16 September 2024

The US-dollar is the dominant currency in the global energy market – which is why managing FX risks is a key task for utility companies like Spanish Endesa. flow explores how Endesa’s treasury team has managed to link payment flows with FX trades and drive automation

MINUTES min read

Seeking to foster a stable and reliable supply of energy to support economic and industrial growth, in 1944 Spain’s government founded a new electricity company – Compañía de Electricidad de España. Over the seven decades since, more than just the company’s name – which today is Endesa S.A. (Endesa) – has changed.

In this time, Endesa, now majority-owned by Italian multinational Enel group, has grown to become one of the the largest utility companies in Spain, and is the second-biggest operator in the Portuguese electricity market. Today, the company operates across three core business lines: generation, distribution and sales. In 2023, Endesa produced 60,264 GWh of electricity, distributed to about 22 million people and sold energy and gas to 10 million customers across Europe.1

Despite its European roots, Endesa works with a host of third parties further afield to meet the energy needs of its customers. Ensuring that these partners receive timely payments, in the correct currency, was the challenge faced by its treasury team.

Navigating international energy markets

Much of the global energy market is denominated in US Dollar (USD), which means that contracts for critical commodities – such as crude oil or natural gas – are typically settled in USD. The use of USD helps to faciliate liquidity and standardisation for the energy sector – and international trade more broadly – but the associated foreign exchange (FX) risks pose a challenge for the treasury teams of global energy companies.

For example, Endesa might import natural gas on the international energy market. While the purchase contracts for natural gas are denominated in USD, the company sells the natural gas to consumers and businesses within Europe – meaning that their core earning revenue will be denominated in euros (EUR). This creates a currency mismatch between the company’s expenses and sales – and it falls to treasury to manage this dynamic.

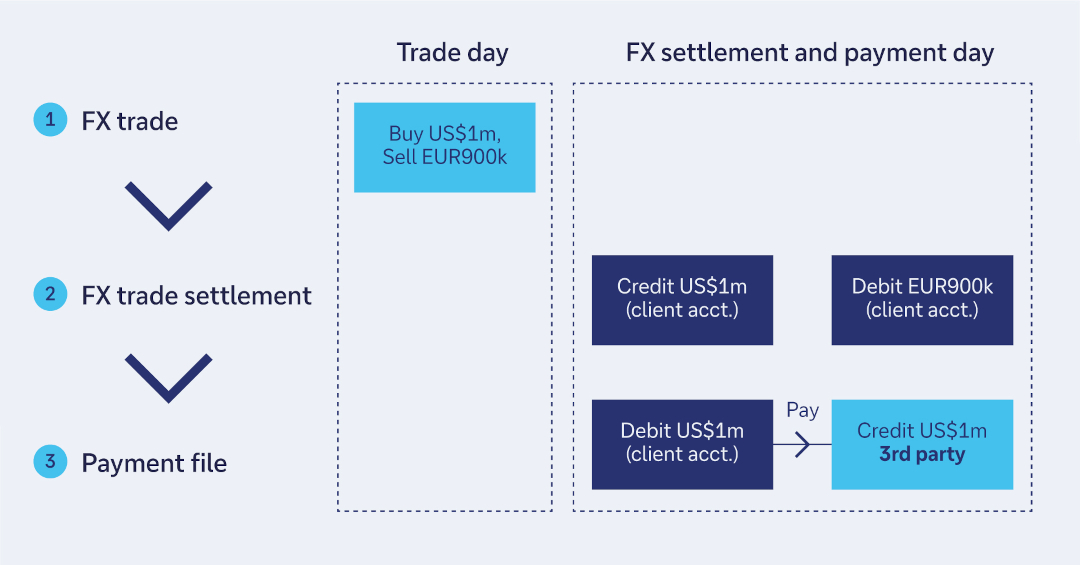

To navigate the task, FX transactions typically settle according to pre-agreed Standard Settlement Instructions (SSI), which help ensure an efficient, reliable, and cost-effective FX transaction process. For this to work, the company maintains foreign currency accounts, where the funds are settled. However, complexities arise where the company needs to use the FX proceeds for onward payment flows. The disconnect between the FX and payment process necessitates a multi-step approach: executing and settling the FX trade, confirming the transaction details, and then authorising the onward payment (see Figure 1). The manual nature of this process brings with it significant operational challenges.

Figure 1: Disconnected FX and payment process

Source: Deutsche Bank

The challenge of manual payments

Until recently, Endesa was executing its FX transactions through a multibank platform. Having received a payment request from Endesa’s administrative department, the treasury team would ask the front office to make spot purchases for this payment using Bloomberg’s FXGO multi-bank FX trading platform. Once the purchase was complete, the treasury team would be informed of the exchange rate used.

Treasury would then manually add the exchange rate into their enterprise resource planning (ERP) system. The ERP system generated a physical letter, which was digitally signed by the relevant parties. This signed letter was then downloaded from the ERP system and emailed to the banks, which would then look to settle the payment to the third party.

“Manual payments introduce more opportunities for errors, and, in turn, bring greater risks,” explains Francisco Casais Muñoz, Head of Cash Management, Endesa S.A. “Settlements were also slow because straight-through processing was not applicable using this workflow, and in most cases, the banks required a call back to confirm payment details before the payment could be executed – adding further delays to the overall process.”

“Manual payments introduce more opportunities for errors, and, in turn, bring greater risks”

To navigate the operational challenges introduced by Endesa’s existing processes, the treasury team wanted to achieve flexibility of FX execution via a multi-bank platform, while utilising the FX proceeds for payments in a seamless manner. This would involve linking payments automatically to multibank trading platforms, such that the FX and payment processes were seamlessly connected in a single workflow. While this is a simple idea, achieving it is less easy.

Linking third-party payment instructions to the various trading platforms – with the aim of making the process fully automated and electronic across all banking partners – would typically require a series of bespoke changes to the existing payment files to ensure that they match the FX trade.

“We have been talking with banking partners for years on this topic and each one has a different solution to input details of the trades,” says Casais. “This would require us to develop special payment files for each bank, which is impossible to achieve within our system because it's so complex.”

Connecting FX and payment workflows

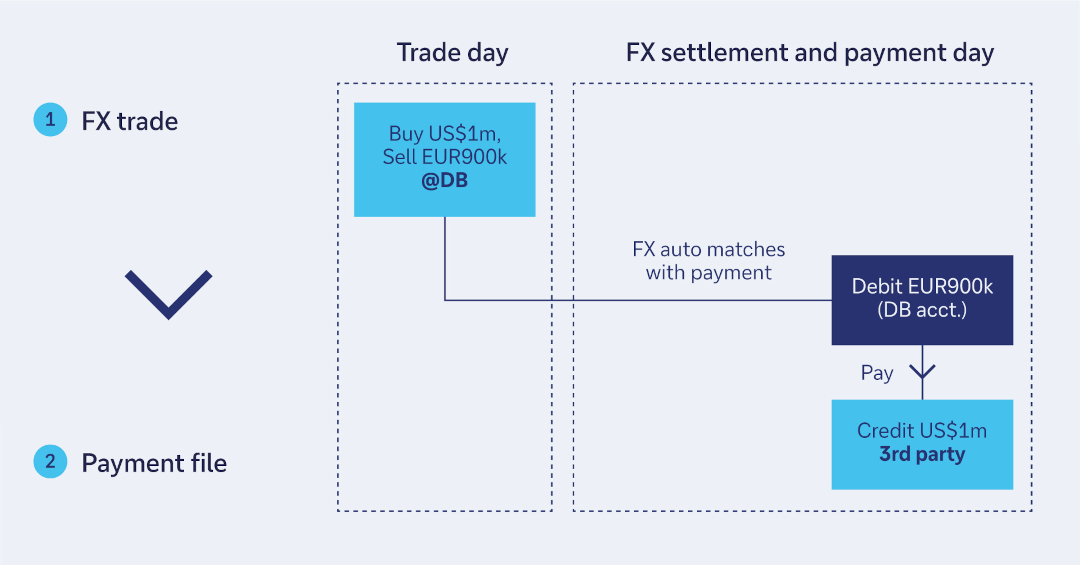

To address these challenges, Deutsche Bank worked with Endesa to develop a solution based on its FX4Cash Matching Service. The solution auto-matches trade information from markets infrastructure with payment information from cash management using currency pair, amount and value data – allowing the treasury team to seamlessly link a cross-currency payment with an FX trade. (see Figure 2). This renders obsolete foreign currency accounts that are maintained purely to settle FX for onward third-party payments.

Figure 2: Linked FX and payment process

Source: Deutsche Bank

“Instead of requesting a custom adaptation that would disrupt or change Endesa's workflow and would not be scalable across other partner banks, we worked closely with the treasury team to develop a solution that used the existing workflow and available international payment standards,” adds Michel Ahnine, Head of Corporate Cash Management Sales France, Italy & Iberia, Deutsche Bank.

“We worked closely with the treasury team to develop a solution that used the existing workflow”

The new workflow helps to standardise the process by using the same XML payment files (Pain.001) as for international payments – meaning that the payment files do not require any changes or additional references. “As a result of the implementation, important, high-value payments, made three to four times per week, are now processed faster, more efficiently, and accurately than before,” says Casais.

In addition to providing Endesa with execution flexibility for high-value transactions, the solution can be used to settle an FX trade to a third party without going through the markets third-party payment process, as well as to link a third-party payment to an FX hedge.

Endesa’s treasury team now intends to implement this best practice solution with all its partner banks, thanks to the structure created being fully replicable and scalable for the company's future banking partners – allowing them to ensure long-term efficiency gains as Endesa expands its operations.

Note: Header image is ©Endesa

Endesa won a Highly Commended Best Foreign Exchange Solution Award at the Adam Smith Treasury Awards 2024