryan notes that the rivalry between the two listing regimes of Hong Kong and Singapore has produced ever-more reassuring corporate governance rules, and this ‘excellence arms-race’ is to the benefit of all concerned.

One prime example of this is the area of ESG. The subject of listed companies’ environmental, social, and governance stakeholder impact actually rose to global prominence through Hong Kong’s pioneering reporting requirements. Given the natural synergy with the stakeholder reporting already undertaken by First Pacific’s IR team, Ryan’s role combines the ESG and IR responsibilities – which is not unusual.

IR effectiveness

With South-East Asia’s growth set to continue,9 First Pacific’s profits and earnings are well aligned, and its employees’ own long-term compensation plans reflect this. First Pacific’s confidence is reassuring for its existing investors, who saw the share price rise by a third in 2023, and by a further 45% in 2024. Prospective investors are reminded that the company’s PE ratio is still below 5 and its progressive dividend policy saw its highest dividend per share in 2024.10

When asked what makes for good IR management, Ryan says that honesty is paramount. The process must be “enormously transparent, honest, and straightforward about the bad news as well as the good”. It seems to be a recipe that is working for First Pacific.

For further information on Deutsche Bank’s Depositary Receipt Services please visit https://adr.db.com

Sources

1 For example, the populations of 7 of ASEAN’s 10 economies will be predominantly middle class by 2035

2 See Corporate Profile at meralco.com.ph

3 See Share Information at firstpacific.com

4 See FIRST PACIFIC CO. LTD. at adr.db.com

5 See East and South Asia maintain solid growth prospects despite heightened uncertainty, says UN economic report at unescap.org

6 See Investor Presentation at firstpacific.com

7 See Deutsche Bank - Depositary Receipts Virtual Investor Conference - May 2025 at adr.db.com

8 See Analyst Coverage at firstpacific.com

9 See Next-Generation Policies to Unleash ASEAN’s Full Potential at imf.org

10 See 2024 full-year audited financial results at firstpacific.com