May 2020

Dan Barnes explains how targeted use of derivatives can create more efficient hedging for FX risk, and provide treasurers with an alternative to incurring overnight deposit charge

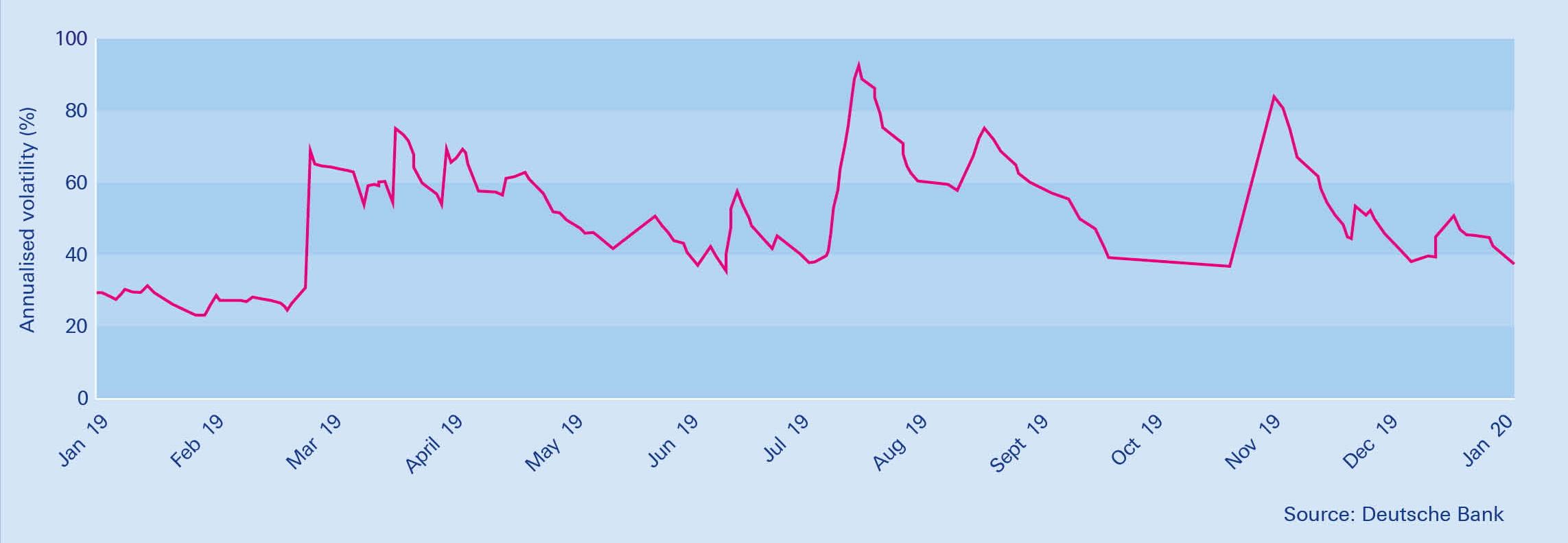

Despite ongoing concern around the US–China trade war, overall volatility in the foreign exchange (FX) space has declined over the past year. This pattern can be seen in Deutsche Bank’s Currency Volatility Index (CVIX) – the historical volatility index of the major G7 currencies (see Figure 1).

The CVIX has not gone past 9% since April 2019, helped by range-bound interest rates in the world’s major economies and low inflation, thereby reducing incentives to move money from one country to another.

Deutsche Bank’s CVIX provides a daily measure of volatility in the FX market, showing how suddenly volatility can spike and fall and providing a benchmark for currency market participants.

Low volatility is often correlated with tight spreads, lowering the cost of moving between currencies. Companies also often reduce hedging activity in periods of low volatility, as the risk of an adverse movement is reduced.

These circumstances in foreign exchange markets create both opportunities and risks for corporate treasurers. Despite low volatility, during 2019 the euro fell 2.37% against the US dollar and 3.34% against the pound, according to data from market information provider Refinitiv (formerly Thomson Reuters Financial & Risk).1

Research from the Bank for International Settlements (BIS), as part of its September 2019 Triennial Survey of the FX market, found that in April 2019, cross-border FX trading activity had reached its lowest level since 2001. While trading in FX markets had reached US$6.6trn per day – up from US$5.1trn three years earlier – trading between banks and non-financial institutions remained at 7% of total turnover, as had been the case in the 2016 survey. Some of that activity can be explained by the levels of market volatility.2

The findings involved collecting data from around 1,300 banks and other dealers in 53 jurisdictions, with national aggregates reported to the BIS, which then calculated the global aggregates.

Cost and opportunity

For firms within highly export-focused economies, managing FX and currency risk is paramount to supporting profitability. For example, Germany runs a monthly €35bn current account surplus, which needs to be converted by the businesses that are bringing those revenues home. If hedging is reduced in periods of low volatility, companies can be caught out as volatility rises and they suddenly face higher hedging costs.

Both they and more domestically focused firms also need to consider the cost of holding euros, given the European Central Bank’s (ECB’s) policy of negative interest rates on deposits has persisted since 2014. In its November 2019 Monthly Report, Deutsche Bundesbank found that 58% of respondent banks were charging a negative volume-weighted average interest rate on overnight deposits held by business clients in September 2019, with those institutions making up 79% of the total volume of overnight deposits of enterprises within the German banking industry.3

Corporate treasurers need to engage with their financial partners to develop strategies that will support their revenues by both minimising costs associated with FX and cash management, and by looking for opportunities to optimise interest expense/ income and reduce FX volatility.

Hedging risk

US$ 6.6trn

Cash flow exposure is the simplest form of FX exposure, with products built in one country sold overseas, creating the need to exchange the foreign currency for the domestic currency.

Increasingly, the globalised industrial structure seen within corporates leads to production and service provision being based overseas from the headquartered location, with products also being distributed overseas. That means the company no longer has cash flow exposure, but instead has earnings exposure. This model has been encouraged by both the shaking up of existing trade and free-trade agreements, and also the drive by firms to be closer to their consumers.

The most common hedge used is an FX forward contract, which sets the price at which the foreign currency is sold in the future. However, there are many variables that might create a demand for more flexibility, at which point options become the preferable tool for hedging.

Firstly, the level of exposure that a firm incurs will differ significantly, based upon its industry sector, the transaction certainty it enjoys and its profitability margin. “If one transaction has a 5% profit margin and another has a 50% margin, the business with the 50% margin has much more leeway on hedging the exposure,” says Konrad Haunit, Head of FX, Institutional and Treasury Coverage at Deutsche Bank.

Another consideration is the price flexibility of a product, as that can allow responsiveness to currency changes. Digital and small unit product providers can change their prices rapidly, but hardware, machinery and vehicle manufacturers cannot.

Developing a skillset

Hedging against FX risk is more complex when product unit sales are less certain. For example, manufacturers need to develop programmes for anticipated exposure, as these are so large they cannot wait for clients to buy a product and then trigger the FX hedge. Instead, they have to anticipate that they will sell a certain amount of stock in a given geography and also assess how quickly they can adjust their supply chains/cost base relative to forecast length.

For single items, the buyer may have a credit event and be unable to complete the transaction. In the example of manufacturers supporting a large number of volume sales, the exact sales figures are an unknown, and so the hedge must reflect estimates. This is where FX options come in. “A manufacturer may be confident of selling US$500m, and see US$700m as likely,” says Haunit. “They layer their hedges, and the size of the exposure, and then if the exposures become too unlikely and too big they would then start using options as a hedging tool.”

Figure 1: Deutsche Bank's Currency Volatility Index

While these dynamics are all reflective of the business itself, corporate treasurers must also consider their own skillsets and those of their partners. Psychology plays an important part in the level of sophistication of hedging tools that firms may be comfortable with.

This comfort level is typically influenced by positive and negative experiences or by an absence of experience, tempered with the level of professional support that can be provided by partner organisations such as banks. Inexperience and negative experiences can both limit the appetite of a firm’s treasury team to use new products or services. However, that can lead to the business missing out on realised profits due to sub-optimal FX hedging. Looking at the decision objectively, cost is a major factor, but so is complexity.

"If one transaction has a 5% profit margin and another a 50% margin, the 50% margin one has much more leeway on hedging the exposure"

Haunit says: “The product needs to be simple, effective and the treasurer needs to be able to explain it; it also needs to be at a reasonable cost. The accounting treatment needs to be working, so their use of the hedge can’t cause a lot of volatility, for example. Then there is also the question of profitability.”

Yet the cost of hedging is often misunderstood, due to a focus on the explicit costs without an understanding of the implicit costs that might be included.

“Businesses often work with the perceived cost, which is not necessarily the analytically correct level of cost in my view,” says Haunit. “So for example, suppose a client wants to sell US$100m and buy euros. They might go onto a price comparison website such as 360T or FXall and ask 10 banks at the same time for a price. As they make that request, the price will start moving, so most of the time they have the cheapest price those 10 banks can offer, but only after the market has moved against them.”

Left holding the euro

FX management should also be used to mitigate risk in local currency, where it carries a burden. Since banks are increasingly passing on Europe’s negative interest rates – as set by the ECB – to their corporate clients, the optimal strategy for managing cash can change.

When rates were artificially high relative to the ECB rate, the effective savings generated by holding cash within current accounts made other ways of managing that cash uneconomical. Now that savings are being eroded, or have turned into costs, corporates – many of which have International Swaps and Derivatives Association (ISDA) Master Agreements with their banks – are able to use derivatives to temporarily move cash between currencies, as a fully hedged transaction, then bring it back into the domestic currency.

“This allows clients to unlock other potential subsidies or risk premiums,” says Yannick Marchal, Director for Automated FX Solutions and Services, Foreign Exchange Trading at Deutsche Bank. “Some banks put a premium on their dollar deposit rate relative to their euro deposit rate because they want to attract dollar deposits, and will provide reasonably beneficial rates for long-term deposits in dollars.”

To access those beneficial foreign currency rates, corporate treasurers can use FX swaps to reduce, alleviate or eliminate the cost of holding euros. “Automated programmes can allow that seamless temporary transition from euros into dollars,” says Marchal. “It can range from doing it on an overnight basis, which requires limited derivatives documentation, to longer dated agreements; for example, a three-month time deposit, partnered with a three-month FX swap.”

"Typically, between five and 15 basis points over the benchmark is not unreasonable"

The impact of MiFID II

In addition to ISDA Agreements, corporates working with derivatives need to be aware of their obligations under MiFID II, the legislative framework brought in by the EU to regulate financial markets in its bloc.4

However, there are exceptions and exemptions, which many corporates will be able to apply to their own business. FX transactions related to payments transactions are out of scope for MiFID II, although these must fulfil a range of criteria, including being a physically settled means of payment, and entered to support payments for goods, services or direct investment.

“To use derivatives effectively, firms need an understanding of the accounting associated with it, and the systems to manage transactions with straight-through-processing,” Marchal observes. “Running overnight swaps every day involves a volume of transactions to process, although in most cases clients’ treasury management systems and enterprise resource planning tools should be able to handle this.”

The trade is fully collateralised, so once the accounting data entry is sorted out, the operational aspect is, in Marchal’s view, painless. The potential savings are a function of the instruments that are made available to that particular firm and how much time they are willing to lock their money in for.

“For a year-long time deposit, the bank offering the time deposit will provide some uplift on the market rate, because it wants to borrow those dollars, or other currency,” Marchal concludes. “Typically, between five and 15 basis points over the benchmark is not unreasonable and, in certain cases, you could probably get a fair bit higher.”

Dan Barnes is Editor of The DESK, presenter of www.tradertv.net and a freelance FX writer Sources

Sources

1 See https://refini.tv/2xwb2b1 at refinitiv.com

2 See https://bit.ly/3dd8DkQ at bis.org

3 See https://bit.ly/2OsW22X at bundesbank.de

4 See https://bit.ly/3b6wvVD at fca.org

You might be interested in

NEWS, CASH MANAGEMENT

Supporting corporate treasurers working from home Supporting corporate treasurers working from home

Deutsche Bank’s FX platform capabilities are helping corporates facing exceptional challenges triggered by the global pandemic – from maintaining liquidity to enabling employees to work from home

MACRO AND MARKETS

Central banks: on-side or outside? Central banks: on-side or outside?

How much “support” should central banks give Covid-19 stricken economies? With the focus on fiscal responses, what tools remain in the monetary policy armoury? flow´s Clarissa Dann reviews Deutsche Bank Research insights

CASH MANAGEMENT

Why e-FX is rocket science Why e-FX is rocket science

How is technology supporting clients and providers in maximising FX market opportunities? Graham Buck talks to Deutsche Bank’s Head of E-FX David Leigh in the run-up to Sibos London 2019 about FX that knows what corporates need before they do…