9 January 2024

The Electronic Trade Documents Act 2023 (ETDA) came into force in September 2023, but what does it mean when it comes to facilitating the digitalisation of trade finance? Legal expert Geoffrey Wynne explains

MINUTES min read

In the second of two articles taking a deeper dive into trade finance documentation digitalisation frameworks – the first having covered Uniform Rules for Transferable Electronic Payment Obligations (URTEPO) – this examines the Electronic Trade Documents Act 2023 (ETDA).

The UK approach to transferable electronic records to reflect the United Nations Commission on International trade Law (UNCITRAL)‘s model law in MLETR1 was to look at and solve the problem for trade of having certain documents not being capable of being created as digital documents. Thus, ETDA does not address electronic records as a whole but looks at specific trade documents with a view to making the electronic version of them effective under English law.

The approach has been to have a list (which is non-exhaustive in that it can be added to) of trade documents to which ETDA applies, and to deal with the legal issues so that the electronic equivalent of that document can be created, possessed and transferred in the same way as paper. The background to the issue was that prior to ETDA coming into force it was not possible to possess an electronic record so that it became necessary to amend key acts to permit this.

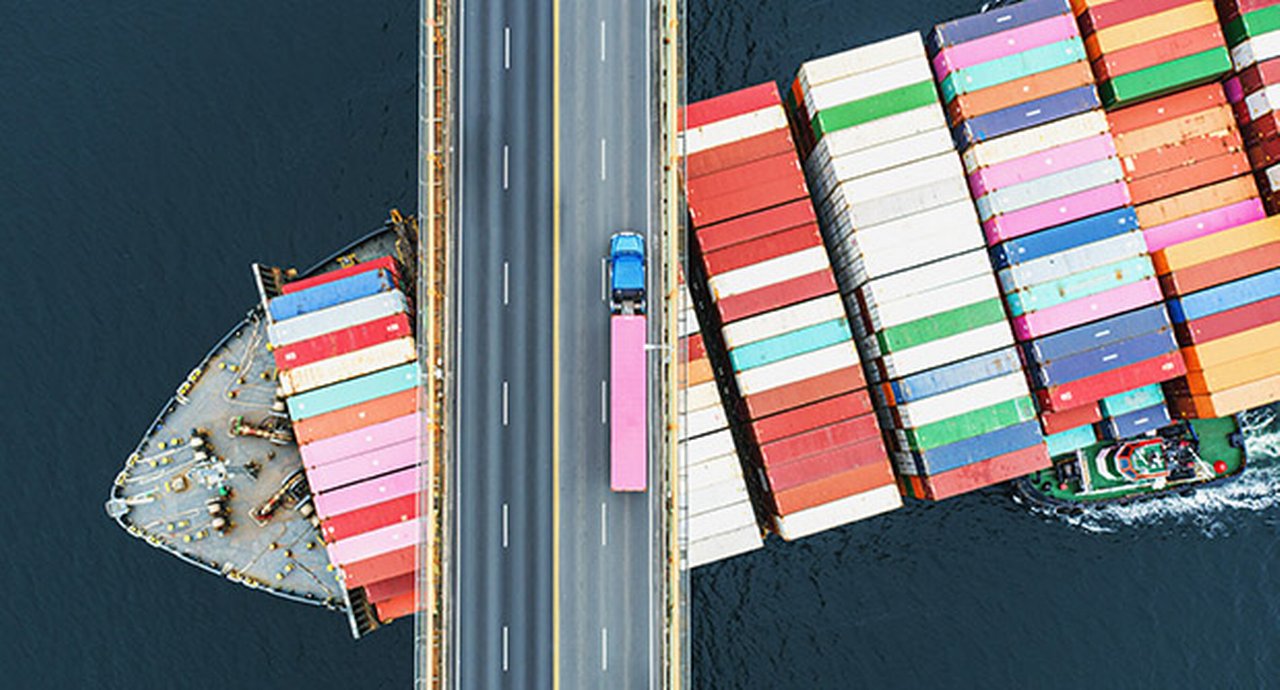

This explanation concentrates on payment obligations. However, ETDA is wider than this as it also permits the creation of other specific electronic documents, including bills of lading and warehouse receipts. These are key documents in relation to the transporting and storage of goods. The requirements of ETDA apply equally to these but, below, the specific payment obligations affected by ETDA are explained.

Electronic Payment Obligations

ETDA focuses on two key payment obligations:

- The promissory note; and

- The bill of exchange.

Both of these are often used to facilitate payment for goods and services. Each of them has its origins in the Bills of Exchange Act 1882 (BoEA) and not unsurprisingly having a dematerialised asset was not in its contemplation. Indeed, a requirement of the BoEA was that the asset - promissory note or bill of exchange - had to be delivered to take effect and consequently that was a physical act requiring possession of a tangible asset.

The approach of ETDA was to provide that the legal effect of an electronic record that complied with ETDA would be the same as if it were a paper document. The key question is then: What is required to comply with the ETDA?

Requirements of ETDA

The Act states that a person may possess, indorse2 or part with possession of an electronic record complying with the Act and it will have the same effect as an equivalent paper trade document.

“A reliable system has to… identify the document as an original in the exclusive control of the holder”

To provide an electronic trade document with the same treatment as a paper document, the Act relies on two elements:

- Possession of the electronic document; and

- The use of a ‘reliable system’.

To prove possession of an electronic document a person must be able to exercise (exclusive) control of the electronic document including having the ability to transfer or otherwise dispose of it. The use of a reliable system to satisfy this requirement is key to proving possession.

The Act states what a reliable system has to do – in essence to identify the document as an original in the exclusive control of the holder. The Act is technology neutral but gives guidance of factors to be taken into account to determine what constitutes a reliable system. Whilst there is much debate about how to achieve this recognition, it seems clear that existing systems can be recognised as reliable systems by the parties using them and it may be possible to contractually agree this.

There will remain challenges on how to deal with the new eNIs (promissory notes and bills of exchange) as the market starts to reflect the same requirements in the digital world as exist in the paper world, including the form of the eNI (as an electronic record), how to sign it electronically, how the parties deal with transfer (essentially electronic endorsement) and how to satisfy the obligor under the eNI as to who the holder is at payment.

Sources

1 See uncitral.un.org

2 To sign one's name as payee on a cheque or bill, or to inscribe something such as an official title with a title or memorandum (Source: Merriam-Webster)