May 2019

How did Germany’s SAP successfully orchestrate change from a one-product software vendor to a fast-growing cloud business? flow’s Janet Du Chenne talks to Stefan Gruber about the company’s transformation and how investor relations adapted

MINUTES min read

When Stefan Gruber joined Lufthansa as a management trainee in the early 1990s, a secure career at the state-owned airline seemed inevitable.

However, his path was drastically altered when, in 1994, the German government announced that it would privatise the airline, taking its 51.4% stake to a minority position. With this statement it became obvious what Lufthansa needed to do next: set up an investor relations (IR) department to manage communication with its new majority owners.

As part of this new team, Gruber suddenly found himself thrust into a whole new world where he was dealing with external stakeholders and financial analysts, preparing reports and setting up analyst conferences. However, since he was also studying economics in parallel, he relished the opportunity to work with this group. “I always had a desire to learn how corporations work and how they are valued externally,” Gruber reflects. “The IR function is the place to be, because you get a good perspective of the corporation and constant feedback from the financial community on how you’re performing.”

A few years later, after his enthusiasm and hard work in helping to set up the Lufthansa IR team had been noted within Germany’s fledgling IR community, he received an offer from software company SAP to join as its second IR officer. Given his natural curiosity and thirst for change, it was an offer he readily accepted.

A new audience

The journey from Lufthansa’s headquarters in Cologne led Gruber to a vastly different organisation and industry. This time it was not only his love of economics and the capital markets, but also of classical music, that would help him to adapt. Gruber, who also plays the piano, observes that “in a chamber music ensemble, it’s important for musicians to listen to each other. In the same way, in investor relations we don’t just need to communicate clearly to the financial market, it’s also about listening to feedback from investors and passing that feedback on to the organisation”.

Little did he know then how these passions would combine years later to help him lead an IR team through the biggest change to SAP’s business: the arrival of cloud computing. For a company that introduced the first real-time enterprise standard software in 1972, cloud computing was to change its direction in profound ways.

The early years

SAP was founded on a vision of real-time computing: software that processes data when customers need it rather than in overnight batches. It began when Xerox exited the computer hardware manufacturing industry and asked IBM to migrate its business systems to IBM technology. Five IBM engineers were working on an enterprise-wide system based on the Scientific Data Systems software acquired by IBM, only to be told that it would not be necessary. Rather than abandoning the project, they set up SAP in 1972 (see key facts box).

Its first client was the German branch of Imperial Chemical Industries in Östringen, for which SAP developed a mainframe programme for payroll and accounting. Instead of storing the data mechanically on perforated punch cards, as IBM did, SAP stored it locally in the electronic system using a common logical database for all activities of the organisation. It called the software a real-time system, since there was no need to process the punch cards overnight.

Over the next three decades, SAP developed a range of software tools and applications to help companies manage their core business functions, including human resources, enterprise resource planning (ERP), sales, marketing and supply chain management. The software was skilfully packaged and combined with companies’ computer mainframes, enabling them to integrate their business processes in one place. By the 1990s, as a global technology provider,1 SAP was one of Germany’s finest exports, but was battling it out with Larry Ellison’s Oracle, based in California.

Then something happened in the early 2000s that would up-end this seemingly safe position. CRM software provider Salesforce pioneered the idea of using the internet to deliver software programs to the end users.2 The virtual computing application could be accessed by anyone with internet access. Small and medium-sized enterprises could purchase the software in an on-demand, cost-effective manner.

SAP key facts

- Founded in Weinheim in 1972 by five former IBM employees as Systeme, Anwendungen und Produkte in der Datenverarbeitung (System, Applications and Products in Data Processing) to develop standard application software for real-time data processing

- Completes first financial accounting system in 1973

- Moves HQ to Walldorf in 1977

- Listed on Frankfurt Stock Exchange via IPO in 1988

- Lists shares on New York Stock Exchange via American Depository Receipts (ADR) programme in 1998

- Acquisitions: SuccessFactors (HR) in 2012, Ariba (spend management) in 2013, Concur (travel and expense management) in 2014, Qualtrics (experience management data analysis) in 2018

- 2008: releases first sustainability report, as an organisation whose technology helps companies track records and achieve long-term sustainability

- 2014: changes legal form from SAP AG to SAP SE, underscoring the company’s international nature

- 2015: unveils SAP S/4HANA, the next generation of enterprise software/cloud platform, and SAP HANA Cloud Platform for the Internet of Things

- 2017: sets out goal to be carbon neutral in its operations by 2025

- 2018: launches SAP C/4HANA customer-focused application suite

- 437,000 customers in more than 180 countries

- 98,600 employees worldwide as of Q1 2019

Source

Company information on sap.com and SAP Global Corporate Affairs (January 2019)

Up, up and away

In response to this, SAP bought human capital cloud-software supplier SuccessFactors and then later Ariba, a cloud-based provider of B2B procurement software and e-commerce platform. In 2015, it unveiled its flagship SAP S/4HANA solution, a completely rearchitected version of its flagship business suite. This next-generation suite essentially leverages the strength and speed of an in-memory computing database and makes all data software programs accessible both on the internet and on companies’ own servers. The solution embeds the Internet of Things (IoT), artificial intelligence (AI) and machine learning throughout its entire software portfolio (see product box).

With the adoption of this disruptive technology, SAP’s vision for delivering real-time computing became a vision for helping customers become ‘intelligent enterprises’ (see strategy box). Today the company provides software for 25 industries and seven lines of business that helps them harness the power of data faster and more effectively to optimise their business processes. “Over 425,000 companies rely on SAP software for their mission-critical processes,” Gruber notes. “Whether it is used for human resources, enterprise resource planning, customer relationship management or other essential business functions, our software is the lifeblood of an organisation.”

Being one of the fastest-growing cloud-based businesses at scale has challenged Gruber and his IR team to study these products and make investors and financial analysts understand the profound impact the cloud is having on SAP and its business model. In doing so, they have to constantly adapt their investor communications to an evolving marketplace and compete with several US-based peers such as Microsoft, Oracle, Salesforce and others.

SAP’s strategy

SAP’s strategy is to be the most innovative cloud company powered by SAP HANA, focussed on helping customers innovate faster and drive successful business outcomes.

Vision for the intelligent enterprise

Data is the new currency – businesses that harness data faster and more effectively will succeed through disruption. SAP offers perspective on the scale and power of data, with customers having vast amounts of enterprise data assets flow through the ERP, cloud applications and business networks every day

Framework for the intelligent enterprise

Intelligent cloud suite of applications for every line of business. This includes SAP’s next-generation ERP in the cloud, as well as solutions for manufacturing, digital supply chain, customer experience, networks, spend management, and people management

A digital platform with the next generation of data management solutions to help customers manage data orchestration and system integration across their entire business; an open cloud platform

Intelligent systems such as IoT, AI and machine learning, as well as analytics, help customers to optimise their core business processes and reinvent their business models

Source SAP’s Investor Relations Fact Sheet (January 2019)

Tuning in

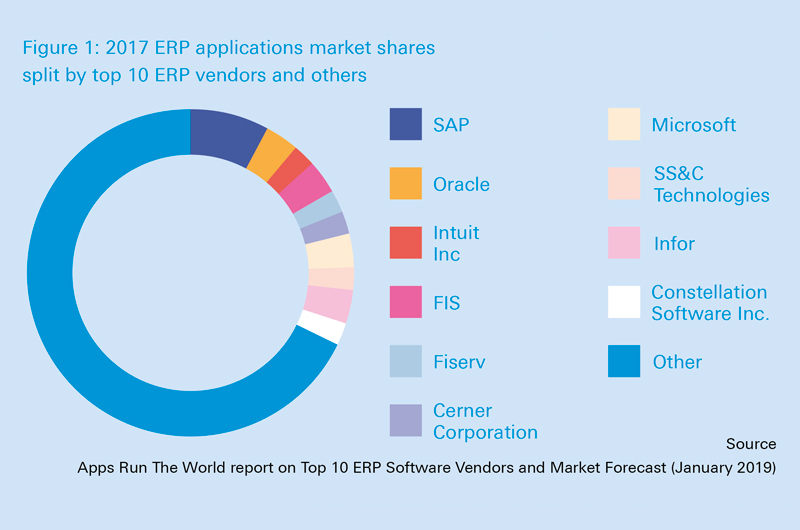

As the only major European business software provider in a US-centric cloud-based enterprise software market (see Figure 1), one of the biggest challenges for SAP’s IR team has been tuning into the capital markets there.

To compete for capital in a country that made up almost one third of its revenues in 2018,3 it used its listing on the New York Stock Exchange via an American depository receipt (ADR) programme currently provided by Deutsche Bank, which also serves as SAP’s depositary bank. With this listing, it became clear that if SAP was going to make an impact on the capital markets as a global provider of technology, it had to be close not only to customers there, but also to investors. So Gruber was briefly seconded to the US in 2000 to set up an IR programme to manage communication with US investors.

The important thing to communicate to those investors from 2012 onwards was SAP’s leadership position, not only as an enterprise application software provider but also as a top cloud vendor. Particularly important for the company was business momentum in the cloud and the variable costs associated with hosting applications on the cloud.

10%

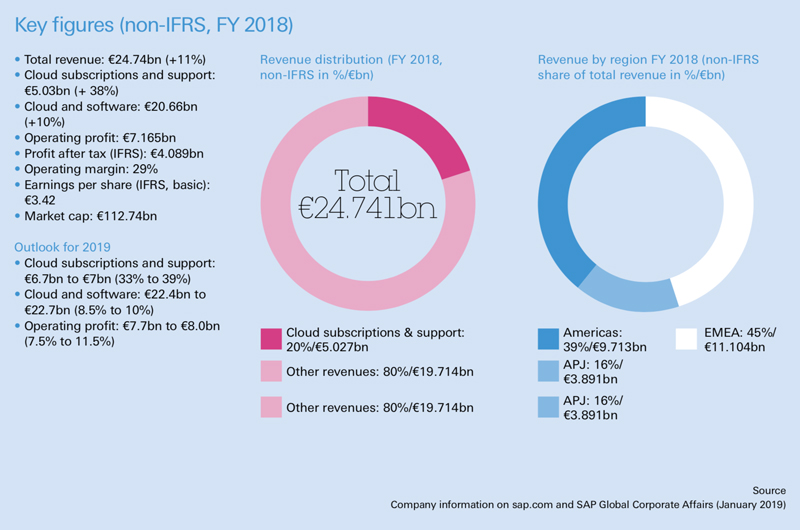

SAP’s cloud business is expected to grow close to 40% in 2019. The company also expects the share of recurring revenue, defined as the total of cloud revenue and software support revenue, to be in a range of 70% to 75% of total revenue in 2020 and approaching 80% in 2023. This is not insignificant, especially when considering research consultancy ReportLinker’s expectation4 that the ERP market will grow from US$18.52bn in 2016 to US$29.84bn by 2021, at an estimated annual growth rate of 10%.

To relay this to growth-oriented investors, the IR team needed to show how these businesses worked together to create value for customers and report the figures. “During the preparation of our quarterly earnings announcements, we work closely with our reporting and controlling functions in the finance team, as well as the communications and strategy teams,” Gruber explains.

While most of SAP’s institutional owners are based in Europe, communicating its growth story means interacting with sell-side analysts and key decision-makers on the buy side in Europe, North America and, increasingly, Asia. The company reaches out to this group through multiple channels, including investor roadshows hosted by CEO Bill McDermott and CFO Luka Mucic.

SAP has also seen a doubling of the number of environmental, social and governance (ESG) investors in its company in the past five years. To support these investors, SAP’s Co-founder and Supervisory Board Chairman Hasso Plattner engages in investor meetings focussed primarily on governance topics. In addition to these meetings, the IR team runs dedicated roadshows for governance analysts in Western Europe and the US.

In 2012, SAP became one of the first software companies to integrate its ESG performance with its financial performance in its annual report. Being a software company with easy access to data created the basis for matching the financial world with the non-financial world of employee engagement, says Gruber: “It’s important as a large company to be able to draw on both financial and non-financial metrics in our overall performance.”

Composing the perfect team

Having only seven IR professionals for a company with a market cap of nearly €140bn5 forced Gruber to think carefully about how he would set up his team to cover IR globally. “The art is to find the right balance between specialists covering institutional shareholders and generalists, but I think everyone has to be a generalist and be able to answer questions from both retail shareholders and financial analysts,” he says.

With this in mind, he has four IR specialists who are primarily focussed on communication with institutional investors. Two of them cover Europe and Asia Pacific, while another two cover institutional IR in the US. One of the US-based colleagues, John Duncan, is based in SAP’s global marketing headquarters in Manhattan and Scott Smith is based in the Bay Area of San Francisco in the company’s Palo Alto innovation labs.

Given the importance of the US financial market to SAP, it’s important to have feet on the ground there. “The risk is that you get too inward-looking, especially if you sit in the German headquarters,” warns Gruber. “However, our daily calls with our US colleagues ensure there is a constant flow of feedback in both directions, so that we are well informed of what is going on in the US financial market. This has been a very successful set-up.”

While the majority of the IR team’s work is done with the executive board for external outreach and investor roadshows, James Dymond oversees communication and regular news flow with socially responsible investors (SRIs) and governance analysts and provides their feedback to Plattner. Another colleague, Johannes Buerkle, leads communication with retail and private investors including preparation of the Annual General Meeting. Together, Dymond and Buerkle co-lead the Integrated Report project.

SAP products: the lifeblood of an organisation

- SAP C/4HANA, customer data cloud: >1.6bn consent records

- SAP S/4HANA: next-generation business suite, unlocking the business value of the IoT and big data for organisations

- SAP S/4HANA Cloud: intelligent cloud ERP, delivering access to digital capabilities and innovation, including machine learning and predictive analytics

- SAP Digital Supply Chain: manages entire supply chains digitally

- SAP Leonardo: portfolio of services packaged by industry, combining machine learning, IoT, blockchain, analytics and big data on the SAP Cloud Platform using design thinking

Source

SAP Corporate Fact Sheet, published by SAP Global Corporate Affairs

Chiming in together

The team contains generalists who work closely with the supervisory and governance functions and specialists who work with the financial reporting and controlling functions. “Like every team, it has to be diverse and the skills have to be complementary. While most of them have a financial and business background, they have different cultural backgrounds and different nationalities,” explains Gruber.

“It’s difficult to use the example of a big orchestra here, but if I look at a string quartet, the top ones are made up of soloists who excel at their individual instruments. But as an ensemble they only succeed when each musician plays with the polish of a soloist while closely listening to the other players. IR is a bit like that: the investor relations officer (IRO) is a soloist who needs to present the equity story on his own during a roadshow, but the IROs have to be strong team players in key projects.”

Closer encounters

According to Gruber, there are two trends that are currently impacting the IR team and its communication with investors and buy-side analysts: the Markets in Financial Instruments Directive II (MiFID II)6 and the proliferation of social media.

First, MiFID II (the European Union legislation which seeks to create transparency for investors in financial instruments) called for a separation between research and trading. This has meant that buy-side analysts and portfolio managers, who now have to pay for research directly rather than through trading commissions, increasingly reach out directly to companies such as SAP.

In the wake of this legislation, which became effective in January 2018, Gruber’s team has seen more direct interactions with these analysts and portfolio managers and the emergence of a number of technology platforms to facilitate easier communication with them. “This trend will lead to more transparency, and these platforms will help in providing access to our company,” notes Gruber. “But the essence of IR is thoughtful discussions with the buy side and sell side, and this will never change.”

"Clear, coherent and concise investor- relations messaging is ever more important in steering through the noise that is sometimes generated through social media"

Second, the proliferation of social media in the last 10–15 years has resulted in what Gruber sees as a race to publish news stories even faster: “Clear, coherent and concise IR messaging is ever more important in steering through the noise that is sometimes generated through social media.”

To manage information flow with analysts, the IR team uses SAP’s tools to access financial performance data soon after the close of the financial quarter. By drilling down into every piece of information stored in the flagship solution S/4HANA, the IR team is provided with access to boardroom data and a core set of numbers at their fingertips.

Gruber finds that the value provided to stakeholders comes from analysing the trends that support the numbers and then deciding what would be helpful to them. “Sometimes people think investors ask for more numbers. It’s not necessarily the case. They ask for meaningful data.”

The IR team also uses AI and machine learning to make standardised processes more efficient and deliver real-time financial information to the market:

- SAP’s digital boardroom technology provides IR with a real-time view into the company’s financial data.

- SAP Disclosure Management software helps with management of the preparation and publication of financial statements and automates standard processes involved in creating earnings releases, so that the IR team does not have to manually input the numbers.

- Qualtrics helps the team to collect, manage and act on feedback from attendees at its annual capital markets day attended by investors. The audience is polled and the embedded intelligence allows them to instantly analyse the feedback on the fly.

- SAP S/4HANA allows the IR team to report its numbers after quarterly close in a record time and publish its integrated report earlier.

Deciding what data is needed also requires close collaboration with the communications team, which is tuned into the media and brings a big-picture perspective to the SAP story. “We are in an environment where the media behaves in a soundbite world and what is published is immediately being read in the financial community, so IR and communications functions have to work closely together,” Gruber stresses.

Working together

Aside from its internal partners, the IR team also partnered up with Deutsche Bank as its ADR programme provider to manage information flow with US investors. The programme supports SAP’s strategy of increasing its visibility and diversifying its shareholder base in the strategically important US market. Under the programme, the shares are issued by the bank to US investors in US dollars and are held in a local custody account. Smaller investors who do not want the complexity of buying SAP shares on the Frankfurt Stock Exchange can buy SAP ADRs through a broker or through the DB Global Direct Investor Services Program, which acts as the SAP depositary bank for ADRs.

Given the size of the programme, SAP partners with Deutsche Bank and runs investor days to educate investors on the basics of SAP and to answer any questions about incorporating tax returns, for example. “When I look at Deutsche Bank, what it brings to the table is the scale, expertise and resources to handle a large ADR programme like SAP’s,” says Gruber. “I always appreciate their creative input on how we can work on investor targeting and outreach to investors in this market. That makes a big difference.”

An ever-changing tune

As SAP adapts to technological change, there is no doubt that IR will follow suit. However, this will not significantly change the team’s core beliefs. “There will always be technological change, but again, IR will always be about direct and thoughtful interaction with our followers on the buy side and the sell side,” Gruber reiterates. “This will be hard to replace with artificial intelligence.”

One of Gruber’s favourite films, about the award-winning French string quartet Quatuor Ébène and called 4, provides a behind-the-scenes observation of the musical and human processes usually hidden from the eyes of the concert audience. In the same way, a lot of behind-the-scenes work needs to happen in IR to make an impact.

It’s exactly this type of skillful composition that sustains the attention of an audience.

Stefan Gruber’s tips for a successful IR meeting:

- Know your audience, whether it’s a one-on-one or a small group. Ask for their thoughts and perspectives at the beginning of the meeting

- The buy side and sell side suffer from information overload, so they need clear communication and help with focussing on what is important

- Avoid industry jargon. In a marketing-driven industry, there is always a risk that you use all these technology buzzwords, so try to avoid them

- Understand your communication in a wider context. It’s not just about your company but your company in a competitive environment, and the core differentiators of your strategy

The Deutsche Bank view

As innovative companies such as SAP look to raise their profile in important capital markets, our Depositary Receipts team will continue the close cooperation with them to support their long-term ambitions

Jose Sicilia

Managing Director

Global Head of Trust and Agency Services at Deutsche Bank

Sources

1 See https://bit.ly/3sZp4Kk at wikipedia.org

2 See https://bit.ly/2UjFC19 at dataversity.net

3 See SAP Corporate Fact Sheet from January 2019

4 See https://prn.to/2FIlsEy at prnewswire.com

5 At the time of publication of the full year annual report 2018

6 See https://bit.ly/2gVjp33 at esma.europa.eu

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-up