October 2020

Most large conglomerates grow through acquisition-led strategies, but not Reliance Industries Limited. Clarissa Dann meets Group Treasurer Soumyo Dutta at the company’s Mumbai headquarters to discover more about its rapid organic growth, its journey to debt-free status, and how its treasury has aligned

The drive from Deutsche Bank’s Mumbai office in Bandra Kurla Complex, over the Bandra-Worli Sea Link bridge to the Reliance Industries Limited (RIL) headquarters, gives one ample opportunity to observe the city’s entrepreneurial culture and prolific infrastructure projects.

As my colleague and I made our way in mid-February towards what is India’s largest company in revenue terms, the Covid-19 pandemic – the only indications of which, on my arrival at the Chhatrapati Shivaji Maharaj International Airport, were selected temperature checks at immigration and officers in masks – had not yet fully hit. Little did we know that the world was about to undergo a seismic change.

As it happened, all of RIL’s businesses were deemed ‘essential services’ and the company was personally thanked by Indian Prime Minister Narendra Modi for its support since the pandemic began. “The entire Reliance team has been making effective contributions in the fight against Covid-19. Be it in healthcare or assisting people, they have been active. I thank [Reliance chairpersons] Mukesh and Nita Ambani for contributing to PM CARES [the Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund] and for their other work towards defeating [the] coronavirus,” he tweeted on 31 March.

Vision and determination

RIL is no stranger to managing change and our host, Group Treasurer Soumyo Dutta, has been busy doing just that since his arrival in 2012 as the company was going through a period of rapid organic growth.

An important part of the RIL growth journey is not only the diversification from oil and energy to its digital services and consumer businesses, but the debt and deleveraging strategy of its Chair and Managing Director, Mukesh Ambani. The most recent manifestation of this took place several months after our meeting with Dutta.

500m

At the annual general meeting (AGM) on 12 August 2019, Ambani declared: “We have a very clear roadmap to becoming a zero net-debt company within the next 18 months, that is by 31 March 2021. We have received strong interest from strategic and financial investors in our consumer businesses, Jio and Reliance Retail. We will induct leading global partners in these businesses in the next few quarters and move towards the listing of both these companies within the next five years. With these initiatives, I have no doubt that your company will have one of the strongest balance sheets in the world.”

The company then went on to announce a capital raise worth US$20bn and the completion of a US$7bn rights issue “completed entirely on a digital platform during lockdown”.1 Ambani proclaimed RIL’s net debt-free status (nine months ahead of the March 2021 deadline) in a statement shared in a Bombay Stock Exchange (BSE) filing on 20 June 2020. “I have fulfilled my promise to the shareholders by making Reliance net debt-free much before our original schedule,” he said. “I wish to assure [shareholders] that Reliance in its Golden Decade will set even more ambitious growth goals, and achieve them.”2

RIL successfully diversified into the telecomms sector when it invested in Indian mobile company Jio

Two days later, on 22 June, RIL stock surged 2.53% to a record high of US$23.75 on the BSE. The sale of minority interests in its digital services arm Jio Platforms to marquee investors (including Facebook Inc; private equity players KKR, Vista Equity Partners, Silver Lake, General Atlantic, TPG and L Catterton; and sovereign wealth funds Mubadala, ADIA and PIF) had been completed in under eight weeks.3 Almost overnight, RIL was transformed into the world’s second largest energy firm after Saudi Aramco and had positioned itself as a disruptive industry leader in the digital connectivity space through Jio Platforms. Other marquee investors followed; by 15 July 2020, Google had become the 14th large investor after purchasing a 7.7% stake.

Areas of operations

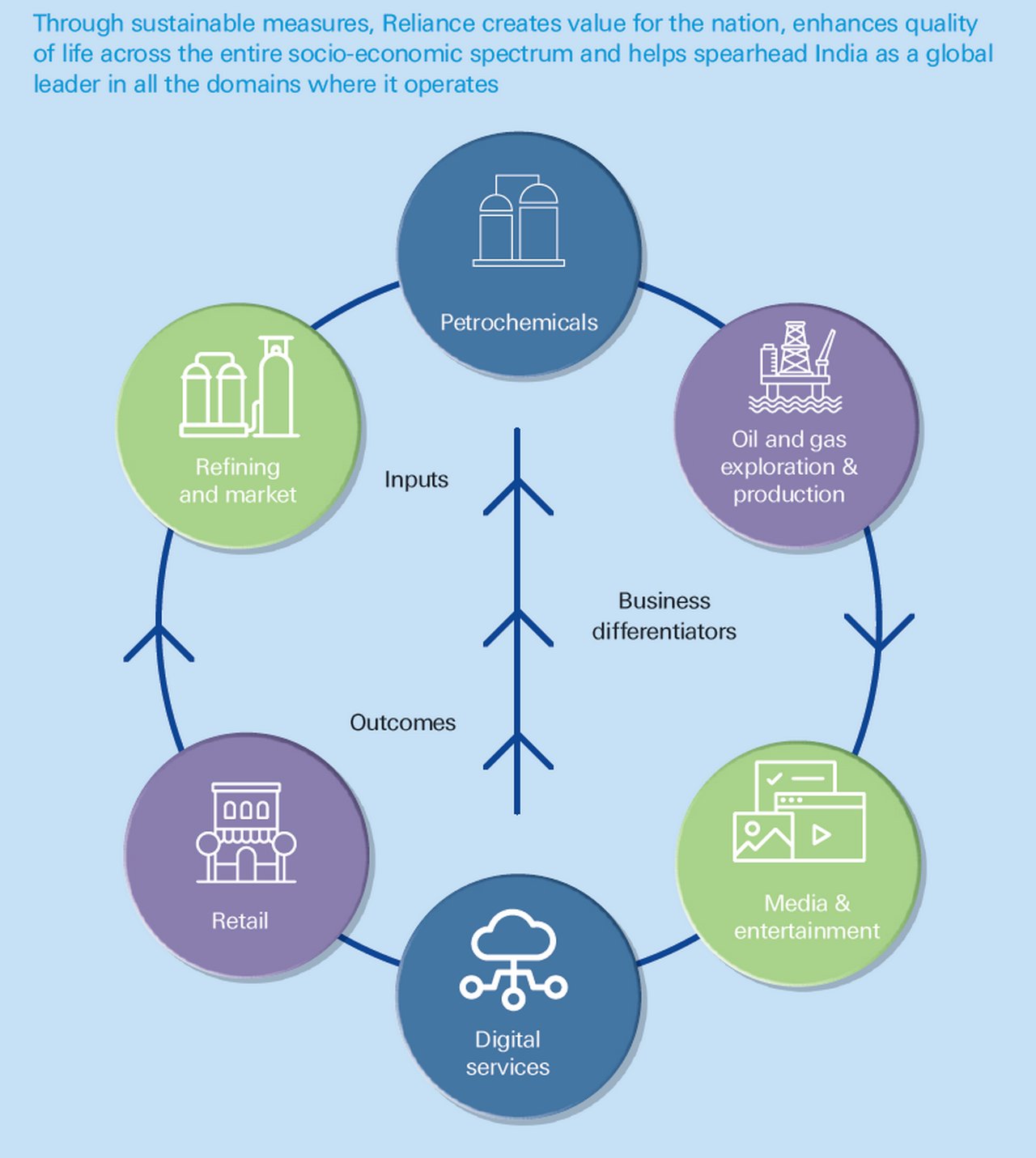

The company’s slogan, “Growth is Life”, aptly captures its ever-evolving spirit. Today, Reliance owns businesses across India engaged in energy, petrochemicals, textiles, natural resources, retail and the digital consumer space (see Figure 1). Not only has Reliance Industries achieved its goal of becoming an energy giant, but its expansion into retail and the digital consumer space on the back of successful oil refining operations has aligned the company with India’s developing consumer demand.

Diversification from hydrocarbons

“When I joined in 2012, the full-year EBITDA for our petrochemical business was US$1bn,” recalls Dutta. “But we have undertaken massive capex [capital expenditure] since then, with capacity starting to come on-stream in the past couple of years, and now we have US$1bn per quarter coming from petrochemicals.”

While hydrocarbons remain a core revenue component, the consumer business has caught up fast. Dutta explains that when he started, this segment accounted for just 5% of total EBITDA; today it represents about 41%.

It was RIL Chair Ambani who invested some US$33bn in Jio;4 the company is a relatively recent entrant to India’s mobile market and has attracted almost 390 million mobile data subscribers.5

"The entire ecosystem is changing, with the government pushing hard for digital payments"

Transition from bank to treasury

What made Dutta choose a career in corporate banking and treasury? After studying at the Indian Institute of Management Calcutta, in 1998 he joined Citibank’s Treasury team in India as a campus hire. Fifteen years later he was promoted to Head of Trading & Head of Risk Treasury for Citigroup South Asia, where he managed balance sheet liquidity, the assetliability book and the bond trading business.

“I grew up in the markets business,” he recalls. “When I joined Citi in India, the bank had only four branches and a balance sheet of US$3bn–4bn. When I left, we had 40 branches, a balance sheet of around US$25bn and a major franchise for foreign exchange (FX) and fixed income.” Dutta credits his Citi experience for teaching him much about the financial markets and treasury business, as well as the skills of engaging with clients.

When a career opportunity in Reliance Treasury emerged, he simply couldn’t turn it down, as it offered “a wider canvas” for his talents and an opportunity for him to broaden out beyond financial markets alone. “The largest attraction was Reliance’s explosive growth in the consumer business and its ambitious plans for continuing this,” he adds. “I wanted to be a part of that story.”

Home-grown treasury

“There are many benefits to the organic growth of our business, and one of them is that it has given us the space to grow our own treasury,” says Dutta. He explains that, structurally, Reliance Industries has treasuries embedded within each of its business divisions; there is a treasury for the refining business, one for the petrochemical business, one for the consumer business and so on. The role of the central treasury, he suggests, is to “lay down the broad boundaries, frameworks and priorities, and define how each individual treasury should interact with our banking partners”.

Figure 1: Reliance areas of operations and business model

Source: Reliance Industries Limited

While each division will have its own needs from the company’s banking partners, it is the central treasury that agrees the prioritisation for the group.

Given that RIL is an innovation-led company, it is no surprise that Dutta speaks of technology as helping to drive efficiencies within treasury. The company uses SAP as its enterprise resource planning system and Murex for treasury and financial markets, working with the providers to ensure there are linkages and interoperability between the two.6 Reliance has also participated in several pilot projects with trade digitalisation specialist Bolero (on electronic bills of lading) and has joined numerous blockchain projects. Yet, given the company’s size, the scalability of any solution is the crucial determining factor.

Payments and the move to digital

On the face of it, cash management across a diverse set of businesses would appear to be a challenge for Reliance. Not only is the company a global operator, with all the challenges that brings, but it spans the full scale of payments, from high-value items in the hydrocarbons business to small, frequent payments in the consumer business.

Yet that isn’t so, stresses Dutta, who explains that the company has different legal vehicles and works closely with banks that specialise in each domain, so is able to offer the right solutions for each of its businesses depending on their unique requirements. “It has been a continuous learning process,” he admits. “Sometimes banks and service providers have offered us products and promises, only to realise that they had not anticipated the extent and pace of scaling up of transactions. Yet, for the most part, our banking service providers have understood our requirements and business aspirations and have been quick to make appropriate investments to provide us with the right tailored solutions.”

In the consumer space, digital payments constitute a significant theme for Reliance. India’s payments system is among the most dynamic in the world, and in 2016 the government launched the Unified Payments Interface (UPI) initiative to turbo-charge the country’s digital trajectory.7 UPI allows account holders to instantly send and receive money using their smartphones with a single identifier – without entering any bank account information – at any time of day. The scheme has been heralded as a driving force behind the ubiquity of real-time payments in Asia. (For more, see the flow article ‘Building Asia’s road to real-time treasury’.)

“The entire ecosystem is changing, with the government pushing hard for digital payments,” says Dutta. “We still find a lot of store collections happening via cash and coins, which brings its own set of cash management challenges, but we are seeing this changing fast and digital payments are the new order of the day.” Indeed, Reliance’s digital services business now receives most of its payments through digital apps or UPI. More than 10 million Jio recharges happen through UPI in a month.

"We have fulfilled our promise to the shareholders by making Reliance net debt-free"

Largest user of ECA financing

On the energy side of the business, Reliance’s organic growth through investment in downstream capacity has provided it with an opportunity to explore a diverse range of trade finance instruments for both the capital and trade account. And its treasury team members have been very active users across the breadth of the company to meet their financing requirements, deploying a range of tools including buyer’s credit, seller’s credit, forfaiting and variants within supply chain finance. “We have been able to use innovative instruments while raising resources, with different tenors, geographies covered and pools of investors,” says Dutta.

Yet, when it comes to long-term funding, export credit agency-backed (ECA) financing has been the go-to source. Dutta describes Reliance as “the largest user of ECA financing in the globe”, using financing ECAs from Japan, South Korea, Italy, Germany, the UK, Canada and the US, to name but a few. “We have been able to access very competitive rates that take care of our asset-liability mismatches,” he adds.

The long tenors offered by ECA financing are particularly helpful for larger projects with significant gestation periods. Telecommunications is a case in point. In September 2019, Reliance Industries, via Jio Platforms, signed a US$1bn 10-year loan, backed by the Korean trade insurer K-Sure, to finance the procurement of goods and services to expand India’s 4G wireless network. The standout deal was the largest-ever Indian loan covered by K-Sure, and its largest-ever telecom financing.8 It picked up GTR’s Deal of the Year and TXF’s Perfect 10 award in 2019 – not the first time Reliance has been celebrated for an ECA-backed deal by industry peers.

Managing market risk

The diversity of the conglomerate’s business certainly brings new and diverse challenges. “When 95% of our earnings were derived from hydrocarbons, managing cash flow and FX risk were, to a certain extent, straightforward,” says Dutta. “We would import crude and sell to global markets – and, as a completely dollarised business, we could manage the FX risk. The growth in our consumer business has changed this dynamic. For the consumer businesses, we now import capital equipment from across the globe – dealing in many currencies – but the revenue for those businesses largely accrues from the local market, and that income is denominated in Indian rupees.”

He explains that this policy has required much more sophisticated hedging structures to help manage the risk. Of course, as Covid-19 has demonstrated, planning cannot account for every potential scenario. Dutta points to the ‘taper tantrum’ of 2013, when US Federal Reserve Chairman Ben Bernanke dealt a major shock to investor expectations, announcing that the Fed would, at some future date, reduce the volume of its bond purchases, thus tapering its policy of quantitative easing.9 It was a key geopolitical shock that hit the company’s balance sheet in terms of interest rates and FX risk. “Interest rates hit the roof,” says Dutta, “and we saw a large outflow from global capital markets back to the US.”

It’s ironic that the pandemic now seems to have sent the Fed in the opposite direction. “There is no such thing as a free market any more. All developed central banks have cut rates to zero and are buying trillions of assets. Inflation is very low,” declared George Saravelos, Head of FX Research at Deutsche Bank in April 2020.10

Blue-sky treasury thinking

Dutta circles back to the topic of change. “We are always looking to new ideas and when it comes to our treasury set-up, the ‘blue-sky thinking’ centres on whether our treasury can be designed as a platform organisation.”

RIL Treasury aspires, he explains, to reorganise itself as a centralised, platform-based organisation through which various users spread across the business can quickly and efficiently request treasury services, whether it is working capital raises, long-term funding raises, or FX risk hedging.

Dutta concedes that existing IT systems, architecture and technology will need to be reconfigured and rewired while shifting to a platform strategy, which will probably not be without its challenges. But he signs off on an optimistic note: “We’re still a young organisation and we don’t have a lot of baggage to carry.”

Sources

1 See https://bit.ly/319iiFH at ril.com

2 See https://bit.ly/3geqpVQ at scroll.in

3 See https://bit.ly/34eI65d at economictimes.indiatimes.com

4 See https://bit.ly/3aDij7Y at forbes.com

5 See https://reut.rs/317DSuu at reuters.com

6 See flow’s SAP profile, ‘'Heart of the enterprise' at flow.db.com

7 See https://bit.ly/2XiTUyW at deutschebank.co.in

8 See https://bit.ly/3iQKpzJ at economictimes.indiatimes.com

9 See https://reut.rs/3aEU61g at reuters.com

10 See Central banks: on-side or outside? at flow.db.com

You might be interested in

CASH MANAGEMENT {icon-book}

A healthy approach A healthy approach

German science and technology giant Merck has been developing healthcare solutions for 350 years, and remains at the leading edge of biotechnology. Graham Buck finds out how the spirit of innovation underpins its corporate treasury team

CASH MANAGEMENT {icon-book}

Heart of the enterprise Heart of the enterprise

Business software provider SAP leads a consistent programme of innovation, the latest being its digital boardroom. Head of Global Treasury Steffen Diel demonstrates why leaving one’s comfort zone and being permanently curious can work miracles

CASH MANAGEMENT {icon-book}

Creative sounds Creative sounds

Until Spotify disrupted the music ownership model, the music industry was under siege from piracy. Clarissa Dann reports on how the Swedish audio media phenomenon has applied its corporate treasury infrastructure to support this incredible growth story