28 October 2021

As green investment taxonomies emerge across markets, market participants are calling for regulators to create a more level playing field. But is a globally recognised and harmonised framework possible? flow reports on insights from the Sibos 2021 conference panel session

MINUTES min read

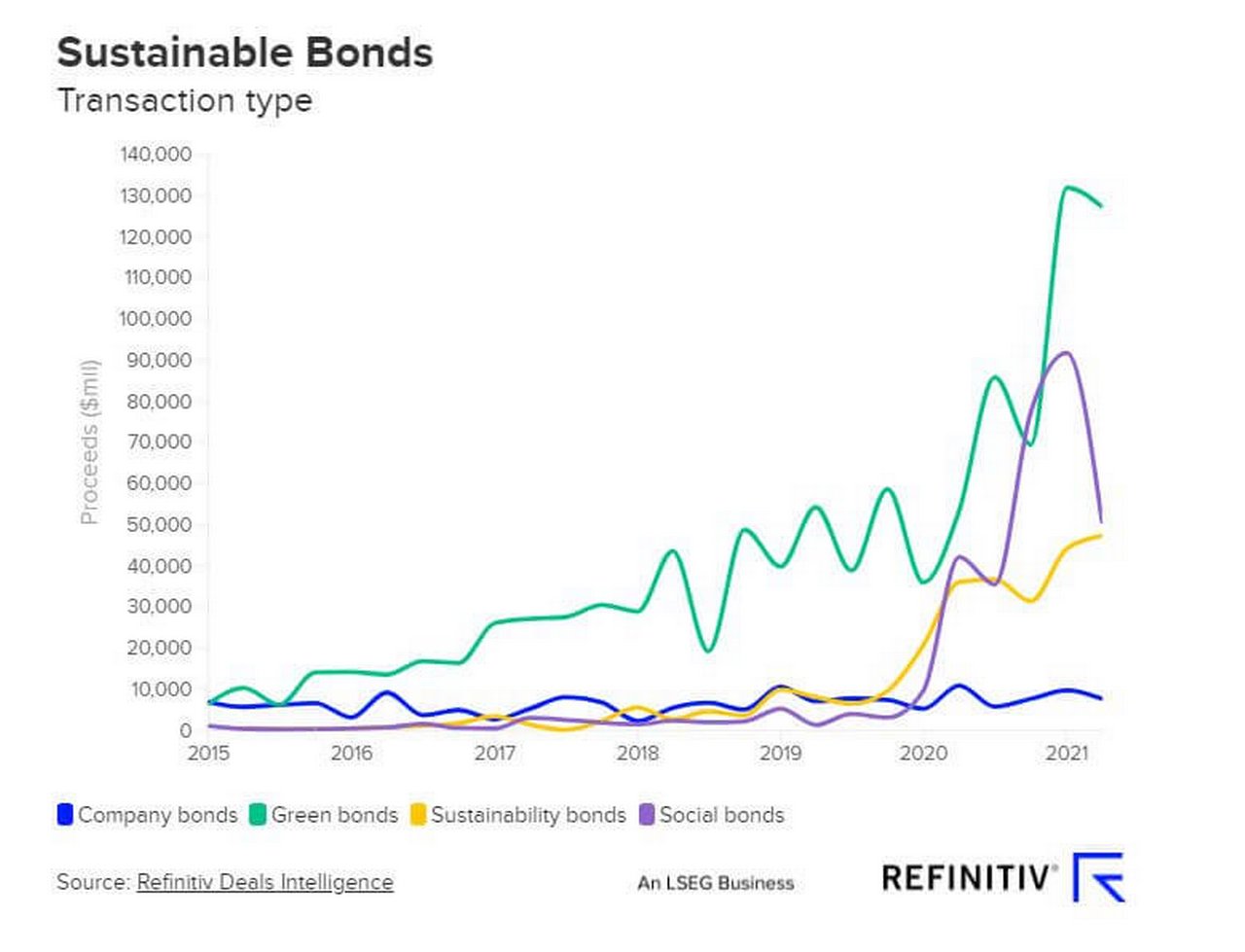

“There’s no question that the topic of sustainable finance is a priority in today’s financial markets and according to Refinitiv Data this bears out in the numbers as well,” opened panel chair Sherry Madera, Chief Industry & Government Affairs Officer at the London Stock Exchange Group, who led the discussion on Day 4: Mandated sustainability reporting: Beast, burden or the only way forward?

Figure 1: Sustainable finance bonds hit new heights

She went on to report how the Refinitiv data showed that in the first half of 2021, sustainable finance bonds volume surged 76% year on year to reach US$552bn, an all-time high (see Figure 1).1 This particular asset class is firmly rooted in the future of finance and reflects how quantitative and qualitative data is analysed, she continued. In addition, as sustainability reporting becomes mainstream – some of it being mandatory and some voluntary, how the two approaches fit together both now and in the future is a key issue for investors and financiers.

Panel member Elree Winnett Seelig, Global Head ESG Markets, at Citigroup Global Markets Limited said, “In financial services we spend so much time thinking about ESG as a product but forget the transformational impact it could have, and it is becoming a new operating system for our markets. When one-third of the assets under management is integrating ESG factors into pricing risk and the way they think about deploying capital, it is going to reshape our markets.”

She added that while two-thirds of the global economy have made net zero commitments2 – that is not enough to achieve the 1.5 degrees target limit set out in the Paris Agreement. “If we are serious about net zero, these commitments will really transform our business models, bank lending, insurance underwriting – and ultimately our economy, and we are certainly seeing that pull from consumers, regulators and investors,” she reported.

How can banks and asset managers, integrate the information on the material ESG factors that nobody has been reporting before now into their decision-making? This means identifying what is material to the sector and each individual company and establishing the baselines that the firm has reached. Once these metrics become part of the annual reporting cycle, it is easier to understand the direction of travel and check the firm’s performance against the sustainability targets and how it compares with its peers. In other words, said Seelig, “Disclosure underpins the ability to analyse a company.”

The Sibos panel left to right clockwise: Sherry Madera, Chief Industry and Government Affairs Officers, London Stock Exchange Group (Moderator); Martin Seimetz, Managing Director, Commerzbank; Elree Winnett Seelig, Global Head ESG, Markets, Citigroup Global Markets; Richard Lacaille, Global Head of ESG State Street Bank and Trust Company; Kamran Khan, Head of ESG for Asia, Deutsche Bank

Materiality

Underpinning all of this is materiality – information that markets can trust when a company’s ESG credentials are analysed. Disclosure is all very well but what else can asset managers check? How do they know the company is not just talking the talk but also walking the walk? Context and sector are important, noted the panel.

Regarding decarbonisation, a relatively small number of sectors account for most of the production and consumption of CO2, reflected State Street Bank and Trust Company’s Global Head of ESG Richard Lacaille. So, while net zero commitments are not yet universal, the big question is whether those we do have are in “areas that are material in terms of CO2 production,” he added. When it comes to financial materiality, Lacaille said that asset managers are guided by independent institutions such as the Sustainability Accounting Standards Board (SASB)3 and the Resolution Foundation4 that help inform what matters in specific industries. “In some cases, this will be carbon but in others material ESG issues. We need to ensure investors get good long-term returns, so must therefore pay attention when making decisions to the things that influence very long-term cash flows of the companies we invest in or the credits we are supporting.”

Of course, the issue of sustainability has both a political and social dimension but accessing evidence is hard for those making decisions in the asset management or banking business. Lacaille reminded delegates that financial decisions from investors and lenders are “long-term in magnitude” so the data quality that informs them is critical to delivering “better long-term outcomes to savers and investors.”

The panel agreed that relevant and robust metrics are vital. ESG transition requires transaction models, product solutions and regulatory measures which meet international standards. In addition, said Kamran Khan, Head of ESG for APAC at Deutsche Bank, “Buy side needs for data are significantly different from what is happening on the sell side. If I am on the buy side, I am buying data so that I can make smart investment decisions whatever my integration philosophy might be. If I am on the sell side, I am advising a client to make themselves more credible as an ESG compliant company.”

“The metric you choose must be credible”

He went on to explain how the ESG Centre of Excellence in Singapore launched by the bank in May 2021 in partnership with the Monetary Authority of Singapore (MAS) makes it possible to satisfy both sides by originating brand new data and coming up with new KPIs not used in that vertical globally. Systems were put in place for the clients to report their data quarterly.

Khan pointed out that “there is a lot of guidance,” including not only the EU Taxonomy, but the Sustainability Accounting Standards Board (SASB), International Finance Corporation,5 World Bank,6 and the UN.7 His team assesses the entire scope to see what the guidance is that affects a particular company in that business. “The metric you choose must be credible so that when a third party looks at it, they know you are measuring the right things and it should be achievable.”

As the metrics requires a very deep understanding of the client business, Khan prefers disclosure sources to be from corporates, because then “investors can make smart decisions and be held accountable for using or not using that information and they can assess whether your integration model is real or soft.”

Towards unified regulation

Another reality check comes from each economy having its own views on how much disclosure it can ask for without scaring business and investment away. In Asia, “even regulators have to balance public interest and a country’s competitive strategy in that region,” he reflected. If requirements are too tough, companies will simply move their hubs to a more accommodating jurisdiction. But if they are too soft, people do not believe the country is serious enough about ESG so is therefore not the right place to do meaningful benchmarking.

The financial industry needs, said Madera “to continue the pressure of being more granular” and get beyond the basic questions such as “Do you have a water policy?”. From 10 March 2021, the EU’s Sustainable Finance Disclosure Regulation (SFDR) required asset managers and other financial market participants to provide (to quote the KPMG snapshot8) “prescript and standardised disclosures on how ESG factors are integrated at both an entity and product level”. But this rule does not apply to corporates.

Commerzbank’s Head of Risk and Resource Steering Martin Seimetz agreed that each jurisdiction has different challenges, and this puts regulators and players in the market into different positions. He regards the financial industry as at the start of a journey where joined-up regulation is just beginning. Another issue, he reflected is that regulators like to be as progressive as possible, but this introduces complexity – making it difficult for the smaller companies to implement new measures.

In Germany, he added regulators are issuing the German Supply Chain Duty of Care Act which comes into force in January 2023. The Act, said Seimetz, will have a cascading effect as it requires companies to beef up their transparency and show within their industry what supply paths they will take – something that will be shared with financing companies. He developed a point made by other panellists that “digitalisation is a means to success.” In other words, enlightened corporates are building out their core financial systems to integrate ESG data. This way, reporting will improve and will help financial market decision-making.

Citigroup Global Markets’ Seelig addressed the question raised earlier in the discussion by lenders and asset managers, “Do our firms have a plan achieving net zero and sustainability targets?” She then shared how Citi’s team had undertaken a project with a regulator looking at climate risk in their balance sheet and trading books for one of the legal vehicles. “It’s really complicated,” she admitted. “You need to bring together climate science with climate economics with that financial materiality and play it forward to understand the impacts on credit insurance, commodity prices, and so on.”

“Regulated disclosures are fact-based and that is why then can be audited”

Looking forward

The difficulty with sustainability risk arises in the opacity of how market participants see and price it, continued Seelig. With the playing field far from level, panellists did agree that regulators need to “step in and help us get the disclosure we need” when it comes to forward-looking scenarios. Madera observed that when using data to assess future risk with scenario planning, participants need to grapple with extrapolation, estimation and error (“the three Es). In other words, how do you deal with uncertainty?

“Investors have also had to look forward,” reflected State Street’s Lacaille. “They have not always had data, and much investment is quite qualitative and involves judgements about a lot of different information which may not be as hard as data. Regulated disclosures are fact-based and that is why then can be audited.” He explained that forward-looking statements might be in the management commentary but have a different status. However, that forward-looking information – especially as it relates to climate and decarbonisation plans – is “particularly important.” In other words, the most important thing an asset manager is looking for is unlikely to be regulated or disclosed in a regulated fashion.

So, what can an asset manager turn to? A strong, independent and credible board who oversees disclosures is particularly important to investors running concentrated portfolios. “We are going to grapple with how much you make mandatory, how political you make mandatory disclosures become and what investors do about encouraging voluntary arrangements, but which I think in some ways are much more likely to be successful,” concluded Lacaille.

As the session wrapped up, it fell to Deutsche Bank’s Khan to connect ESG with value and return. “We are just getting into ESG as a risk management tool,” he said. “If we all believe ESG is going to permeate every aspect of the financial services industry, we must anticipate that at some point people will be adding value to the ESG part. It cannot just be PR or CSR. It needs to be associated with material financial return implications.”

Figure 2: Sibos mind map on mandated sustainability reporting

The Sibos Conference session, Mandated sustainability reporting: Beast, burden, or the only way forward? took place on 11 October 2021 and can be viewed by registered delegates at www.sibos.com

Sources

1 See https://refini.tv/3CmTwSK at refinitiv.com

2 See https://bit.ly/3Eivkld at un.org

3 See https://www.sasb.org/

4 See https://www.resolutionfoundation.org/

5 See https://bit.ly/3nBTBf8 at ifc.org

6 See https://bit.ly/3nxFIPg at worldbank.org

7 See https://bit.ly/3Ckz3xT at unfccc.int

8 See https://bit.ly/3BlrPIX at assets.kpmg

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

SUSTAINABLE FINANCE, MACRO AND MARKETS

How banks contribute to COP 26 How banks contribute to COP 26

Climate protection is gaining importance around the world. However, more speed is needed to limit global warming to 1.5°C. flow’s Desirée Buchholz reports on what to expect from the upcoming UN climate conference in Glasgow – and how the financial sector sees its role

Sustainable finance, Regulation

Journey to green in ESG transformation Journey to green in ESG transformation

As capital pours into ESG investing, how are regulatory frameworks developing to support this growth? flow’s Clarissa Dann focuses on key points from dbSustainability Research analysis

Sustainable finance, Cash management

How should banks drive the ESG agenda? How should banks drive the ESG agenda?

How should banks support corporate clients with their environmental, social and governance issues? Should they be involved in setting the client’s targets? These and many other issues were addressed in a keynote session at the 2021 ACT virtual conference