30 November 2021

A new survey from Deutsche Bank Research sheds light on what corporates and investors think about ESG and sustainable finance. flow’s Desirée Buchholz identifies five key learning points from the team’s findings

MINUTES min read

Why do corporates use ESG instruments? Which sources do investors consult when assessing the sustainability performance of companies? Why are some investors and companies not incorporating ESG criteria into their investment decisions or finance strategies? These questions are addressed by a new Deutsche Bank Research (db Research) paper, ESG Survey – What corporates and investors think.

In the aftermath of the UN climate conference COP26 held in November,1 analysts Luke Templeman, Olga Cotaga and Jim Reid of dbResearch conducted a survey among 530 respondents, comprised 70% of investors and 30% corporate issuers working in the treasury department or a business close to their firm’s capital markets operations. The survey offers a compelling insight into their ESG activities, motivations, and intentions. This article summarises the five key learnings that financial decision makers can take from the survey.

Fact 1: Most investors are integrating ESG into their investment decision and corporates are following their lead

Of the 350 investors surveyed, 37% said that they are “considering” ESG criteria during the investment process while another 30% have “completely integrated” sustainability measures into their decisions. Only 23% said that ESG criteria have no impact at all, and the remaining 10% look at them only for dedicated mandates.

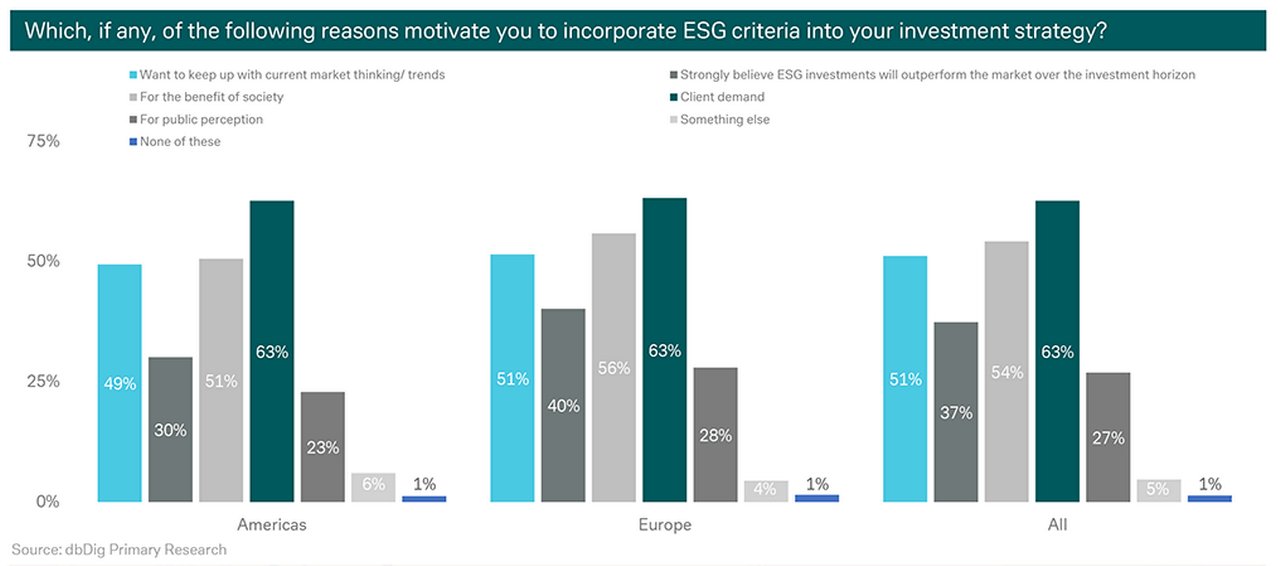

The main reasons for investors increasingly paying attention to how their investments affect the environment and society, the survey shows, are because their clients are urging them to do so and because they feel that they need to keep up with current market trends (see Figure 1). Interestingly, only a minority “strongly believes that ESG investments will outperform the market over the investment horizon”.

Figure 1: Clients are urging investors to incorporate ESG criteria (click to enlarge)

Companies are responding to the increasing demand for ESG investments. So far, 39% of the corporate respondents have already used a sustainable finance instrument. Another 33% are currently preparing their first ESG instrument while only 7% say that are not interested in using sustainable finance at all.

While the survey does not provide data on which kind of instruments are most popular among corporates, it does show that European treasurers are more engaged in non-capital markets instruments such as loans, derivates and special finance solutions than their American counterparts. Therefore, it appears that the trend towards ESG has not changed general financing preferences, as European companies traditionally rely more on banks than those in the United States.2

Fact 2: Europe leads when it comes to ESG implementation, but the US is catching up

Financing choice is not the only regional difference when it comes to ESG. According to the survey, European investors are keener than their US peers to implement ESG criteria into their investment decisions. In Europe, 74% of the respondents stated that sustainability plays some role in their investment process while in the Americas this share was much lower (52%).

“Legislative and regulatory changes naturally resulted in a first-mover focus from European investors. We do see US investors catching up quickly”

One explanation for the difference could be that “the EU government has taken the lead in pushing the ESG agenda in Europe, by establishing the EU Taxonomy and a number of other policy and regulatory initiatives, including the European Green Deal and Sustainable Finance Disclosure Regulation (SFDR),” says Claire Coustar, Head of ESG FIC at Deutsche Bank. “This has naturally resulted in a first-mover focus from European investors. We do see US investors catching up quickly.” 3

The EU taxonomy is a classification system establishing a list of environmentally sustainable economic activities.4 Together with the SFDR, which requires asset managers and pension funds to inform their clients about how sustainable certain financial products are, it is designed to fight greenwashing by fostering transparency and comparability, while shifting investments to climate-friendly activities.

“This increased regulatory momentum, coupled with increased societal awareness and investor demand for ESG, is urging an all-encompassing paradigm shift within Europe's Mutual Funds landscape,” notes a recent report from PwC. The consultancy saw ESG assets under management climbing to €3.3trn by the end of June 2021 and about a third of all assets in European investment funds are now green. PwC expects that volume to “skyrocket” to as much as €7.6trn by 2025, or 57% of total EU-domiciled assets.5

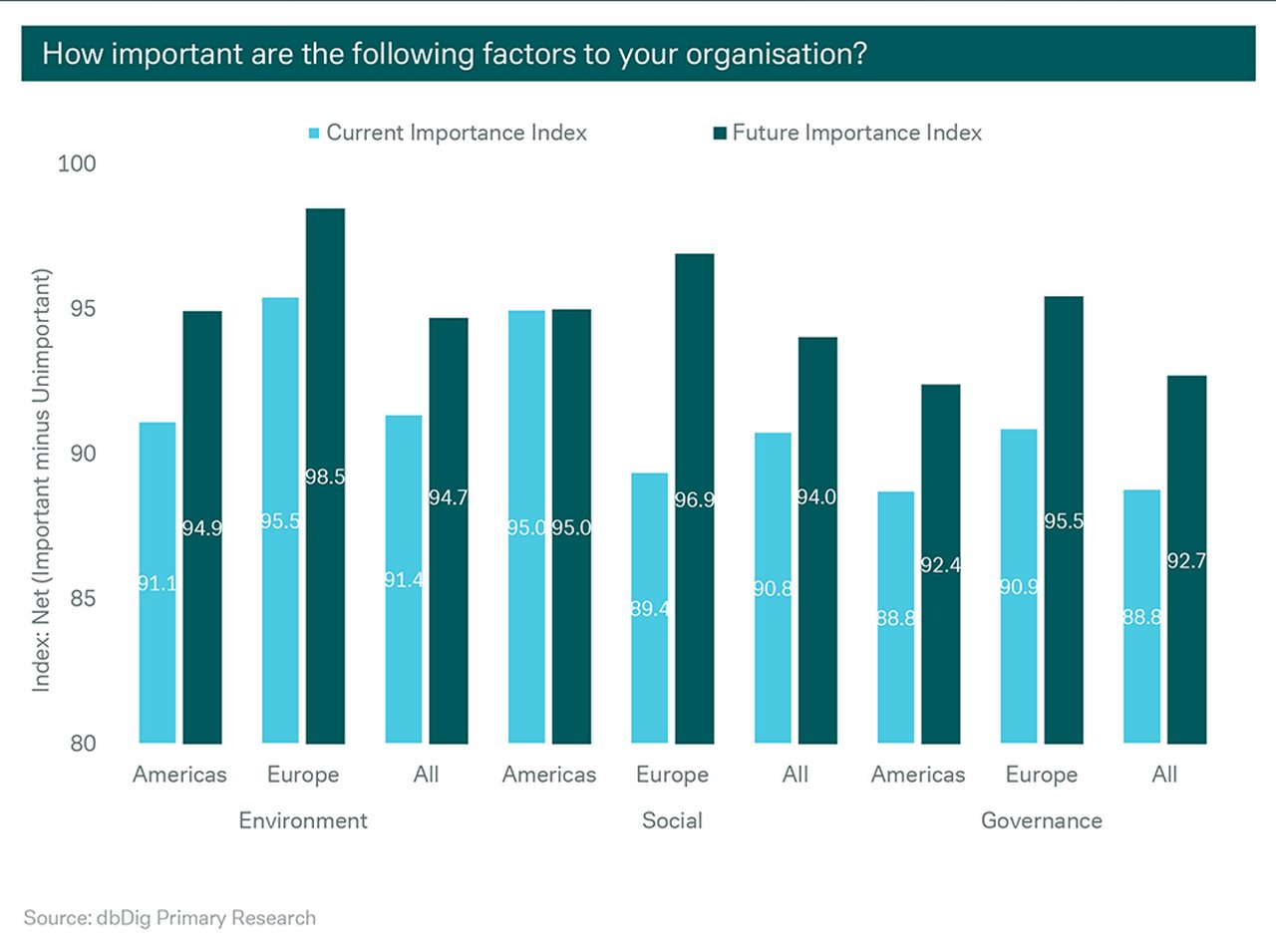

On the corporate side, there are also regional differences. The survey shows that European companies are currently more focused on environmental factors – which is not surprising giving the public focus on climate change in countries such as Germany and the aforementioned initiatives by the EU.

For US firms however, social factors are relatively more important (see Figure 2). To an extent, this is mirrored on the investment side with investors concentrating mostly on the ‘E’ and ‘G’ dimensions of ESG. Yet both US and European investors expect social factors to gain importance – possibly having in mind regulatory initiatives, such as the EU early stage plans for a social taxonomy on economic activities that include housing, healthcare, education and infrastructure.6

Figure 2: In Europe, the E is most important, but S is expected to pick up

Fact 3: Companies are using ESG instruments primarily to showcase their sustainability strategy to the market

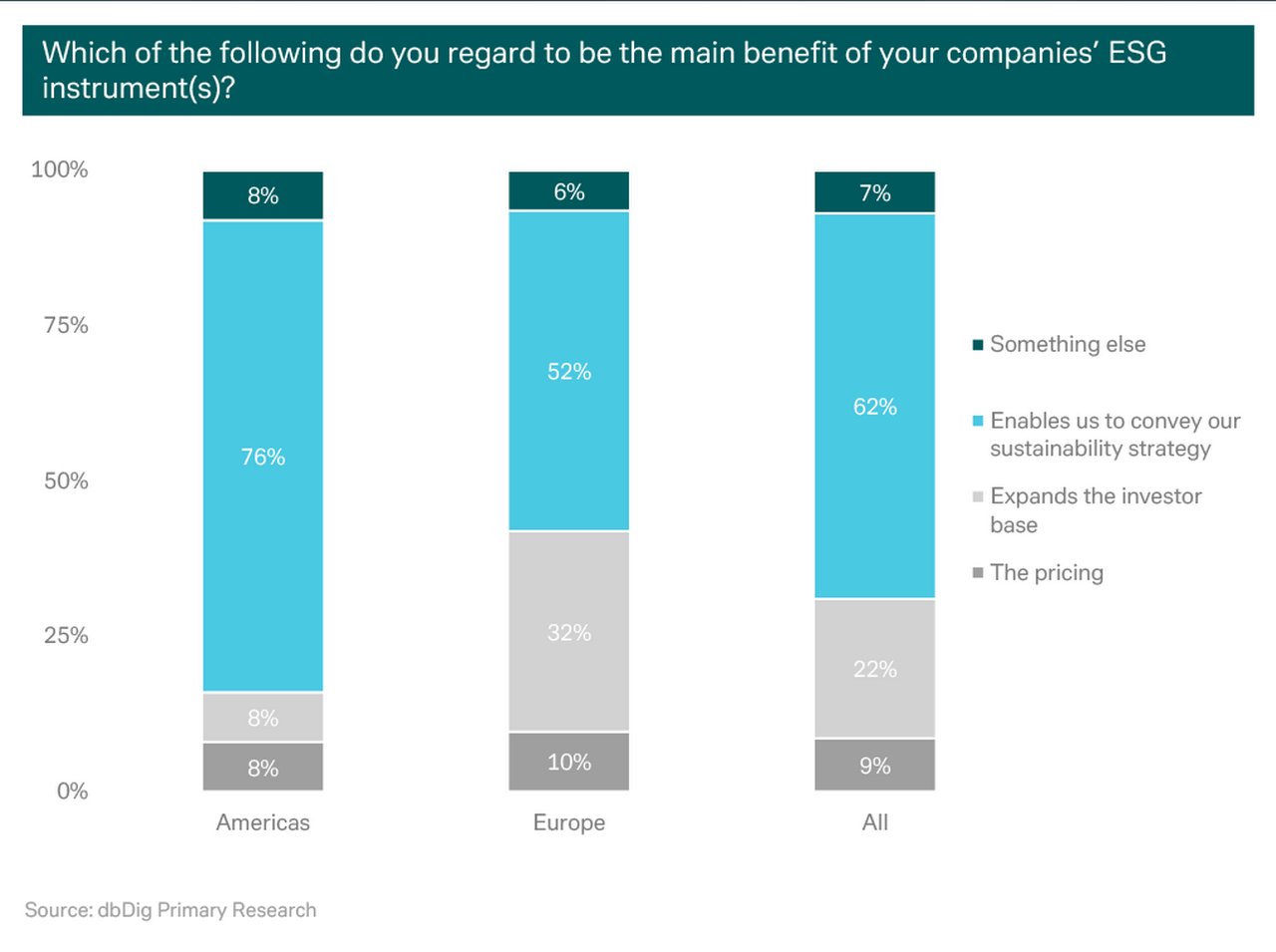

So why are companies using ESG instruments? The main benefit, the survey respondents suggest, is to “convey their sustainability strategy to the market”, as dbResearch data shows. This is particularly true for US issuers, with 76% agreeing that showcasing their ESG ambition is the main reason for choosing to issue an ESG instrument (see Figure 3).

In Europe, the expansion of the investor base also plays a major role when corporates decide to tap into sustainable finance – which can be understood as a reaction to the increasing number of dedicated ESG funds. Pricing, on the other hand, is rarely seen as the main benefit by corporate treasurer and capital market executives.

Figure 3: Corporates want to demonstrate their transition path to investors

However, it would be wrong to conclude that pricing plays no role at all. The survey results rather suggest that with ESG loans, derivatives and project finance, pricing considerations play a bigger role than with capital market instruments. More than half (52%) of the corporate respondents said that they are engaging in non-capital market ESG instruments because they can ensure a lower pricing – even though signaling benefit still outweighs cost considerations, being cited by 76% as a reason to tap into sustainable finance.

Interestingly, of those corporates that have yet to use sustainable finance, the lack of price benefits and also the need for reporting that takes up time were major reasons for them not using such an instrument. Both could vanish over time, as Claire Coustar points out, “We are already seeing pricing benefits in both capital markets and loan markets, together with great demand from investors and lenders for these products,” she reports. “We expect this to continue as the financial sector puts more concrete plans in place to back the net zero commitments made and as the regulatory ESG disclosure landscape increases globally.”

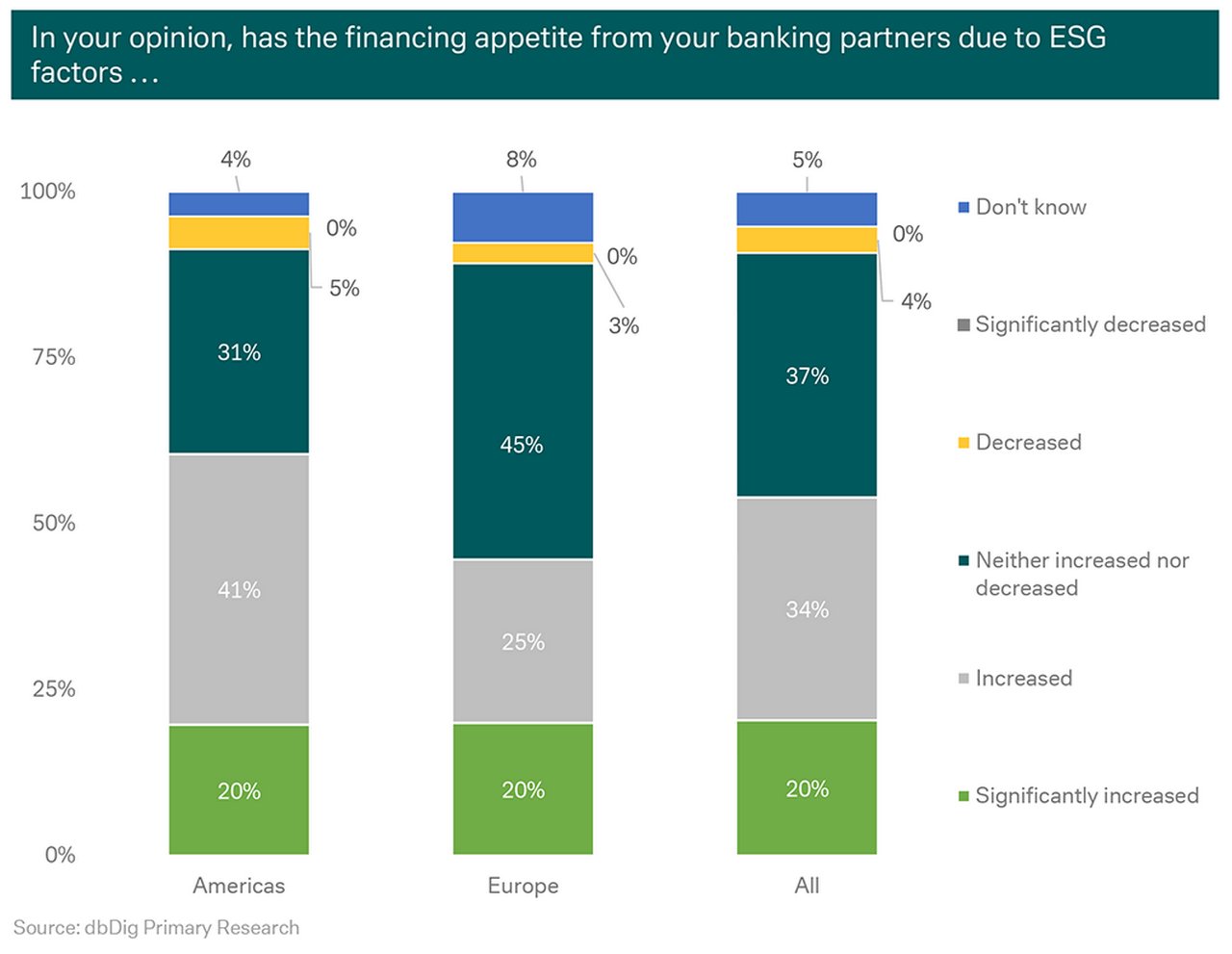

Accordingly, corporates that are incorporating ESG factors in their finance strategy feel that the financing appetite from their banking partners has increased (see Figure 4).

Figure 4: How banks are reacting to ESG factor

Fact 4: ESG is affecting credit risk, but dedicated ESG ratings are not decisive for investors

Some corporates already report that ESG factors have impacted their credit rating in the past 12 months, with 19% saying that this was the case for environmental factors. “I would expect that percentage to increase and, unsurprisingly, it will be most heavily felt with those corporates in high carbon-intensive sectors or with those exposed most to physical climate risk,” says Coustar. “We are seeing a fundamental and accelerating investment shift away from high carbon sectors and those companies that do not adjust their operations and investment plans as well as articulate a credible transition strategy to their stakeholders will face more and more pressure on access to capital and cost of capital.”

As credit risk has become clearer, most issuers have already assessed their climate risk. According to the survey, 68% of the corporate respondents have undertaken a climate risk assessment in the past 12 to 24 months. Only 10% of firms have no plans to do so.

While investors are looking at credit risk, public ESG ratings are of minor importance in their investment decision. Only 26% of the survey respondents said that these ratings – issued by agencies such as Sustainalytics – are a “major input factor” in the investment process and 29% do not use public ratings at all as a source for assessing the ESG performance of companies.

Instead of relying on public ratings, investors prefer to use a wide, and sometimes bespoke, set of data sources for ESG information, as the dbResearch team points out. One in five of the investors who responded said that direct interaction with issuers is the main source of information to evaluate an issuer's sustainability profile, roadmap and targets, while 19% tap into company non-financial reporting and 25% rely on data from information vendors.

Fact 5: There is still a long way to go; everyone is still new to ESG

While most investors are paying more attention to ESG, few have actually put in place decarbonisation targets for their portfolios with only 13% of respondents stating they have defined a yearly target. This share is set to increase as announcements made at COP26 are fulfilled.

During the climate conference, members of the Glasgow Financial Alliance for Net Zero (GFANZ), representing more than 450 of the world’s biggest banks and pension funds across 45 countries, committed to limiting greenhouse gas emissions.7 Furthermore, major lenders such as HSBC and Fidelity International agreed to stop financing the coal industry.8 This trend is also reflected in the survey as 43% of investors are currently evaluating whether to set commitments and targets to decarbonise their portfolio.

What could prove helpful in this respect, is that the majority of corporate respondents (73%) have already published quantifiable, ESG-focused performance targets – mostly linked to emissions reduction, as the survey shows. Only 6% have yet to define such targets and have no plans to so.

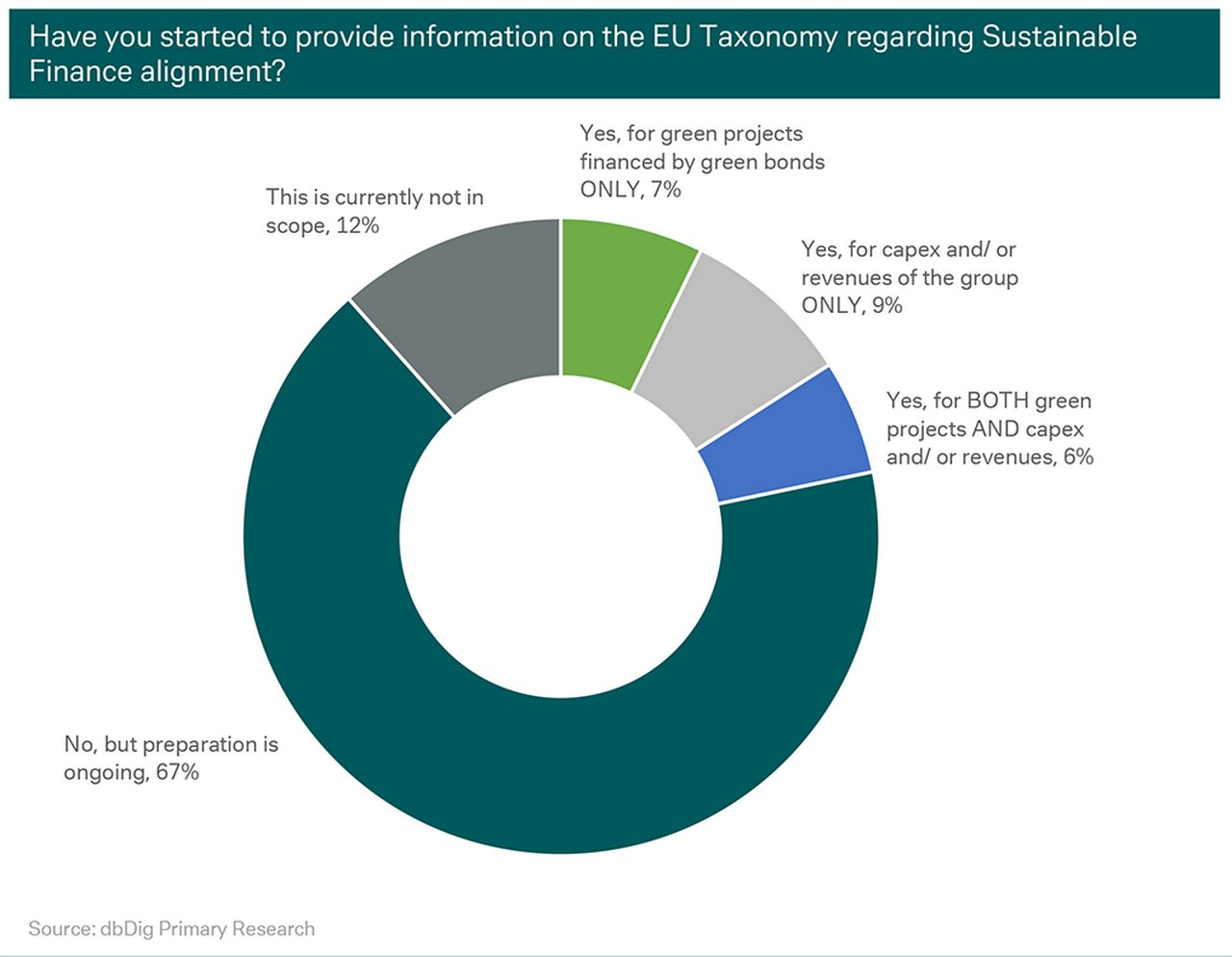

More work still needs to be done with respect to the EU Taxonomy. Starting in 2022, European corporates with 500 or more employees will need to disclose their revenue/turnover and capex that is aligned with the EU Taxonomy (i.e. sustainable), while European investment funds will need to disclose what percentage of assets held are aligned by 31 December 2022. So far however, only a minority of corporates are prepared (see Figure 5).

Figure 5: Most companies are still preparing for the EU Taxonomy

The entire presentation on ESG Survey – What corporates and investors think by Luke Templeman, Olga Cotaga and Jim Reid can be downloaded here.

Sources

1 See 'COP26: Can companies bear the burden?' (10 November) at flow.db.com

2 See https://bit.ly/2ZrWMOH at bruegel.org

3 See 'Journey to green in ESG transformation' (21 May 2021) on the rate of ESG regulatory framework development in the US and EU at flow.db.com

4 See https://bit.ly/3xsmZJn at ec.europa.eu

5 See https://pwc.to/3rdmKAY at pwc.lu

6 See https://bit.ly/3cNPAiW at ec.europa.eu

7 See https://bit.ly/3FVQ2s1 at gfanzero.com

8 See https://bit.ly/3rgTx87 at ukcop26.org

Sustainable finance solutions Explore more

Find out more about our Sustainable finance solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

SUSTAINABLE FINANCE, MACRO AND MARKETS

COP26: Can companies bear the burden? COP26: Can companies bear the burden?

While governments are making announcements to reduce emissions, the responsibility to make the targets happen falls onto the corporates. flow summarises new Deutsche Bank Research demonstrating why costs are a key concern for some corporates and how finance can support the transition

SUSTAINABLE FINANCE, MACRO AND MARKETS

How banks contribute to COP 26 How banks contribute to COP 26

Climate protection is gaining importance around the world. However, more speed is needed to limit global warming to 1.5°C. flow’s Desirée Buchholz reports on what to expect from the upcoming UN climate conference in Glasgow – and how the financial sector sees its role

Sustainable finance, Regulation

Journey to green in ESG transformation Journey to green in ESG transformation

As capital pours into ESG investing, how are regulatory frameworks developing to support this growth? flow’s Clarissa Dann focuses on key points from dbSustainability Research analysis