17 November 2021

Driven by local governments’ desire to promote digital economies and financial inclusion, real-time payments are accelerating in APAC. In an Economist Impact webinar supported by Deutsche Bank, two corporate treasurers shared why instant payments and APIs are vital supply chain connectors. flow reports

MINUTES min read

Application programme interfaces (APIs) are a powerful technology for corporate treasurers because they facilitate operational efficiency and automation. The technology can provide significant benefits to businesses especially if used in combination with real-time payments. Therefore, companies in Asia Pacific are increasingly adopting APIs to connect to their banks – and the banks are ramping up their capabilities in this space. However, the technology has not yet become mainstream due to lack of standardisation and the need for a holistic API strategy that goes beyond treasury.

These are the key takeaways of a recent webinar on “New-Age payments: making the most of instant payments and APIs in APAC”, hosted by The Economist and supported by Deutsche Bank. Rishit Kumar Samrani, General Manager Finance & Treasury at Bosch India explained how Bosch India a leading supplier of technology and services leverages real-time payments to extend its business model. Also presenting the corporate perspective was Xuelin Chen, Director Group Treasury at Trip.com, who shared why APIs sit at the heart of this travel agency’s business.

They were joined by Rachel Whelan, Global Head of Transactional FX Product Management & APAC Head of Cash Management, Deutsche Bank. Moderating the session was Amit Mallick, Managing Director Global Open Banking & APIs Lead at Accenture.

Frontrunners in China and India

Right from the start of the webinar, it became clear that Asia Pacific is leading the charge when it comes to instant payments and APIs. One of the most prominent examples in the region is China with several tech companies such as Alibaba or Tencent building their entire business model around API connectivity.

“Connectivity to API is fundamental to our business model”

The same goes true for Trip.com, one of the world’s largest online travel agencies with more than one million suppliers and 400 million users. “Connectivity to API is fundamental to our business model,” explained Xuelin Chen. The company operates a platform for booking flights, hotels, trains, car rentals and attraction tickets. “All the flight schedules and price information are obtained in real time through APIs. We also opened up our business to other providers such as price comparison engines so that our deals appear on their platforms.”

To exchange information within a few seconds, the business infrastructure of the company is based on API connectivity. The finance department started as early as 2008 to build a treasury management system based on API connectivity with Chinese banks. “Treasury acts as a business partner to enable payments and FX flow as necessary for the enterprise,” Xuelin described.

While in China tech companies are driving payment innovation, in India the government is playing a big role when it comes to new development. The concept of a national real-time payment system dates back as far as 2009. After several years of development, the Unified Payment Interface (UPI) was officially launched for public use in May 2016 under the guidance of the Reserve Bank of India.1

UPI started in conjunction with AADHAR a national unique identity which in turn was to promote financial inclusion of the poorest and has by now become one of the most advanced 24/7 real-time architectures globally that is used for peer to peer, business-to-consumer and business-to-business payments alike, explained Bosch’s Rishit Kumar Samrani: “The scale of UPI is gigantic. In September, there were US$3.65bn instant payment transactions in India adding up to a volume of US$88bn.”2

According to him, an important success factor of the UPI is the cooperation between banks, providing the architecture, and distribution by fintech’s, which are managing the front end of the payment. “The payer needs to open a fintech app, scan a QR Code and the money gets transferred from his bank account to the vendor bank account,” explained Samrani. This process would not be possible without APIs. This process illustrates the relevance of this technology for a real-time payments’ world.

“Clients are seeing the benefits of foundational type APIs such as account balance and credit notification APIs. These areas have become a ‘must have’ for banks”

The necessity for banks to support APIs is increasing, confirmed Deutsche Bank’s Rachel Whelan: “Clients are seeing the benefits of foundational type APIs such as account balance and credit notification APIs. These areas have become a ‘must have’ for banks, and we are definitely seeing a higher uptake there.” However, she differentiated between different client types. “Our fintech clients absolutely expect API-enabled services while our traditional corporate clients are not necessarily asking for APIs yet because they are simply not ready yet.”

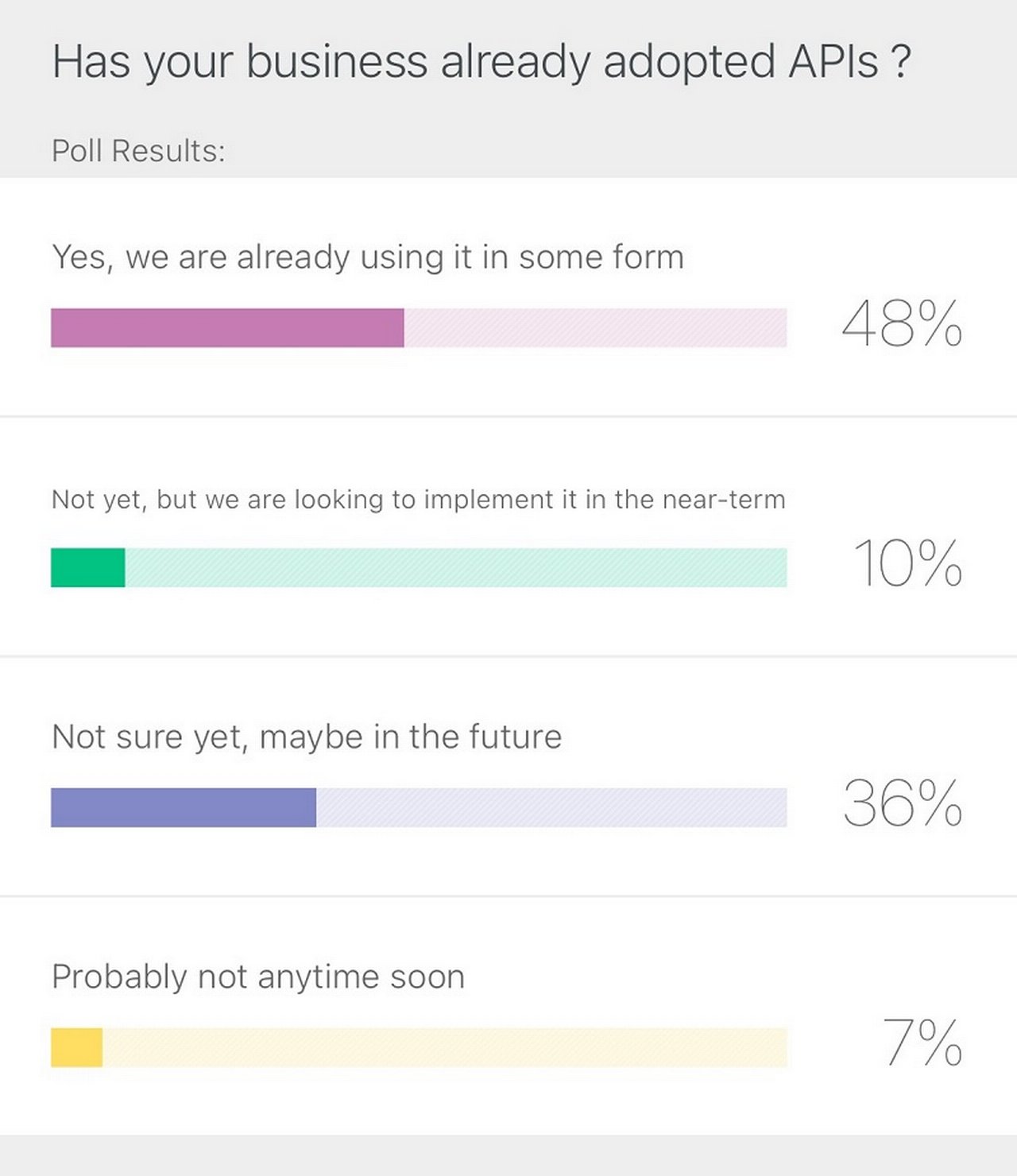

Therefore, it came as a small surprise to all the speakers that a poll held during the webinar showed that almost half of the participants are already using APIs in some form, while only 7% said that they probably will do not do so any time soon (see Figure 1). These polls, of course, always have a certain bias given that participants of a webinar on APIs would be expected to show more interest in this technology than the cross-section of companies.

Figure 1: Poll question on API usage

Current use cases

The question of whether to adopt APIs and instant payments is very much linked to the benefit companies expect from using this technology. The treasury team of Trip.com has identifies several use cases. One is associated with cash management, explained Xuelin: “In the past, we managed our cash balance end-of-day. Now, with APIs and instant payments we can achieve to have no surplus cash at any time of the day.” This allows the travel agency to reduce its cash buffer while having more money stay in the investment account. “Cash planning and usage have become more efficient,” said Xuelin.

The second use case she mentioned is associated with FX. In the past, the company used a trading platform to ask its banks for quotations. Now, Trip.com is using APIs to connect with its banks directly. “Our information does not go to a third-party platform which increases security,” she added.

Bosch’s Rishit Kumar Samrani gave an insight of how the companies’ automotive aftermarket division is leveraging UPI and API in India in partnership with Deutsche Bank to provide instant gratification to their customers there by improving customer experience and increase process efficiency around payments.

“It took 60 to 90 days for the refund to be made. Thanks to UPI and API this time was reduced to a few seconds”

First, one needs to understand the complex structure of the business: In the past, the aftermarket division sold lubricants to more than 800 distributors across India. Those in turn try to sell it to the local retailers where the end consumer – in this case a self-employed mechanic purchases the lubricants. “In the past, we would provide a coupon to the mechanic. Once the lubricant was opened, the mechanic had to go back to the retailer to collect the money. The retailer would then contact the distributor who eventually logged in to Bosch interface, and claim credit from Bosch,” explained Samrani. “It took 60 to 90 days the refund was made,” he recalled. “Thanks to UPI and API this time was reduced to a few seconds,” he says.

Because now, once lubricant is opened, the mechanic can use his smartphone to log into the Bosch interface directly. As a first-time user, he needs to enter basic information and his bank account details. This triggers the API which will automatically initiate a penny drop to validate the account. Then the mechanic scans a QR code which will trigger an API to Deutsche Bank. “Deutsche Bank will then provide the cash back via the UPI interface,” explained Samrani.

According to the treasurer, this has several benefits for Bosch: The payment and its reconciliation is done immediately reducing manual effort and improving cash management visibility. Furthermore, the company can approach the end consumer directly thereby increasing its data base on customer preferences and habits.

“We see a lot of our MNC clients changing their value chain”, adds Rachel Whelan, Global Head of Transactional FX Product Management & APAC Head of Cash Management, Deutsche Bank. “With Covid-19, the importance of selling directly to the consumer has increased significantly for large corporates. APIs help to automate payment, liquidity and FX flows end to end. Some clients may not have visualised that yet, therefore banks are there to provide advice.”

Lack of standardisation

End-to-end automation is also the major benefit that the audience associates with APIs and instant payments as a second poll showed. 80% of the participants hope that these technologies will support operational efficiency and increase Straight Through Processing (STP). However, few participants seem to think about new business opportunities yet, as only 18% said they would use APIs and instant payments to differentiate offerings or support new value chain – reinforcing Whelan’s argument that more advice is needed (see Figure 2).

Figure 2: Poll question on benefits of APIs and instant payments

While APIs can deliver several benefits to corporates, there are also limitations to the scope of usage. “Some international banks do not offer API,” Trip.com’s Xuelin Chen pointed out bringing up a challenge that is shaping the market: Introducing APIs requires banks to invest which they are more likely to do if demand from corporates is increasing. Outside of China, however, several companies however are waiting for banks to ramp up their API capabilities.

While Trip.com belongs to the frontrunners, Xuelin also said she “would like to see more API offerings by bank”, mentioning for example about account opening, money market funds, trade finance and guarantees. Furthermore, she appealed to banks to commit to certain standards of how they provide information via an APIs as this would allow Trip.com to further enhance automation and build analytic tools on top of account information.

Outlook for APIs in payments

Closing the webinar, moderator Amit Mallick asked the panellists to provide an outlook on the development of APIs and the payment landscape in APAC. Given the high speed of innovations in the sector – with digital currencies and CBDCs also on the horizon – the participants focused on the near future.

Bosch’s Samrani stated that “real-time payments have essentially commoditised the financial industry in India”. Making payment would no longer be a unique selling proposition by banks, instead supporting UPI and providing multiple products around that, would become even more decisive, he predicted. Xuelin Chen of Trip.com added that with the era of the digital economy and fintechs on the rise, she would be “looking forward to how they change traditional banking sector”.

From the company’s perspective she pointed out that APIs change the entire IT infrastructure. Her recommendation for companies thinking about adopting APIs therefore was: “Do not look at it just from treasury perspective, look at it from a business perspective; and choose the right API supplier that can serve the company for a long time.”

“It is a technical journey,” confirmed Deutsche Banks’ Rachel Whelan. “Companies have to have a technology strategy as well as the experts and the funding behind it, otherwise the use case cannot be delivered.” However, she concluded, if the commitment is made, business and treasury will see great benefits from, using APIs and instant payments.

The Economist Impact webinar, ‘New age payments making the most of instant payments and APIs in APAC’, supported by Deutsche Bank took place on 27 October 2021. A replay of the webinar can be viewed here.

Sources

1 See https://bit.ly/3Exisrq at comnpci.org.in

2 See https://bit.ly/3orJSIU at business-standard.com

Cash management solutions Explore more

Find out more about our Cash management solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

CASH MANAGEMENT, MACRO AND MARKETS

Extending in-house bank services in APAC Extending in-house bank services in APAC

In a webinar hosted by The Economist as part of its Global Treasury Leaders programme and supported by Deutsche Bank, two corporate treasurers shared on the special challenges that the region presents when setting up an in-house bank. flow reports

Trade finance, Dossier Covid-19

Dealing with supply chain disruptions Dealing with supply chain disruptions

Supply chain disruptions are currently the main source of concern for corporate treasurers, research by Economist Impact shows

Dealing with supply chain disruptions MoreCASH MANAGEMENT

EIU Perspective: Connected with financial services partners EIU Perspective: Connected with financial services partners

Through a series of surveys and reports over recent years, The Economist Intelligence Unit (EIU) has taken the pulse of corporate treasury; recording its response to both day-to-day challenges and specific events from supply chain disruptions to Covid-19

EIU Perspective: Connected with financial services partners More