13 December 2021

Digital sales are booming. While marketplaces provide new business opportunities for buyers, sellers and operators, they also create new challenges for treasurers. flow’s Desirée Buchholz reports on how treasury can define a new payment strategy

MINUTES min read

In May 2021, Siemens acquired Supplyframe, a fast-growing marketplace for the global electronics value chain, which connects more than 10 million engineering and supply chain professionals to design, source and sell electronics. Although it was a rather small acquisition for the German industrial technology company – Siemens paid US$700m – it was a strategically important one. Supplyframe will be “be the nucleus to accelerate our overall digital marketplace strategy“, said Cedrik Neike, member of the Managing Board of Siemens in a press release, adding that the company “complements our industrial software portfolio perfectly and strengthens our capabilities for the growing market of small- and mid-size customers”.1

Siemens’ strategic purchase is just one example of how the business-to-business sector (B2B) is increasingly adopting digital sales channels – a trend that is further accelerated by the Covid-19 pandemic. The market research institute Research and Markets predicts that by 2030, the global e-commerce market will reach US$66.9trn2 – with the B2B sector accounting for more than three quarters of the digital sales market, equalling US$51.2trn3.

However, it does not stop with the extension of sales channels to online, as the Siemens example also highlights. “Companies are building digital ecosystems around their original product and service offering,” says Ole Matthiessen, Global Head of Cash Management, Deutsche Bank. Automobile companies are expanding their offering horizontally with mobility solutions such as car sharing, machine builders are ramping up their software development and aftersales business by leveraging data on IoT platforms, and in the healthcare sector, manufacturers of diagnostic equipment create vertical marketplaces to monetise new goods and services at scale through a convenient integration of smaller medical suppliers.

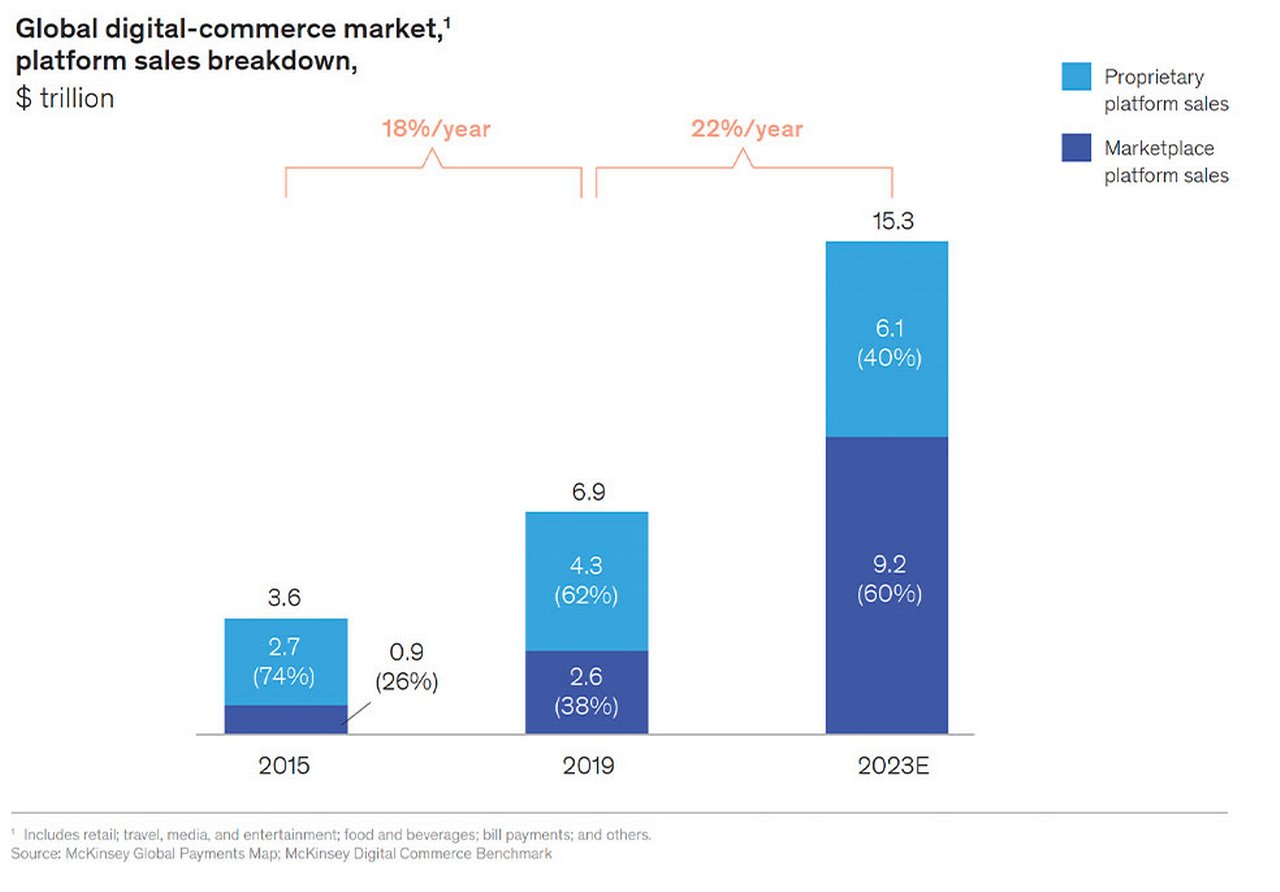

While buyers on these platforms benefit from greater choice, faster delivery and cost reduction, sellers gain access to a larger number of clients at a lower risk. Given these advantages, global sales conducted via B2B marketplaces are expected to quadruple from US$1trn in 2020 to US$4trn in 2025.4 The consultancy McKinsey even expects marketplaces to account for 60% of online sales by 2023; or US$9.2trn, an increase of 22% each year compared to 2019 figures (see Figure 1).5 The higher volume is due to the fact that McKinsey also includes business-to-consumer (B2C) sectors like retail, travel, media and entertainment as well as food and beverages.

New opportunities for the business, new challenges for treasurers

There are several reasons why becoming a marketplace operator is so attractive. As Matthiessen points out, “It allows companies to generate new revenue streams from fees on transaction volumes and capture upside through as-a-service (aaS) recurring revenue.” Furthermore, marketplaces provide a great opportunity for manufacturers to sell directly to the customer, thereby circumventing resellers and increasing their margins. “Owning the interface to the client is getting even more important as sales channels shift from physical to digital,” he adds.

This new business model is a challenge for corporate treasurers as operating digital platforms requires a totally new payment strategy. “Payment acceptance plays a key role in end-to-end user experience, so companies should ensure that they accept a wide range of payment methods and currencies without cutting back on efficiency, security, and risk management,” explains Matthaeus Sielecki, Cash Management Structuring at Deutsche Bank.

In a webinar hosted by The Economist earlier this year, Wolfgang Ratheiser, Corporate Treasurer at luxury carmaker Porsche, reported that e-payment has become an important part of treasury, as e-commerce strategies are put in place. He emphasised that the treasury team needs to be strongly interlinked with the business, for instance with the sales department.6

“Banks can help to empower treasurers such that they become a driver of business model transformation”

However, not every treasury department is as advanced as Porsche’s. “So far, treasury is not always directly involved in projects to enable embedded payments in new digital business models,” observes Matthiessen. Instead, the initiatives often originate from the sales department or the business development, with treasurers sitting in the back seat. “Banks can help to empower treasurers such that they become a driver of business model transformation,” he says.

System integration is the greatest challenge

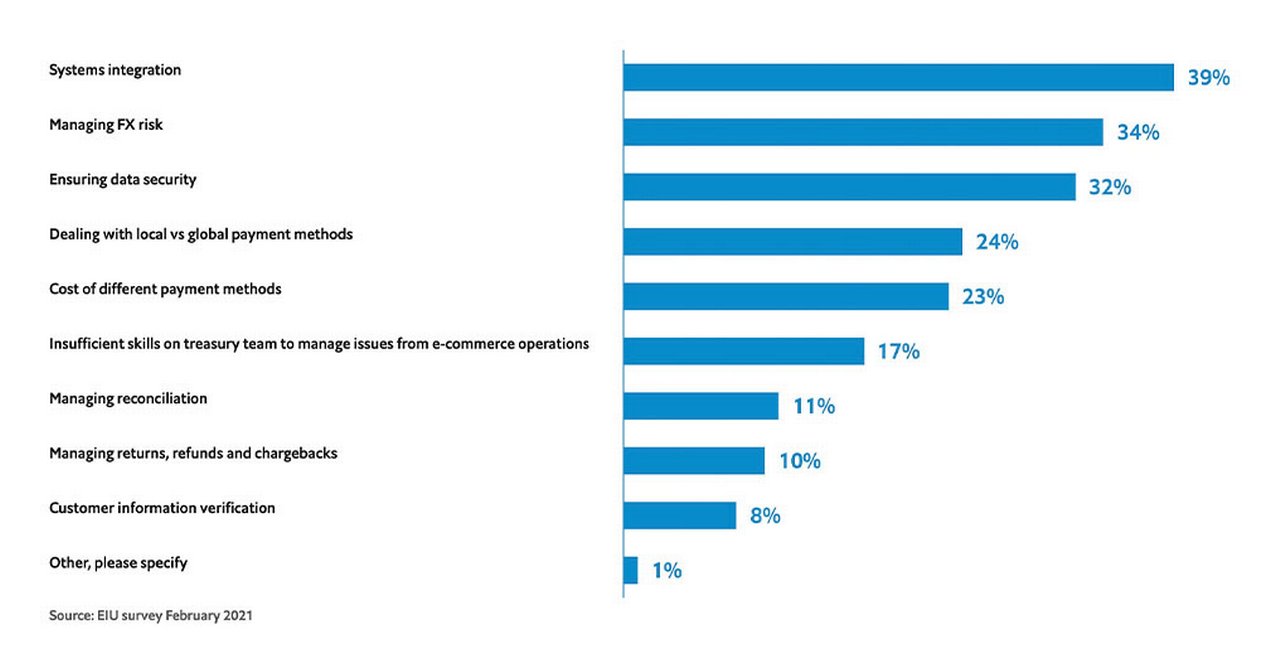

So, what exactly are the challenges faced by corporate treasurers when it comes to digital sales? A survey of 150 senior corporate treasurers across North America, EMEA and Asia-Pacific conducted by Economist Impact between February and April 2021 and supported by Deutsche Bank offers several insights. It found that as companies expand their digital payments infrastructure, the top challenge encountered by treasurers is systems integration, cited by 39% of respondents, followed by managing FX risk and ensuring data quality (see Figure 2).7

Figure 2: Top challenges facing treasurers as they expand their digital payments infrastructure (click to enlarge)

Source: Economist Impact survey “Connected with customers”

However, the survey responses revealed regional differences: While for North America two in three (66%) said that systems integration is their biggest problem, managing FX risk ranks top of the list for respondents in Asia-Pacific (38%). “Stringent exchange control regulations dominate most markets in APAC. As corporates expand their business online across these markets, the key challenge for them is to enable local currency collections in each of the APAC markets while being able to get liquidity out,” explains Chintan Shah, Head of Corporate Cash Management, APAC at Deutsche Bank. “Although Payment Service Providers (PSPs) are able to support this for card products, corporates are also keen to implement low-cost Instant Payments/Request to Pay functionality across markets in APAC to support local currency collections,” he observes.

Apple iPhone 8 screen with Online shopping e-commerce mobile app icons applications Amazon, Ebay, AliExpress, Wish

In general, he explains that supporting sales via digital marketplaces is nothing new for treasurers in Asia: “The region is not only home to Alibaba, one of the world’s largest B2B marketplaces, it is also one of the drivers for payment innovation, so treasurers are used to incorporating new payment methods like mobile or instant payments.”

For those in EMEA, safeguarding consumer data within digital payment systems was the top challenge (34%), which as the authors of the survey report point out “may stem from stringent enforcement under the EU’s General Data Protection Regulation (GDPR)”. Economist Impact also cites Stephen Hogan, Vice President Regional Treasury Asia Pacific, Deutsche Post DHL explaining why greater access to consumer data means more compliance requirements for treasurers: “Do I [keep all of the consumer data] with my payment service provider?” he asks. “In that case, I don't store any of my customers’ data and it's held within the PSP. This means they will have to maintain compliance, but then I’ve kind of lost some of the data [and the insights that come with it].” 8

Four factors that treasurers should consider

So, from a treasurers’ perspective, supporting digital sales goes beyond just the front-end checkout process. “It requires embedding and monetising payment and lending services, using innovative payment technology to enable the growth of the business,” says Matthiessen. This translates to four key factors that treasurers should address when it comes to B2B marketplaces.

“Once companies start to sell internationally via digital platforms, banks are usually better positioned than fintechs”

- First, they must tackle the lack of integration that typically exists between their e-commerce platform, Payment Service Providers (PSP), the Treasury Management System (TMS) and Enterprise Resource Planning (ERP) systems as fragmentation can lead to problems with accounts-receivable management and reconciliation, cause delays in payment refund and ultimately frustrate the customer.

- Second, treasurers should ensure that legal requirements are met across payment partners. This, for example, includes know-your-customer (KYC) checks, fraud protection and guaranteeing the traceability of flows. While the onboarding of merchants is cumbersome as it requires KYC checks and data collection, buyers need to be screened to ascertain their credit risk.

- Third, as B2B marketplaces grow cross-border the FX exposure generated from digital sales activities will increase, so prudent treasurers will incorporate platform cashflows into their hedging policy.

- Fourth, they need to consider counterparty risks when choosing their payment partners. “While fintech solutions are often fast to be implemented and convenient for the end user, they usually lack global reach and FX capabilities,” says Matthaeus Sielecki. “Once companies start to sell internationally via digital platforms, banks are usually better positioned than fintechs.” Furthermore, given the fast pace of change in the payments landscape, it is uncertain whether some start-ups will even exist in three years’ time.

At Porsche, for example, as Wolfgang Ratheiser revealed during the webinar, the treasury department deals regularly with fintechs and it asks which of them can best support the business. Initially the company began with just a single PSP, but now it needs to evaluate a portfolio of different vendors, as the business grows more complex.

Enabling the payment orchestration

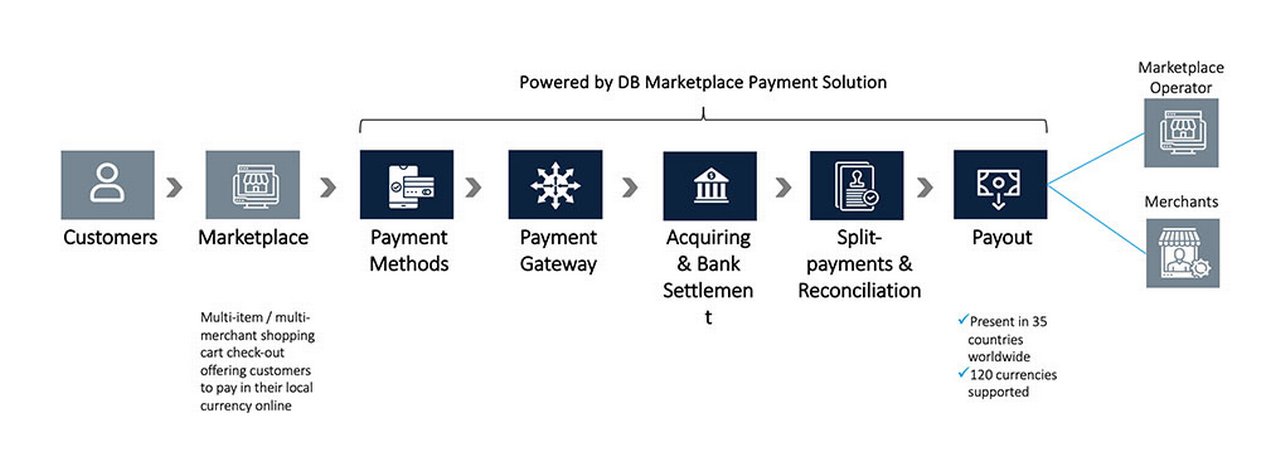

Summing up, the goal of the treasury department should be to create a seamless payment experience for all stakeholders. For buyers, marketplace operators should accept relevant B2B online payment methods like credit card or invoice payments while for sellers, it involves ensuring low-cost pay-outs in all currencies and automated reconciliation. “A functionality that is of particular importance not only for marketplaces but any multi-party, digital ecosystem, is split payments, which allow funds to be credited to different merchants within one transaction,” reflects Sielecki.

Deutsche Bank is currently piloting a marketplace payment engine that includes features such as single purchase API, split payments, and currency conversion with a large original equipment manufacturer (OEM) supplier. The supplier operates an IoT and software platform on which business clients can purchase apps from software developers that accompany the service offering of the supplier. However, when setting up the marketplace the company faced several payment-related challenges – including the onboarding of partners globally and ring-fencing their funds on the platform.

The new marketplace payment engine developed by Deutsche Bank now allows the treasury department to streamline bank and PSP relationships, scaling pay-out and FX processes globally, and establishing governance control on headquarter level across the group (see Figure 3).

Figure 3: Deutsche Bank Marketplace Payment Solution (click to enlarge)

Source: Deutsche Bank

“This is a great example of how treasurers are becoming enablers of business growth,” says Matthiessen. In an even more sophisticated operating model, the treasury department could even become an internal profit centre by internally reselling a white-labelled payment solution to other web shop applications or marketplaces. This would be a true gamechanger for the treasury function.

Sources

1 See https://sie.ag/33cimYN at siemens.com

2 See https://bit.ly/30jz0ow at researchandmarkets.com

3 See https://bit.ly/33kcg8X at researchandmarkets.com

4 See https://bit.ly/3pNVK8P at finextra.com

5 See “The 2020 McKinsey Global Payments Report”

6 See also 'E-commerce for treasurers: staying ahead of the game' at flow.db.com

7 See https://bit.ly/3EQlqbi at economist.com

8 See https://bit.ly/3dEswDz at economist.com

Cash management solutions Explore more

Find out more about our Cash management solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

Cash management, Technology

E-commerce for treasurers: staying ahead of the game E-commerce for treasurers: staying ahead of the game

No industries are safe from digital disruption and the pandemic has accelerated the pace of change in the world of shopping. At a recent webinar hosted by The Economist, treasurers of a B2B and a B2C company outlined the challenges of expanding e-commerce operations, choosing the right platforms and payment providers, and increasing payments digitalisation to support emerging retail trends

CASH MANAGEMENT, TECHNOLOGY {icon-book}

Reimagining the future of payments Reimagining the future of payments

The pandemic has accelerated the pace of change over the past year and bank-led merchant solutions are among the responses to a huge shift in payment methods and the boost to e-commerce, reports Helen Sanders

TECHNOLOGY, MACRO AND MARKETS {icon-book}

AI in motion: Tracking the smart money’s journey AI in motion: Tracking the smart money’s journey

Deutsche Bank Senior Strategist Marion Laboure takes a closer look at the explosion in artificial intelligence (AI) commercial applications by examining patent growth areas