13 December 2021

Best practice is something every treasurer strives for but getting there is a tough task. Drawing on the results of a benchmark review among 200 corporate treasurers globally, flow outlines five steps that will help to improve cash management

MINUTES min read

Cash is king – during the Covid-19-pandemic this maxim has proved to be more relevant than ever. In Europe particularly, companies have increased cash buffers to ensure they have enough liquidity to withstand repeating lockdowns, supply chain disruptions and reduced demand. 1 At the same time, the pressure on corporate treasury departments to improve cashflow forecasting and to make internal processes more efficient in order to cut costs has increased. While the pandemic is far from over, it has already shone a spotlight of what went right in corporate cash management – and where improvements are necessary.

A good indication for how to get better is learning from peers. To outline what best practice in corporate treasury looks like, the Association of Corporate Treasurers (ACT) partnered with Deutsche Bank to conduct a review among more than 200 corporate treasurers and CFOs worldwide spanning nine different industries. The results were used to develop the first ACT International Treasury Peer Review, which features a series of articles, interviews, and case studies on best practice in the form of a guide.

The guide was designed to help treasurers benchmark their practices and operations against their peers – and offers an additional focus on the geographical and industry-specific factors involved in decision-making. Because “what makes sense for a regional treasurer of a chemical company operating in Asia might be different to what is appropriate for a group treasurer of a European automotive business”, says Ole Matthiessen, Global Head of Cash Management at Deutsche Bank puts it in his forward to the guide.

There are, however, several tips that could help almost all treasury departments to improve their cash management. “The peer review is an exciting step to benchmark multinational treasurers against each other, providing them with tailored reports, and the key advantage of this particular review is that it was created by treasurers, for treasurers, with the support of Deutsche Bank,” says Caroline Stockmann, Chief Executive of the ACT. Drawing on the detailed results of the review, which are accessible to the individual participants, flow selected five basic steps for reaching best practice in cash management.

Step 1: Rationalise the number of bank accounts

Good cash management starts with a clearly defined banking strategy. Consolidating the number of banks and bank accounts a company is working with usually provides the starting point to further centralise, standardise and automate treasury processes. To give an example, German copper specialist Wieland recently reduced the number of banks for its US cash management business from roughly 10 to two, as Fabian Schwarz, Director Treasury & Corporate Finance at Wieland Group reported in the October 2021 flow article “Connecting cash”.

However, the ACT best practice review shows that most companies still have room for improvement with 80% of all respondents stating they have between five and nine (49%) or 10–19 (31%) core cash management banks. While these figures could also reflect the fact that a company is active in several countries around the world and has chosen one or two partners per region, the number of actual bank accounts delivers a clearer picture on best practice.

Across all industry segments and corporate sizes, respondents indicated they had fewer accounts in Latin America and Middle East and Africa. In North America over half of the respondents (57%) also have no more than 20 accounts, whereas in Europe and APAC with multiple jurisdictions and currencies the numbers vary (see Figure 1).

Figure 1: In Europe, companies have the highest number of bank accounts (click to enlarge)

Source: ACT International Treasury Peer Review, Best practice guide

One option for reducing the number of bank accounts is to implement virtual accounts, which allow organisations to sub-divide physical accounts while each has their own account number. However, although they could prove to be particularly relevant to treasurers in Europe, 50% stated that they have not considered virtual accounts despite 10% having more than 500 accounts in the region.

According to Christof Hofmann, Head of Corporate & Payment Solutions, Deutsche Bank, technical advancements have recently lowered the barrier of adoption for virtual account solutions. “While virtual accounts are clearly not the only solutions to rationalise bank accounts, they are often of great value especially for centralising collections,” he points out.

Step 2: Increase centralisation by using in-house banks

Since the onset of the pandemic centralisation has become a top priority for many corporate treasurers; strengthening the case for using an in-house bank (IHB) as flow reported in April 2021.2 The ACT review underpins this trend as 50% of respondents already operate an IHB while a further 6% are currently planning to set one up.

Yet, when looking at which processes are included in the IHB, adoption is still done selectively – while almost half of the respondents confirmed they have made use of an IHB for intercompany lending and borrowing and 39% use it for intercompany payments, only 22% have implemented payments-on-behalf-of (POBO) and an even lower share (13%) uses collections-on-behalf-of (COBO).

“A fully centralised POBO/COBO setup provides one of the largest streamlining opportunities, as it allows consolidation of the flow of funds and data”

“For many treasury departments, a fully centralised POBO/COBO setup provides one of the largest streamlining opportunities, as it allows consolidation of the flow of funds and data,” says Hofmann. However, implementing this setup requires a lot of effort, “ranging from cultural change within the cash management teams – because after all, one is partially taking away the subsidiaries’ access to bank accounts – to the required legal and tax due diligence, and ultimately technology integration in often still diverse ERP and TMS environments”.

New technology solutions like “in-house banking as a service”, could ease their adoption, he suggests. With this approach banks and external IT providers are providing cloud based IHB solutions to companies, thereby reducing the workload for companies’ IT department.

Step 3: Improve cashflow forecasting

When a company can to reduce the number of bank accounts and sets up an IHB, this will not only make processes more efficient but also help increase the treasury’s oversight over cash flows. This, in turn, is the pre-requisite for ensuring accurate cash flow forecasting – which was the top priority over the next 12 months for the companies surveyed by the ACT.

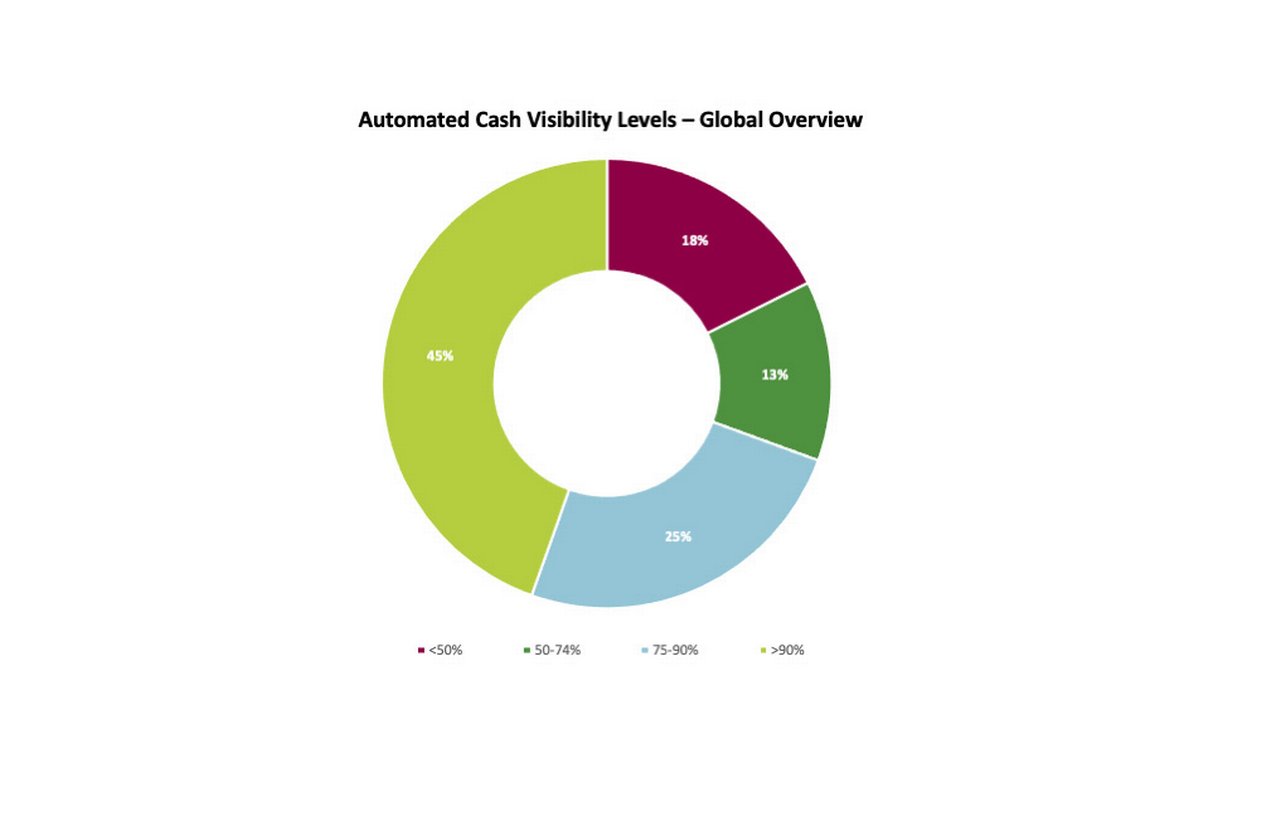

However, the ACT review offers a mixed picture when it comes to cash flow visibility. On the one hand, 45% of respondents have automated oversight of 90% or more of their cash balances (see Figure 2). Yet nearly one in five respondents do not even have visibility over half of their funds at the click of a button. For these companies it will get very hard to improve cash flow forecasting.

Figure 2: The majority of respondents have automated visibility over their cash balances (click to enlarge)

Source: ACT International Treasury Peer Review, Best practice guide

Regional treasurers in APAC score lowest in cash visibility against their regional peers in EMEA and US, possibly because many countries in the region are highly regulated which also hinders the implementation of IHBs. 3

Step 4: Utilise emerging technologies

While a good oversight over cash levels is needed to improve forecasting, it is not enough. Cashflow forecasting is one of the treasury tasks for which leveraging data and utilising emerging technologies could deliver a real benefit. For example, “factoring in external data, such as weather reports, can help to improve cash forecasting,” as Claudia Villasis-Wallraff, Head of Treasury Advisory, APAC Deutsche Bank writes. 4 This could for example be the case for a clothing retailer, who will sell more items if it is sunny.

Including those kind of unstructured data sources into their cash forecast is a vision of the future for most treasurers. Several departments still need to get the technology basics right, as the ACT review shows. 29% of respondents do not even work with a treasury management system (TMS), with uptake being particularly low among respondents of the industrial segment and – surprisingly – the technology, media and telecoms sector.

When it comes to the more advanced technologies such as machine learning and robotics, 61% have yet to apply them although they would help lessen the manual workload of repetitive work and free up treasury department resources for more strategic tasks. 5 Respondents to the ACT review cited a wide area of existing use cases, with bank account data download and reconciliation as well as subsequent cash positioning coming out on top.

“APIs will become essential for treasury departments as they allow for the transition towards real-time treasury – and this will be required to support the digitalisation of business models”

The much-talked-about application programming interfaces (APIs) are currently used to connect to bank systems by just 7% of corporates. This can be seen as a clear sign that banks and corporates alike still need to do more in in this regard – and standardised API formats across banks would help expedite this journey.

“APIs will become essential for treasury departments as they allow for the transition towards real-time treasury – and this will be required to support the digitalisation of business models,” says Hofmann. However, he admits that “standardisation is still one of the largest hurdles for adoption by multi-banked corporates”. To address this challenge “Deutsche Bank is not only offering our own suite of advanced API services but also contributes to a joint initiative with SWIFT and some corporates to provide a harmonised multi-bank experience”, he reveals.

Step 5: Improve the handling with surplus cash

Finally, treasury needs to define how to deploy surplus cash. Responding to the pandemic, most organisations have ramped up cash buffers with treasurers uniting with sales, procurement, and logistics departments to improve working capital. As cash is unlocked, this has created challenges on the investment side – especially in Euro area where interest rates have been negative for several years.

Despite this, Europe-headquartered corporates generally prefer term deposits and non-interest-bearing bank accounts over commercial papers and money market funds, which are the most common short-term cash deployment methods in the Americas. Among Asian- headquartered companies structured deposits are relatively more popular; probably driven by the larger basket of high interest yielding currencies (see Figure 3).

Figure 3: Avenues of surplus cash deployment (click to enlarge)

Source: ACT International Treasury Peer Review, Best practice guide

Considering new strategies for surplus cash is therefore of particular importance for treasurers in Europe. Finding the right instruments is closely linked to having an accurate cash flow forecast – as this helps aligning investment horizons – which in turn is fostered by a centralised, standardised treasury landscape. So, one step follows the next in improving cash management.

Sources

1 See https://bit.ly/3rQLGyx at eulerhermes.com

2 See 'Doing more with less' at flow.db.com

3 See also 'Extending in-house bank services in APAC' at flow.db.com

4 Add also 'The road to a data-driven treasury' at flow.db.com

5 See also 'Boosting treasury in India' at flow.db.com

Cash management solutions Explore more

Find out more about our Cash management solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

CASH MANAGEMENT

Doing more with less Doing more with less

More than a year on since the onset of Covid-19, the pandemic has made centralisation a top priority for many corporate treasurers and strengthened the case for using an in-house bank, reports flow's Graham Buck

CASH MANAGEMENT, MACRO AND MARKETS

Extending in-house bank services in APAC Extending in-house bank services in APAC

In a webinar hosted by The Economist as part of its Global Treasury Leaders programme and supported by Deutsche Bank, two corporate treasurers shared on the special challenges that the region presents when setting up an in-house bank. flow reports

Cash management, Technology {icon-book}

Automation should come first, AI will follow Automation should come first, AI will follow

Treasurers will benefit from AI, but there are many issues to be fixed before thinking about using this technology, François Masquelier, Chair of the European Association of Corporate Treasurers (EACT) believes. What should intermediary steps look like?