11 September 2025

Bayer AG, the life sciences multinational, has shaken up its traditional structure with a global initiative. The company’s Corporate Treasury team tells Graham Buck how the spirit of agility and innovation powered an in-house bank project with Deutsche Bank

MINUTES min read

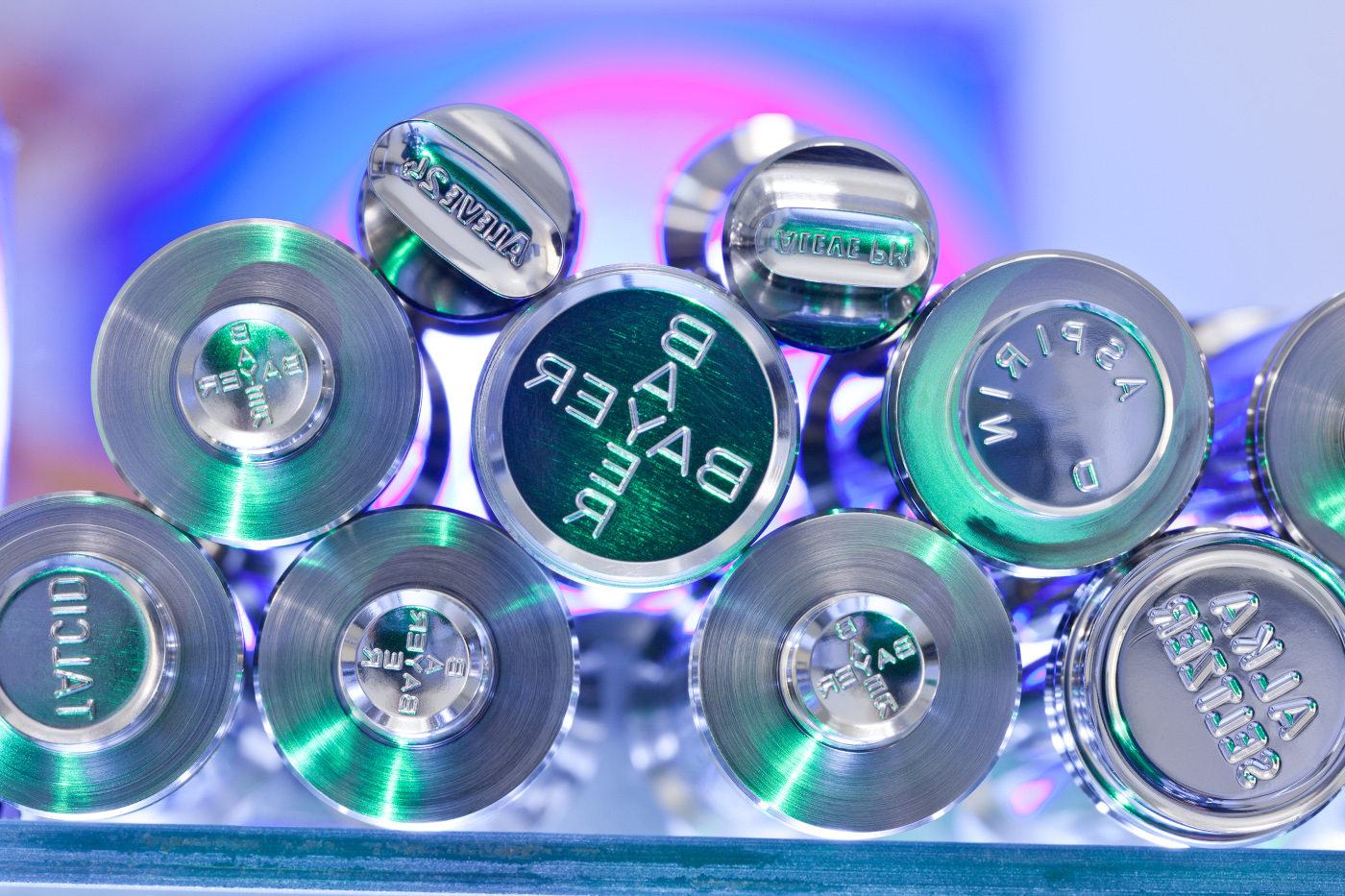

Aspirin™, the humble over-the-counter medicine providing pain relief to consumers for 128 years, is just one example of how Germany’s Bayer AG has created lasting impact for future generations. Another is the creation of Bayer Leverkusen Football Club by its employees in 1904.

It is this spirit of agility and achieving goals that plays out in the company’s treasury operations transformation. This article looks at one example of this – leveraging virtual account solutions to expand the scope of its in-house bank (IHB).

Corporate mission

Bayer’s three main businesses are pharmaceuticals, consumer health and crop science, which collectively operate through a total of 291 consolidated companies in 80 countries and an international workforce of more than 90,000 employees. Global sales in 2024 totalled €46.6bn. The corporate mission is defined as “health for all, hunger for none”, and Bayer promotes itself as a solutions provider to the three global challenges of climate action, health equity and food security.

Recently, the company implemented a new operating model named Dynamic Shared Ownership (DSO), an initiative pioneered by CEO Bill Anderson who moved to Bayer from Swiss competitor Roche in April 2023. The aim of DSO is to replace the traditional management structure with a network of self-managing teams, a concept that has also caught the interest of corporate giants such as Amazon and Dell.1

“DSO is certainly a dominating topic – a new operating model and an agile, modern way to shape the organisation more dynamically,” explains Renato Barbone, Bayer’s Lead Cash Management, who joined the company in 2003. “It offers various positive effects, although we’re still in the middle of the transformation journey, so it’s too early to assess the impact on areas such as research and development and sales. We at Treasury are also adapting DSO and believe that it will help to further improve our work.”

Bayer’s Corporate Treasury structure is ‘hub and spoke’, with the head office, located in the town of Leverkusen in North Rhine-Westphalia, as the main hub. Smaller hubs are established in the US at St Louis, Missouri and in the Netherlands, with spokes in countries including China and Brazil. Treasury’s relationship with Deutsche Bank goes back to the start of the 20th century, with the bank acting as the company’s key financial partner in bond offerings, loans and other strategic initiatives. Deutsche Bank has also been involved in Bayer’s acquisitions and divestitures and provided funding for various projects.

“We in Treasury are also adapting DSO and believe that it will help to further improve our work”

Bayer’s acquisition of Monsanto in 2018, the biggest in the company’s history, saw two separate treasury operations integrated relatively swiftly, with both running SAP enterprise resource planning (ERP) software. “Monsanto was actually a little ahead of us, as they had already adopted SAP’s In-House Cash,” says Barbone. “So, we were able to learn from them quite quickly and link our respective IHBs, which sped up the integration.”

Easing the account management burden

Three years ago, Bayer announced a US$1.4bn digital transformation plan with significant investment in artificial intelligence (AI) and data sciences. The tech revolution extends to Corporate Treasury: over recent months, Bayer’s Treasury team and Deutsche Bank have been working on a virtualisation project, with the first phase already completed for the company’s key accounts in Germany and the second phase – rolling out the initiative to Spanish subsidiaries – following recenty. The Netherlands and Switzerland are scheduled for the project’s next stage.

The potential for virtualising Bayer’s account numbers was first explored three years ago, reveals Thomas Kittel, Cash Manager at Bayer. Kittel moved to Bayer in early 2021 from steel producer ThyssenKrupp, where he worked as a senior finance manager for 14 years.

“Our Global Treasury HQ in Leverkusen is committed to enhancing cash management efficiency on a global scale by continuously evaluating and optimising our banking operations,” he explains. “A primary objective is to reduce the number of bank accounts wherever feasible.”

Other efficiency targets for the initiative include reduction of:

- The high risk of fraud;

- Costs associated with underutilised accounts;

- Regular know your customer (KYC) requests from banks;

- The necessity of managing and updating bank authorisations for each account; and the extensive documentation required.

Barbone adds that a couple of years ago, the team decided to use Swift’s KYC Registry, which has proved highly successful. “We’re not using the portal for all of our subsidiaries, but those that are actively engaged with the outside world,” he explains.

As the demands of KYC compliance have steadily increased, by contrast the number of full-time equivalents within the team has reduced, adds Kittel. “The process of managing bank account structures is predominantly manual and labour-intensive. Additionally, group companies frequently request accounts for specific projects, such as marketing campaigns, product launches, and initiatives targeting special clients, including farmers.”

Other major demands on the team include streamlining account structures not only but also for collection processes across the globe at the same time as Bayer’s ERP migration to SAP S/4HANA – basically moving away from the older SAP ERP systems to this more modern one. Furthermore, implementing ISO 20022 financial messaging; and a ‘deep dive’ into the Verification of Payee security feature.

Harnessing the in-house bank

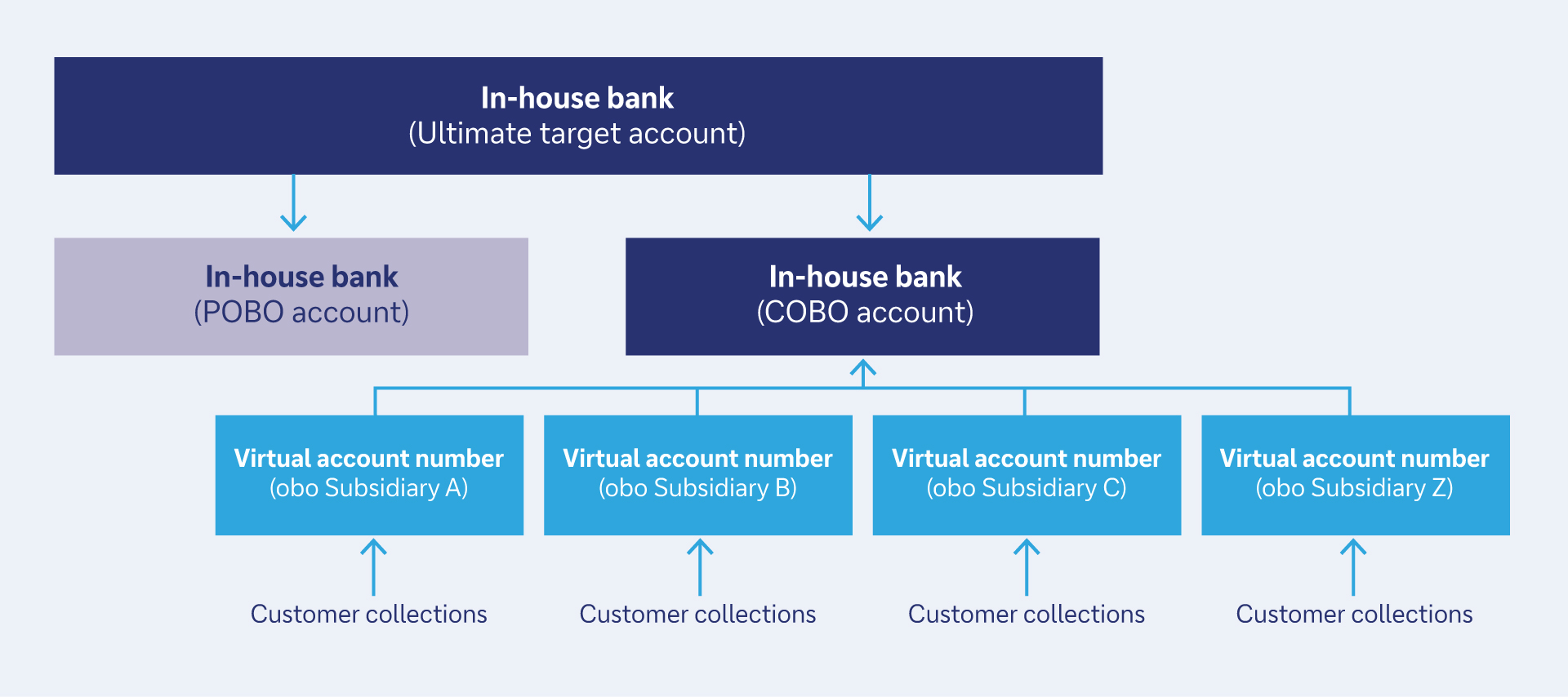

Fabian Trostorf, Cash Manager at Bayer, adds that the Treasury team recognised early on the many benefits offered by virtual account solutions in easing and reducing the workload. Having joined Bayer’s IT division in 2013, he moved over to his current role three years ago. The company’s approach to IHB is summarised as “operating a global IHB that seeks to incorporate as many countries as legally feasible, with the broadest possible scope”. So, the IHB’s current capabilities include payments-on-behalf of (POBO); intercompany netting; cash pool posting; and internal interest calculations, while more recently the introduction of virtual account solutions has enabled collections-on-behalf-of (COBO) to be added.

“The IHB enabled automatic posting and minimising the initial implementation efforts,” adds Trostorf. “We utilised the existing IHB cash pool with slight adjustments, allowing for automated routing of transactions processed via the virtual account numbers to the appropriate entities.”

While the POBO structure has been in place for several years, initial concepts for the COBO architecture emerged during Treasury’s in-depth review in the US in early 2022, Kittel reveals. There followed group-wide discussions on how to implement the structure without requiring clients to manually update their bank account details for Bayer. “Such a scenario could potentially lead to complications, including the maintenance of duplicate accounts for extended periods until all clients transitioned to the new account information.”

“We faced some tough questions from our Treasury Community, but we always try to co-create value for our business”

After thorough consultations with Bayer’s tax, legal, accounting, and IT teams all parties involved concluded the project was feasible. It took some time to convince everyone,” admits Trostorf but, by early 2024, the team was ready to partner with Deutsche Bank in virtualising existing account numbers. “We began with a deep dive into our German accounts and initially looked at those with less complexity for introducing virtualisation,” he explains.

Kittel agrees that launching the project with a limited number of simple accounts and scenarios helped the company to adapt and build trust in the new solution. “That proved easier than expected, thanks to the fact that Deutsche Bank’s solution allows for virtualising the existing account numbers. Certainly, we faced some tough questions from our Treasury Community, but we always try to co-create value for our business.”

Virtualising account numbers

He adds that Deutsche Bank was the first of Bayer’s banking partners to offer a solution that enables the same-day virtualisation of active physical account numbers. “This process enables us to retain the existing account numbers, thus preventing the need for account numbers to be updated at our clients’ end. “Besides this, the bank could also integrate its Virtual Ledger Manager app to significantly simplify the technical implementation of the solution and augment Bayer’s IT resources. “The Virtual Ledger Manager plays a crucial role in this process, as we continue to receive separate statements for all virtual account numbers associated with our IHB,” Kittel confirms.

“Today’s technology – enabling the virtualisation of existing account numbers and aligning reporting with what our clients’ systems are used to from real accounts – has drastically reduced the complexity of an IHB implementation,” adds Donika Jakupi, Senior Cash Management Specialist at Deutsche Bank.

The principle of virtualising existing account numbers is relatively straightforward: existing physical bank accounts are closed, while retaining the account number as a virtual account number linked to the IHB’s main account, which is utilised for receipts on behalf of the respective subsidiary. With this change taking effect on the same day, Deutsche Bank’s solution ensures the availability of the account number with no interruption.

Having virtualised a substantial amount of Bayer’s key account numbers in Germany during the second half of 2024, the company has started to establish new virtual account numbers for its Spanish subsidiaries, providing central and real-time visibility from the head office for incoming payments. “Following the rollout of SAP S/4HANA, we plan to further investigate the implementation of virtual account solutions, with the intention of expanding to other countries where it is technically and legally feasible,” explains Trostorf. In addition, the ability to create new virtual account numbers within hours opens up new possibilities such as virtual account numbers specifically for marketing events or merger and acquisition deals.

“Following the rollout of SAP S/4HANA, we plan to further investigate the implementation of virtual account solutions”

Further Treasury initiatives planned alongside the virtualisation of account numbers across Europe include:

- Implementing streamlined virtual account processes with S/4, transitioning from traditional bank accounting processes to a more efficient model specifically for virtual accounts;

- Following the S/4HANA Roadmap with COBO Go-Lives; initially for Spain, with the Netherlands and Switzerland in the next phase and further European countries to follow;

- Review and analysis for non-European countries in alignment with S/4 rollout.

Figure 1: Summary of virtual accounts structure

Source: Deutsche Bank

Widening horizons

The team says that careful planning and strategic use of existing resources has enabled the integration process to be simplified, minimising disruptions and ensuring that the company’s IT resources are utilised efficiently. They envisage a relatively smooth roll-out across Europe, while acknowledging that extending the project to other regions “will be difficult, but not impossible”. Bayer’s ultimate goal is to extend its collection factory to other regions, although this will be a complex task due to the different tax, legal and country-specific rules that must be considered. “Unfortunately, not all our relationship banks are today ready to virtualise existing account numbers,” admits Kittel.

He is confident that the project’s momentum can break down the ‘silo mentality’ prevalent in many large organisations. News on progress to date has been publicised across the company and there has been “a very positive reaction across the globe, with calls and emails from colleagues wanting to know more”, particularly on the potential for virtual account solutions to reduce the operational burden that comes from managing a global account structure. Indeed, interest has extended beyond the company, with other European corporates keen to learn more about Bayer’s experience with virtualisation.

The team emphasises that while the qualitative benefits are already evident in improved operational efficiency, it will take longer to assess the quantitative benefits of virtualisation. The number of bank accounts has started to reduce already – a Treasury key performance indicator – with a resulting improvement in complexity and management overhead. Add to this several components to support the business case:

- Using a virtual account solution aims to make the task of bank account management easier, particularly in regions with limited Treasury resources, enabling more efficient use of available resources.

- For COBO, implementing a common bank statement layout for multiple European entities facilitates easier management of customer inflows, enhancing the receivables processes and ensuring immediate cash availability for the corporation.

- Minimising implementation efforts – initially Minimum Viable Product and integrating a virtual account implementation into a broader global roll-out project, specifically the S/4HANA migration, which can lead to greater overall efficiency.

Will the next step be a move to ‘real-time treasury’? It’s not an immediate priority for now, but over the medium to long term it’s certainly on the agenda. “Like everyone else in the market, we are interested in overseeing our cash position in real time to better gain interests effect and manage the cash properly,” says Kittel, “Especially when it comes to quarter or year-end management of the cash position, all eyes are focused on cash. With a virtual account structure in place, this becomes more feasible than before, thanks to the cash of the participating subsidiaries being centralised in a single account – in real-time.”

In general terms, by combining instant payments, which enable immediate liquidity movements, with enhanced cash visibility through virtual accounts in an IHB, companies can optimise interest effects by centrally pooling available funds in real time and deploying them instantly for financing or investment purposes. This will be particularly powerful in light of changes to the Instant Payments Regulation, which come into effect in October 2025, and the resulting anticipated increase of instant payment usage.

For more information on the next milestone of the Instant Payments Regulation see our flow briefing, ‘Instant payments for corporate treasurers and their clients – what’s in our toolbox?’.

Graham Buck is a freelance corporate treasury journalist and former member of the flow editorial team at Deutsche Bank

Above image © Bayer AG