20 October 2021

Supply chain disruptions are currently the main source of concern for corporate treasurers, new research by Economist Impact shows. Deutsche Bank’s Daniel Schmand tells flow which strategies could help to overcome supply-chain finance risks

MINUTES min read

Supply bottlenecks, higher sourcing prices and ongoing limitations due to Covid-19 are hampering economic recovery around the world. In Germany, for example, complaints about material shortages have reached a new record high in September. In a survey conducted by ifo Institut, 77.4% of industrial companies reported that shortages in the supply of input materials were impeding their production.1

Unsurprisingly, the automotive industry and its suppliers are hit the most, with 96.6% reporting bottlenecks of intermediate products. But it’s not only a German phenomenon: Over the past couple of months, several global automobile manufacturers were forced to temporarily shut down plants. Japanese Toyota, for example, recently announced to cut global production for October by 330,000 units because of the shortage of semi-conductors and the spread of Covid-19 in South-East Asia.2

In other industries the situation looks only slightly better: In electrical engineering, mechanical engineering, the rubber and plastics industry as well as the furniture industry the share of German companies that complain about supply bottlenecks is higher than 80%, data of ifo Institut shows. And Deutsche Bank Research expects “supply chain disruptions to keep us busy into 2022”.3

Reconfiguring supply chains

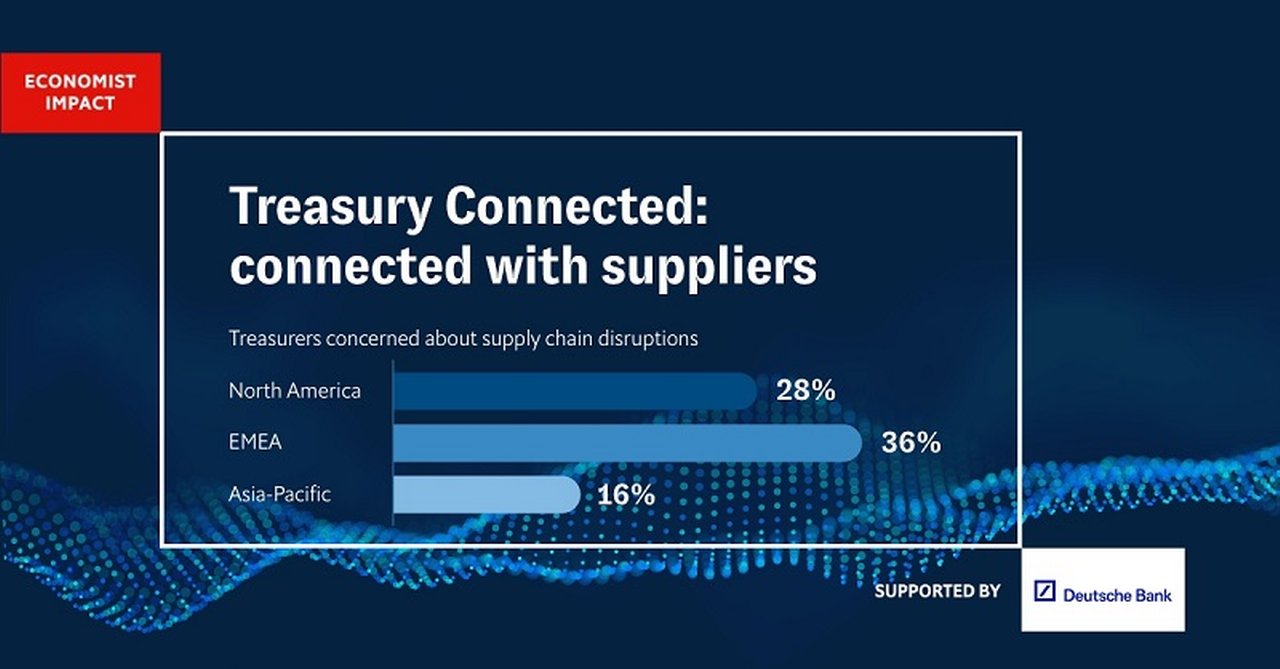

These challenges require immediate action by procurement and logistics divisions. But they are also a burden to corporate treasury departments, new research by Economist Impact suggests. In its just-published third-quarter global survey of senior corporate treasurers, 27% of respondents said that supply-chain disruptions are the top trend currently impacting the treasury function. “The concern stems from the need to continually reconfigure supply chains in response to ongoing pandemic-related disruptions, according to 36% of respondents,” the report comments.

While the pandemic is still weighing on supply chains, there are also long-term risks that treasurers should bear in mind. “Many companies are still underestimating the dynamics following the geopolitical conflicts between USA, China and Russia,” says Daniel Schmand, Global Head of Trade Finance & Lending and Institutional Cash Management at Deutsche Bank. He continues, “Globalisation has come to a turning point. Companies will need to increase the share of local sourcing while at the same time diversifying their supplier base.” According to Schmand, new supply chain regimes need to balance input prices, stability and sustainability. “The complexity of managing supply chains will increase,” he predicts.

Globalisation has come to a turning point. Companies will need to increase the share of local sourcing while at the same time diversifying their supplier base”

Sustainability is on the treasurers’ agenda as well, as Economist Impact research suggests: The report for example mentions the new EU directive on Corporate Due Diligence and Corporate Accountability. If introduced, the Directive would compel businesses to identify and remedy the environmental, social and governance (ESG) risks in their supply chains. 24% of the respondents believe that local regulations will impact their companies’ supply-chain strategy.

Considering Inventory financing

The changing macroeconomic, regulatory and geopolitical dynamics also affects supply chain finance and working capital management – key areas of the treasurer’s function. “In order to ensure minimum disruption and the continuation of trade flows, the importance of strategic warehousing is increasing,” observes Schmand. This means that inventory reserves are build up such that supply shocks do not disrupt production. While this technique improves supply chain resilience, it also ties up capital.

Treasurers could therefore turn to payables finance, as the recently published Guide to Payables Finance points out. It states that “the SCF supplier market has been on a sharp upward trend since 2010, growing from no more than five SCF deals per year between 2000 and 2010 to up to 24 per year between 2010 and 2020”. But the potential has not been exhausted yet, Schmand points out. “Additionally, corporates should consider inventory financing to free cash.” However, he admits that these instruments are quite complex as they need to be arranged off-balance and at the same time do not interfere or complicate physical flows of goods.

What are the strategies that treasurers believe are most effective to overcome supply chain risks? And which technologies seem most promising to them? If you want to learn more, read the new Economist Impact Perspective – which is supported by Deutsche Bank and can be downloaded here.

Sources

1 See https://bit.ly/3azIcGA at ifo.de

2 See https://bit.ly/2YKJRGB at automotivelogistics.media

3 See https://bit.ly/2YCTgA9 at dbresearch.de

Daniel Schmand

Global Head of Trade Finance & Lending and Institutional Cash Management, Deutsche Bank

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

WHITE PAPERS & GUIDES

Payables Finance: A guide to working capital optimisation Payables Finance: A guide to working capital optimisation

Now in its 3rd edition, this Guide not only explains how payables finance helps defend supply chains while helping buyers protect their working capital, but updates the previous edition in the light of Covid-19, ESG considerations and the relationship of the asset class with the capital markets, also including new case studies

Trade finance and lending {icon-book}

Trade’s choking hazards Trade’s choking hazards

What happens if cargo ships can’t get through ports? Does trade grind to a halt and impact economic growth in surrounding countries? Independent trade economist Rebecca Harding examines supply chain resilience

Macro and markets, Trade finance and lending {icon-book}

More Beyond the greenwash

More could be done to address the social reasons why unsustainable trading activities continue, argues Rebecca Harding. Having systems in place to check mirror trade data and supporting communities with alternative sources of income are good starting points

More More