8 October 2025

Over four decades, India’s JSW Group has grown from a steel re-rolling mill near Mumbai to a major conglomerate with interests spanning energy, infrastructure, cement, paint and e-commerce. The latter was the genesis for the launch in 2021 of JSW One Platforms, a tech-first, full-stack B2B e-commerce platform serving India’s manufacturing and construction small businesses. Treasury journalist Graham Buck charts the company’s progress

MINUTES min read

After its brief, Covid-induced blip, India’s economic growth has roared back to life. International Monetary Fund data projects that India is set to overtake Japan and become the fourth-largest economy by the end of 2025, with a GDP of approximately US$4.2trn.1 This rapid transformation is underpinned by strategic investments in infrastructure, manufacturing, and urbanisation, with India targeting a more than sixfold increase in the GDP figure by 2048 to US$30trn.2

JSW One plays a major role in this impressive growth, acting as the digital commerce arm of the US$23bn JSW Group, a multi-national conglomerate with headquarters in India. Founded in 1982 as Jindal Iron & Steel Company, JSW Group expanded significantly in the 1990s, as did Karnataka-based Jindal Vijayanagar Steel Ltd, and the entities merged in 2005 to create JSW Steel, now ranked among the world's leading steel manufacturers. In recent decades JSW has steadily diversified to become a global conglomerate, adding energy, infrastructure, cement, paints, realty, e-commerce, green mobility, defence, sports and venture capital to its portfolio.

Today, JSW Group has operations spanning India, the US, Europe and Africa with a "culturally diverse" international workforce of 40,000 employees.3 It attributes its growth to factors including strong execution capabilities, a focus on “pursuing sustainable growth”, and a “relentless drive to be ‘Better Every Day’”.4

A one-stop platform

One of the Group’s recent ventures – which is already positioned to be a major contributor to earnings – is JSW One Platforms Ltd (JOPL), which has established itself as India’s fastest-growing B2B digital marketplace, with a strong operational and technological backbone. It launched in April 2021, with a strategic vision of becoming a one-stop platform primarily serving the micro, small and medium enterprises (MSMEs) segment. MSMEs are often first- or second-generation businesses and are the lifeblood of many economies,5 especially in India, where the sector is the heart of the country’s industrial activity. JOPL’s focus is on those in the manufacturing and construction industries with annual turnover ranging from INR25 crore (US$2.8m) to INR2,500 crore (US$280m).

JOPL serves as a commercial business-to-business (B2B) e-commerce platform tailored to "address the sourcing, financing, and fulfilment needs of MSMEs, individual home builders, and influencers.” It does so by digitising procurement for MSMEs, with a range of offerings that include materials sourcing, financing, fulfilment, and private-label products. The platform draws on the parent group’s position as a major producer of steel and cement to deliver a reliable and tech-enabled supply chain solution. The product portfolio is steadily expanding, as evidenced in the recent US$1.6bn deal that saw JSW Paints acquire a majority stake in the India business of Dutch paint producer Akzo Nobel,6 making it the country’s fourth largest by market share.

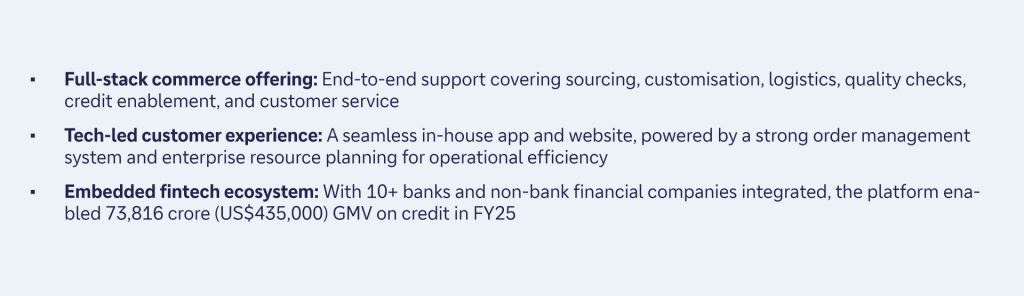

Figure 1: JSW One Platforms: key capabilities and offering

Source: JSW One

"JSW One Platforms is a tech-first, full-stack B2B e-commerce platform designed to meet the end-to-end needs of India’s manufacturing and construction MSMEs," says Gaurav Sachdeva, Joint Managing Director & CEO of JOPL, who adds that JSW One is in essence a new-age tech company that operates like a startup – albeit one that has the financial and infrastructural backing of the wider JSW Group.

"Our offerings span procurement, logistics, fulfilment, credit access, and private brands, all delivered through a seamless digital interface,” he explains. “By combining JSW Group’s manufacturing and supply strengths in steel and cement with in-house technology, supply chain infrastructure, and financing capabilities, JSW One offers an integrated ecosystem that simplifies procurement, improves operational efficiency, and supports business growth."

In launching a customer-centric multi-brand online marketplace for MSMEs in the manufacturing and construction sectors – both major consumers of raw materials – the company aims to narrow the gap between India’s business-to-consumer market, which has been transformed over the past decade by the digital revolution, and the country’s relatively archaic B2B market, which JOPL aims to revolutionise over the years ahead.

"JOPL is an innovative platform that provides end-to-end solutions for MSMEs including customised orders, logistics and final delivery of steel," says Gourang Shah, Head of Cash Sales – APAC & MEA, Deutsche Bank. "Customers can place an order on the jswonemsme.com platform, and their operations team identifies potential sellers and matches the order based on the product, any customised requirements, and location nearest to the buyer."

"JSW One Platforms is more than a marketplace – it's how India's MSMEs procure, finance, and grow," announced Parth Jindal, JOPL’s chairman in May, when the company raised INR340 crore (US$38.6m) in a funding round.7 He continued: "We're solving critical pain points by combining our tech-led distribution model with JSW Group's strength in manufacturing. We are well-positioned to fulfil the ambitions of India's expanding MSME sector." The success of the funding round pushed the company’s valuation to US$1bn and earned it unicorn status within four years of its launch.

JOPL’s customer base has steadily grown and already exceeds 86,000 MSMEs in India, but the company believes that building an integrated tech stack that enables a seamless procurement journey will grow this further to 500,000 construction and manufacturing MSMEs across the country. According to India’s Ministry of MSMEs, there were more than 63 million MSMEs across the country as of 2019, with that number likely to have grown substantially since then. This means there is plenty of room for JOPL to increase its market share in the sector in the coming years, should it wish to.

“JSW One Platforms offers an integrated ecosystem that simplifies procurement, improves operational efficiency, and supports business growth”

Speedy progress

Since its 2021 launch, JSW One has set up three main operating entities:

- JSW One Platforms Limited (JOPL)

The parent company houses www.jswonemsme.com, the front-facing commerce platform for customers to explore and access the full suite of services offered by JSW One and www.jswonehomes.com, with JSW One Homes providing full-stack construction support, working with expert construction professionals. In December 2023, JOPL launched its private brand portfolio with JSW One TMT. - JSW One Distribution Limited (JODL)

A wholly owned subsidiary of JOPL, JODL manages the distribution operations, including procurement, warehousing, material processing, and manufacturing of its private brands. - JSW One Finance Limited (JOFL)

Launched in August 2024, this entity provides financial services, including purchase finance, vendor finance, and working capital loans. It supports both principal and co-lending models, backed by secure digital infrastructure. JOFL plays a key role in expanding financial access for MSMEs, while ensuring data integrity and regulatory compliance.

The JOPL platform currently operates across three integrated business verticals: Marketplace – a digital-first commerce model offering a wide range of manufacturing and construction materials; Distribution – providing warehousing, processing, and timely delivery; and Private Brands – including JSW One TMT brand in North and Central India. TMT, or Thermo-Mechanically Treated bars, are a basic material in home building, construction and infrastructure projects.

Given the JSW Group’s presence outside of India, could the JSW One model be adapted for international markets? "Our current focus is on unlocking the full potential of the domestic market, which presents substantial headroom for digital transformation in B2B commerce," says Mayank Gupta, JOPL’s COO. "That said, the platform’s architecture is scalable, and we are open to evaluating international opportunities in the future. For now, our priority remains deepening our presence and impact across India."

And will JOFL, JSW One’s most recent launch, offer credit directly to its growing customer base, or through partners? "JOPL, as a marketplace, orchestrates credit through multiple partner non-bank financial companies and banks, using high-velocity customer transaction data coupled with cash flow-based underwriting to match customers with appropriate and customised credit solutions," says Gupta. "JOFL, a 100% subsidiary, is formed with a vision to be a digital-first approach to lending to the MSME ecosystem within JSW One and JSW Group at large. Accordingly, JOFL is one of the lenders on JSW One Platforms. This blended approach allows us to provide faster servicing and optimise credit access to customers while maintaining flexibility to grow our fintech stack as business needs evolve."

Automating for growth

"Deutsche Bank has partnered with JSW One Platforms to co-develop a tailored payment and collections infrastructure for the fast-growing company," says Deutsche Bank’s Shah. "It was recognised this year in an award from The Asset for Best Payments and Collection Solution, India”.

"As the platform is a marketplace model, JOPL maintains an eCommerce special nodal account with Deutsche Bank to comply with regulations that ensure consumer funds are protected until product delivery, as well as aligning with seller payout timelines as per their agreement with the platform. The bank has a strong regulatory advisory team on the framework governing India’s eCommerce/fintech space, as well as digital solutions that ensure merchant/supplier settlements are done accurately and promptly."

"Deutsche Bank has partnered with JSW One Platforms to co-develop a tailored payment and collections infrastructure"

COO Gupta says that the partnership was rooted in JSW Group’s longstanding relationship with Deutsche Bank, which enabled a swift and strategic alignment of objectives. "We discovered a variety of different use cases in our ecosystem and so developed appropriate solutions," he explains. The goal was to automate and scale the commerce business lifecycle from order to collections, in a way that matched JSW One’s growth aspiration and idiosyncratic use cases in the B2B ecosystem, with multiple payment options, including embedded credit access. To enable this transformation, JSW One implemented a robust, fully integrated digital infrastructure that includes:

- A tech-enabled framework that could scale: The partnership enabled the foundation of digital-first architecture for disbursements and collections, focused on operational efficiency, speed, and auditability. This system ensured compliance, minimised manual errors, and supported readiness for future scale.

- End-to-end API integration between JSW One’s Loan Management System and Deutsche Bank’s Core Banking System, delivering straight-through processing and enabling real-time fund movement across the commerce lifecycle.

- Real-time visibility and reconciliation tools: Deployment of Payment Status Check APIs and Collections APIs gave operations teams and customers instant visibility into fund flow, whether successful, pending, or failed. This reduced support load and enhanced customer trust.

- Automated transaction updates and ledger sync: Reconciliation and ledger updates were triggered automatically on repayment confirmation, with customers notified via email/SMS and the platform maintaining digital trails to support compliance.

- Improved liquidity access for MSMEs: With reduced turnaround times and seamless integration with credit workflows, the platform now ensures faster working capital availability for MSME buyers, a critical pain point in B2B commerce.

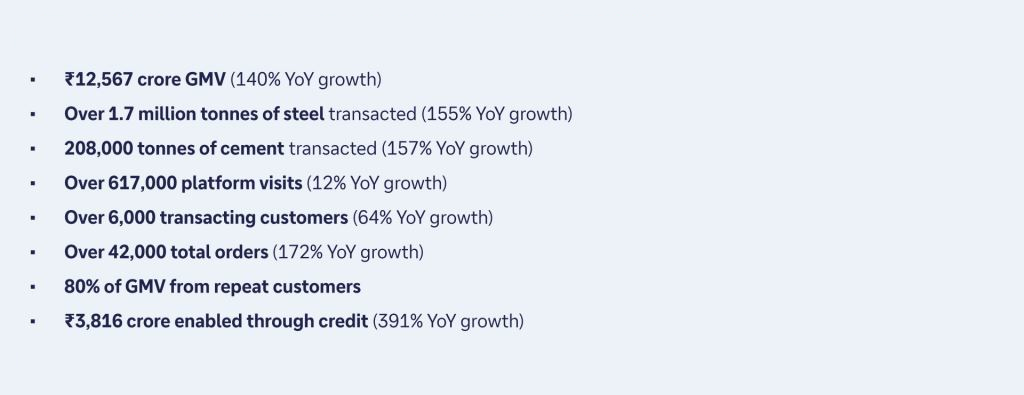

Figure 2: JSW One: FY25 performance (31 March 2024 - 31 March 2025)

Source: JSW One

JOPL is now ready to extend the range of products offered by onboarding competitors to the platform. How is it addressing the challenge? "JSW One Platforms was built with a customer-first, multi-brand catalogue philosophy. While the platform draws on the JSW Group’s strengths, it also features a diverse portfolio of third-party brands to cater to the wide-ranging procurement requirements of MSMEs. This is a strategic and deliberate choice," says Gupta. These third parties include competitors, such as Tata Steel and ArcelorMittal Nippon Steel.

"By offering choice, transparency, and reliability across categories like steel, cement, paints, and construction materials, and services like credit access and logistics, JSW One enables customers to make informed decisions based on their specific needs,” Gupta says. “This model strengthens customer value proposition, drives trust in the platform, leading to high repeat sales, and allows us to solve critical B2B challenges like availability, price transparency, and delivery assurance at scale."

JOPL expects to continue scaling across products, regions, and customer cohorts, which will enable it to move into profit by the 2027–28 financial year, and has set a target to achieve a gross merchandise value (GMV) of US$5bn by then. Sachdeva confirms recent reports that the platform is preparing for an IPO; noting that “we intend to list the company within 18 to 24 months". These strategic ambitions are "supported by the strong momentum in gross merchandise value (GMV) growth, operational efficiency, and an integrated tech-fin-stack." India’s ambitions to turbocharge its economy – the country is projected to become the world’s third-largest economy by 2027, overtaking Germany8 – should further ensure that JSW One’s future is bright.

Image: JSW Group

Sources

1 See imf.org

2 See ey.com

3 See jswsteel.in

4 See jswsteel.in

5 See mckinsey.com

6 See group.jsw.in

7 See group.jsw.in

8 See imf.org