July 2019

With geopolitical risk and FX volumes on the rise, flow explores how combining the right technology with trusted market expertise is essential for corporate treasurers

FX volumes are set to increase in 2019, thanks in large part to increasing geopolitical tension in global markets. In Europe, Brexit continues to drive uncertainty, while US–China trade tensions are adding a level of unpredictability to their home markets and beyond. This year will also see several emerging markets holding key elections that will add to global market uncertainty, with Argentina, India, Indonesia and South Africa among the countries heading to the polls.

Looking at the micro level, the escalation of tensions between India and Pakistan in February 2019 provides a good example of how unplanned events can have an immediate impact on FX rates, with the USD/PKR moving half a percentage point in a day as a result.1

Corporate treasury challenges

According to a recent Deloitte survey, finance executives’ risk appetite dropped to its lowest level in more than nine years in the last quarter of 2018.2 When juxtaposed with increasing levels of uncertainty – 58% of respondents rated levels of uncertainty as high or very high, the most intense since mid-20163 – it is little wonder that “financial risk management, FX” was the second most important priority for treasurers for the third successive year in Treasury Strategies’ annual survey of treasury priorities.4

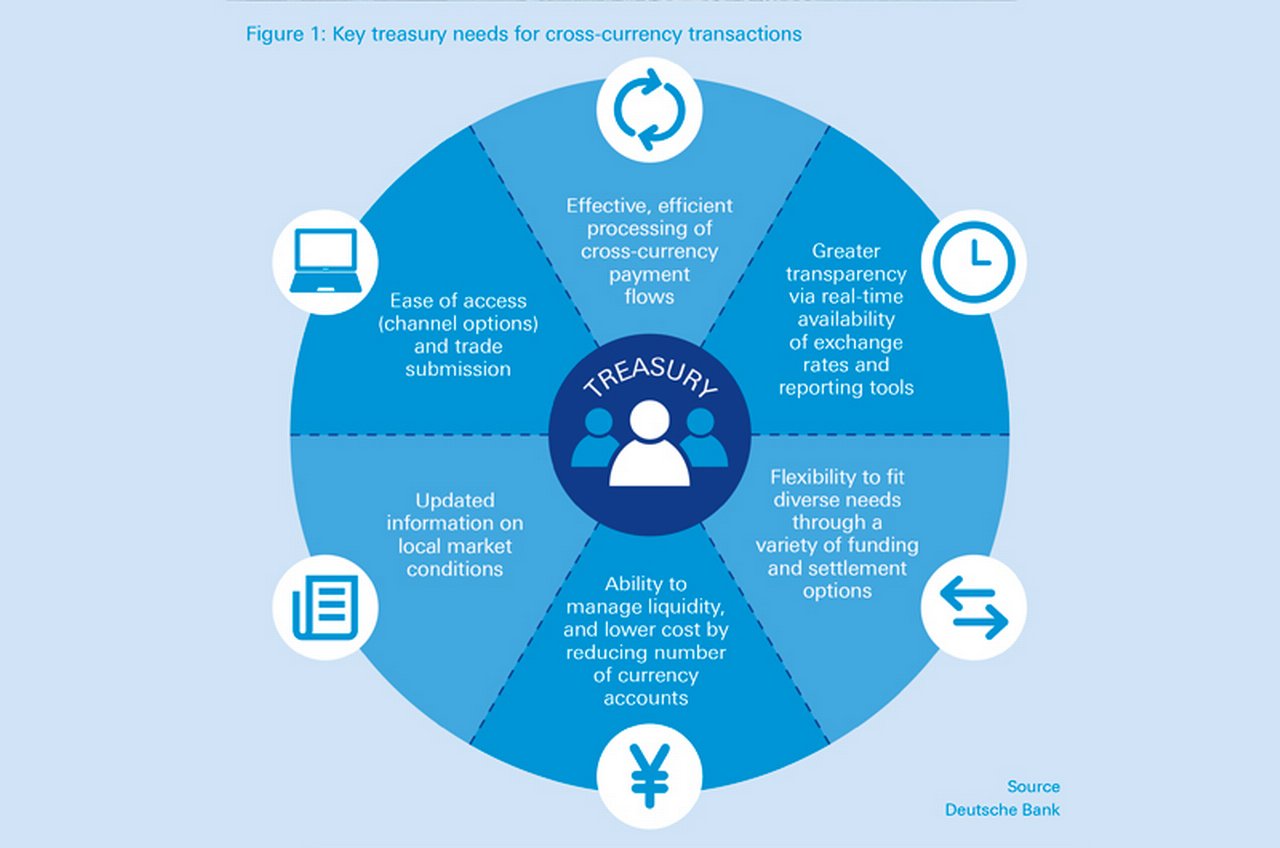

Indeed, FX management has become even more of a priority for the strategic treasurer. A treasurer’s biggest driver is to protect the firm’s profit and loss and, against a backdrop of market volatility, gaining control and visibility over corporate FX are prerequisites for implementing successful hedging strategies (see Figure 1).

Achieving this, however, is particularly challenging for global firms managing multiple business entities with myriad bank accounts across countries and currencies, and numerous counterparties throughout their value chains.

Economic fluctuations

6.1%

Even when a single view of a firm’s current state can be achieved, broader market developments can quickly impact supply chains and change the game. The latest Dun & Bradstreet Global Supply Chain Risk Report found that supply chain FX risk increased 6.1% over the last quarter of 2018, and 5.7% over the last three quarters of the same year.5

Consider for instance the impact of the ruble’s depreciation – it has dropped nearly 10% since the beginning of the year.6 The exchange rate volatility and high ‘cost to carry’ (or cost of holding the currency) would have affected businesses that manufacture products in Europe for sale in Russia. This is a broader supply chain issue that cannot be solved by simply tapping into the FX market. While trading the currency may partly hedge the risk, it would not negate the cost to carry of buying rubles and selling euros. This is just one specific example. For firms with supply chains that span multiple markets, this complexity would be multiplied many times over, creating structural risk for the business.

Market fragmentation, regulation and dispersed liquidity

In addition to the potential ripple effects of currency volatility on global supply chains, treasurers also have to manage amid decentralised and fragmented FX markets. This means there are myriad regulations to navigate – from local regulation and taxation, to more sweeping reforms, such as the introduction of Markets in Financial Instruments Directive II (MiFID II) in European Markets in January 2018, Capital Requirements Directive IV (CRD IV), International Financial Reporting Standards (IFRS 9) and the recommendation that corporates adopt the FX Global Code of Conduct (a set of principles of good practice for FX market participants). It also means there are a variety of trading windows, funding sources, execution platforms and settlement times. Add to all this the evolution of the FX landscape to one with scores of electronic trading platforms and dispersed liquidity sources.

Reporting and reconciliation

Amid all this, corporate treasurers are still hampered by manual processes, making FX reporting and reconciliation a headache. This lack of automation results in longer lead times, concerns about data security and inaccuracy of forecasts.

Cost pressures

"Technology is the enabler, but front-to-back focus drives step changes in efficiency"

Finally, corporates are constantly under cost pressure, needing greater transparency on FX fees, rates and spreads, as well as access to data to make strategic decisions that contribute to revenue growth. There is also a need to rationalise the number of currency accounts maintained, while optimising operational efficiency.

Johnny Grimes, Global Head of GTB FX at Deutsche Bank, notes: “Given all these factors, treasurers are actively seeking to achieve central visibility of the consolidated exposure across their firms’ value chains. A holistic view of currency risks would enable them to take strategic steps to offset the risks against each other, or to review business models with internal partners in order to control overall exposure durations, reduce costs, and improve forecasting and cash-flow hedging.”

Local bank account inefficiencies

Consider the case of Honeywell, a Fortune 100 software-industrial company that recorded US$41.8bn in sales in 2018 and does business in more than 970 sites.7 Its Brussels-headquartered EMEA Treasury manages 48 currencies on behalf of the firm’s affiliates, netting all exposures. While it is a euro-functional entity, the firm had exposures emanating from local bank accounts associated with different business units that were causing FX- management concerns.

First, some local business entities had multiple currency accounts; for example, dollar, sterling and euro bank accounts to facilitate customer payments. While this set-up responded to the entity’s customers’ needs, it created inefficiencies for treasury. “The extra accounts created extra risks and security issues associated with monitoring the different accounts, additional costs of retaining these accounts, and an additional dependency from controllership and accounting to monitor the accounts and to sign off the books monthly,” says Rónán Clifford, Treasury Director at Honeywell’s EMEA Corporate Treasury.

Another complication was that, due to reasons of legacy or customer service, some entities held more than one bank account in a non-functional currency. When a business entity is paid in dollars, sterling, or any of the 45 other currencies the company has exposures to in EMEA, the payments flow into non-functional currency accounts. “Having all these small pockets of non-functional currencies in several different locations meant that we would miss opportunities in terms of centralising and investing, and we had to carry the associated costs,” Clifford explains.

To manage this process, the company had someone based in its service centre in India to look at the balances on a regular basis, and to make manual FX transactions between accounts. For example, manual transfers had to be made from sterling and dollar accounts in order to have the cash reside in euros.

Technology for greater treasury control

Given the inherent complexity and relative opacity of cross-currency transactions, forward-thinking corporates like Honeywell are looking to technology solutions to enhance visibility and control over FX flows. By digitising and automating workflows, treasurers will not only achieve operational efficiency, but will also be able to access and build better, timelier data that in turn will enhance trend analysis and the understanding of the drivers of exposures, as well as enable more accurate forecasting.

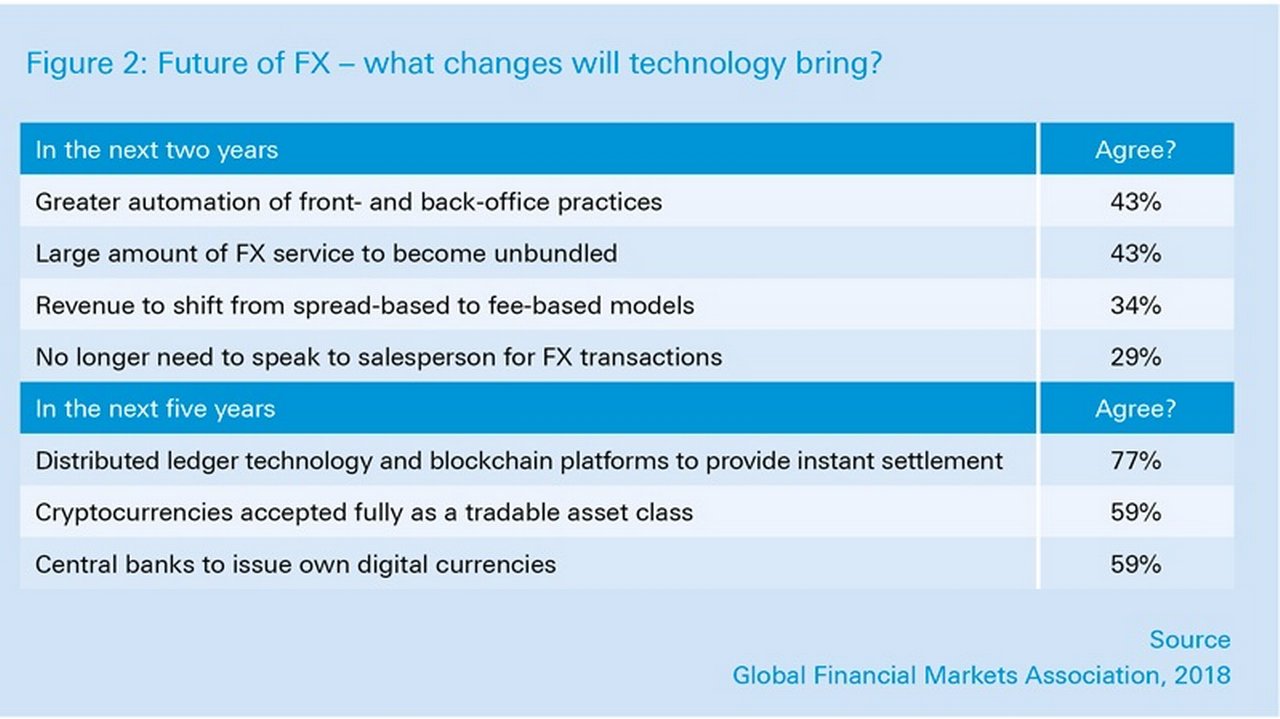

Following a 2018 Global Financial Markets Association (GFMA) survey on technology-driven shifts (see Figure 2), James Kemp, the Managing Director of GFMA’s FX division, stated: “We are now seeing a strategic application of technology spend to drive their businesses forward, enhance the end-user experience and reduce costs, using what could be transformational technologies.”8

This coincides with a change in focus from banks which, following a decade of addressing regulatory and structural changes, are now shifting their sights to innovating and investing in technology in 2019, for the sake of differentiation and efficiency.

The results of the GFMA survey suggest that automation is already front of mind across the industry. Grimes reflects: “The innovation we are seeing is the extension of technology solutions increasingly deeper into our front-to-back workflows. You can no longer look at a process in isolation and try to automate it. You need to be willing to take a step back and look at an outcome you are trying to achieve, and strive to make as many steps in that workflow as efficient as possible.”

He concludes: “Technology is the enabler, but front-to-back focus drives step changes in efficiency.”

Automating cross-currency flows

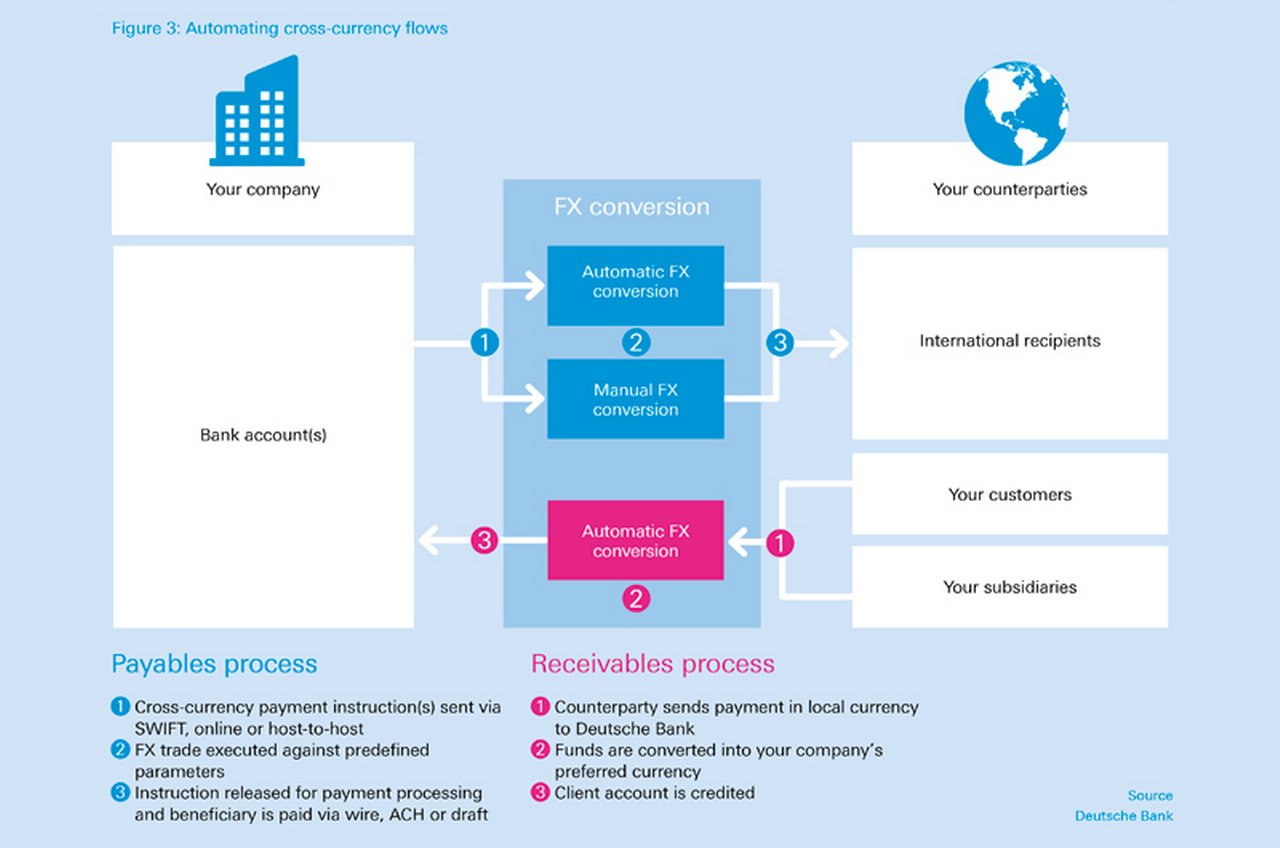

In Honeywell’s case, the firm recognised that there were opportunities to improve its processes holistically. Clifford says: “Account structure inefficiencies were being addressed via a manual process; the challenge was to find an automated solution.” So it implemented Deutsche Bank’s FX4Cash, an automated solution that addresses its challenge of non-functional currency flows (see Figure 3).9

"Account structure inefficiencies were being addressed via a manual process; the challenge was to find an automated solution"

The company agreed pre-negotiated FX prices with the bank, which are deployed automatically when it receives cash. For example, if a Honeywell entity receives pounds sterling into a euro-functional account, there is a pre-agreed margin that the bank will apply to the rate, and the funds are automatically converted into euros and deposited into the euro-functional account. Clifford comments: “We’re able to receive funds in foreign currency into the functional currency account, yet also have straight-through processing in terms of reconciliation, which is very important to us.”

To eliminate the manual process at its Indian service centre, Honeywell also implemented Deutsche Bank Maestro − a robot that automates the process using a set of rules established between the company and the bank.

“We worked with the bank on a robust set of rules so that we would have clear visibility of how and when these exposures would sweep into the functional currency account,” Clifford says. “A bank can do an FX trade for you, but you need to have some form of control over pricing. This gave us clear visibility of pricing, which was important to us in terms of transparency, but we no longer had to worry about the exposure as it was automatically done for us.”

Underpinning technology with expertise

While much progress is being made with the help of automation, technology alone is not enough to mitigate all the potential risks associated with cross-currency flows. There will always be global risks in one area or another, but the intent is to mitigate that risk as much as possible. CFOs and treasurers are not looking to bet on a market, but to diffuse the volatility-related price risk over time.

“Locally, banks need to provide advice, as appropriate, to corporates based on the outcome they are looking to achieve during challenging market circumstances,” says Grimes. “On a more macro level, banks can speak to clients and share the experience they have from weathering challenges in multiple markets, as they build their own FX strategies for managing exposure to potentially volatile currencies.”

Ultimately, treasurers want to have a successful FX management strategy that keeps exposures within acceptable parameters. To achieve this, a combination of technological innovation, in-depth expertise of FX markets, and local market knowledge is required to provide greater control, transparency and efficiency over cross-currency transactions.

Sources

1 See https://bit.ly/2u7DNrF at tradingeconomics.com. Accessed 25 March 2019

2 See https://bit.ly/2Pi7tJZ at deloitte.com

3 See https://bit.ly/2Pi7tJZ at deloitte.com

4 See https://bit.ly/2ZgHiYT at treasurystrategies.com

5 See https://bit.ly/2Cs2Wik at dnb.co.uk

6 See https://bit.ly/2DjfqtJ at tradingeconomics.com

7 See https://bit.ly/2EJBLDn at honeywell.com

8 See https://bit.ly/2TehXyr at fxweek.com

9 See https://bit.ly/2YchrC2 at corporates.db.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

CASH MANAGEMENT

The art, and science, of the possible The art, and science, of the possible

In the face of falling margins and rising competition – including some from non-traditional sources – the payments industry is under pressure to deliver digital, seamless and transparent solutions

SECURITIES SERVICES

Automating FX custody processes Automating FX custody processes

Deutsche Bank and BNY Mellon have collaborated on an API-enabled FX custody solution which reduces confirmation times for trades in restricted emerging market currencies

CASH MANAGEMENT

Basel yesterday, today and tomorrow Basel yesterday, today and tomorrow

Prudential regulation in the form of the Basel accords on capital adequacy has been evolving for almost 30 years. Etay Katz and Kirsty Taylor explain this quest for safety and soundness as “Basel IV” awaits agreement