22 February 2024

As 2024 began, bringing with it slower global trade growth, delegates at the BAFT European Bank-to-Bank Forum in Frankfurt also considered rerouted container shipping traffic in the Red Sea and post-pandemic changes in the supply and demand of goods and services. Yet improved collaboration and long-awaited momentum in digitisation meant the overall mood was upbeat. flow’s Clarissa Dann reports

MINUTES min read

As Tod Burwell, President and CEO of the Bankers Association for Finance and Trade (BAFT) opened the 2024 European Bank-to-Bank Forum on Tuesday 17 January in Frankfurt, Germany, little did he know just what a captive audience this event would turn out to have.

Extreme weather warnings detained many delegates (including your correspondent) as de-icing work grounded planes. But this injected into the gathering a more intense spirit of working together, a closeness that underpinned much of the conversation around environmental, social and governance (ESG) issues, trade finance digitisation and correspondent banking.

“There was a focus on…

re-establishing focus on fully executing the many transformative initiatives”

“The new year brings new energy, and the BAFT Europe Forum consistently offers an opportunity for our transaction banking community to start it off with a fresh focus on important issues, and an opportunity for collaboration,” said Burwell. Later that week as the event concluded, he observed, “There was a focus on reinforcing relationships, building new relationships, and re-establishing focus on fully executing the many transformative initiatives ongoing in the industry including digitisation, ESG and human capital.”

In the first of two articles based on the 2024 Forum’s agenda, flow reports on how external drivers are reshaping cross-border trade in terms of growth and trade types, and what is accelerating the adoption of digital trade finance solutions.

Trade and payments policy

The outline of this year’s programme took shape last September at Sibos Toronto 2023, where members of the BAFT Global Trade Industry Council discussed “the fragmented nature of the trade space, with multiple platforms, rulebooks, and processes spanning physical and financial supply chains across various jurisdictions and industries”.1 The close relationship between cross-border trade and cross-border payments, along with ESG standards implementation and the evolving digitisation of trade finance shaped the Frankfurt 2024 discussions.

In his welcome address, Burwell reminded the 300 Forum delegates of BAFT’s ongoing work, such as:

- Addressing correspondent banking network decline –The Respondents’ Playbook 2.0: A Correspondent Banking Relationship Guide, which updated the 2019 edition, was reissued last October. It “reflects the expectations and recommendations of a majority of the 20 largest global correspondent banks, clarifies correspondent bank expectations and provides constructive guidance for respondents to reduce their perceived financial crime compliance risk”.2

- Basel III implementation impact – capital adequacy and liquidity regulation for large financial institutions that has different treatment and rates of implementation in the US and the EU. BAFT has made a submission to the Office of the Comptroller of the Currency (OCC), the Board of Governors of the Federal Reserve System and the Federal Deposit Insurance Corporation (FDIC) in response to the agencies’ proposed Basel III Endgame Notice of Proposed Rule (NPR) issued in July 2023. It expresses concern for “unintended consequences” and provides a reminder of the safety of trade finance.3

- ISO 20022 migration – On 11 January 2024, BAFT published a new white paper, ISO 20022 Migration: Lessons Learned, offering “a deep dive into the experiences, challenges, and best practices from organisations that have successfully navigated the transition to ISO 20022”.4

Trade outlook

Structural changes

It fell to Paul Donovan, Chief Economist of UBS Global Wealth Management to set the scene of ongoing trade uncertainty and volatility in his keynote talk on Day 2. He spoke of a landscape of reducing inflation following three “inflation waves”:

- The transitory/temporary inflation wave triggered during the pandemic, as travel restrictions and government furlough schemes drove demand up in excess of supply.

- Energy price shock triggered by the Russia/Ukraine war (not demand-related).

- Profit-led inflation – concentrated at the end of supply chains when companies manage to convince customers to accept price increases, even where their labour costs have fallen. As consumers rebel and refuse to pay the higher prices, inflation comes down.

He then addressed the likelihood of central banks adopting stabilisation policies with their balance sheets shrinking compared with GDP. “For monetary policy I am expecting that central banks will be “reducing interest rates to maintain stable real interest rates,” he said, adding that the interest rate “story” will “match the decline in inflation experienced over the course of this year.” Donovan’s prediction proved accurate a fortnight later when the Federal Open Market Committee (FOMC) left US interest rates unchanged at 5.25–5.50% until there was “greater confidence that inflation is moving sustainably towards 2%”.5

Global trade – broadly defined to include global capital flows – will be an increasing focus over the course of 2024, continued Donovan. He pointed to a “structural” moderation of consumer goods demand – a decline in Europe and stagnation in the US – as the 2021 pandemic lockdown level of goods spending “was never going to last” and “people have shifted to going out and spending on having fun”. In addition, as working patterns such as working from home (WFH) – along with the isolation this brings – have greater flexibility built in, people seek increased social activity after work. Other factors such as deglobalisation, resource nationalism and reshoring are, said Donavan, “long-term drivers” in reducing trade “and, he added, “a number of economies will need to reconsider their economic models”. He cited how music streaming platforms had steadily undermined the CD manufacturing industry and prompted increased localisation of supply and demand. Donovan’s full address at this event can be viewed on the BAFT YouTube Channel here.

Further trade updates can be found in Donovan’s regular podcasts at UBS Insights. “Structural changes are also adjusting trade patterns as the lengthy supply chains of the third industrial revolution appear unnecessarily complex given the technologies of the fourth industrial revolution. Geographic details of trade patterns are of interest,” he reflected in a 7 February podcast.6

Flat line

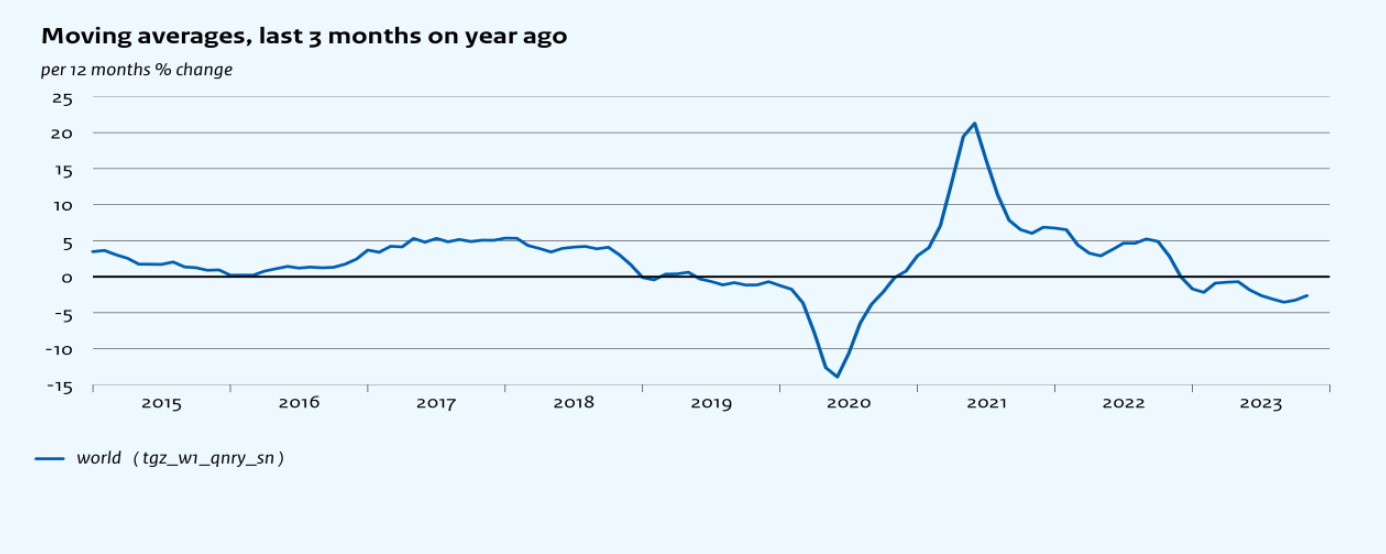

Figure 1: Global trade three-month moving average % change on a year ago (published January 2024)

Source: CPB World Trade Monitor November 2023

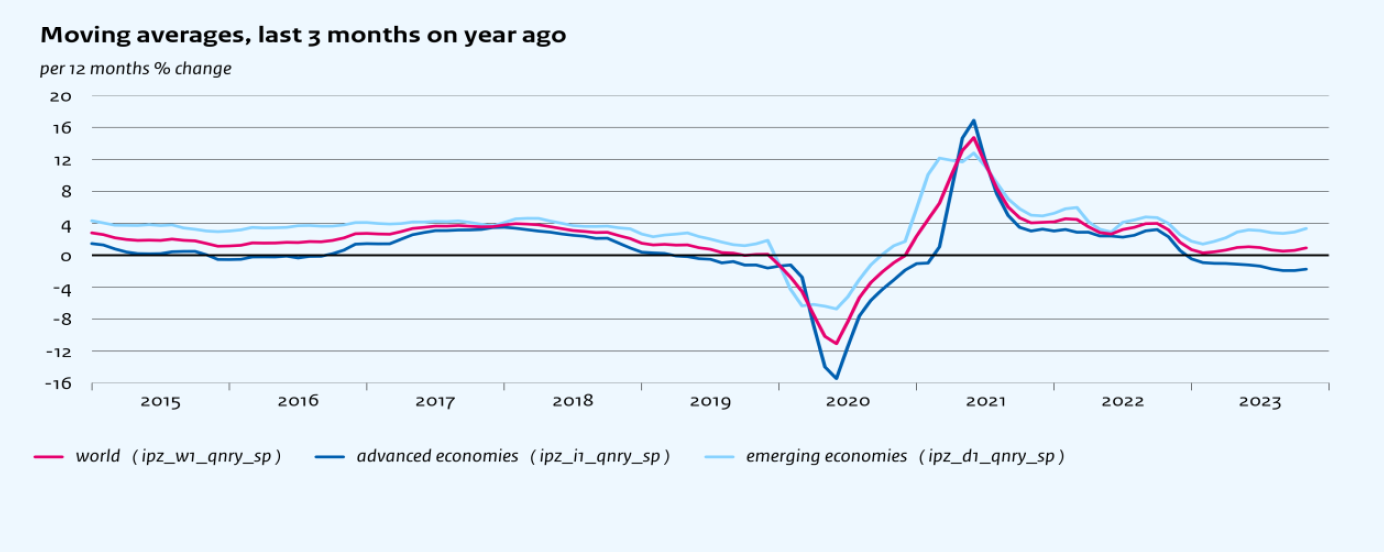

Figure 2: Global industrial production three-month moving average % change on a year ago (published January 2024)

Source: CPB World Trade Monitor November 2023

Donovan’s perspective together with those of panelists at the Geopolitics, Globalisation and Trade session on Day 1 offered the picture of a very different world trade order. In a thought-provoking session, Carsten Brzeski, Chief Economist at ING Bank, Klaus Baader, Chief Economist of Société Générale and Philippe Dauba-Pantanacce Senior Economist and Global Geopolitical Strategist at Standard Chartered Bank agreed that nearshoring is happening at the margins and, increasingly, so is “friendshoring” where supply chains are shaped according to the partner country’s “ideological alignment”.

Left to right: Carsten Brzeski (ING Bank); Klaus Baader, (Société Générale); and Philippe Dauba-Pantanacce (Standard Chartered Bank)

Using CPB Netherlands Bureau for Economic Analysis trade and industrial production data,7 they noted how during the 2000s there was steep growth in world trade, as China joined the WTO and intra-Asian trade accelerated. During the 2010s disinflationary period, levels flatlined, and then, when the pandemic hit in 2020, demand surged for goods such as tech and home furnishing. More recently there has been a “bit of a decline” and the risks to trade from China’s subsidies of electric vehicle production were highlighted. Figures 1 and 2 provide a snapshot of the more recent picture with industrial production patterns mirroring those of global trade.

Shipping lane vulnerabilities

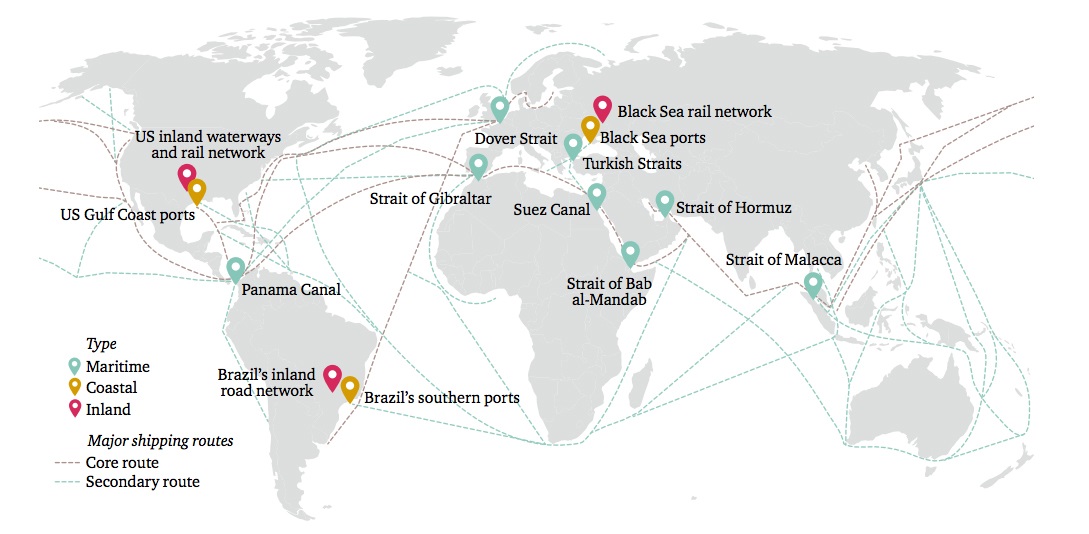

Figure 3: Trade chokepoints

Source: Shipping routes adapted from Rodrigue, J.P., Comtois, C. and Slack, B. (2017), The Geography of Transport Systems, New York: Routledge, https://people.hofstra.edu/geotrans/.

In addition, following the attacks on merchant ships in the Red Sea,8 the panel looked at trade “chokepoints”, highlighting the current vulnerabilities (such as Panama’s ongoing drought9) as another risk to trade. On 12 February, consultants BCG declared, “more than 50% of global maritime trade is at threat of disruption in four key areas of the world” with a map indicating these at the Panama Canal, the Suez Canal and Bab el Mandeb Strait, the Strait of Hormuz and the Strait of Malacca.10 Figure 3 sets out the main global trade chokepoints impacting global trade and although published in 2017, the World Economic Forum article explaining them is a useful guide.11

Trade finance digitalisation

Sharyn Trainor, Head of Product Management, Trade Finance & Lending at Deutsche Bank, explains how a combination of external forces and innovation momentum will help make digitalisation part of business as usual

With Deutsche Bank’s Guide to Digital Trade Finance published just days before BAFT 2024, the panel discussions in An Update on Digitalisation of Trade and Trade Finance Transaction had a particular resonance. Among the main barriers, opened one panelist, “is that the law relating to key trade documents used in day-to-day work [such as promissory notes, bills of exchange insurance documents and bills of lading/shipping documents] has not permitted these documents to be as effective in an electronic form as they are in the paper form”. But progress is underway. Further information on how the legal landscape is changing is covered in the Guide to Digital Trade Finance and also in the flow summary articles by Sullivan & Worcester’s legal expert Geoff Wynne: How URTEPO can drive trade finance digitalisation and ETDA in action.

“If you don’t have that digital core, how can you collaborate and interoperate?”

Sharyn Trainor, Head of Product Management in Deutsche Bank’s Trade Finance and Lending team set out her perspective on how the movement of business as usual towards digitisation adoption is propelled by the external environment (regulation, markets, etc) on one side and continued innovation/technology change on the other – a point further developed in her flow video interview afterwards. According to Trainor, for disruption to happen “you need pressure from all three levels and collaborate as an industry”. The benefits, she added during the panel discussion, “are compelling”, which raises the question of why the culture is changing at such a glacial pace. Successful digitisation “not only takes costs out of the system but enables innovation and the creation of new value-added solutions” for clients. Straight-through transactional visibility up and downstream of supply chains requires automation “and ensures that we better understand risks” while further automating controls prevents fraud, supports ESG and provides many other advantages. Concluding, Trainor asked, “If you don’t have that digital core, how can you collaborate and interoperate? All of us need to do that together.”

In the final trade panel on Day 1, discussion around how transformation of trade and its finance is evolving in practice continued in the session Reimagining Trade: A Vision of the Future Unfolding Before Our Eyes. The panel comprised: Gwynne Master Managing Director & Head of Working Capital Solutions, Lloyds Bank; André Casterman Founder & Managing Director, Casterman Advisory; Alberto Gutierrez Escudero Director & Head of FIG Trade and Working Capital, Europe Barclays; and Chris Sunderman, Program Lead Banks, Digital Container Shipping Association. Casterman and Sunderman are also contributors to Deutsche Bank’s Guide to Trade Finance white paper.

Left to right: Gwynne Master (Lloyds Bank); André Casterman (Casterman Advisory); Chris Sunderman (DCSA); and Alberto Gutierrez Escudero (Barclays)

According to Casterman, three distinct trends are unfolding in the new funding landscape:

- New market entrants. Complementing the bank positions in trade finance, alternative trade finance and embedded lenders are providing more liquidity – particularly for smaller companies. “We see SMEs served by alternative non-bank platforms extending liquidity,” he said.

- Logistics providers expand into trade. Using APIs to connect to financial systems, logistics providers are using funding from banks and the capital markets to service their customers. “There are a lot of opportunities to connect the B2B world where trade originates and the capital markets world looking for assets to allocate liquidity to.” Echoing some of the distribution themes from the Trade Finance Investor Day 2023 Casterman added that third party liquidity, moving from the originate to distribute model, also addressed balanced sheet considerations highlighted by Burwell earlier.

- Regulation/policies and technological innovation driving change. This picks up Trainor’s point about drivers of adoption and several themes in the Guide to Trade Finance about why single platforms had not been successful. “You cannot expect the whole world to join a single platform and you need operability,” reflected Casterman. He saw Web3 technology based on distributed ledger technology (DLT) as a key enabler here.

DCSA’s Sunderman, who represented the vital connector between shipping documentation and trade finance, agreed on the role of standardised digitisation to drive this forward. “It is easier for banks to adopt standards that are clearly understandable, leave no room for other interpretation and are securely safe for everyone,” he said. By way of background, according to its website, the DCSA “collaborates with carriers, shippers, banks, industry associations and other stakeholders to develop vendor-neutral, technology-agnostic, open-source standards for IT and non-competitive business practices and ensure the interoperability of container shipping solutions”.12

Overall trade takeaways

By the time delegates had managed to leave Frankfurt as the snow melted, it was clear that the outlook for trade finance is even more unpredictable than the weather. In short, the balance between global merchandise and service-related trade has changed, due both to geopolitics and post-pandemic working patterns. Furthermore, working together to share trade finance risk and agree on digital standards now that the legal framework is more supportive is no longer tinged with optionality and good intent at conferences but a requirement for keeping trade flowing.

The BAFT 2024 Europe Bank to Bank Forum 2024 was held in Frankfurt 15–17 January at the Frankfurt Marriott Hotel

To view replays of selection sessions at the event, visit the BAFT (Bankers Association for Finance and Trade) YouTube channel here

Sources

1 See baft.org

2 See baft.org

3 See baft.org

4 See baft.org

5 See federalreserve.gov

6 See ubs.com

7 See cpb.nl

8 See theguardian.com

9 See reuters.com

10 See bcg.com

11 See weforum.org

12 See dcsa.org