14 July 2021

The latest event in the series “The future of Asset Servicing Leadership”, organised by The Asset magazine in collaboration with Deutsche Bank, considered what Environmental, Social and Governance (ESG) factors mean for funds in Asia. flow reports

MINUTES min read

Environmental, social and governance (ESG) investment is now an unstoppable movement in the Asia-Pacific region. Covid-19 has added impetus to conversations surrounding the trend and has consolidated its place at the top of the agenda. According to a recent MSCI 2021 Global Institutional Investor survey, around 79% of investors in Asia-Pacific increased their ESG investments ‘significantly’ or ‘moderately’ in response to Covid-19.1 And the statistics back up their claims; according to Morningstar Asia, ESG assets under management in Asia totalled US$25.4bn by the end of 2020, representing an increase of 131% from the previous year.2

Yet, while enthusiasm may be high, certain barriers in the region remain. Asia’s regulators lag behind their European and US counterparts, making ESG disclosure a disparate and confused landscape. As asset managers look to integrate sustainability standards into their portfolios, the lack of standardisation is creating a number of operational challenges surrounding data and reporting. Fortunately, progress is underway. To discuss this and more, five esteemed specialists – and a 415 strong audience from across 26 countries – came together for a panel entitled ‘ESG and what it means for funds’, the first event in a new Future of Asset Servicing Leadership series hosted by The Asset.

A focus on regulation

“Globally, the tide of new regulation – in terms of sustainable finance – has been on the rise,” began Satoshi Ikeda, Chief Sustainable Finance Officer, Financial Services Agency, Japan. Disclosures are increasingly becoming the norm in the Asia-Pacific region, as more nations get involved with regulatory efforts to advance sustainability. For instance, Japan and Australia recently joined China and Singapore in the Network for Greening the Financial System (NGFS) created in 2017 with 83 central banks and financial supervisors as members, which shares information about incorporating green finance into everyday business.3

Elsewhere, the International Financial Reporting Standards (IFRS) Foundation is in the process of finding a chair for its newly created International Sustainability Standards Board (ISSB), which is designed to help investors and other participants in the world’s capital markets to understand, compare and contrast a company’s sustainability performance with that of its peers. According to KPMG, the formation of this board could “signal a new era in corporate reporting where the same rigour is demanded for sustainability reporting as for financial information.”4

“I hope that these efforts will further align financial markets with climate-related disclosures, as well as encourage further work around biodiversity and other nature-related risks,” concluded Ikeda.

Pictured: David Smith, Aberdeen Standard Investments, Nina Hodzic Allianz Global Investors, Satoshi Ikeda, Financial Services Agency, Japan, Jenn Hui Tan, Fidelity International, Kamran Khan, Deutsche Bank, Eric Bramoulle, Amundi and Daniel Yu, The Asset

But, when it comes to regulation, there is a great disparity in how the world’s major markets are addressing ESG-related issues. As Eric Bramoulle, CEO of South Asia, Amundi explains, Europe has had a head start on the AsiaPacific region, with the European Union having already published a common classification system for economic activities, known as the Taxonomy Regulation.5 “Since the European market has been the most advanced on the topic, it is important to look at what their regulators are doing,” said Bramoulle.

"Globally, the tide of new regulation – in terms of sustainable finance – has been on the rise"

Last year, for example, the European Securities and Markets Authority (ESMA) proposed changes to MiFID II – an EU legislation put in place following the financial crisis to improve protection for investors. The new changes require advisers to incorporate clients’ sustainability preferences as part of the existing suitability process.6 This is likely to be a game-changer for investment advisers. For the first time, firms will have to consider specific, non-financial factors when carrying out a client suitability assessment and when demonstrating ongoing suitability. “In Europe, we are moving away from ESG integration and more towards making an impact,” explained Nina Hodzic, Head of Sustainable and Impact Investing, Allianz Global Investors.

“But there is not going to be a simple copy and paste from Europe to Asia,” notes Kamran Khan, Head of ESG for Asia Pacific, Deutsche Bank. Investors in North America and Europe are increasingly concerned with how ESG will impact their investments along the supply chains where they have low visibility. As a result, moving forward, “Asia will increasingly have a role in the standards being set up in Europe,” said Khan.

Hearts and minds

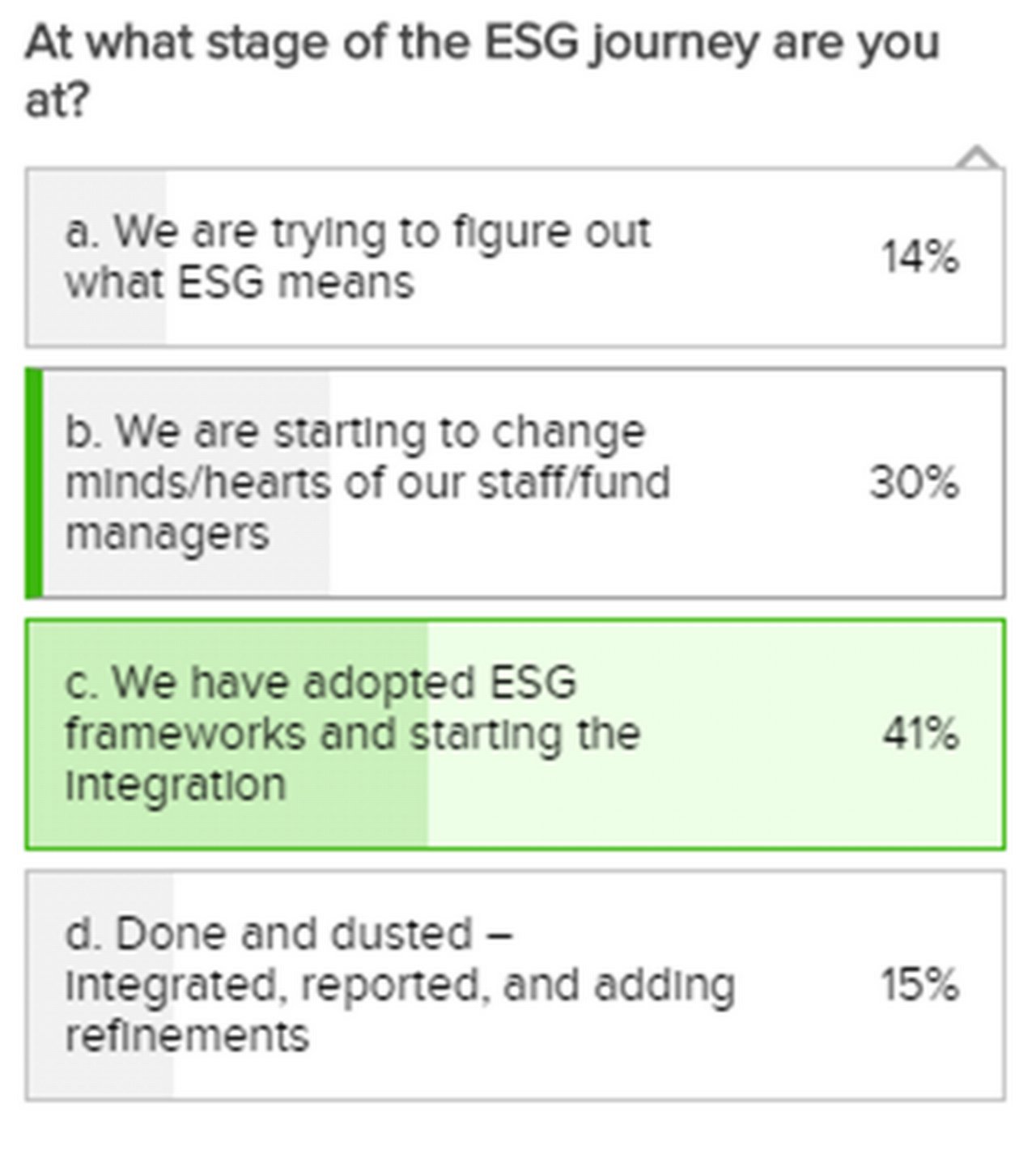

When event attendees were asked to identify which stage their ESG journey had reached, 41% responded that they had adopted ESG frameworks and had started their integration (See Figure 1). But, when it comes to ESG integration, Khan points out that “it really depends on our definition”. What investors and clients consider to be an appropriate level of integration ranges from the very basic level to the ambitious, metric-led sustainability goals. “More often than not, companies want to be sustainable, but they don’t know how to apply this to actual transactions,” said Khan.

Figure 1: First audience poll

So, how exactly will the industry achieve ESG integration? According to the UN-supported investors’ network Principles for Responsible Investment (PRI), there are two common options for incorporating ESG into an organisational structure: firstly an integrated investment team, whereby the existing team conducts the ESG analysis and integrates it into overall investment analysis and decisions, and secondly a dedicated ESG team, whereby members conduct the ESG analysis and integrate this into overall investment analysis and decisions.7

While these may, at first, seem like simple steps to take, a number of roadblocks remain. Jenn-Hui Tan, Global Head of Stewardship and Sustainable Investing, Fidelity International noted that in his experience “it is quite easy to make a set of standards, but if you are trying to reengineer the way investment is done, the real struggle is changing the hearts and minds of those involved”. The challenge then, it not just the integration itself, it is securing the necessary budget, resources and personnel to achieve it.

"In five years, we won’t be calling this ESG investing, but simply investing"

As more fund managers progress on their ESG journeys, the scale of the change needed may also not be fully appreciated by the market. David Smith, Head of Corporate Governance, Aberdeen Standard Investments reflected on the complexity of the task, explaining that given the intricacies of the diverse region in an economic, governance and environmental context, it is important to build out a strong team. “That is why our Asia-Pacific team is the largest so that we can get a handle on the sheer number of opportunities that are evolving and accelerating in the region,” said Smith.

Tan went on to say that, although only 15% of attendees reported their ESG journey to be ‘done and dusted’ (See Figure 1), he hopes that “in five years, we won’t be calling this ESG investing, but simply investing.” Some firms are on the right path in this respect. As of last year, for example, the DWS Group, Deutsche Bank’s Asset Management arm, made its entire product suite ESG-compliant. This, explained Khan, “is what we consider to be ultimate integration: where every portfolio manager, analyst and member of the team has gone through ESG training – making ESG part and parcel of all due diligence.”

The great data deficit

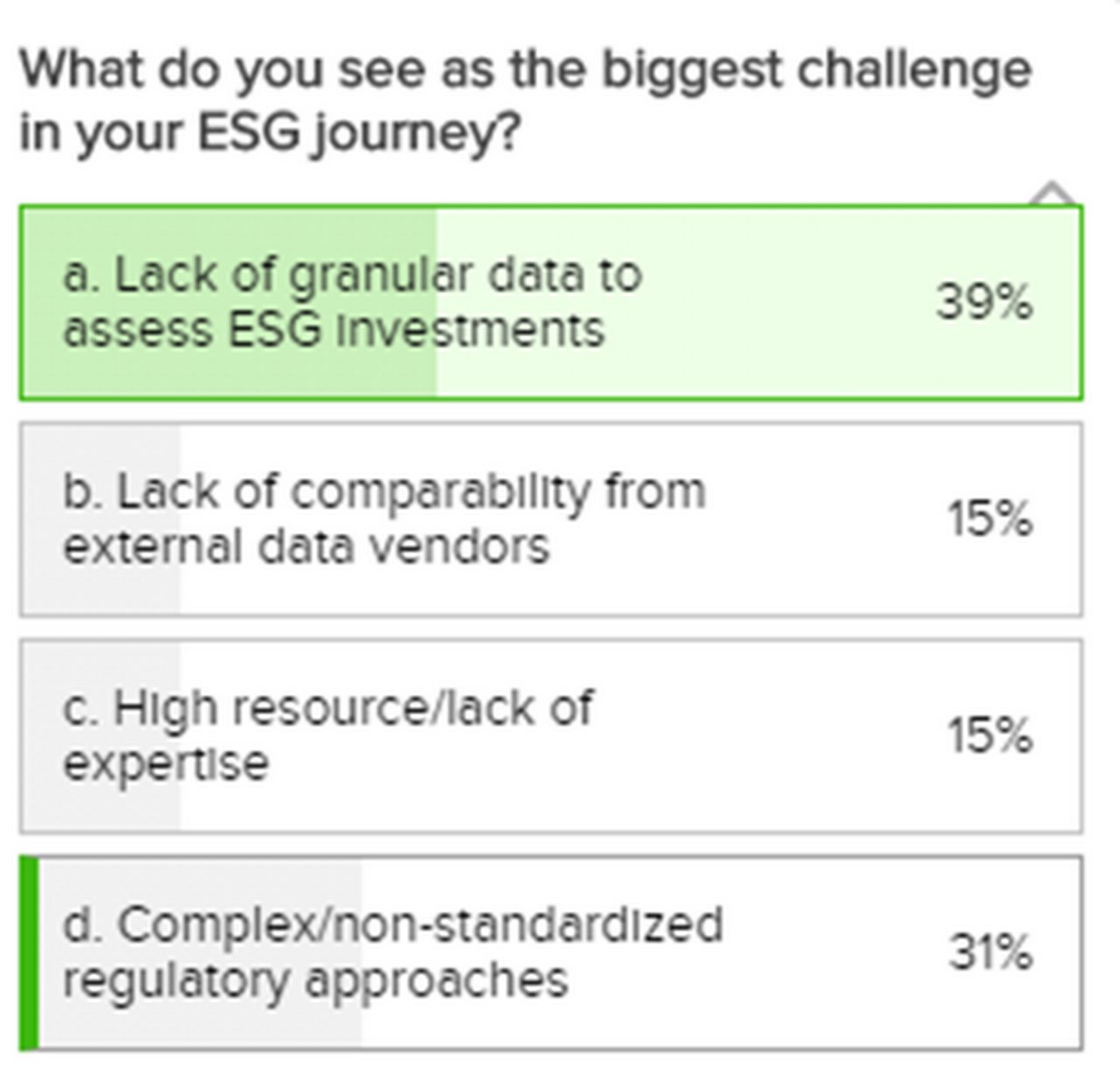

The future growth of ESG investment in Asia is inextricably linked to the availability, accessibility, reliability and comparability of data. In fact, when asked what the biggest challenge to their ESG journey is, 39% of participants to the webinar reported a lack of granular data to assess ESG investments (See Figure 2). The existing landscape is complex and disparate – with numerous disclosure frameworks, incentive structures, data collection methods and external assessments making the world of ESG difficult to navigate. From sector to sector, and market to market, there is no standardisation to measure ESG factors.8

Figure 2: Second audience poll

This is an area where Asia lags significantly behind its western counterparts, whose regulators have already made great strides in standardising ESG disclosures. Lacking a standardised approach, investors and investment managers in Asia use a combination of sources to inform ESG investment, including disclosed information, data from third parties, and raw data that needs to be sourced and analysed in-house. To put this complexity into context, Bramoulle explains that Amundi currently covers around 10,000 companies using 37 ESG criteria – and is working with 15 data providers as a result. “This produces a lot of data that takes a long time to compute – and this is where we are focusing a lot of our energies today,” said Bramoulle.

"Asia is hands down going to lead the way, as this is where the trickiest ESG investments are actually happening."

While many view the lack of data as a negative – as it prevents the industry from easily performing the proper analysis needed to make informed decisions – others view it as an opportunity to create a competitive advantage.9 As Smith explained, “we are in a situation where there is not as much disclosure of ESG data in the region – especially compared to somewhere like Europe or the US. This leads to a situation where we have an information asymmetry around ESG quality.” Often, this means that although companies may be involved in a number of ESG initiatives, the information is not readily available, as their disclosure lags behind – allowing companies with more informed, rigorous processes around data collection and analysis to get the upper hand.

For Khan, digging deeper into the data is a must for companies looking to make a well-informed investment decision. “When it comes to private data,” he explained, “it can, to some extent, be used as a crutch as to why something cannot be done. Yet, if you demand more data, more data will come – and this is where the smart money is at.”

Taking the lead post-Covid

“I think it is fair to say that 2020 has left a lasting impact on the global market, but it is about more than just Covid-19,” said Khan. At the beginning of the year, there were a number of other transformative trends taking place, surrounding race, gender equity and the environment. These considerations were never really front and centre for investors before, yet now many asset managers are adjusting their strategies to incorporate these risks. “I think this represents a significant, lasting change – one that is going to benefit the ESG market as it develops further”, he added.

When it comes to the ‘E’ of ESG, Asia is very aware of the potential risks. In a recent report, titled ‘Climate risk and response in Asia’, McKinsey reported that without adaption and mitigation, Asian societies and economies will be increasingly vulnerable to climate risk – a result of Asia’s many low-lying coastal cities exposed to flood and typhoon risk, as well as the dramatic increases in heat and humidity, the extreme precipitation and the extreme droughts forecast across the region.10 In 2020, for example, Cyclone Harold and Hurricane Gon uprooted people’s lives across the Pacific and Southeast Asia, while consecutive droughts have devastated agriculture crops and livestock across Laos, Thailand, and Vietnam.11

As well as having potentially the most at stake from their impact, Asia-Pacific is also by far the largest contributor to carbon emissions, accounting for 53% of the global total in 2019.12 With this in mind, Hui Tan explained that “it is good news that Asia is taking the lead, as there will be no solution to the climate crisis without Asian involvement and leadership” – with China, South Korea and Japan all having recently announced ambitious net zero targets.13

For Khan, it’s important to understand and pursue the right kind of leadership: if leadership is defined by which region has the biggest green bond market, then Asian leadership is not necessarily important – as this does not take into account where the capital is being deployed. If, however, you define leadership as the region putting its best foot forward in terms of cutting-edge ESG execution models, then “Asia is hands down going to lead the way, as this is where the trickiest ESG investments are actually happening.”

Sources

1 See https://bit.ly/3xBUlEU at msci.com

2 See https://bit.ly/3wxsQeh at pionline.com

3 See https://bit.ly/3xFsunj at ingwb.com

4 See https://bit.ly/3egEOCK at home.kpmg

5 See https://bit.ly/3i485lt at ec.europa.eu

6 See https://bit.ly/3yTTBew at esma.europa.eu

7 See https://bit.ly/3edYg39 at unpri.org

8 See https://bit.ly/3r53GCG at asifma.org

9 See https://bit.ly/3xQ2vdb at esgclarityasia.com

10 See https://mck.co/3hDwxuZ at mckinsey.com

11 See https://bit.ly/3edU9nC at thediplomat.com

12 See https://bit.ly/3ki8EdZ at ourworldindata.org

13 See https://bit.ly/2T6Y0LY at wwf.panda.org

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

TRUST AND AGENCY SERVICES

The green home maker The green home maker

On the road to economic recovery, Spain’s mortgage lender Unión de Créditos Inmobiliarios aims to facilitate access to housing and support the development of energy efficient buildings. flow’s Janet Du Chenne reports on how a securitisation enables the company to offer products that promote these goals

Sustainable finance, Cash management

How should banks drive the ESG agenda? How should banks drive the ESG agenda?

How should banks support corporate clients with their environmental, social and governance issues? Should they be involved in setting the client’s targets? These and many other issues were addressed in a keynote session at the 2021 ACT virtual conference

Sustainable finance, Regulation

Journey to green in ESG transformation Journey to green in ESG transformation

As capital pours into ESG investing, how are regulatory frameworks developing to support this growth? flow’s Clarissa Dann focuses on key points from dbSustainability Research analysis