4 May 2022

ISO 20022 promises to unlock new opportunities for the payment industry – from richer data to improved fraud protection and cash positioning. flow explores how participants can take full advantage of the new standard

MINUTES min read

International payments is a global network business that involves numerous parties. At present, there is a lack of harmonised standards and rules for the exchange of information between these parties, which often results in an inefficient payment process.

A number of initiatives and organisations have strived to achieve this standardisation over the years. Yet, it is the decision by major central banks and SWIFT to migrate to ISO 20022 that signifies the biggest breakthrough to date. The International Organization for Standardisation (ISO) first published ISO 20022 – a global standard for payments messaging – in 2004. The new standard creates a common language for payments data across the globe, enabling faster processing and improved reconciliation.1

The industry has been on its ISO 20022 journey for a number of years now – and is closing in on several significant milestones. This November, a number of key infrastructures, including Target2, EBA Clearing and SWIFT, will migrate to ISO 20022. Readiness is, therefore, the key word on everybody’s lips.2

Ahead of this implementation it is important for participants to take stock of the opportunities and challenges that lie on the road ahead. So, what benefits does ISO 20022 bring? And how can banks ensure they maximise on their investment to taking digital transformation to the next level?

“ISO 20022 should not be seen as a burden, it should be seen as the beginning of a new era”

“ISO 20022 should not be seen as a burden, it should be seen as the beginning of a new era,” said Charles De Rougé, Head of SaaS Solution – Financial Messaging, Bottomline Technologies in a webinar hosted by Bottomline and Finextra. “It is an opportunity to gain market advantage and fundamentally change the way things are done.”

Opportunities unlocked

The new standard will introduce new data components, meaning that far richer information can be transmitted alongside the transaction in comparison to existing formats. This, in turn, will allow banks to provide better customer service – for example, by enhancing straight-through processing.

Hence, even though the migration from MT to MX (ISO 20022) messages initially focuses on the interbank space, the introduction of the new formats also affects the corporate banking space. Corporates stand to gain significantly, with standardised formats and processes for payment reporting and exception handling messages facilitating end-to-end automation across the corporate banking ecosystem – from invoicing and liquidity management, to exception handling and reconciliation.

“As we are developing our understanding it is becoming obvious that ISO 20022 is not just a standard – it will have a wide impact on how the community interacts,” added Christopher Gardner, Programme Manager at Deutsche Bank. As ISO 20022 delivers much more detailed data, issues with misinterpretation are reduced. This lowers transaction costs, improves intraday liquidity management and enhances cash visibility.

However, there are a still number of open questions for corporates, including the suitability of certain message capabilities, character limits being too low, and the compatibility of structured addresses for certain jurisdictions – many of which could cause problems further down the line, as Mark Sutton, Senior Manager at Zanders pointed out. Nevertheless, he explained that “the opportunity for prescriptive and predictive analytics – as afforded by the structured data – is an area that could be of real benefit. I suspect this will become a table stake in the future – helping the beneficiary to further automate the cash application process.”

Fighting fraud

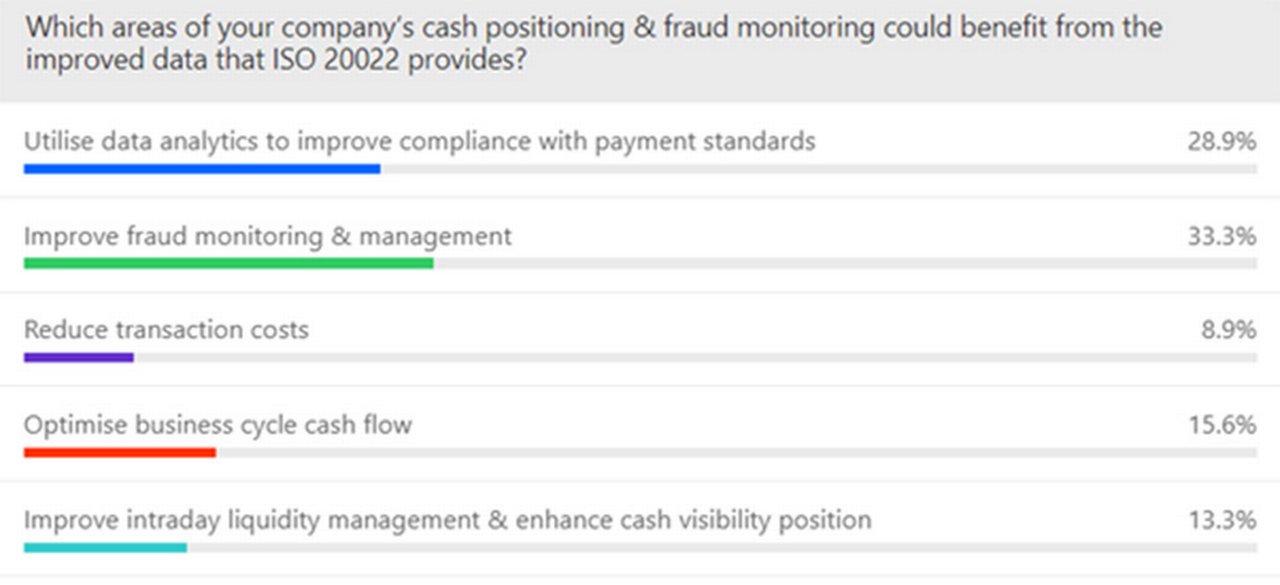

Another area which could see major improvements due to move to ISO 20022 is fraud prevention. As part of the Finextra webinar, participants were asked which areas of their company could benefit from the improved data ISO 20022 provide – with 33.3% choosing improved fraud monitoring and management, and a further 28.9% voting for data analytics.

Figure 1: Areas that could benefit from the improved data provided by ISO 20022

Source: Finextra Webinar

Currently, banks are facing a host of regulatory challenges – especially in the areas of anti-money-laundering (AML) compliance and fraud prevention – making the ability to rapidly process large amounts of data crucial. ISO 20022 could facilitate this, Becky Clements, Head of Industry Engagement, Pay.UK said during the webinar: “The richer nature of the new standard, and the enhanced data elements being introduced, such as purpose codes and more specific information about the account and account holder, will have a positive impact on fraud prevention.” For example, using enhanced data would enable sending and receiving banks to recognise ‘normal’ patterns of payment behaviour, she added “and when that isn’t the case, to more readily detect potentially fraudulent activity.”

“By having more structured data, and using standardised messages, it becomes easier to mine that data, and then provide better analysis and identification of possible fraudulent cases”

This richer data will not only help banks, but the entire payment industry to improve fraud prevention and detection tools that are being employed. “CFOs are looking very closely at how to mitigate fraud,” explained Sutton. “They're looking at outlier detection capabilities that look at patterns to identify whether a transaction could be fraudulent or not. Clearly, by having more structured data, and using standardised messages, it becomes easier to mine that data, and then provide better analysis and identification of possible fraudulent cases.”

However, these benefits will most likely not materialise immediately as it is important to remember that, come November, “we will likely see a limited amount of enhanced data,” Deutsche Bank’s Gardner pointed out: “There will be lots of translation and we will need to be aware of the truncation risk. As this becomes more mature, however, and we begin to receive additional identifiers, structured remittance data and structured addresses, the new standard will begin to play a significant role in the fight against fraud,” he added.

Bracing for change

As the industry approaches the key migration dates in November, there are several steps that should be taken by participants, as the flow article ISO 20022: Changes on the final stretch outlines.

The first mandatory aspect is to be able to receive MX messages by November 2022 – and all banks, whether large multinational or local banks, are getting ready for this connectivity requirement. Yet, outside of this mandatory item, there is a lot of variance in approach – and it is dependent on whether the participant plans to become fully ISO native from day one or take a step-by-step approach of their choosing.

For Deutsche Bank, for example, there are two distinct parts to their approach. “First, there are the mandatory changes – and we are pushing these forward as a priority,” explained Gardner. “The second part is that by the November 2022 deadline we aim to have 90% of our flows on ISO 20022.” In order to achieve this, the bank is taken an “invasive approach”, he said: “We are taking migration as an opportunity to simplify and modernise our architecture – replacing monolith applications with more agile and stable environments.”

While the end may seem in sight, it is actually just the beginning for ISO 20022. The new standard lays the foundation for vastly improved payment processing efficiency and interoperability among high value payment systems. It is, therefore, a journey with far-reaching implications for all financial institutions and corporates.

Sources

1 See https://bit.ly/3LzGwxP at corporates.db.com

2 For more information on migration strategies and timelines, see flow article ISO 20022: Changes on the final stretch

Cash management solutions Explore more

Find out more about our Cash management solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

CASH MANAGEMENT, TECHNOLOGY

ISO 20022: Changes on the final stretch ISO 20022: Changes on the final stretch

In November 2022, the Eurosystem, EBA Clearing, and SWIFT will all migrate to the new, global payment messaging standard ISO 20022. With just seven months to go, flow explores the challenges so far – and those that still lie ahead of the industry

CASH MANAGEMENT, TECHNOLOGY

Keeping the SWIFT network secure Keeping the SWIFT network secure

As the number of cyber attacks on financial institutions increases, SWIFT needs to further safeguard its network. flow’s Desirée Buchholz reports on why the Customer Security Programme is key – and how banks should prepare for the upcoming changes in 2022

CASH MANAGEMENT, TECHNOLOGY

How to prevent payments fraud How to prevent payments fraud

With payments fraud on the rise, how can treasury departments prepare the best line of defence against would-be fraudsters? flow reports on a recent EuroFinance webinar that explored new fraud patterns and how these risks are being addressed