9 December 2021

The launch of SWIFT Go is a milestone for the cross-border payments space. As the story continues to develop, flow explores how the industry is driving the initiative forward – and how companies could benefit

MINUTES min read

The banking industry remains under enormous pressure to improve cross-border payments. In order to address the growing competition of Fintechs and other non-bank players, they need to focus on enabling instant and frictionless transactions with full transparency and strong security. To tackle some of the remaining pain points, SWIFT launched a new service in July 2021.

Known as SWIFT Go, it is designed to enable faster, more predictable and competitively priced low-value cross-border payments for small businesses and consumers. So far, 11 global banks, collectively handling more than 41 million low-value cross-border payments per year, have already gone live with the service and 120 banks have also signed up, with many more expected to join.1 So how is the industry driving the initiative forward?

Building on gpi

SWIFT intends the new service to build upon the foundational success of SWIFT gpi, which was launched four years ago and has already significantly improved high-value cross-border payments in terms of speed, transparency and tracking capabilities, as flow reported in the September 2021 article “SWIFT gpi: a progress report”.

Speaking at this year’s Festival of Finance, Sebastian Rojas, Head of Product, Payment Solutions, SWIFT noted, “when we introduced gpi a few years ago, the intention was to start introducing best practices at a multilateral level between banks. The focus was on transparency, the ability to monitor payments and – perhaps most importantly – the effort to bring finality of credit to international payments. Today we can see that banks are providing this visibility to end clients and, from a B2B perspective, therefore, we have dramatically improved high-value cross-border transactions.”

With those foundations laid, the banking community is able to respond to further client expectations and industry developments. One such example is that the payment industry is gradually moving towards full principal pay solutions – where the full amount sent by the payer is exactly equal to the full amount received by the beneficiary and no deductions are made along the way, which means end-to-end pricing transparency up-front. The roll-out of SWIFT Go is the banking community’s answer to this industry trend and is also a direct response to new entrants that are offering services for retail and low-value payments.

“Our top priority when developing SWIFT Go was predictability upfront”

“Our top priority when developing SWIFT Go was predictability upfront – to ensure that a bank is able to indicate how much the payment will cost and when it will be credited,” explained Rojas. He continued, “we wanted to ensure that SWIFT Go could build on existing investments, while also simplifying processes. We hope this will result in a better offering for the end user, not just in terms of speed, transparency and predictability, but also price.”

Figure 1: How does SWIFT Go work? (click to enlarge)

Source: SWIFT

SWIFT Go is designed to provide a seamless service offering for banks and clients alike, and can help improve low-value payments in three main ways:

- An enhanced customer offering: This can be delivered through full predictability of payment conditions (time, fees, amount) and by the full payment value being delivered to end customers through SWIFT Go banks. In turn, this will result in improved payment processing, which can even be performed instantly where available.

- Increased harmonisation: The single format requirement where a common currency guide is provided for SWIFT Go banks, as well as simplified fee options to help banks bilaterally agree, implement and calculate the commercial conditions for SWIFT Go, will foster standardisation.

- Cost reduction: This common currency guide, along with stricter network validation and SWIFT Go’s Reporting Engine, which supports reconciliation and bilateral billing, will drive higher straight-through-processing (STP) rates between correspondents, reducing costs. There is also a roadmap to achieve full STP over time.

An industry-wide effort

For Marc Recker, Global Head of Product, Institutional Cash Management at Deutsche Bank, the strength of this network is critical. “The biggest asset we have as correspondent banks is the network. If we can provide access to the reach of 11,000 banks across the globe, there is no solution that can compete with the correspondent banking industry,” he said.

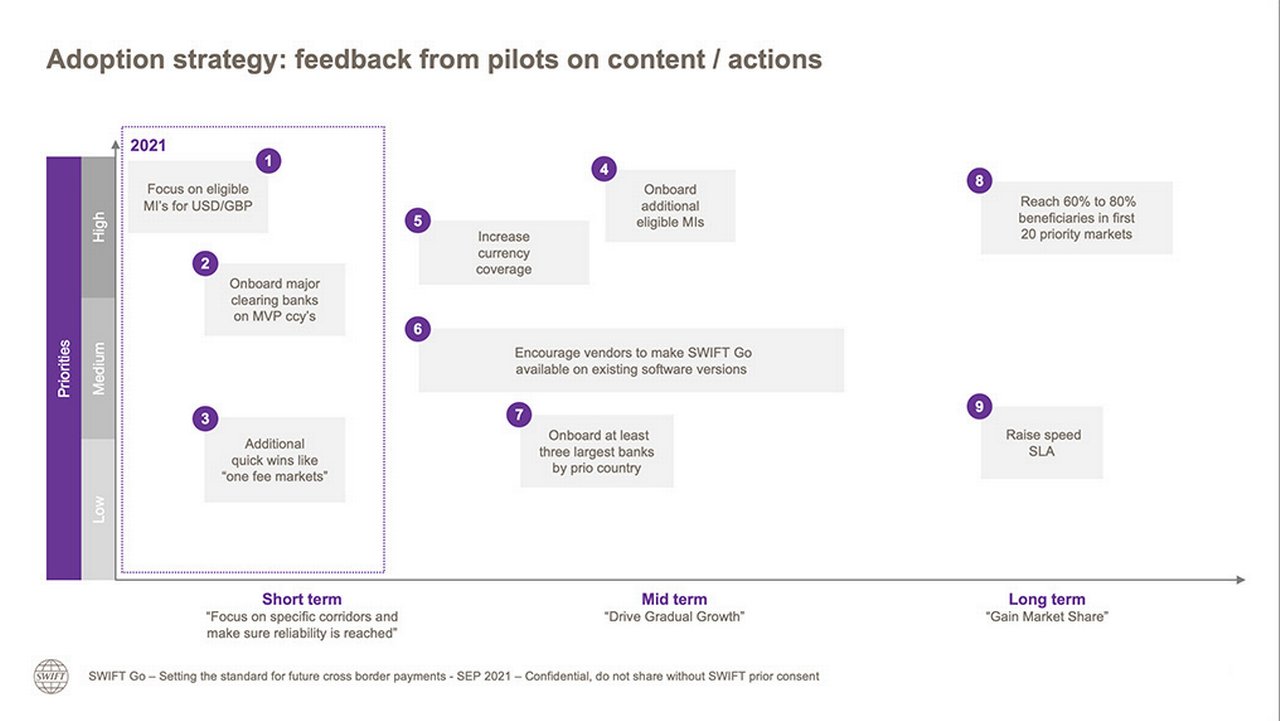

As a result, the first phase of SWIFT’s adoption strategy for the new service is focused on onboarding the major eligible market infrastructures and clearing banks, providing a strong foundation for growth (see Figure 2 for an outline of the full strategy).

Figure 2: SWIFT Go adoption strategy (click to enlarge)

Source: SWIFT

The next step is to align the initiation process with customer needs and expectations, lowering the barriers to execution. Core features, such as predictability of duration, fees and amount will enhance utility and ease for customers at SWIFT Go banks. With that comes the security and reliability offered by correspondent banks.

“In the end, SWIFT Go offers us a competitive advantage. We need to think as an industry about how we can overcome some of the initial complexity on the client side to unlock these long-term benefits – and one of the ways to do this will be through standardisation,” noted Recker.

Next steps

The SWIFT Go journey is just beginning – and an ambitious roadmap lies ahead. Application programming interfaces (APIs), for instance, are being heavily discussed by the SWIFT Go working group, which is looking to define eligibility APIs that will allow for more dynamic conversations between banks for specific flows.

“We should continue collaborating together as an industry to create market utilities in the non-competitive space that will help us to drive the industry forward”

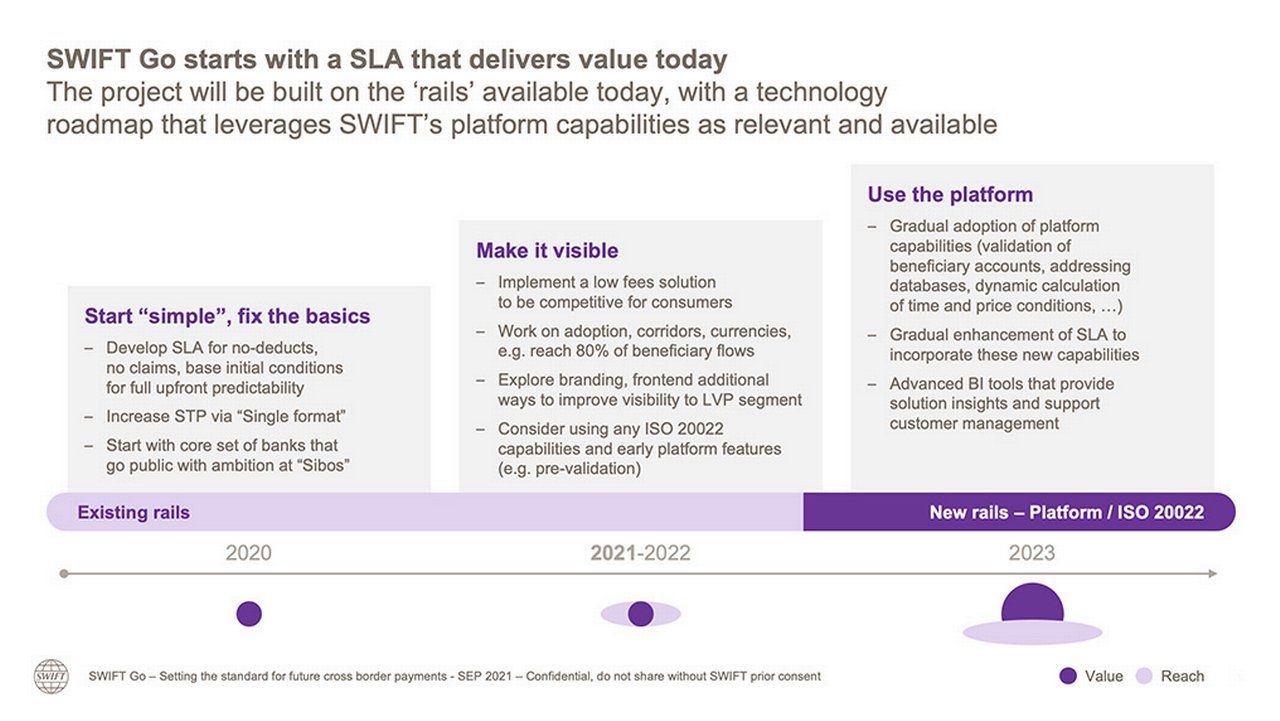

Widespread support of the SWIFT Go service will be the key to its success. As demonstrated by SWIFT gpi, the more organisations that adopt a solution such as this, the more ubiquitous it will become. A crucial next step will therefore be to build up adoption, corridors and currencies, with an aim of reaching 80% of beneficiary flows by 2022 (see Figure 3).

Figure 3: An ambitious roadmap (click to enlarge)

Source: SWIFT

“In general, we should continue collaborating together as an industry to create market utilities in the non-competitive space that will help us to drive the industry forward. This includes working with SWIFT on topics such as the Beneficiary Account Validation service, as once these value-add services are available on SWIFT, they will also be available on SWIFT Go,” concluded Recker.

Cash management solutions Explore more

Find out more about our Cash management solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

CASH MANAGEMENT, TECHNOLOGY

SWIFT gpi: a progress report SWIFT gpi: a progress report

As SWIFT’s gpi initiative approaches its fifth anniversary, many of its original goals have been achieved since the 2017 launch while more recent fine tuning has enhanced the service. What’s next on the agenda? The flow team reports

CASH MANAGEMENT, TECHNOLOGY {icon-book}

Reimagining the future of payments Reimagining the future of payments

The pandemic has accelerated the pace of change over the past year and bank-led merchant solutions are among the responses to a huge shift in payment methods and the boost to e-commerce, reports Helen Sanders

CASH MANAGEMENT

CBDCs and the impact on cross-border payments CBDCs and the impact on cross-border payments

A growing buzz around central bank digital currencies (CBDCs) is seeing proofs of concept and pilots worked on by many central banks across the world. As these schemes gain traction, Deutsche Bank’s Bradley Lonnen, Alexander Bechtel and Marc Recker outlined in a webinar how CBDCs could transform cross-border payments