25 August 2022

The migration of ISO 20022 promises to upend payments as we know them. flow looks beyond the upcoming deadlines to explore the long-term vision for the payments standard and the challenges that lie ahead for the industry

MINUTES min read

ISO 20022 has been many years in the making. First recognised by the International Organisation for Standardisation (ISO) in 2004, it was positioned as the global payment standard of the future – one that was both comprehensive in scope and flexible in nature.

11000+

However, it would take more than 10 years for momentum to build in its favour. The tipping point came as calls for faster payments grew louder, with demand coming from both retail and corporate banking customers. For banks to keep up with the expectation for near-instant payments around the clock, a next-generation market infrastructure would be needed – one that could offer seamless and quicker payments processing in support of digital business models.

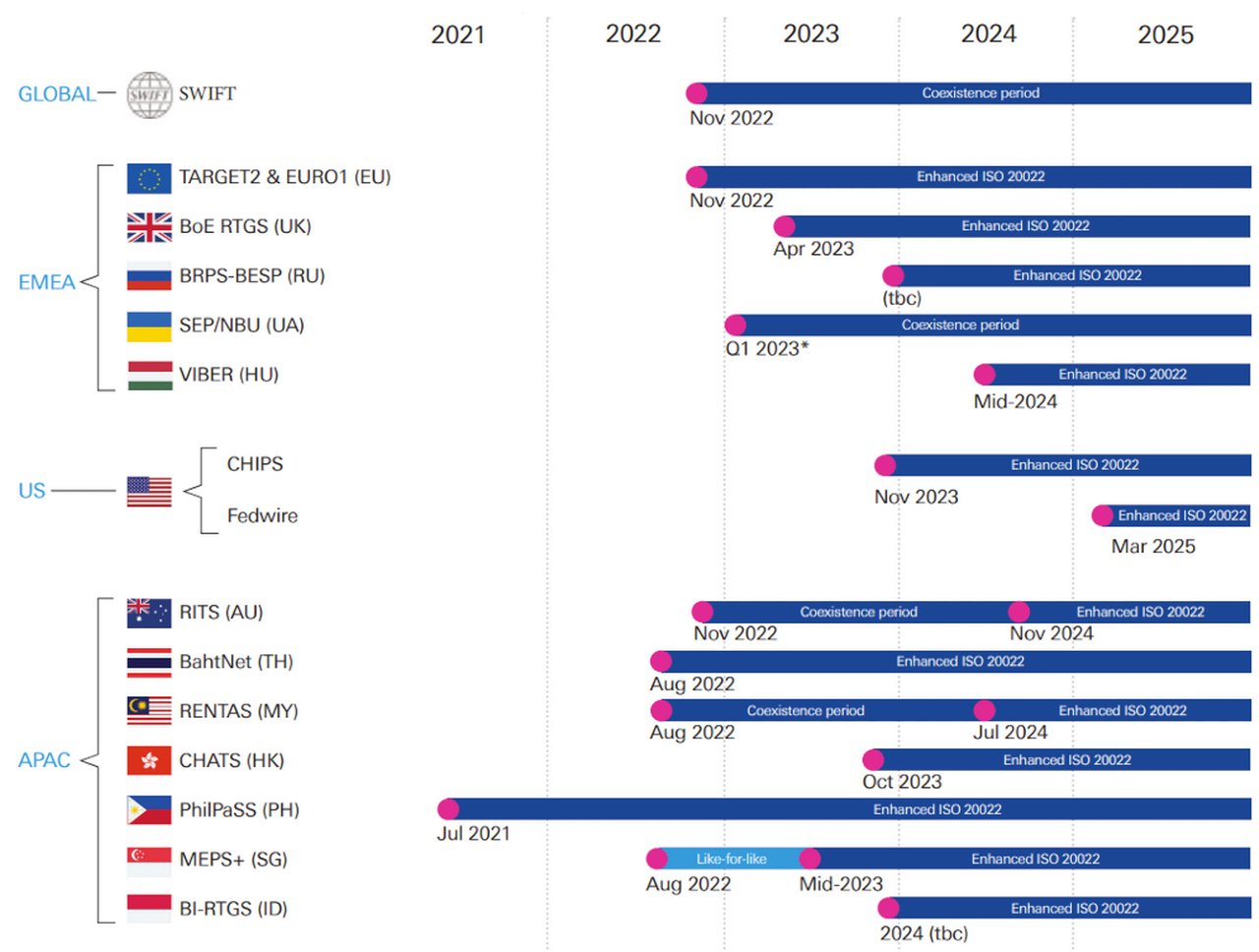

These considerations led SWIFT, the global payments organisation, and the world’s major central banks to agree on a common migration to ISO 20022. Flash forward to today, and the industry is well into its ISO 20022 journey – with the clock counting down to several significant milestones. By November 2022, a number of key infrastructures, including the Eurosystem, EBA Clearing and SWIFT, will have completed the first major milestone in the migration to ISO 20022 (see Figure 1).

“The faster the industry adopts the enhanced data...the more accurate AFC models will be”

Multiple benefits

The decision to migrate to ISO 20022 is a game-changer in payments processing. It promises greater interoperability between various settlement networks and will lead to simplified global business communication. As the standard is not bound to any existing technologies or processes, it will also be future-proof.

Moreover, compared to other formats, ISO 20022 introduces richer and more structured data components. This, in turn, increases the transparency of payments and supports financial institutions with their task of guaranteeing secure, straight-through payments processing and conforming to compliance regulations. For banks, this presents a host of opportunities, from offering enhanced customer services to completely re-evaluating their business models.

In particular, the richer data will have a significant impact on anti-financial crime (AFC) monitoring and surveillance. “The faster the industry adopts the enhanced data in addition to the schemes, the more accurate AFC models will be,” says Christopher Gardner, Programme

Manager at Deutsche Bank. By leveraging the Ultimate Debtor/Creditor address information – new to ISO 20022 – banks will, for example, be able to monitor the true initiator and destination of a payment, and better fight fraud as a result.

It is not only banks that stand to benefit. Corporates could also gain significantly, with standardised formats and processes for payment reporting and exception handling messages facilitating end-to-end automation, from invoicing and liquidity management to exception handling and reconciliation.

For example, delays in cross-border payments are often now caused by the need for manual compliance checks. “Think, for example, of a beneficiary living on Cuba Avenue, Staten Island, New York,” says Christof Hofmann, Global Head of Corporate and Payment Solutions. “Any payment for a beneficiary with this address would likely involve the payment being stopped and manually investigated. In the future, ‘Cuba’ will be provided in the dedicated street name field, enabling this payment to be processed without any disruption, instantly.”

Figure 1: Global ISO 20022 adoption overview

Corporate bank – Data as of June 2022

- This overview includes DB Cash Management countries only. Please consult PMPG’s document centre for the most comprehensive list of migrating Market Infrastructures

- Like-for-like refers to an approach that implements a subset of ISO 20022 limited to the same functionality as the standard it replaces, e.g. MT

*The timeline has moved from August 2022 to Q1 2023, but there is still a lot of uncertainty surrounding the migration, due to the ongoing conflict in Ukraine

Source: Deutsche Bank

Considering coexistence

It is important to note that the promised benefits of ISO 20022 will not be available overnight. From November 2022 to November 2025, there will be a coexistence period in the correspondent banking space during which some financial institutions will begin sending ISO 20022 messages, while others will rely on translation services to continue sending the existing Message Type (MT) messaging format.

Banks remaining on MT should note that, when receiving an ISO 20022 payment message from another agent, some data truncation may be necessary due to the richness of the format. Due to the imperfect nature of the translation, it will therefore be necessary to have access to both the MT and the original ISO 20022 versions of the message for transaction due diligence, such as sanctions screening, creating additional challenges for those banks continuing to use MT messages.

“Training will be important because the flows will be different, and especially because some parts will be performed using ISO messages, while others will remain on MT”

SWIFT has understood that it needs to address these challenges, and one of the key tools will be its Transaction Manager solution. This will enable customers in a transaction to communicate in multiple formats and will be backwards-compatible with existing infrastructures. But this solution will not go fully live until March 2023, which means that the myriad challenges it seeks to fix will remain unsolved until then.

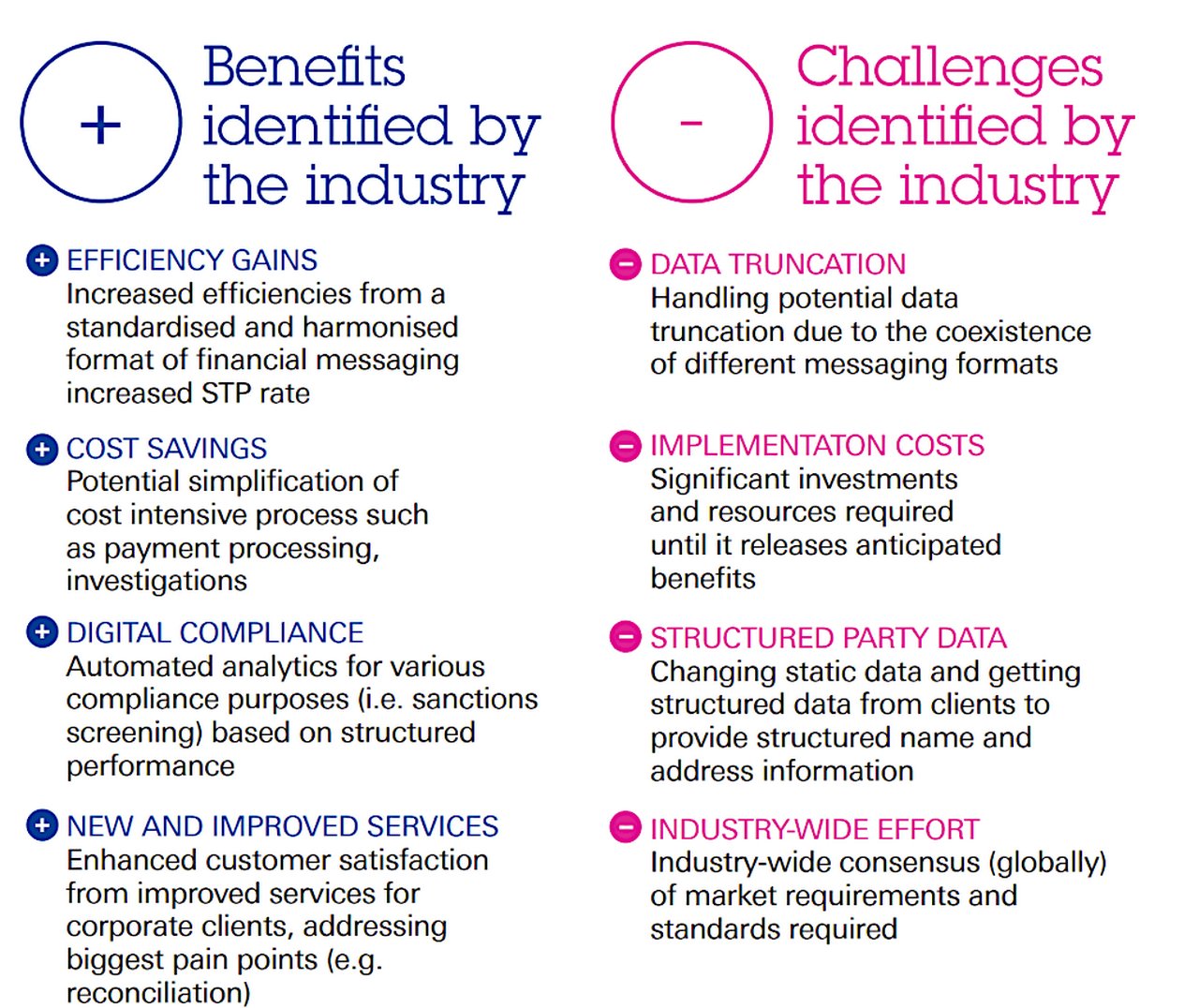

Figure 2: Why ISO 20022?

Source: Deutsche Bank

Beyond 2022

Over the last few months, all eyes have been on the industry’s readiness ahead of the 2022 migration dates, but this is just the start of the ISO 20022 story.

The structured addresses ushered in by ISO 20022, for instance, will bring much-needed efficiency to payment processes. However, to start with structured addresses will remain optional in the cross-border payments space. It is expected that the market will move to structured addresses for debtor and creditor by end of 2023. But the rules remain the same until November 2025: structured addresses are only required for ‘new’ parties (e.g. ultimate debtor, ultimate creditor) and highly recommended for others (e.g. debtor, creditor). By November 2025, this will be mandatory, meaning that all existing databases will have to be updated accordingly – or risk the payment being rejected.

Due to the nature of the discrepancies between the go-live of ISO 20022 and the go-live of certain mandatory aspects, one focus will be on getting teams up to speed using the new standard. “Training will be important because the flows will be different, and especially because some parts will be performed using ISO messages, while others will remain on MT,” says Romain Reinhard, Head of Payments and Ancillary Services, Banque Internationale à Luxembourg.

Some domestic systems also have mandatory aspects that will follow the go-live date. The Bank of England, for example, is planning to introduce mandatory purpose codes, category purpose codes, and legal entity identifiers (LEIs) for agents. These are planned to come into force by 2024 – though there is no strict deadline as yet, with the central bank keen to see how the migration itself goes first.

Work remains

The benefits of ISO 20022 cannot be unlocked without hard work. For an idea of the scale of the migration, think back to the transition to the Single Euro Payments Area, or the introduction of the euro.

Moreover, the impact extends beyond just core payments systems, touching everything from booking systems to embargo and know-your-customer systems, through to electronic banking, liquidity management and archiving. And ISO 20022 is not just about cash management – securities, trade finance, global markets and treasury departments will also need to be able to process the contained information and apply it elsewhere.

So, as we approach the deadlines, we must remember there is still more to be done.

Cash management solutions Explore more

Find out more about our Cash management solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

CASH MANAGEMENT, TECHNOLOGY

Six key takeaways from EBAday 2022 Six key takeaways from EBAday 2022

How will digital currencies, real-time payments and SWIFT initiatives shape the future of payments? The flow team attended EBAday 2022 to bring you its top six highlights – including a wake-up call for an upcoming regulation

CASH MANAGEMENT, TECHNOLOGY

Keeping the SWIFT network secure Keeping the SWIFT network secure

As the number of cyber attacks on financial institutions increases, SWIFT needs to further safeguard its network. flow’s Desirée Buchholz reports on why the Customer Security Programme is key – and how banks should prepare for the upcoming changes in 2022

WHITE PAPERS/GUIDES

Guide to ISO 20022 migration: Part 4 Guide to ISO 20022 migration: Part 4

In September 2020, we released the third in our series of guides to the upcoming ISO 20022 migration. That edition covered a number of changes that had taken place that year, including the revised ISO 20022 delivery dates for SWIFT and several of the world’s major market infrastructures. This meant that 2021, the original year of the ISO 20022 migration, had become the year of delivery. As we edge closer to the finish line, Deutsche Bank team now presents Part 4 of this journey in advance of Sibos 2021