03 December 2021

The COP26 summit saw governments commit to achieving Net Zero by 2050, but this will prove “incredibly difficult to achieve”, a recent Deutsche Bank Research report concludes. flow’s Clarissa Dann examines why its analysts believe that although the world’s appetite for coal and oil must be cut, gas plays a vital role in keeping the lights on

MINUTES min read

If the road to hell is paved with good intentions – as a 12th Century French theologian once put it,1 – then the recent COP26 summit in Glasgow provided more paving slabs. Seasoned commentators queried how much of the discussion would be backed up by real action. In their 3 November report, Michael Marshall, Graham Lawton and Adam Vaughan of New Scientist magazine noted, “The ultimate aim of the whole COP26 exercise is to phase out use of fossil fuels as quickly as possible. Pledges to hit net zero by a given date are all very well, but they need to be backed up by policies to make it happen.”2

One example, they pointed out, is that many countries continue to give public funding for fossil fuels, sometimes in the form of tax breaks for exploration. The ultimate success of COP26 rests partly on whether those subsidies will now be removed and if more countries set timelines to end their use of coal.

The Deutsche Bank Research report of 13 September, dbSustainability Tracker: Should gas be viewed as a vital energy transition fuel? in which James Hubbard considers the outlook for oil and gas demand in a decarbonising world, introduced a note of scepticism some six weeks before the COP26 meeting. This article shares the main themes of their research as it has implications for global energy supply and demand.

“Despite many governments targeting net zero by 2050, we believe this will be incredibly difficult to achieve,” writes Hubbard and fellow analysts Liam Fitzpatrick, Brian Bedell, Debbie Jones and Luke Templeman. “Under a more realistic and achievable pathway, we expect gas to remain a key part of the transition energy mix in decades to come.”

The team does not agree with the International Energy Association (IEA)3 flagship report issued in May 2021 that predicted reaching the net zero target by 2050 would involve a -55% reduction in gas demand. Hubbard and colleagues forecast quite the opposite – a 46% increase.

“The issue is whether it is politically acceptable for leaders to stand up and state the case for gas when a vocal minority wants to see an immediate end to all fossil fuel investment, no matter whether it actually helps or hinders decarbonisation,” they state.

While natural gas – a naturally occurring fossil gas ¬– is recognised as a cleaner energy source when compared to coal and oil-based products such as bitumen and diesel, – some worry that it could hinder a commitment to renewables. “Existing studies agree that natural gas helps avoid greenhouse gas emissions in the short term, while unintended long term effects might also hinder the transition into renewables,” said academics Gürsan and de Gooyert in their paper, ‘The systemic impact of a transition fuel: Does natural gas help or hinder the energy transition?’ published in the Renewable and Sustainable Energy Reviews journal in March 2021.4

Fossil fuels and global warming

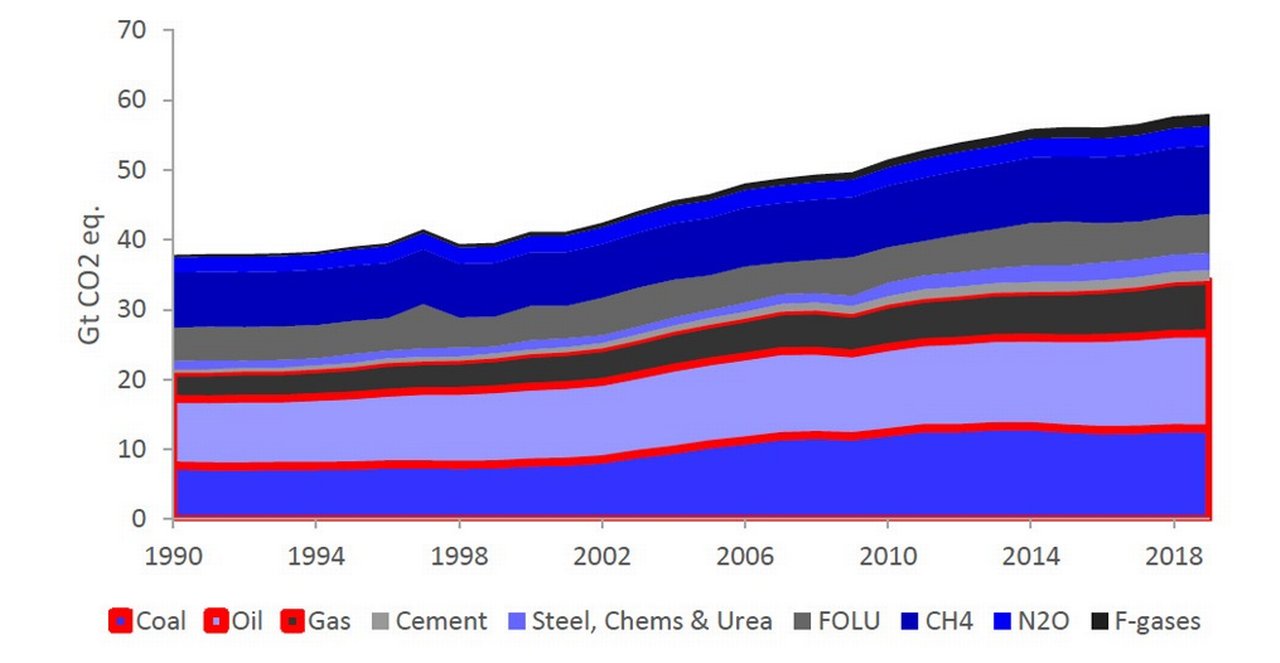

Deriving why the team is making the case for gas, the db Research report starts by citing the widely accepted understanding that human-caused greenhouse gases (GHG) are slowly but inexorably driving average global temperatures higher. The main culprit is carbon dioxide (CO2), for which current atmospheric concentrations have reached levels last seen more than 800,000 years ago. Two thirds of GHGs come from fossil fuels, including CO2 from fossil fuel direct combustion; other contributors are steel,5 cement and urea (also known as carbamide) manufacturing, deforestation and agricultural practices. GHGs also include methane from oil industry leakages and flaring; also from cattle, sheep, and rotting waste. Adding further to the mix are N2O emissions (agriculture) and fluorinated gases (F-gases). See Figure 1.

Figure 1: Anthropogenic (caused by humans) greenhouse gas total emissions broken down by source

FOLU = Food and Land Use; Methane = CH4

Source : DB based on BP statistical review 2020 for oil, gas coal derived data, ‘Global CO2 emissions from cement production 1928-2018’ (https://essd.copernicus.org/preprints/essd-2019-152/essd-2019-152.pdf) for cement emissions, EDGARv5.0_FT2019 dataset (https://edgar.jrc.ec.europa.eu/overview.phpv=booklet2019), for derived steel, chems, urea data, The Global Carbon Budget 2019 for land use change emissions (https://www.globalcarbonproject.org/carbonbudget), and ‘Trends in global CO2 and total greenhouse gas emissions’ (www.pbl.nl/en) for CH4, N2O, Fgas, data

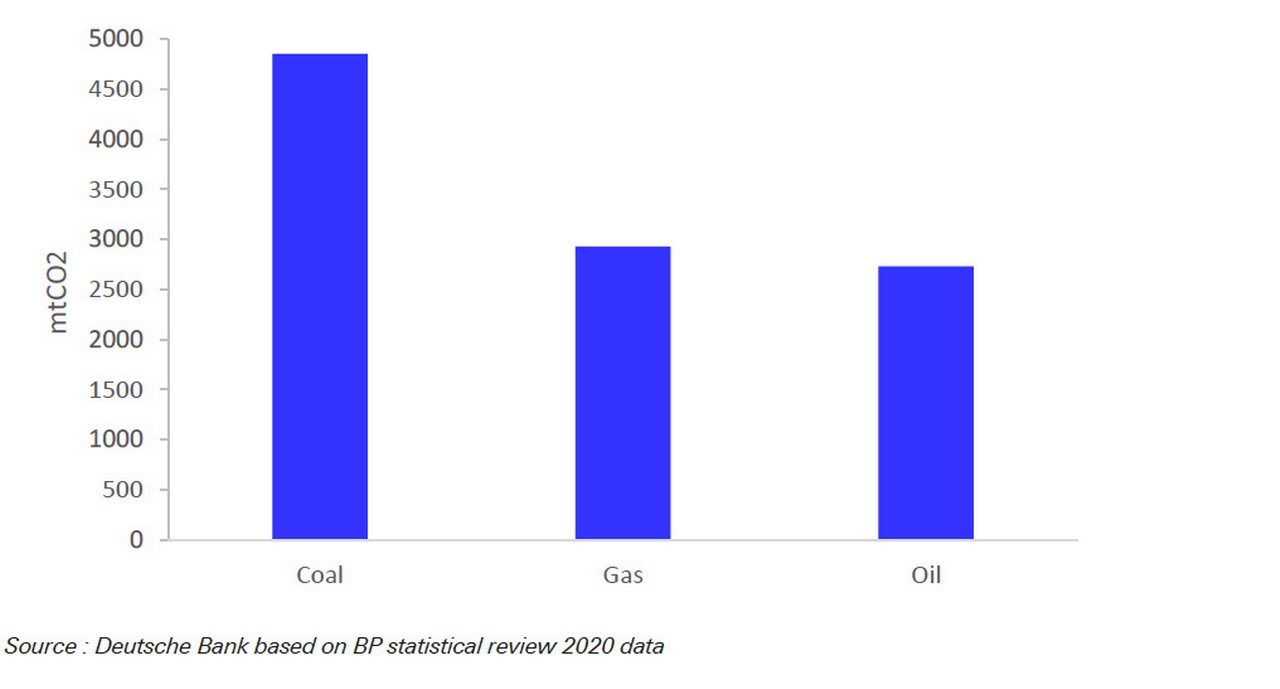

Focusing on fossil fuel emissions since 2000, the team calculated that oil represents the largest source at 40% of CO2 emissions against 38% for coal and 22% for gas. However, over 20 years coal’s CO2 emissions has grown at a much faster pace than either oil or gas – accounting for 46% of the combined increase, against 28% for gas and 26% for oil. See Figure 2.

Figure 2: From 2000 to 2019, coal CO2 emissions increased the most

Power generation (powergen) is, states the report, “the largest source of fossil fuel CO2 emissions”. The team explain that at 40% of the total of total CO2 emitted, powergen accounts for more than double the emissions from transport (20% from road and domestic air travel). They add, “of the main energy consuming sectors, power generation emissions have also grown the most over the last 20 years, accounting for 41% of emissions growth from 2000–19”. Transport accounted for 18% and while international air travel “gets a lot of bad press when it comes to emissions” it only accounted for 3% of global CO2 emissions growth from 2000-2019. These numbers outline that – in order to reduce fossil fuel CO2 emissions – the power generation mix plays a very important role.

“[Coal’s] increased use is mainly due to its relative attraction for emerging market power generation,” the team reports. “In regimes where there is no carbon cost, coal power has often been the more economic choice versus gas or renewables until relatively recently, but this is no longer true – solar power is now cheaper in most countries even without considering carbon pricing.” But clouding the basic economics is the fact that in China and India local coal use often supports a large domestic mining industry and associated jobs, thus “politics inevitably enters the equation”.

In April 2021, Wood Mackenzie senior consultant Xinlin Chen observed, “In the past, Chinese producers would strategically choose locations for new smelter projects based on local power tariffs and where self-generated or captive power plants were permitted. This is a more cost-effective solution. However, the strategy of building power plants first and aluminium facilities later has become harder to sustain under China’s goals to control energy consumption and achieve carbon neutrality.”6

However, renewables capacity is being added to the global powergen mix, notes the team. During the period 2010–19 when 507 gigawatts (GW) of new coal-fired powergen, and 384GW of new gas-fired gen were added so was 1330GW of renewables capacity. This means that 58% of all new capacity globally since 2010 was attributable to renewables. “It is wrong to think that the world (or China) is standing still and doing nothing to try and curtail powergen CO2 emissions growth – it just needs to do a lot more,” the team reflects.

As atmospheric CO2 emissions are cumulative and persist for hundreds (maybe thousands) of years, the report sets out the world’s two basic goals:

- to stop emitting CO2 and other GHGs and eventually; and

- possibly also to extract CO2 from the air and safely store it.

“For now, we need only worry about step 1, because thus far the world has collectively made zero progress in even stopping annual emission increases, let alone actually being on a pathway towards net zero,” the team adds.

The powergen mix

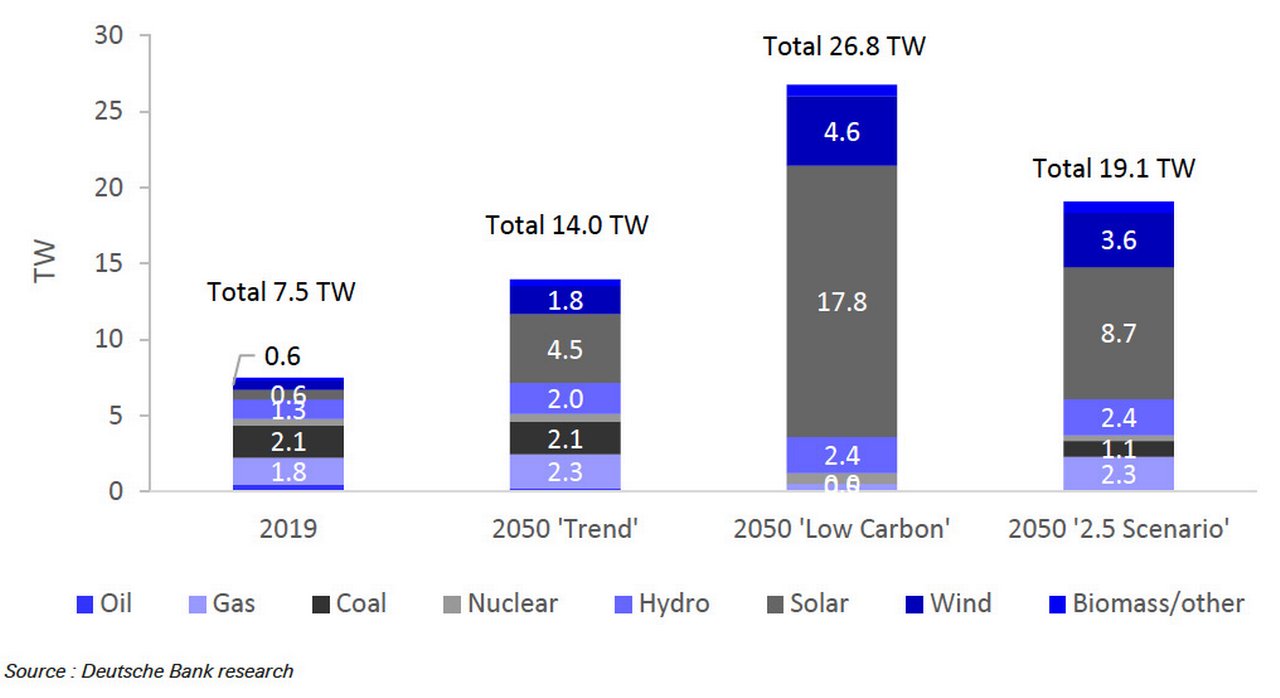

The report sets out two possible decarbonisation pathway scenarios:

- 'Low Carbon 2050', the attempt to get as close as possible to net zero CO2 emissions by 2050; and

- '2.5 scenario' where “given the current lack of progress in aggregate at a global level” is, the team observes, “a more realistic and achievable pathway, that implicitly results in +2.5 °C of global warming and doesn't achieve net zero until 2088”.

Figure 3 illustrates how even with the help of a projected 46% gas use increase by 2050, the implied required renewables powergen construction is still daunting. “The incremental required solar and wind powergen capacity by 2050 is not the 21 terawatt (TW) required by our Low Carbon 2050 scenario, but it is still 12TW versus current total global powergen capacity of 7.5TW. It still implies an 8.2 x capacity scale-up versus end-2020, which while possible (it requires the global PV/wind manufacturing and installation capacity to almost double by 2035), would clearly require a large, globally coordinated effort.”

“We see natural gas (i.e., methane) as a vital enabler of decarbonisation”

Figure 3: Required global 2050 electricity powergen mix by scenario

The report sets out specific actions that need to be achieved – such as China not going ahead with adding to its already capacious coal powergen – in order to “leave the planet broadly on track with the requirements of Net Zero 2050” and several appear unlikely. “Nonetheless, we agree that for any eventual net zero pathway (even if decades after 2050), oil and coal consumption need to fall as soon as possible,” the team adds.

Leading role for natural gas

“Where we differ from some is that we see natural gas (i.e., methane) as a vital enabler of decarbonisation,” given that the world appears increasingly unlikely “to build enough photovoltaic (PV), wind, nuclear power gen and expand grids with associated storage enough to credibly say 'no more fossil fuel use by 2050'”.

Arguing for a more realistic approach, they suggest that a decarbonisation pathway “that can more realistically be delivered than Net Zero 2050” should have gas playing a leading role for several reasons:

- Gas is 42% less carbon intensive than coal. For every GW of old coal plants replaced with a modern gas version, 4.3 million ton per annum (mtpa) of CO2 is saved. Even when factoring in full life-cycle carbon emissions of liquified natural gas (LNG) versus life cycle emissions of coal, gas is significantly less carbon intensive.

- Gas power plants give flexibility for faster penetration by renewables of national grids (far more than coal power plants can provide). Without fast-acting gas plants, renewables’ powergen will be limited by the ability to build massive battery storage capacity that will often lie idle.

- Gas infrastructure built today can be re-tasked to handle hydrogen tomorrow. Pipelines, storage and power plants can be built with a long-term hydrogen future in mind – the capital spend is not ‘locking in fossil fuels’, unlike ongoing large-scale coal plant expenditure.

- Gas is the feedstock for blue hydrogen (i.e., hydrogen from methane with storage of steam-reforming CO2 emissions). Ideally, in time green hydrogen from renewable powergen and electrolysis can be used, but the priority is to get a meaningful hydrogen economy up and running. Natural gas can help deliver this more quickly than relying purely on (currently uneconomic) green hydrogen alone.

The team concluded that relying on gas far more than the IEA and others envisage is “a sensible, level-headed approach”.

Deutsche Bank Research reports referenced:

dbSustainability Tracker: Should gas be viewed as a vital energy transition fuel? by Liam Fitzpatrick, James Hubbard, Brian Bedell, Debbie Jones and Luke Templeman (13 September)

Sources

1 Bernard of Clairvaux (1090 to 1153), L'enfer est plein de bonnes volontés et désirs

2 See https://bit.ly/3o7UjT2 at newscientist.com

3 See https://bit.ly/3xHZsUV at iea.org

4 See https://bit.ly/3G6qBUn at sciencedirect.com

5 See also Funding a zero-carbon future for steel at flow.db.com

6 See https://bit.ly/3d9sL9m at woodmac.com

Sustainable finance solutions Explore more

Find out more about our Sustainable finance solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

SUSTAINABLE FINANCE, MACRO AND MARKETS

COP26: Can companies bear the burden? COP26: Can companies bear the burden?

While governments are making announcements to reduce emissions, the responsibility to make the targets happen falls onto the corporates. flow summarises new Deutsche Bank Research demonstrating why costs are a key concern for some corporates and how finance can support the transition

Trade finance and lending

What’s next for commodities? What’s next for commodities?

Commodities are bouncing back from their Covid-19 lows and some even talk of a supercycle. flow reports on longer term issues facing the industry, such as fraud, digitalisation and ESG transition discussed at the May 2021 TXF Virtual Commodity Finance Conference

Funding a Zero-Carbon Future for Steel Funding a zero-carbon future for steel

SUSTAINABLE FINANCE, MACRO AND MARKETS

Funding a zero-carbon future for steel

As the European Union pushes forward with an ambitious roadmap for a sustainable, net-zero emissions future, Claire Coustar, Head of ESG, FIC, Deutsche Bank explores how the steel industry can ensure it has the funding needed to support – and even drive – this green transition