20 August 2025

HUTCHMED’s cutting-edge work helps reduce the toxicity of cancer drugs while increasing their efficacy. flow’s Clarissa Dann finds out how this innovative company is delivering progress for patients and financial self-sufficiency for shareholders

MINUTES min read

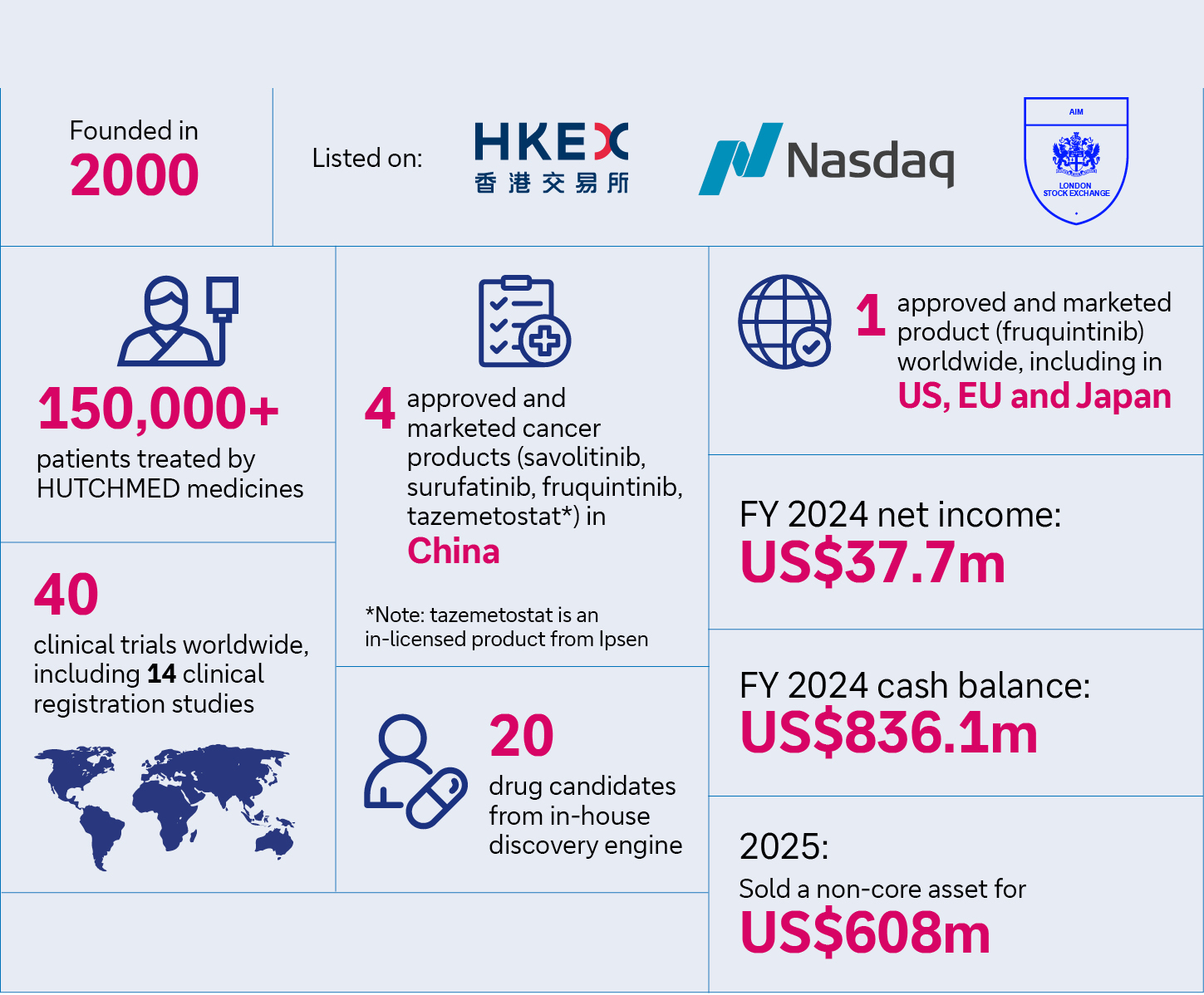

Celebrating its 25th birthday in 2025, HUTCHMED’s metamorphosis into one of China’s leading biopharmaceutical firms has been remarkable. It started out being incubated – as the name suggests – within former international conglomerate Hutchison Whampoa, headquartered in what is now Hong Kong SAR. Mark Lee, Senior Vice President in Corporate Management at HUTCHMED, explains that its parent company was not in the biotech space but had flexibility to invest in new areas. Certainly, the fledgling idea of “let’s see what we can do in China with a pharmaceuticals company” has yielded handsome dividends.

HUTCHMED took the opposite path to many of its competitors in the Chinese biopharmaceuticals market. Others favoured licensing the rights to European or American drugs as a way of then trying to achieve sales in China. But HUTCHMED has always focused on “actually discovering our own medicines, and then developing and launching them”, Lee says. Furthermore, HUTCHMED may be based in China, but it aims to “create innovative pharmaceutical products for the world, not just for China”.

Scientific excellence meets capital markets expertise

Lee should know: a biochemical engineer by training, he was a healthcare sector-focused M&A banker in London and New York. He joined HUTCHMED in 2009, when it was valued at US$70m and had just started clinical trials in China. Some 16 years later, over US$1.4bn in capital has been raised, the firm has had two further IPOs, and so it is now triple listed in London, New York and Hong Kong. Its novel cancer products achieved sales of US$500m in 2024, and the company now has a market capitalisation of more than US$2.5bn.

Also supporting the scientist-businessman CEO Dr Weiguo Su and his team are David Ng and his investor relations (IR) department, who help to bridge and nuance communications between the scientists, corporate management and the capital markets. This is quite something, given the complexity and dynamism of the firm and sector.

A pharmacist by training, Ng worked for a few years in the field of pharmacology before becoming a sell-side equity analyst for biotech stocks in Toronto. On returning home to Hong Kong, he switched to cover the ever-popular real estate sector before seizing the opportunities afforded by the Hong Kong regulators’ efforts to attract investment into biotech. As one of the first analysts to cover HUTCHMED, he gained an in-depth view and liked what he saw so much that he joined them. As he says, “That’s a good personal testimonial: it’s an attractive company to work for”.

Figure 1: HUTCHMED: key facts

Source: www.hutch-med.com

Investor relations

The three-person IR team Ng heads provide global coverage, with Ng and one colleague based in Hong Kong SAR and a third, based in Shanghai, predominantly dealing with mainland investors. The team sits alongside Lee’s external relations team and the business development team: a useful location, given the coordination required across communications with investors and the public in general. This culture of collaboration can be found throughout HUTCHMED. Ng explains that in some companies, “IR teams are often totally excluded from managerial discussions, such that the IR team might be the last to know something: that is not the case for us”. Management in general – from the CEO and CFO down – value the capital markets expertise that Ng and Lee provide.

HUTCHMED’s disposal of a non-core asset earlier in 2025 helps illustrate this.1 The disposal led to a huge cash windfall, boosting the company’s cash balance by 50%. Lee and Ng tempered management’s expectations by explaining that investors’ reaction – and HUTCHMED’s share price – might be more muted than anticipated, due to a range of market factors. They also managed investors’ expectations; in response to investor requests for the cash windfall to be used for dividends and buy-backs, they explained that this would not make much sense for a biotech firm in a growth phase. Ng notes that this should not have come as too much of a surprise for investors, given that HUTCHMED is “well-known for being very realistic and conservative, for never wishing to ‘over-hype’ or over-promise”.

But whether the issue being addressed is a one-off disposal or the mainstay of its business model, Ng’s IR team works hard to constantly inform – and even educate – its ever-expanding roster of investors and stakeholders on key aspects of its finances, products and value generation. HUTCHMED’s bread-and-butter work can be divided into its pipeline of products and its modes of commercialisation and distribution.

Given that companies such as HUTCHMED have various products at different development stages, from clinical trials to going to market, walking investors through that pipeline is something all biotech IR teams do (see Figure 2 in the flow 2024/5 AstraZeneca case study). Likewise, the very nature of these products means that, after the long wait, the product may be an instant ‘home run’, with a ten-fold increase in the stock price, or the market’s reaction may be more muted. However, there is a need to articulate where HUTCHMED’s model differs to current and prospective investors.

Improving cancer drugs

The firm’s particular expertise lies in targeted therapies: small molecules that inhibit very specific pathways in cancer to stop a particular mutation from working for the cancer. The company has a strong focus on developing drugs within this field that aim to minimise toxicity and improve safety.

“With chemotherapy and many other novel injectables, the statistically improved survivability is great, but the experience is very much not,” Ng observes. This is why HUTCHMED is working to improve on current antibody-drug conjugate (ADC) medicines that use cytotoxic drugs as their ‘payloads’. Instead, HUTCHMED’s antibody-targeted therapy conjugates (ATTCs) take newly created targeted therapy drug candidates and attach them to an antibody, which can then be administered. That improves the tolerability of the medicine because it is more targeted, and not going all around the body, while still remaining potent.

Recently, HUTCHMED has remained relatively quiet about its extensive research and development (R&D) efforts, but Ng notes that it is important to remind investors about the novel product R&D that is in the pipeline: “The future of the company – its five- to ten-year growth line – will be coming from what is currently in the lab, and how that cash [from the disposal earlier in 2025] is going to be invested.”2

“The future of the company will be coming from what is currently in the lab”

In 2025, HUTCHMED is looking to launch its first product for haematological malignancy (blood cancer) in China, and plans to move the first candidates from the ATTCs platform into clinical trials. As the company develops further, it is seeking to extend the use of its targeted therapies and boost its manufacturing capability. Regarding potential acquisitions, HUTCHMED’s business development, external relations, IR and management teams are keeping an eye out for complementary partners within this space.

Financial self-sufficiency and resilience

That question of ‘where is the money coming from?’ often triggers quick thinking and agility in firms. Ng points out that 10–20 years ago, and certainly before the advent of Hong Kong SAR’s pro-biotech regulatory regime, “The volume of funding for biotech companies coming out of China was not so abundant, so we had to think on our feet and devise supplemental businesses to ensure sufficient cash flow”.

One solution is HUTCHMED’s history of successfully partnering on its products. It has partnered with AstraZeneca and Eli Lilly for more than a dozen years, Takeda for a couple, and also with Ipsen as well as a number of other biotech companies from China.3 Such collaboration requires HUTCHMED’s IR team (and external relations and business development colleagues) to coordinate communication with investors and the public in general. It also, according to Ng, makes HUTCHMED “less reliant on the ebb and flow of investor interest and market sentiment, and less beholden to fluctuating stock prices to raise money at times (and at prices) that the company does not deem attractive”.

HUTCHMED favours a model of “financial self-sufficiency” to provide investors with a sense of comfort that, as a maturing biopharmaceutical company graduating to the next level, it does not need to constantly rely on external financing to keep growing and that its R&D work and commercialisation will continue, come what may. Ng points to the past two years of positive earnings, which were “supported by several different revenue and income drivers, not necessarily just from HUTCHMED’s innovative drugs”.

All of this is just as well, given the increasing cost of debt and volatility in capital markets since the start of the Russia/Ukraine conflict, and a new tariff landscape. But developing such resilience was the result of prescience. HUTCHMED was an outlier in rejecting a previously held industry assumption that biotech companies only tend to generate cash after 15-plus years, while its decision to ensure an ongoing supply of capital by growing organic revenues means it is well placed to navigate geopolitical headwinds.

“We are an innovative drug company down to our DNA”

Growing sales and partnerships

Ng explains that the company commercialises drugs itself, with its large commercial team marketing its suite of existing cancer drugs – currently the focus is on colorectal and other gastrointestinal cancers – to around 3,000 hospitals across China. This existing infrastructure will also provide the launchpad for HUTCHMED’s new haematology drug, which will be released in 2025. There may also be opportunities to combine and test the company’s existing medicines with partners in the field, to improve efficacy, which in turn presents other avenues for commercialisation.

While HUTCHMED’s financials feature product sales, this is different from the top-line numbers on the financial reports. Partner companies sell HUTCHMED’s products for them, and so these are categorised as royalties, licensing agreements, milestone payments and other collaboration-type payments. These are a big driver of its profits.

New investors and modes of communication

Just as the content of HUTCHMED’s messaging has evolved, so too have its recipients and the technology used to do so. As a triple-listed company, HUTCHMED’s team has dealt with an ever-changing mix of investors, and has done so alongside Deutsche Bank from its early days. Although it first listed on London’s AIM exchange in 2006, “the reality was that the investor base was not as broad as it could have been and, given our rather unique profile and industry, we required a wider base”, Lee says.

A US listing on NASDAQ using American Depositary Receipts (ADRs) in 2016 was able to provide this, he explains. Deutsche Bank acted as underwriter and ADR depositary bank for this listing. After HKEX courted biotech sector investment, a listing there also made sense. Ng explains that with the triple listing, “Investors need to have confidence that the UK, US and Hong Kong listings are fully fungible – it allows them to have confidence in the whole system”. He adds that HUTCHMED is “very committed” to the disclosure and corporate governance requirements for each of its respective exchanges and investor bases. He notes, for example, that Hong Kong SAR’s emphasis on ESG to differentiate itself from competitor exchanges in London, Frankfurt and New York aligned with HUTCHMED’s own award-winning ESG efforts.4

Like regulators, investors also differ, ranging from the ‘cool and patient’ long-term capital of Western pension funds to the ‘hot’ money of Chinese retail investors. For example, from 2022 to the present, Chinese investors through the Southbound Stock Connect have gone from holding zero to 25% of HUTCHMED’s outstanding shares. Hanging on every announcement, these institutional investors attend in-person conferences across China in droves and are also “very online”. Ng’s IR team have embraced this adoption of technology to enhance communication with institutional investors: “Investors might take three days to reply to an email, but only 30 seconds to reply via WeChat”.

HUTCHMED have been closely engaged with Deutsche Bank’s Depositary Receipts IR Advisory team on a number of value-added initiatives. In particular, HUTCHMED has presented on Deutsche Bank’s ADR Virtual Investor Conference (dbVIC) a total of 13 times, allowing the company to reach a broad base of investors.

Figure 2: HUTCHMED’s focus for the future

Source: HUTCHMED

But while the ‘what’, ‘how’ and ‘to whom’ of the IR team’s messaging may evolve, one constant remains: HUTCHMED’s focus on R&D. As Lee puts it, “We are an innovative drug company down to our DNA.” This focus has driven the company’s product successes, which in turn have raised its profile, global commercialisation, and ability to craft good deals with multinationals. Another constant is that R&D, product development and commercialisation (including of the next-generation technology ATTCs) is all done in-house, enabling HUTCHMED to drive its own future and ensure financial strength for its investors and – the end beneficiaries of all of this – a better experience for patients.

Images: HUTCHMED