17 August 2023

The harmonisation of ISO 20022 corporate-to-bank messages for cash management dates back to 2009. Now is the chance to make a step forward, three industry experts argue in an article first published in TMI

MINUTES min read

In March, the global banking community started the process of moving to ISO 20022 – the new global messaging standard for high-value and cross-border payments.1 While this marks an important milestone for the correspondent banking space, it also puts spotlight on how corporate cash management can benefit from ISO 20022 messaging.

This debate is not entirely new, but the forthcoming implementation of the core corporate-to-bank and bank-to-corporate messages based on the ISO 2019 maintenance release offer new opportunities. Three industry experts share why the corporate community should see a compelling business case in this new de facto standard – and what banks need to do to make this happen.

To some, the CGI-MP (Common Global Implementation-Market Practice) Group is just another acronym in the financial sector that was around during the early days of the ISO 20022 XML messaging standard. Formed in October 2009, the CGI-MP objective was crystal clear: “A corporate can use the same message structure for all their payments with all of their transaction banks reaching any payment system across the globe”.2

Today, the CGI-MP comprises 350 members including banks, bank associations, corporates, corporate associations, consultants, fintechs, software vendors, clearing associations, and market infrastructures with Swift Standards having an integral support role. Importantly, the CGI-MP has continued to play a proactive part in the evolution and adoption of ISO 20022.

The original objective of the CGI-MP was to remove the friction that existed in the multi-banking space as a result of the complexity, inefficiency, and cost of corporates having to support proprietary bank formats. The adoption of ISO 20022 provided the opportunity to simplify and standardise the multi-banking environment, with the added benefit of providing a more portable messaging structure.

Challenges around ISO20022 migration for corporates

However, even with the work of the CGI-MP group, which produced and published implementation guidelines back in 2009, the corporate community has encountered a significant number of challenges as part of their adoption of this global financial messaging standard.

Figure 1 highlights some of the core friction points over the past 14 years, which have resulted in the corporate community achieving a sub-optimal cash management architecture. Significant divergence in terms of the banks’ implementation of this standard (pain.001 V03) covers a number of aspects. The differing use of the core service level codes for payment method identification, where and how regulatory reporting information is provided, identification of the sending customer, and payment batching logic all translate into additional complexity, inefficiency, and cost on the corporate side.

Figure 1: Key implementation friction points

Furthermore, an original core principle of the CGI-MP was around data over-population, which enabled corporates to establish a more generic XML template by providing excess information to all banking partners to minimise customisation. One common example of this is around bank data – the Business Identifier Code (BIC, which is ISO 9362), local bank routing code, branch code, bank name and address.

For many corporates, they maintain all of these data points within the bank master record, so from a message design and build perspective, it’s easier to pass this information through, if it is maintained, with the banks extracting the relevant data point based on the requested payment method. Clearly, this principle requires the originating customer to provide the required minimum data and ensure that there is no conflicting data. However, despite the benefits this core principle delivers to the corporate community, it was adopted by very few banks.

New CGI-MP implementation guidelines reflect the lessons learned

For the corporate community to see a compelling business case around the migration to pain.001 V09, the banking community has to embrace a more prescriptive mindset that will help deliver a win-win situation. We need to remove the numerous friction points mentioned above to be addressed. Banks that follow the same ‘lift-and-shift’ logic to how they developed pain.001 V03, which typically followed the core logic of their own proprietary file formats, will be missing a real opportunity to remove friction and accelerate implementations.

“The guidelines now make it clear which service level codes apply to each electronic payment method”

The cornerstone to the new CGI-MP pain.001 V09/pain.002 V10 implementation guidelines is the more prescriptive approach that has been taken. The guidelines now make it clear which service level codes apply to each electronic payment method to make it easier for banks to standardise and simplify their own XML corporate-to-bank service proposition. XML pain.001 V09 is about reflecting on the lessons learned and recognition of where the collaborative and competitive boundaries exist.

Another important feature will be around supporting additional data, providing this does not create any conflict with a specific payment method, or conflict with any compliance policy. Examples include identification of the sender of the XML file – with the XML message structure allowing the corporate to send multiple data points such as name, BIC and even a proprietary identification to enable the corporate to design a single group header record template for all banking partners.

More visibility on the local country rules

The CGI-MP has also completely redesigned the XML pain.001 V09 Appendix B document, which supports the Usage Guidelines on MyStandards (link) by providing greater visibility on the local country rules (like central bank reporting). Appendix B now lists the available electronic payment methods in more than 40 countries across the regions, combined with a series of detailed tabs to support a drill down of the more complex local requirements.

The CGI-MP is recommending a more prescriptive approach around the adoption of these guidelines and the implementation of the relevant data points, e.g. by a new user handbook. If all banks can support the same service level code to identify a domestic urgent payment, for example, then it will help standardise and simplify the implementation effort. This approach will contribute to the materialisation of the adoption benefits.

“There is currently no requirement for the corporate community to migrate from either their existing XML pain.001 V03 or bank proprietary file formats”

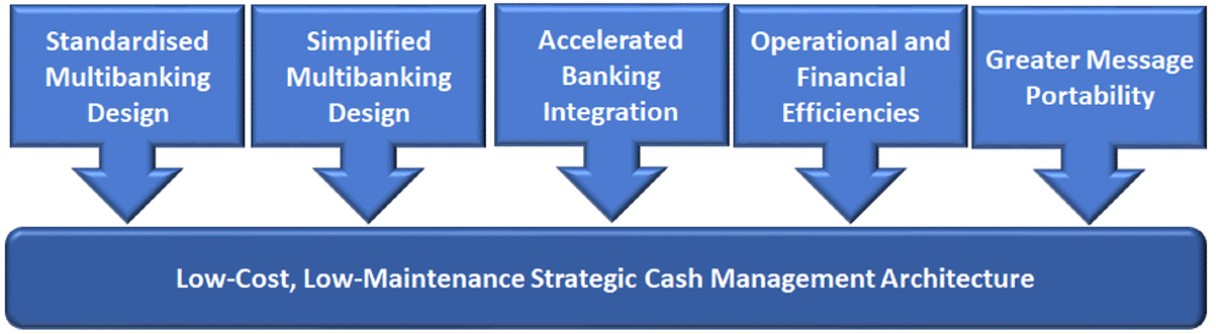

There is currently no requirement for the corporate community to migrate from either their existing XML pain.001 V03 or bank proprietary file formats. The key question that the corporate community will be asking is to ascertain the benefits of migration. Figure 2 highlights the main core benefits of adoption.

Figure 2: Core adoption benefits

These new implementation guidelines combined with a more prescriptive mindset around bank adoption provides the first major benefit to the corporate community – the real possibility of removing friction between banks. And while we have to be realistic about the potential level of alignment across the banking community due to possible legacy system limitations, the potential for the corporate to simplify and standardise their pain.001 V09 implementations will be a key benefit and therefore incentive to migrate.

Linked closely to the first point is the acceleration of implementations due to the higher levels of standardisation across banking partners and the more structured way of supporting additional local country rules. Faster development, testing, and simplified maintenance will lead to a lower overall total cost of ownership of the banking integration systems landscape.

The second major benefit is around the preferred structured data approach. Banks now have an opportunity to redefine what is possible in terms of the provision of data back to corporates – and richer data will enable the acceleration and automation of the reconciliation process – improving straight-through processing (STP) and straight-through reconciliation (STR) rates. A good example here is the long-awaited support of structured remittance information.

With the corporate community also providing more structured data, this will help banks achieve higher payment automation and compliance processing rates, reducing manual intervention and delivering a higher-quality customer experience.

The work of the CGI-MP now provides clear guidance to the banking and the software vendor communities around the opportunity to remove existing friction through greater simplification and standardisation in the cash management space. The benefits around ISO 20022 messaging in terms of structure and richness of data are evident. The time is now to provide a more frictionless ISO 20022 payment environment to the corporate community.

This article was first published here in Treasury Management International (TMI) www.treasury-management.com on 27 July 2023