16 November 2022

The arrival of the Revised Payment Service Directive (PSD2) changed the face of European payments, but how far has this taken Open Banking? flow shares an article from Deutsche Bank’s Tino Meissner, first published in the global payments newswire The Paypers

MINUTES min read

The implementation of PSD2 has helped to steer the European market towards Open Banking – unlocking a host of improvements for all market stakeholders, from new tailored products and services to increasingly fast, automated, and safe transactions. However, for many, PSD2 has not gone far enough in enabling industry-wide standardisation and collaboration.

There is now a growing demand from a range of market participants to go beyond the regulatory scope of PSD2’s ‘access to account’ requirements and embrace ‘Open Finance’ – potentially the next big milestone for the industry. By applying the Open Banking approach to a much wider range of financial services, such as investments, lending, or insurance – and beyond – Open Finance will support a variety of new use cases for customers.

Several industry-led initiatives are now under way. Among the most notable initiatives is the SEPA Payment Account Access (SPAA), which focuses on fostering Open Finance across Europe by incentivising account maintaining banks – known as Account Servicing Payment Service Providers (ASPSPs) – to align their service developments and technologies with other TPPs.

Beyond PSD2

Since PSD2’s enforcement in early 2016, many in the financial services industry began to voice their concerns about the limitations of the regulation. In particular, a lack of interoperability and standardisation has led to high costs for TPPs, who have had to set up individual integrations with a range of interfaces across various ASPSPs. Similarly, ASPSPs may have had to redesign their own data and transaction asset sharing interface to remedy the inefficiencies.

With this in mind, the Euro Retail Payments Board (ERPB) set up a working group tasked with defining the key elements for a potential scheme that would simplify integration and bring down the high associated costs.

“The SEPA API framework is expected to foster innovation and increase choice”

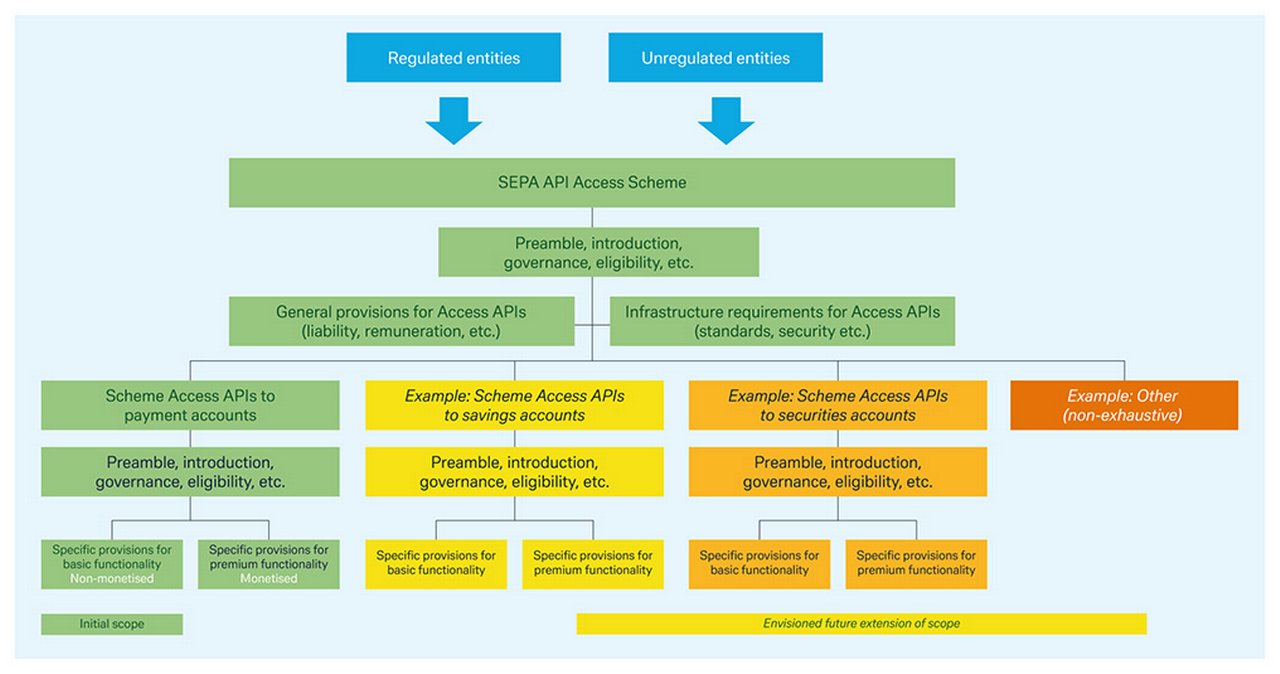

In June 2021, the working group settled on a framework for using APIs to share key data not originally specified by PSD2, such as non-personal, bank-owned information and customer transaction data, while improving access to customer transaction initiation services. Subsequently, the European Payment Council (EPC) was appointed to govern this framework as part of the SEPA Scheme. The SEPA API framework is expected to foster innovation and increase choice for customers and scheme participants, as outlined in the ERPB’s Working Group report on the SEPA API Access Scheme, of which SPAA forms a part (see Figure 1).

Figure 1: Envisaged structure of the SEPA API Access Scheme

Source: ERPB WG API Report (June 2021)

In June 2022, the EPC announced the launch of a public consultation on the draft SPAA rulebook. Currently being drafted by the SPAA Multi-stakeholder Group, facilitated by the EPC, the rulebook aims to provide a set of rules, standards, and practices that enable ‘premium’ payments services beyond those covered by PSD2, while ensuring effective renumeration for ASPSPs, and transferring data and transactional assets to TPPs.

How does SPAA aim to address these challenges?

Leveraging a market-led approach, SPAA goes beyond the regulatory requirements of PSD2 to facilitate the distribution of value and risk as equally as possible along the payment processing-chain. SPAA proposes detailed standards for account access procedures, which, at a minimum, need to be compliant with existing and future regulatory requirements.

When creating the rulebook, the working group focused on how account-based data and transactional assets can be better leveraged to meet the needs of current and future use cases.

Under the scheme, data assets, such as lists of accounts, transaction details, Strong Customer Authentication (SCA) exemptions, and card transactions, can be used by TPPs to offer support services for end customers to manage their personal finances and for finance providers to carry out risk assessments for loans. This stands to benefit end users, driving faster approvals (or rejections) for credit assessments.

Transactional assets, meanwhile, such as one-off payments, recurring payments, and flexible recurring payments, can be harnessed to determine payment certainty, which is the basis for all BNPL models. With a robust API connection between the merchant and its bank, as well as a strong financial partner providing guarantees on behalf of the consumer, merchants can have the confidence to process BNPL purchases and continue with the underlying commercial transaction without receiving immediate payment.

This is a clear example of how the participation of all market players in the drafting of the SPAA scheme ensures a focus on use cases that bring the most value to consumers.

What’s next?

The decision as to whether SPAA will move to the next stage of development is then expected from the EPC in November 2022. If successful, the draft of the rulebook will likely be finalised and ratified in the next year, with the first services potentially starting sometime in 2024.

SPAA and the work done by SEPA and the EPC are essential developments towards a market-led Open Finance ecosystem. However, the rulebook is only one piece of the puzzle here and market adoption is not predictable. The European Commission, for example, is preparing a proposed regulatory framework for Open Finance that cuts across all financial services, which is expected by Q2 2023. A review of PSD2 is also underway.

In parallel, Deutsche Bank, and other industry stakeholders are participating in the development of numerous other complementing market-led initiatives, such as the SEPA request to pay scheme (SRTP) led by the EPC, the Request to Pay clearing service by EBA CLEARING and the European Payments Initiative (EPI).

Open finance is here to stay. Whether it’s through SPAA or another industry-led framework, this trend towards collaboration and innovation will continue to grow – offering clear benefits to consumers, regulators, and industry stakeholders alike.

This article was first published in The Payper’s The Enablers of Open Banking, Open Finance, and Open Data Report 2022, which can be found in full here.

Tino Meissner

Product Team Lead RTP, iDEAL, EPI, BNPL, Deutsche Bank

Trade finance solutions Explore more

Find out more about our Trade finance solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

CASH MANAGEMENT

Sibos – unwrapped (Part 1) Sibos – unwrapped (Part 1)

Sibos Amsterdam 2022 returned to an in-person event at the RAI Convention Centre against the backdrop of rising inflation, energy security worries and increased levels of financial crime. In the first of three post-Sibos reports, flow’s Clarissa Dann takes a deep dive into post-pandemic payments

CASH MANAGEMENT

Ten PSD2 essentials Ten PSD2 essentials

PSD2 applies from 13 January 2018. flow summarises how this affects your business and transaction flows

Cash management, Technology {icon-book}

Automation should come first, AI will follow Automation should come first, AI will follow

Treasurers will benefit from AI, but there are many issues to be fixed before thinking about using this technology, François Masquelier, Chair of the European Association of Corporate Treasurers (EACT) believes. What should intermediary steps look like?