June 2020

German science and technology giant Merck has been developing healthcare solutions for 350 years, and remains at the leading edge of biotechnology. Graham Buck finds out how the spirit of innovation underpins its corporate treasury team

Nestling some 35 kilometres south of Germany’s financial centre of Frankfurt is Darmstadt, bearer of the official title ‘City of Science’ or ‘Wissenschaftsstadt’ and home to a range of scientific institutions, universities and high-tech companies.

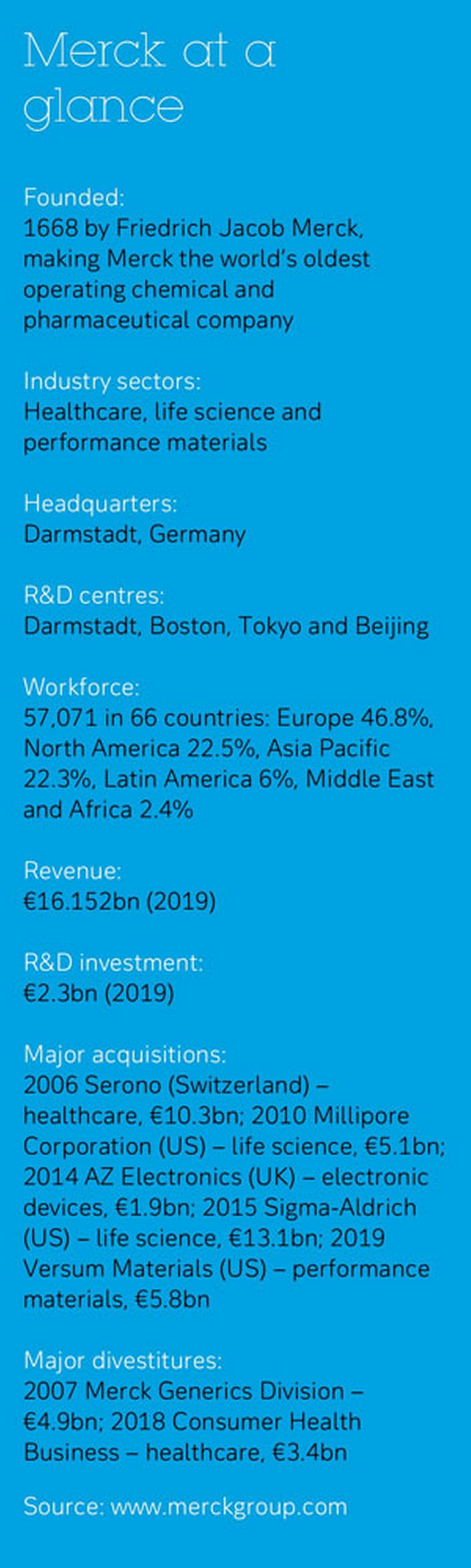

One of its corporate inhabitants is Merck, the multinational science and technology group whose proclaimed mission is to “make a positive difference to millions of people’s lives every day”. Today’s multibillion- euro company has evolved over more than 350 years, dating back to when the Engel-Apotheke (Angel Pharmacy) in Darmstadt was acquired in 1668 by Friedrich Jacob Merck.

Its subsequent history includes the formation in 1891 of an American subsidiary in New Jersey which, as a result of the First World War, became a separate US entity called Merck & Co, which today is known as MSD outside the US and Canada.

Darmstadt-headquartered Merck survived and thrived despite this setback, adopting its present title in 1995 when its shares began trading on the stock market. However, even today only around 30% of the shares are publicly traded and the Merck family retains the remaining 70%.

Healthcare industry

US$1.43trn

The pharmaceutical and medical device industry is one of the most powerful and influential sectors in the world, with global revenues estimated, according to the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), to reach US$1.43trn in 2020. The industry plays an essential role in providing access to medicines and support to the world’s overall healthcare structure.

Barriers to market entry are prohibitively high, because of the huge amounts invested in research and development (R&D) of a drug before compounds can be developed into safe and effective medicines. As the IFPMA puts it, once researchers identify a promising compound, having screened between 5,000 and 10,000, R&D begins – a process that can take 10 to 15 years. Companies will often experience lost R&D investment because of systemically high failure rates. The marketing of drugs is subject to intense regulation and sales are dependent on the decisions of large purchasing entities such as government health departments, so this is not an industry that can easily be disrupted by new entrants.

Curiosity fuels us, research is our passion, and responsibility is a core value"

With such a market position comes responsibility, which Merck takes very seriously. “We think in generations instead of quarters”, the company declares on its website, adding that “this commitment is the foundation of our lasting economic success.”

At the company’s 350th anniversary ceremony in May 2018, which included Germany’s Chancellor Angela Merkel among the 900 guests, the company’s values were described in the following terms: “Curiosity fuels us, research is our passion, and responsibility is a core value that shapes our daily actions.”

Merck added: “We are currently at a crucial point. Many of the technologies at our disposal today have an entirely new dimension. They raise fundamental ethical questions. Think of examples such as big data, artificial intelligence (AI), or genome editing. We need these technologies because they can help us, for instance, to find new therapies for serious diseases. Yet apart from all these opportunities, we must never lose sight of the tremendous responsibility that their applications involve.”

The words ‘curiosity’ and ‘responsibility’ resonate throughout the company’s many touchpoints with its consumers, and these are also centrally placed in Merck’s recent advertising campaign that uses the phrase ‘Turn The World On Its Head’. It invites individuals to “explore how a more curious society can change our planet for the better”. A graphic of smokestack industries, polluting vehicles and traditional logistics is mirrored by a future world of solar energy, electric cars and bicycles, and deliveries by drone.

Growth trajectory

“Merck is still a family-owned business, but one that is science and technology-based and that helps to bring tangible benefits to people – such as combatting diseases – through our products,” confirms Jörg Bermüller, Head of Merck’s Cash and Risk Management in Group Treasury.

“Over the years, the company has regularly added to its portfolio and, helped by technology, is rapidly growing and changing thanks to a combination of strategic mergers and acquisitions (M&As) coupled with high organic growth rates,” explains Bermüller.

Merck is well placed to achieve further sustainable and profitable growth. Net sales in 2019 rose 9% year-on-year to €16.15bn and earnings before interest, tax, depreciation and amortisation were 15% higher over the same period at €4.385bn. Its products and markets turn in margins of 30%, but its scale and success have not eroded its DNA of innovation and entrepreneurial behaviour. An important milestone was the October 2015 launch of the company’s €69m 7,100-metre Innovation Center in Darmstadt that aims to “develop entirely new businesses and technologies beyond our current scope, bringing people, technologies and skills together from different areas under one roof”.1 More recently, an Innovation Center in Shanghai was opened in October 2019.

Merck’s three main businesses are healthcare, which accounts for nearly 40% of its revenues, life science and performance materials. “They share several basic characteristics, among which each is research-intensive, as we want all the products that we produce to be top of their field,” says Bermüller.

In recent years, sizeable acquisitions have included the 2015 purchase of US life science company Sigma-Aldrich, a specialist in laboratory testing materials, for €13.1bn and last year’s €5.8bn addition of Versum Materials, also a US-based multinational, which is known for its process chemicals, gases and equipment used in semiconductor manufacturing. As part of a move to focus more on innovation-driven businesses, Merck also disposed of its consumer health business, which in 2018 was sold to Procter & Gamble in a €3.4bn cash deal.

Treasury tiller

Bermüller and his treasury team helped steer through each of these transactions. Bermüller arrived at Merck back in 2008, three years after colleague Rando Bruns had joined the company as its Head of Cash and Risk Management. Bruns took up the post of Group Treasurer on Bermüller’s arrival, with Merck’s total treasury team at that time no more than 11 individuals.

“For both of us, it’s crucial that financial risks can be identified immediately, and Rando was wholly supportive in providing me with the financial means to meet this target,” says Bermüller. “Right from the outset, we shared a joint approach on the need for centralisation and standardisation and recognised the efficiencies possible through the establishment of an in-house bank.

“The treasury team members consider themselves as service providers; we do not narrow our focus solely on bank services, we go beyond – for example by providing enriched account statements for automatic reconciliation in order to ease the work of our shared service centre colleagues. Likewise, we do not believe in the so-called 80/20 rule. To see only 80% of the account balances is not an option – I want to see100% of Merck’s accounts on a daily basis, not 80%. So we’re unique in considering 100% as perfectly possible. As a consequence, it means that we need treasury systems that can deal with a heterogeneous enterprise resource planning (ERP) landscape throughout the group.”

This insistence on high standards is not surprising; Bruns has spoken of how each individual in his team is there when needed and ready to do more than meet the basic requirements of each task by going the extra mile.

“It’s also important to us to see all foreign currency positions in our internal systems – running daily foreign exchange (FX) rates enables us to see gains and losses at the end of each business day,” adds Bermüller. “The power of our treasury IT landscape is such that we have the capability of working with any ERP system or file format, both inbound and outbound.”

Robust structure

In common with many treasury professionals, Bermüller began his career in a different role. “I started my professional career as a banker while studying economics at Frankfurt School of Finance & Management at the same time, so theory and real work were combined,” he recalls. “Initially I was with HypoVereinsbank (aka UniCredit Bank AG) as a clerk. After some years in the foreign trade and credit departments, I became a relationship manager for multinational corporations. Following several years with DZ Bank AG my entry into treasury came in 2002, when I moved to the glass and ceramics group Schott AG as Head of Corporate Finance.”

"Introducing intercompany clearing throughout the group gives you the ability to shape treasury processes, creating efficiencies within the financial supply chain as well as centralising the FX risk."

In 2006, he joined DyStar Group – the Singapore-headquartered chemicals company that became world market leader for the textile dye businesses by acquiring several former producers such as Bayer, Hoechst, BASF and ICI/Zeneca – as Head of Treasury, before moving to his present role two years later. “The big difference working for a corporate is the freedom to shape the department and the ability to introduce new products,” he notes. “For example, introducing intercompany clearing throughout the group gives you the ability to shape treasury processes, creating efficiencies within the financial supply chain as well as centralising the FX risk.”

Although the global financial crisis was rapidly unfolding as Bermüller joined Merck, the impact on the company and its divisions was relatively light. “The business was – and is – financially healthy in terms of its equity, earnings and cash flows. On top of this, our turnover has doubled over the period since the crisis,” he reveals.

His first project on joining Merck was to further shockproof the company against the tremors rocking the financial services industry by restructuring its global cash management programme. “We established Merck Financial Services GmbH – which Introducing intercompany clearing throughout the group gives you the ability to shape treasury processes, creating efficiencies within the financial supply chain as well as centralising the FX risk Jörg Bermüller, Head of Cash and Risk Management in Group Treasury, Merck Panoramic view inside the Innovation Center in Darmstadt became our primary in-house bank – as a legal entity, so that all our financial services were separated from the operating business,” explains Bermüller.

At the start of 2010, Merck set about rationalising its cash management framework; multiple USD, EUR, GBP, CHF and other currency cash pooling structures needed to be restructured, resulting in 18 newly established cash pools. The given complexity and time-consuming tasks at that time were partly a legacy of two major acquisitions: a €10bn deal in 2006 to buy Swiss biotech Serono and the addition in 2010 of Millipore, a US producer of biomedical research products, for US$7.2bn.

The challenge of integration

Another priority task was the introduction of a treasury management system (TMS). “While we already had a good cash management system, we needed to supplement it with a TMS for additional tasks such as ad hoc risk reporting,” says Bermüller. “After the successful implementation of the TMS, the next priority was the rollout of the payment factory across the countries in order to establish standardised processes for payments and collections.

“In parallel we introduced a web-based guarantee tool for all our subsidiaries, with all sharing the same targets: standardisation, efficiency and savings. Not to mention the go-live of the Single Euro Payments Area, which had to be managed on top of this. All this took place against the backdrop of several further major acquisitions by the company, resulting in intensive integration projects.”

Bermüller agrees that integrating a new business following a merger or acquisition is a very complex process, but he highlights that the company has gained plenty of experience over the past decade. “This experience has helped us in adopting the best solution, which is recognising that acquired entities can also be a source of good processes and ideas and can shape the way in which we work.”

For him, the process of integration that follows any major M&A deal is among the most exciting challenges for treasury. “The Sigma-Aldrich deal was particularly demanding. There was considerable variety within the company’s treasury operations – while it had a number of great processes, other parts were only semi-automated and some were still greenfield. We had to find a different solution for each of them. Taking into account these various stages, the challenge was to make them fit into our overarching standard process.”

Treasury re-engineered

The cash management restructure also reached a further milestone when the company’s cash management service provider withdrew its product from the market. “We had to implement an entirely new treasury management landscape from scratch while running the existing one,” recalls Bermüller. “This project wasn’t restricted to just one system but across Merck’s entire set-up. After digesting the shock, we took it as a great opportunity to remove several obstacles that were holding us back. We created a new treasury IT landscape with the clear aim of taking it to the next level. But it was a major undertaking that took no less than five years from inception to completion.”

The organisational structure of the Merck treasury team has also evolved. After two years’ work, the highly centralised department is about to establish regional treasury centres in the Philippines and Uruguay – based in their respective capitals of Manila and Montevideo – to be closer to the shared service centres, the business and the local country organisations in general.

In addition to the company’s expansion in the world’s emerging markets, Merck has also been adding to and developing its research facilities in China and offering support to its pharmaceutical start-ups there.

“We have a good track record in successfully adapting very fast to deregulation,” says Bermüller. “For example, Merck was one of the first companies introducing CNY intercompany invoicing right after the Chinese government gave permission. In light of this, we were the first corporate to open a CNH account with Deutsche Bank in Hong Kong and accordingly when allowed in Germany.

“With this move we’ve been able to centralise the currency risk, manage our businesses in China better and generate savings, as the offshore hedging was much cheaper compared to the onshore spot trades. It’s all about getting closer to the local markets and having treasury experts on the ground, although we do have a need for more expertise in several countries. We’re addressing this by establishing our regional treasury centres.”

Technology transfer

While Merck’s treasury team has steadily expanded since the arrival of Bruns and Bermüller – it numbers 32 financial professionals currently – it remains a relatively small department within a company of nearly 55,000 employees.

“I’d say that treasury today is far more about dealing with the company’s internal projects and processes than dealing with banks and other financial market participants. The former now accounts for around 80% of my time,” adds Bermüller.

He reflects on how the IT part of the business also “occupies a growing part of my working day and that of the team” as they all look to make the most effective use of big data, IT processes and standardisation. In line with its peers, Merck is assessing how best to deploy new emerging technologies over the coming decade.

“We’re already employing robotics in our treasury operations and AI will increasingly be a driver over the years ahead,” predicts Bermüller. “At the same time, it’s not the solution to everything. As it undergoes further refinement, AI can be the replacement for repetitive tasks that follow certain rules. It isn’t yet there for the more complex solutions, although that will come over time.”

The treasury team uses application programming interfaces in reaching out to Merck’s relationship banks to gain more data and have a deeper analysis in areas such as payment types. But ultimately, the company wants the ability to own its own digital boardroom. “For the time being though, I’m more of a believer in big data management and analytics,” Bermüller says. “This is the route that is leading to the day when we can employ process mining to identify where all treasury’s roadblocks are.”

Although consumer habits are steadily fuelling demand for instant payments and penetrating the B2B sector, this is one area where Merck has been less proactive. “They [instant payments] have yet to play a major role within our business outside of the life sciences division, where instant payments are sometimes connected to logistics and mostly when the delivery of goods is expected within 24 or 48 hours,” confirms Bermüller. “It’s something we’re looking into for this particular business, but it’s not a top priority as we’re not a retailer. We also recognise the risk of fraud when a payment is made instantly and it’s then too late to be retracted. So a payment period of, say, 30 days does have certain advantages.

“We have to be vigilant about preventing fraud, which is increasingly a risk for all businesses. The starting point of fraud is the human interface, so as well as making sure your people are aware you have to ensure that all of your systems are secure. We see the roll-out of our payment factory as a means of combatting fraud. It’s all about awareness and keeping one step ahead of the criminal – even voice recognition is no longer a foolproof system.”

A win-win proposition

A recent accolade for Merck’s treasury team was winning the Treasury Today’s Adam Smith Awards Asia 2019 for Best Cash Management, as well as a highly commended award for Best Liquidity Management Solution. “We’re very happy with this latest award, while the cash pooling solution has also been recognised by Treasury Management International (TMI) magazine,” enthuses Bermüller.

The transaction that caught the eye of he judges was one where Merck was performing a bank service request for proposals in Korea. “One out of many specialities of our Korea business is our huge local USD cash flows. We targeted to centralise the trapped cash besides managing the FX risk better. Therefore we searched for a holistic solution.

“Together with Deutsche Bank, we approached the Korean central bank authorities to gain approval for an automated cross-border solution,” adds Bermüller. “We now have a multibank sweep from local Korean banks pooled to our master account in Korea, and from there cross-border to our in-house bank in Germany. This is processed each evening Korean time. The same amount is then pooled back to Korea the following morning – the so-called ‘Cinderella sweep’ – to ensure that Korea remains liquid.” He points out that this is the first fully automated cross-border USD cash-pooling structure in the Korean market and with its implementation “a critical treasury process for Korea was changed to Merck’s global standard, resulting in financial savings through lower hedging costs”.

It would appear the Merck spirit of curiosity, collaboration, problem solving and innovation is not just confined to the company’s business divisions, but is thriving in Group Treasury as well.

You might be interested in

TRUST AND AGENCY SERVICES {icon-book}

Antibody builders Antibody builders

Following the success of the blockbuster anti-cancer drug DARZALEX (Daratumumab), Genmab is developing a pipeline of proprietary antibodies. Anthony Pagano, the Danish firm’s new CFO, tells flow’s Janet Du Chenne how the company’s US capital raising fits that strategy

TRUST AND AGENCY SERVICES {icon-book}

The personal touch The personal touch

Twenty-one years after it was established, the UK-Swedish biopharma company AstraZeneca is one of the first developers of a candidate vaccine against Covid-19. flow's Janet Du Chenne finds out how a people-centred mindset makes a difference in scientific innovation

Cash management, flow case studies, Technology {icon-book}

Tomorrow’s treasury: what’s the role of real-time? Tomorrow’s treasury: what’s the role of real-time?

The vision of a “real-time treasury” has been around for several years now. But how do instant payments and access to real-time information really change the way treasury is managed? flow’s Desirée Buchholz hosts a debate on the role of real-time in the future of treasury