26 June 2024

What happens if cargo ships can’t get through ports? Does trade grind to a halt and impact economic growth in surrounding countries? Independent trade economist Rebecca Harding examines supply chain resilience

MINUTES min read

When Baltimore’s Francis Scott Key Bridge collapsed in March 2024, the immediate reaction was that there would be a major disruption to supply chains generally in the US, and in the automotive sector. An estimated 5,000 trucks per day, carrying US$28bn in goods, would be disrupted in the immediate aftermath of the collapse, and for as long as the bridge itself takes to be rebuilt. In 2023 the Port of Baltimore handled nearly 850,000 vehicles (the most of any US port) and 28% of US annual coal exports.

In the end, however, the impact has not been as great as expected. The World Bank’s Container Port Performance Index ranked it 300th in the world in 2022 (the latest year for which full data is available) and the US Army Corp of Engineers is working to re-open the Baltimore shipping channel by the end of May 2024. There has undoubtedly been disruption to logistics caused by the collapse, but the port is not regarded as big enough to impact world trade generally; for example, running a simulation through the IMF/Oxford University Port Monitor showed that the impact of supply chain disruption on national gross domestic product (GDP) elsewhere is likely to be less that 1/100th of GDP in Latin American countries closest to Baltimore and only 1/1000th of GDP in countries further away.

Port disruption impact

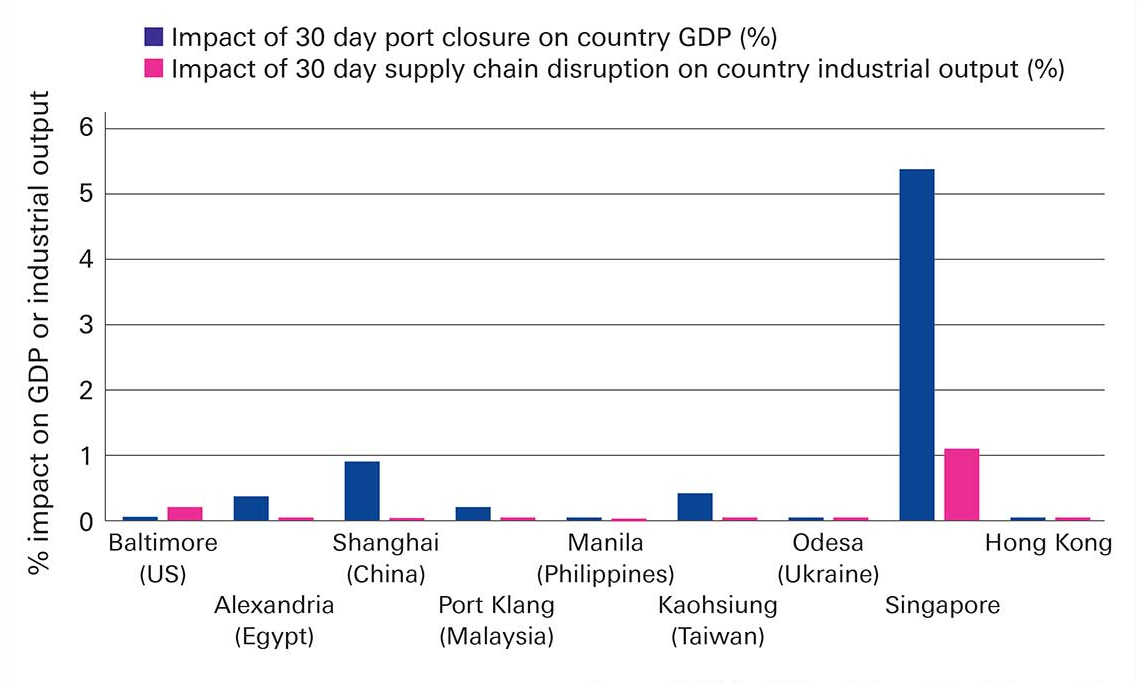

Similarly, the impact of port disruption from geopolitical conflict looks not to be particularly severe either from general impact on country-level GDP or from more specific supply chain disruptions (see Figure 1).

Figure 1: Largest impact on GDP and industrial output of specific port closure for 30 days (%)

Source: IMF/Oxford University impact simulation model

This shows the biggest possible impact on GDP and industrial output in any country in the world from the closure of the largest port in that country. Several regions stand out:

- The biggest impact of any port closure is from a closure of Singapore port. But the impact is not on Singapore’s GDP – the model suggests it would be on Liberia’s GDP, because of the amount of oil, food and machinery that is exported from Singapore. Singapore would suffer a loss of around 5% of GDP from its port closure. Liberia would also be the country whose industrial output would be most affected.

- There has been a lot of discussion of the impact of the Russia-Ukraine crisis and its impact on Odessa. The closure of Odessa would impact Libya’s GDP by around 0.02% only and Kazakhstan’s industrial output by a similar amount. Indeed, the impact on GDP would, according to the simulation, be felt most strongly in African countries.

- Alexandria port is clearly impacted by the Red Sea crisis and Egypt’s economy is the one that would suffer most from any prolonged closure. It would also be the economy that would be most affected in terms of industrial output. What is surprising is that the effects are less than 1% of both GDP and industrial output.

- Threats from any conflict in the South China Sea, or between Taiwan and China, would have similarly minimal effects on GDP or industrial output elsewhere. For example, if Kaohsiung Port in Taiwan closed, this would impact Singapore’s GDP to the tune of around 0.5%, but the largest impact on industrial output it would have would be in the Philippines, of around 0.01%.

- Interestingly, the scenario modelling of port closures consistently showed that it was less developed countries that were more impacted by port closures. Many of these impacts were felt most significantly in Africa, adding to a general risk to shipping that comes not just from crises elsewhere but also from the risks of piracy.

This is a stylised description to illustrate a point: are we worrying too much about the risks to shipping from strategically placed ports and canals – in other words trade choke points? Are the risks perceived ones or actual? The Boston Consulting Group’s models of trade identify four key choke points (actual or potential): the Malacca Strait, the Strait of Hormuz, the Suez Canal and the Panama Canal. They argue that these four routes account for nearly half of global trade and therefore pose a threat to the global economy.

However, the IMF model in Figure 1 above does not suggest any impact of the current drought in the Panama Canal, while disruption to Bandar Abbas in Iran would not affect GDP anywhere and the impact on industrial output would be below 0.002% in Iran itself.

Supply chain interdependency

This points to two things. First, since the Covid pandemic and the closure of the Suez Canal in March 2021, when the container ship Ever Given became stuck, commentators have become aware of the inter-dependency of global supply chains. Perhaps unexpectedly, a relatively short closure of a port may only cause minimal damage to the global economy and its industrial output. However, current disruptions to ports alone are affecting some 708.9 million people worldwide, often in emerging economies; and the longer-term impact of a trade choke point may be bigger simply because of the number of vessels and the types of sectors it affects.

Second, the impact of disruption in global choke points is likely to be in redistribution and logistics, and any price pressures relatively short-lived as a result. For example, the Red Sea disruption because of Houthi rebel attacks appears to have had a relatively muted impact on trade and inflation. Supply chains have adapted and shown themselves to be relatively resilient. Even if there are costs involved from sending shipping via longer routes, this has been priced in and has merely contributed to the general picture of slow economic growth, dampened consumer demand and over-capacity in shipping as a result. It seems that because oil prices have not risen to the extent that they could have done given the geopolitics, inflationary pressures have remained low.

Does this mean that trade is less prone to supply chain disruption and political risk than might be expected? Can we discount risk to shipping entirely? The short answer to this is, of course, no, upon examination of the actual evidence.

“Natural causes are far more likely to cause disruption than political events”

Causes of closure

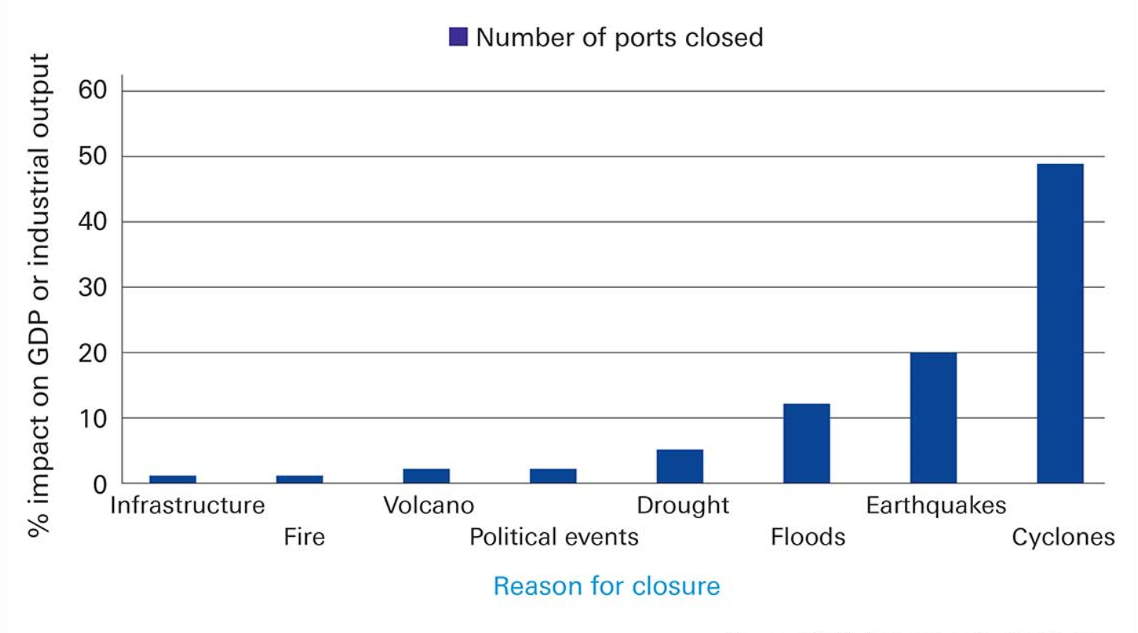

Of the 93 port closures since 2018 (and excluding Covid), the causes have been largely to do with climate and not political risk (Figure 2).

Figure 2: Number of ports closed since 2018

Source: IMF/Oxford University PortWatch

In other words, as Figure 2 shows, natural causes are far more likely to cause disruption than political events. More worryingly, the number of incidents has increased – there were 16 closures in 2019 and this number remained relatively constant until 2022. However, in 2023 there were 29 closures and, apart from the earthquake in Afghanistan, all were associated with weather events and were distributed across a range of nations.

Economic modelling is beginning to look at the longer-term impacts of climate change on trade and GDP from choke points such as the Panama Canal, the Turkish Straits and the Suez Canal. These channels are particularly important for soft commodities such as agriculture. In terms of agricultural trade, climate change will have a measurable impact on GDP because of its impact on the capacity of the ports in the regions above to continue to operate if there are more climate-related events.

This means we may be looking at the wrong things. We are distracted by the inter-dependencies of global supply chains on one source, such as China, and by a more general debate on geopolitical conflict and supply chain resilience. This is not to say these are unimportant. They are – because we need to think about energy and food security. Furthermore, there is a bigger risk of uncertainty in emerging economies where the impact of port closures is felt more acutely.

However, a bigger picture is at play and climate change is at the centre of a more permanent and worrying trend in global trade flows. This will affect our food and energy security as well as more immediate access to the goods that we need for our daily lives.

Our current model of trade and supply chain dependency is at risk from trade choke points. These are obviously exacerbated by the impact of political risk, but this risk is relatively short-term and does not seem to impact inflation, prices, or even GDP, significantly, as shipping companies have become more resilient since the Russia/Ukraine conflict started in February 2022.

However, the extent to which climate is affecting, and will increasingly affect, the world’s trade flows is an inescapable long-term risk.