3 May 2022

In November 2022, the Eurosystem, EBA Clearing, and SWIFT will all migrate to the new, global payment messaging standard ISO 20022. With less than seven months to go, flow explores the challenges so far – and those that still lie ahead for the industry

MINUTES min read

Few would contend that the planned migration to ISO 20022 – the new, global payment messaging standard – has been straightforward. The migration strategies proposed by the major market infrastructures and SWIFT have, for a variety of reasons, been a moving target – with significant changes being announced as recently as March this year.

But now, with less than seven months to go before the European high-value and cross-border payments will go-live over the weekend 19/20 November 1, it seems likely the target is finally still – and financial institutions around the world are waiting with their arrows. As the go-live weekend draws nearer, what final preparations lie ahead?

Another bump in the road

In 2020, as the Covid-19 pandemic unfolded, the world’s high-value payment systems, as well as SWIFT in the correspondent banking space, announced significant changes and delays to their migration strategies.2 These delays were seen as a much-needed respite during a particularly resource-intensive period. At the start of this year, however, it seemed as if the move to ISO 20022 was finally back on track – but there were still more changes to come.

“The changes to the timelines are impacting us quite significantly”

“The changes to the timelines are impacting us quite significantly,” explained Christopher Gardner, Programme Manager at Deutsche Bank. “Take the Bank of England’s [BoE] revised approach, for example. We have been very much an early adopter, making sure our understanding and technical deliveries are in place well ahead of the deadlines for market testing. This meant that when the BoE announced the changes to its timeline – as well as its approach – we had already spent a lot of time and effort ensuring we were ready,” he added.

In January 2022, the UK central bank had announced that migration of CHAPS to ISO 20022 will now take place as a single event in April 2023, rather than in two separate stages in June 2022 (migration from legacy MT to MX ISO20022 messages) and February 2023 (enablement of enhanced data).3

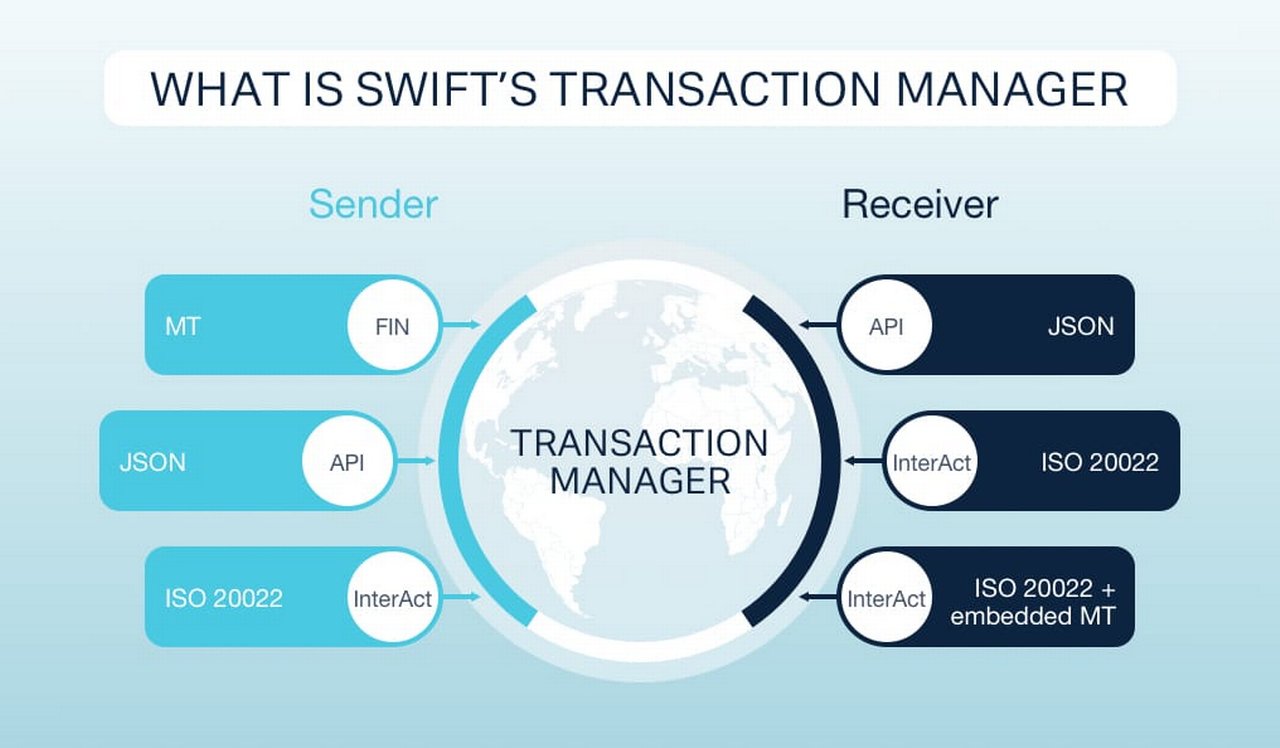

Soon after, SWIFT announced that the full scope of its Transaction Manager (see Figure 1)4, the creation of which was one of the major reasons behind the 2020 delay, would not be available from November 2022 as originally planned. While the Transaction Manager will still technically be live from this date, the full scope of the functionality will not go live until March 2023 (following an activation period of between six and nine months). This means that the myriad challenges the Transaction Manager sought to fix, will return to the top of the industry’s agenda unsolved for up to nine months longer than originally planned.

Figure 1: What SWIFT’s Transaction Manager does

Source: Deutsche Bank

In particular, banks are once again facing the issue of the weakest link in the chain. In the existing cross-border payment flow, financial institutions pass transaction data directly on to the next party in the chain. This means that the least rich message format in the chain determines what data is received by the end beneficiary – thereby limiting the benefits of the enriched ISO 20022 format.

Once the Transaction Manager goes live, financial institutions will instead exchange transaction data directly with the central platform, which will maintain a central copy that is used to orchestrate the payment. Regardless of whether all banks in the chain are ISO 20022-ready, this new message flow will mean that the complete transaction data is maintained end-to-end.

Now that this option won’t be available for months to come, an alternative solution would be for banks to send the missing information on as an MT199 message. But, as Gardner explains, “to do this for every message would be incredibly time intensive – and there is a clear need for the market to come up with best practice guidance on how to acquire the truncated information.”

Test, test, test

By now, testing of ISO20022 should be well under way. This is certainly the case for Banque Internationale à Luxembourg (BIL) – the oldest multi-business bank in Luxembourg. “We started with our internal testing at the start of 2022, have just recently begun testing with a sparring partner for both the SWIFT and European migrations, and will soon move on to industry testing,” explains Romain Reinhard, Head of Payments and Ancillary Services, BIL.

But with so little time left, what parts of testing are most important to ensure a seamless transition? “In these next few months, the focus should not be on the vanilla flows but the trickier flows – those that may cause issues come the go-live date,” explains Gardner. For example, one of the more technical challenges that has emerged from testing is cancellation and return messages. While it seems like a very simple process, there are so many scenarios involved around how you can cancel or return a payment. “These vary from one market infrastructure to the next and need additional focus, especially for those working in multiple regions,” he adds.

For Reinhard, one of the focuses will be on getting the investigation teams up to speed on using the new standard. “This training will be important because the flows will be different, and especially because some parts will be performed using ISO messages, while others will remain on MT. In the correspondent banking space, for example, the ISO 20022 investigation standards will only be finalised and deployed at the end of 2023,” he reflects.

The go-live weekend

The implementation will, invariably, be a very stressful time for all involved. For Deutsche Bank, the operational aspect of the go-live weekend is one of the biggest concerns – and, naturally, there are plans in place to mitigate this. Some jurisdictions, such as Switzerland and the Philippines, have already made the switch to ISO 20022. For those involved in these early deliveries, the experience has proved invaluable. “Thanks to the bank’s extensive branch network, we have been able to leverage our experience as an early adopter to get a better feel for the operational challenges we will face come November,” said Gardner.

“Operational, treasury and IT departments – as well as the call desk for our clients – will all be on standby over the go-live weekend, and come the following Monday, it will be all hands on deck”

BIL also has experience of ISO 20022, having used the format since the migration of the Swiss Interbank Clearing system a few years back. “It certainly helps that our staff are already familiar with the new ISO format. It also means that we know what to expect on a basic level. Come the implementation date, we will make sure all the procedures and parameters are in place – then it is a case of crossing your fingers and being prepared to react if something goes wrong,” explains Reinhard. “The unique difficulty this time around, however, will be the double migration aspect. Operational, treasury and IT departments – as well as the call desk for our clients – will all be on standby over the go-live weekend, and come the following Monday, it will be all hands on deck.”

He also makes the point that a large project such as ISO 20022 migration when run in parallel with an overhaul of internal systems has significant operational impact if the scope of that migration suddenly changes. For BIL, the misalignment of the launch of ISO 20022 and the launch of their new core banking system is creating a unique set of needs anyway.

“We are set to replace our core banking system in January 2023, which means that, come November 2022 – when the migration to ISO 20022 goes live for high-value payments in Europe and cross-border payments globally – we will still be using our current, and soon-to-be legacy, core banking system,” notes Reinhard. “As such, our plan is to make the minimum number of changes required, before then migrating with a “big bang” approach once the new system is in place. For this strategy to work, we are reliant on an onsite translation for European high-value payments and SWIFT’s in-flow translation for cross border payments.”

He is not alone in hoping that there will be no further last-minute changes. Deutsche Bank is also planning a complete overhaul of their legacy systems in preparation for ISO 20022. “Our migration is not just a case of flicking a converter on and carrying on as usual,” says Gardner. “We have made significant investments into fundamentally improving our existing infrastructure, which we will then be able to leverage to incorporate further innovations in the years ahead.”

Eventually, ISO20022 will be the beginning of a new era in the payment industry – providing benefits to banks and corporates alike. However, the next couple of months will be hard work.

Sources

1 See https://bit.ly/3ONPx8D at ebaclearing.eu

2 See https://bit.ly/39syk4j at ecb.europa.eu

3 See https://bit.ly/39vihTv at bankofengland.co.uk

4 See What is swift`s transaction manager and what more is needed to ace ISO 20022 transition? at corporates.db.com

Cash management solutions Explore more

Find out more about our Cash management solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

CASH MANAGEMENT, TECHNOLOGY

Keeping the SWIFT network secure Keeping the SWIFT network secure

As the number of cyber attacks on financial institutions increases, SWIFT needs to further safeguard its network. flow’s Desirée Buchholz reports on why the Customer Security Programme is key – and how banks should prepare for the upcoming changes in 2022

CASH MANAGEMENT, TECHNOLOGY

SWIFT Go: Low value payments rethought SWIFT Go: Low value payments rethought

The launch of SWIFT Go is a milestone for the cross-border payments space. As the story continues to develop, flow explores how the industry is driving the initiative forward – and how companies could benefit

CASH MANAGEMENT, TECHNOLOGY

A new era for payment validation A new era for payment validation

As payments become increasingly fast, minimising fraud risk and ensuring visibility is gaining importance. flow explores how the faster payments space is evolving and how pre-validation will help financial institutions and corporates