14 September 2021

For Swiss multinational healthcare company F. Hoffman-La Roche AG – aka Roche – full visibility over available intraday bank transactions is essential for its treasury department in efficiently managing cash. flow reports on how working with Deutsche Bank enabled the team to develop an enhanced intra-day statement

MINUTES min read

In 2021, Roche celebrates its 125th anniversary. Launched in October 1896 by 28-year old Fritz Hoffmann-La Roche, who deduced that the industrial manufacture of medicines would be a major advance in the fight against disease, the Basel-headquartered Swiss company has become a world leader in the field of healthcare. Most recently, Roche swiftly responded to the Covid-19 pandemic by initiating internal research programmes to develop SARS-CoV-2 tests and devise potential drugs against coronavirus and also established an internal review team to rapidly evaluate various partnering opportunities.

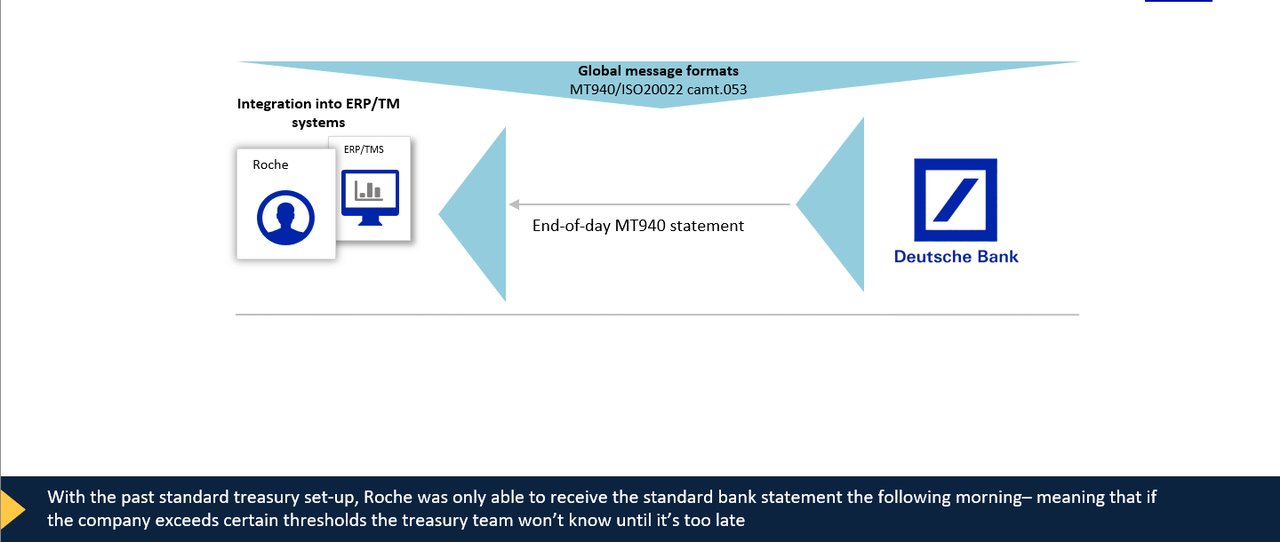

With more than 100,000 employees worldwide and global sales of CHF 58.3bn (€53.7bn) in 2020, Roche’s treasury team needs full visibility over available intraday bank transactions to efficiently manage cash. However, the standard treasury set-up means most corporates only receive a given day’s bank statement next morning via a SWIFT MT940 message (or its xml pendant Camt.053). 1 Should the company exceed certain thresholds the treasury team won’t know until too late. While payments are scheduled and cash levels are well known, the collection side is unknown. Having excess liquidity in a bank account is inefficient; credit balances have been subject to penalties in recent years from the negative interest rate environment and increased exposure to counterparty risk.

At the same time, operational buy and sell entities, which receive the same end-of-day bank statement via the Enterprise Resource Planning (ERP) structure from the treasury system, want to identify which customers have paid. “Most Roche entities run customer ratings and process new shipments of goods only when a certain level of outstandings have been paid,” explains Stefan Windisch, the company’s Senior Cash Manager in the Treasury Operations team.

“Roche recognised that understanding the credit of certain invoices faster would enable the company to release new shipments earlier and sell faster,” he adds.

Roche’s Basel head office

Solutions and obstacles

Figure 1: Roche’s previous treasury set-up

Source: Deutsche Bank

Two solutions with intraday transaction visibility were available to Roche, but both had major disadvantages says Windisch.

API solution

The first, an API solution, enables a corporate to set up an individual channel between itself and its bank, through which the bank provides pre-agreed data points, such as account balances and payment statuses, at pre-agreed intervals. The corporate can easily receive feedback at a very high frequency – in some cases as often as every second – but there are also disadvantages:

- As there is no defined API standard, banks and corporates must agree a process on a bilateral basis. A corporate working with multiple banks cannot always replicate this agreement across each of its partners. This may mean the corporate works with multiple API standards, slowing down processes and fostering errors.

- An API update also has a lower level of acceptance than an MT940, which requires the corporate to maintain a second bank statement to confirm its transactions at the end of the day and possibly even additional reconciliation between the two channels. So Roche would be unable to use the intraday statements provided via the API to carry out intraday customer or vendor clearing, forcing it to wait for the end-of-day statement.

Interim update

The other option, the standard MT942 is a solution that gives the corporate an interim transaction update. So if Roche wanted to receive its MT 942 statement, 2 treasury could simply log on to the e-banking platform to view the update. The downside, as with the API solution, is an accounting difference between the MT 942 and MT 940, which again prevents the user from performing intraday customer or vendor clearing.

Devising an alternative

With neither the API nor the MT942 solution fully meeting needs, Roche sought an integrated intra-day statement that could replace the end-of-day statement without duplicating any processes: effectively a bank statement of the same quality – from an accounting and data perspective – as an MT940 but with the added capability of frequent multiple statements during the day. Ideally, the solution would follow an industry standard, allowing it to be replicated with different banks and locations, and also to be utilised within an ERP structure without the need of a conversion. This would allow treasury to use the solution for customer clearing and determine customer ratings more quickly. By knowing exactly when the customer has paid, Roche can initiate a same-day shipment.

To meet its criteria, Roche partnered with Deutsche Bank in developing an intra-day statement that duplicates the format, content, quality and accounting standard of an MT940 end-of-day statement, with the added advantage that it can be retrieved as often as required (three times a day is sufficient for Roche although every 15 minutes is possible). The solution can be further enhanced with intraday cash sweeping to receive full intraday visibility in a single account, ensuring true end to end processing, and provides various added benefits:

- The new solution shares the same structure as a traditional end of day account statement – the user simply increases the frequency. The plug-and-play approach contrasts with API or MT 942 solutions, which would require changes to the existing systems.

- It works with virtual accounts, providing seamless visibility over collections.

- Coupled with intraday cash sweep true end to end processing including the customer and vendor clearing is achieved multiple times a day.

- The frequency of the intraday statement can be selected on account level. For accounts with collections, only a higher frequency can be chosen. Accounts with less “surprising” transactions can remain with a frequency of one statement; identical to the ordinary end of day statement.

- Roche can easily monitor levels of excess cash in its accounts and, where practical, make overnight or longer-term investments on a T+0 basis.

- The solution is fully integrated into Roche’s treasury cash management system, with no need to check balances online or incorporate specific reports such as MT 942. Numbers in the intraday statement are final and automatic postings are built on them.

- Roche gains greater visibility over its incoming funds, which could facilitate cost savings. For example, if Roche is relying on collections to maintain an adequate level of liquidity in a given account, visibility over the status of the account at various points during the day can enable the team to make more informed decisions on whether short-term external funding is required. Previously, external funding was needed as a precaution when the funds on the start-of-day account statement were below a certain level, as the team couldn’t ascertain whether funds had been credited during the day. The greater visibility afforded by an intraday MT 940 means the team only draws on credit (increasing its costs) when necessary.

- Roche can view its intra-day account statements as often as required, allowing treasury to perform certain processes faster and more seamlessly. For example, on the last day of the month, Roche can now view its collections in the morning, rather than next day. The team can begin work on closing books early and issue reminders for customers yet to pay ahead of time.

- The solution mitigates counterparty risk as Roche can react to changing situations quickly and effectively.

Bucking the trend

“Conventional thinking might suggest that the solution utilising the latest technology must be the best one available”

“Conventional thinking might suggest that the solution utilising the latest technology – in this case, APIs – must be the best one available,” says Windisch. “Our successful implementation of the intraday MT940 proves this isn’t always the case. Instead, the lesson learnt is to fully evaluate the situation and not just follow latest industry trends. What objective are you are trying to meet? How will the solution work for an entire region or organisation? How can it be integrated into current standards and systems?

“In our case, while the API solution could be implemented with relative ease, the lack of a defined standard – and as the intraday statements produced via this solution cannot be used for customer or vendor clearing – made it ultimately unsuitable. Instead, we found that a bit of time and exploration meant we could adapt the existing MT 940 solution to provide intraday statements that are fully recognised, widely used and can be fully integrated into existing processes. So while our solution does not leverage on the latest industry trends and buzzwords, it is functionally superior for our needs.”

Figure 2: The new plug-and-play approach for intraday statements

Source: Deutsche Bank

An integrated intra-day statement (and there are plans to introduce intraday zero balancing in time) creates an innovative solution to a thorny problem. It can customise bank statements based on its individual requirements and accounts in a way that wasn’t possible with API updates and MT942 messages. “It allows Roche to take a further step forward on its journey to achieve a real-time treasury – making possible a much higher degree of automation throughout the entire process chain,” adds Windisch.

He adds, “Offering the same quality as end-of-day statements, with the added advantage of being available at a much higher frequency, the solution mitigates counterparty risk, allows faster sales to established customers, enables much tighter credit management and closing of books, which is particularly useful during end-of-the-month clearing.”

Note, Stefan Windisch, Senior Cash Manager, Treasury Operations will be talking about this process transformation that gives Treasury the ability to combine intraday statements with the virtual bank account set up with Deutsche Bank and provide business entities with improved services with true end-to-end solutions, on 28 September 12.00 to 13.00 BST at virtual EuroFinance 2021

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

flow case studies, Cash management

Bottling success Bottling success

Coca-Cola European Partners’ treasury team worked with Deutsche Bank to manage the FX and interest rate risk associated with the acquisition of Coca-Cola Amatil and the company’s subsequent transformation into Coca-Cola Europacific Partners. flow provides a summary of the deal

CASH MANAGEMENT, TECHNOLOGY {icon-book}

Reimagining the future of payments Reimagining the future of payments

The pandemic has accelerated the pace of change over the past year and bank-led merchant solutions are among the responses to a huge shift in payment methods and the boost to e-commerce, reports Helen Sanders

flow case studies, Cash management, Sustainable finance {icon-book}

Treasury transmission Treasury transmission

An internship with BMW led ElringKlinger’s treasurer, Matthias John, to the automotive component manufacturer, where he centralised its treasury systems and improved free cash flows. He tells flow’s Graham Buck about the importance of giving back