December 2018

Treasury operational models are under scrutiny more than ever before. But how can organisations ensure their processes are optimised for efficiency – and make sure they are not missing out on what evolving technology can do for them? Amy Beninato of Deutsche Bank and Kristy McKay of insurance multinational MAPFRE discuss their tips for success

Today’s modern corporate treasurer has a much more strategic role in their organisation than, say even 30 years ago. As the EIU report, The future is now, how ready is treasury? puts it, while treasury cannot de-emphasise its core functions of cash and liquidity management, accounts payable/accounts receivable (AP/AR) oversight, funding and financial risk management, it has “progressed from being a transaction and reporting centre to a more strategic risk holder and analytics centre of excellence”.1

This trend had been picked up twelve months earlier in the Deloitte Global Corporate Treasury Survey, which noted, “While treasury continues to be viewed as a risk management function, there is an increasing trend towards supporting business strategy and delivering greater cash efficiencies through capital management.”2

What are the drivers? One seismic shift was, of course, the global financial crisis that occurred in 2007-2009. A focus on earnings was replaced with a focus on cash and liquidity and “marked the end of easy availability of cash for most corporates and the beginning of a situation in which the financial markets were no longer able to “reliably supply corporate demand for financing”.3

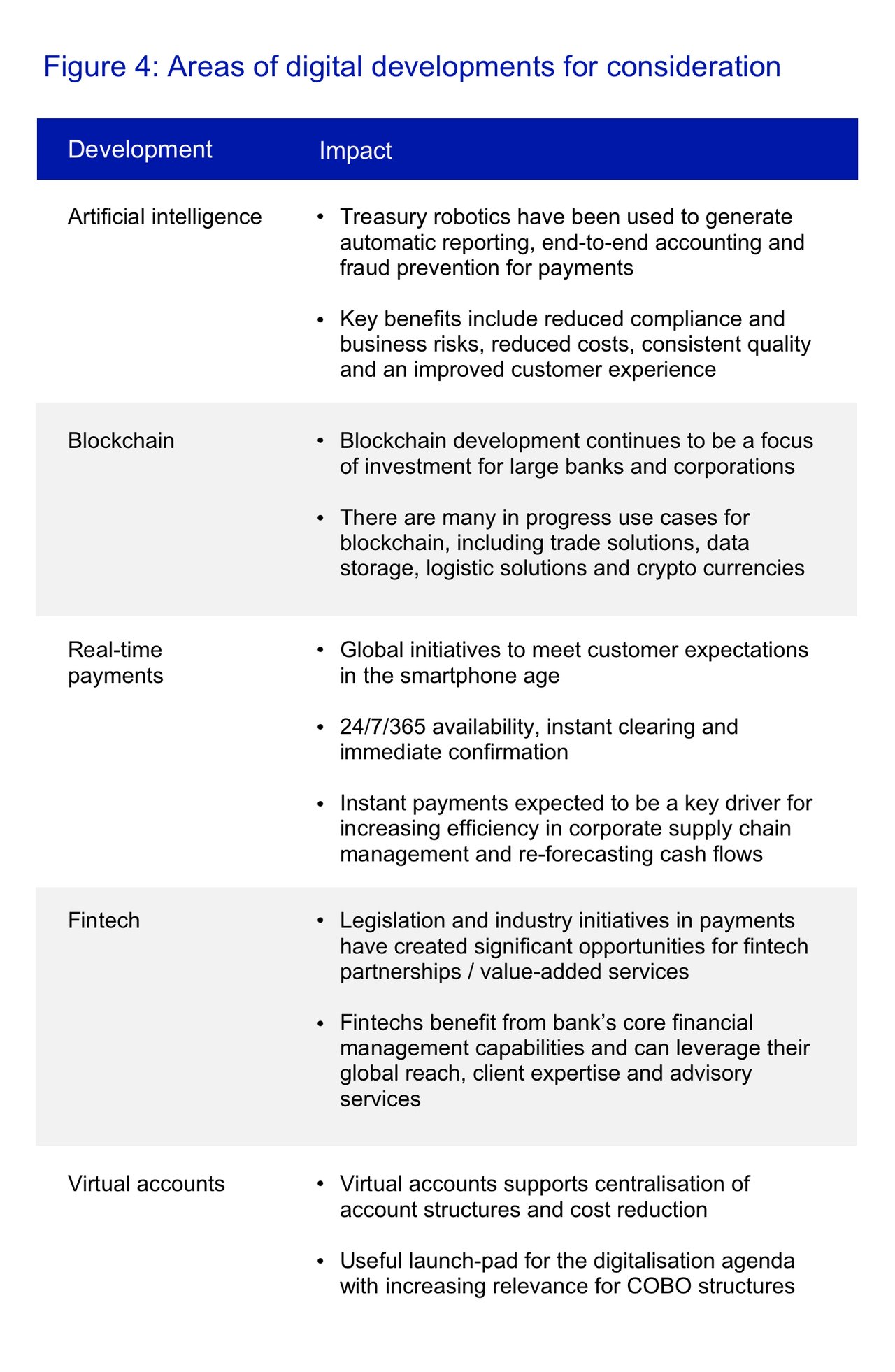

But, ten years after the vortex of the crisis, it is technology that is recognised as the game changer and the EIU research delves into attitudes towards digitalisation, along with artificial intelligence, blockchain and cloud technologies (the ABCs). In forums such as the Deutsche Bank/EIU Global Treasury Summits and EuroFinance, discussions are exploring what potential this has to update systems and processes used in the past.

However, treasury needs evolve even though many survey respondents believe that existing systems will remain the core of their operations for the foreseeable future. The EIU research notes that “the old models are still functional but cannot deliver the service levels required in an era of real-time digitisation. Faith in existing systems is misplaced.” What does this mean for treasury teams? The report authors state:

- Treasury has to be proactive. It cannot be a passive consumer of technology but must actively work with suppliers and banks. They must develop their own in-house abilities in areas like APIs or at least be able to work with third-party engineers who can.

- Treasury teams need to upskill. This means “evolving in terms of upgrading skills and hiring new digital expertise instead just the traditional finance, tax and accountancy skillset”.

Operational efficiency

While corporate treasuries are evolving operational efficiency, are they evolving this fast enough? The EIU research did indicate that “while some companies are well advanced in their preparations, others are, at best, ambivalent about the profundity of the changes they face”. It is in this context of balancing the longer term strategic view along with keeping on top of the traditional day to day tasks (and getting them done as quickly as possible so that strategic engagement is possible) that Treasury Manager Kristy McKay of MAPFRE USA (a division of the Spanish insurance provider) and Deutsche Bank’s Director of Corporate Cash Management Americas Amy Beninato shared their experiences in a webinar with Treasury and Risk on 13 November 2018. The remainder of this article summarises the key points of their discussions, along with poll feedback from the 42 voting participants, which cover the following broad areas:

- Identifying and eliminating inefficiencies

- Benchmarking performance

- Creating a roadmap for improvement

- Managing and monitoring: periodic review

Identifying and eliminating inefficiencies

A poll of the webinar participants revealed a dominant profile of organisations with turnovers of at least US$1bn or more. But, explained Beninato, the difficulties presented by legacy systems, the lack of real-time architecture and duplicate structures and processes create inbuilt inefficiencies for entities of all sizes. At €27bn (2017) 4, MAPFRE is at the large end of the scale and McKay confirmed all these pain points. “There are technology differences between old and new platforms, you have to try and find a common timeframe across time zones and everyone wants their numbers yesterday – an efficient month-end is an ongoing challenge.”

Multiple financial reporting tools also creates inefficiencies, and a second poll demonstrated how even large corporates with well-established financial systems still “mostly” use Excel albeit alongside other reporting tools (39%). Beninato reflected, “When I consult with clients and ask how they do their forecasting, nine times out of ten the answer comes back, ‘Excel’.” This is in addition to enterprise resource planning (eg SAP or Oracle), but Excel does seem to be a cornerstone of reporting.

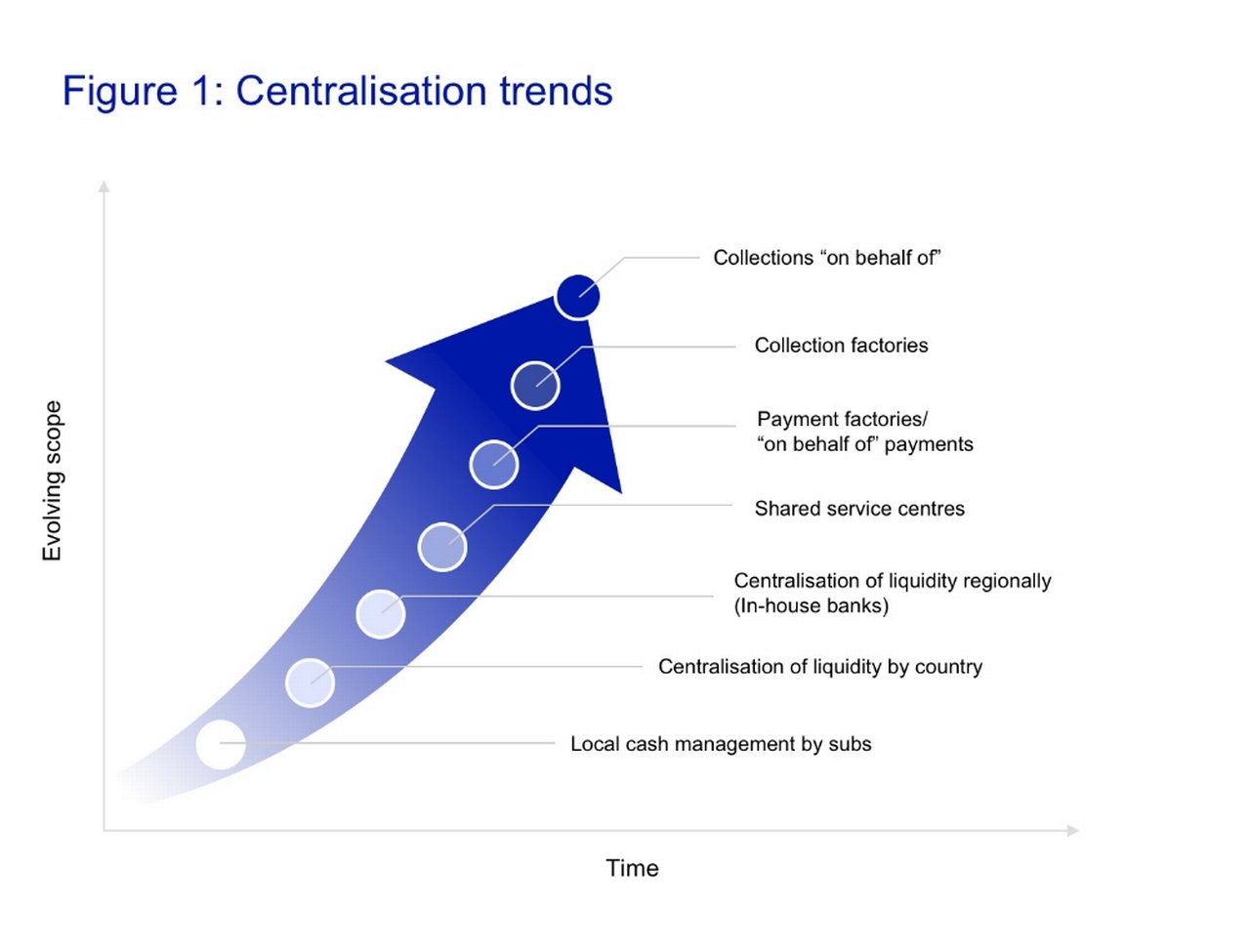

Beninato is also seeing more of a move towards centralisation of payment and collection processes into shared service centres, payment factories and collection factories where regional and local treasuries are centralised. Centralisation was confirmed by 55% of participants. However, 34% said they had hybrid models where some operations are centralised and others are handled locally.

Top performing corporates, she said, have in-house banks (IHB), payment on behalf of (POBO) and collection on behalf of (COBO) structures and virtual accounts where “on behalf of” models can include FX payments; intercompany settlement and, sometimes, third party payments/collections.

“We are a centralised organisation,” said McKay. However, in terms of positioning on Figure 1 above, she sees MAPFE at the bottom of the blue arrow in the white and pale blue circles. As MAPFRE has evolved through acquisitions, the entities have been integrated into the company and duplicate structures that have been in place for a while have to be addressed. However, she said, “We maintain cash under our separate entities so our cash is not pooled. Our functions are repetitive and different for each entity and set of systems. Yes, we try to bring it all together and have consistency but this doesn’t always work as well as it could.”

Benchmarking performance

Having identified a treasury’s strengths, the next stage is to sort out what needs to be improved. But how do treasurers define the key performance indicators (KPIs) and set up dashboards so that all the disparate sources of information are accessible in one living document?

Participants were then asked what formal methodologies they used to track continuous improvement. Most of the (77%) indicated that few chose formal solutions, but 11% put their hands up to Six Sigma, a set of techniques and tools developed by Motorola in the 1980s to improve manufacturing and business processes. McKay made the point that at MAPFRE, different methodologies are used to address different issues. So Kaizen helps deal with change for the better, Lean is deployed to eliminate waste and duplication with Six Sigma framing wider strategic process improvements.

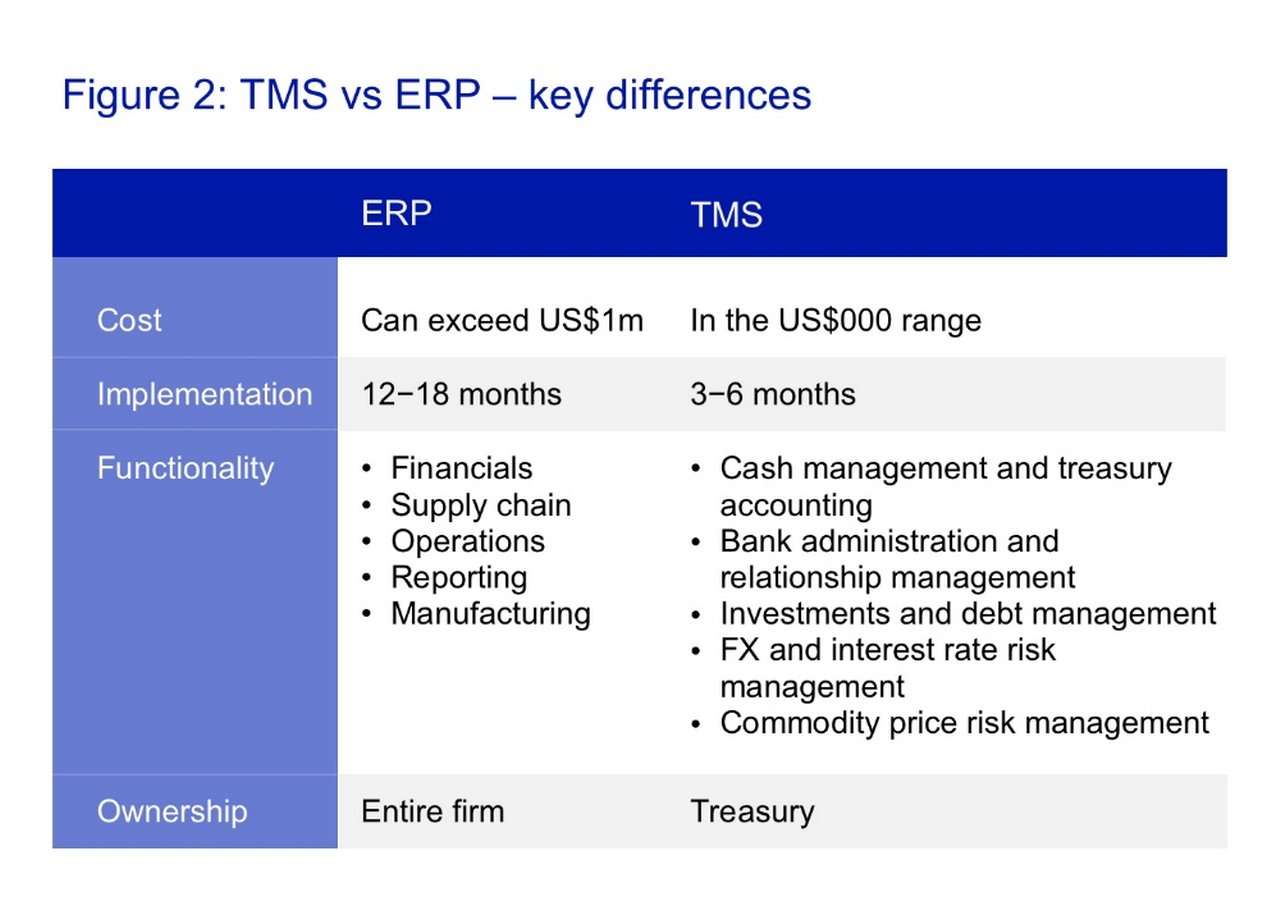

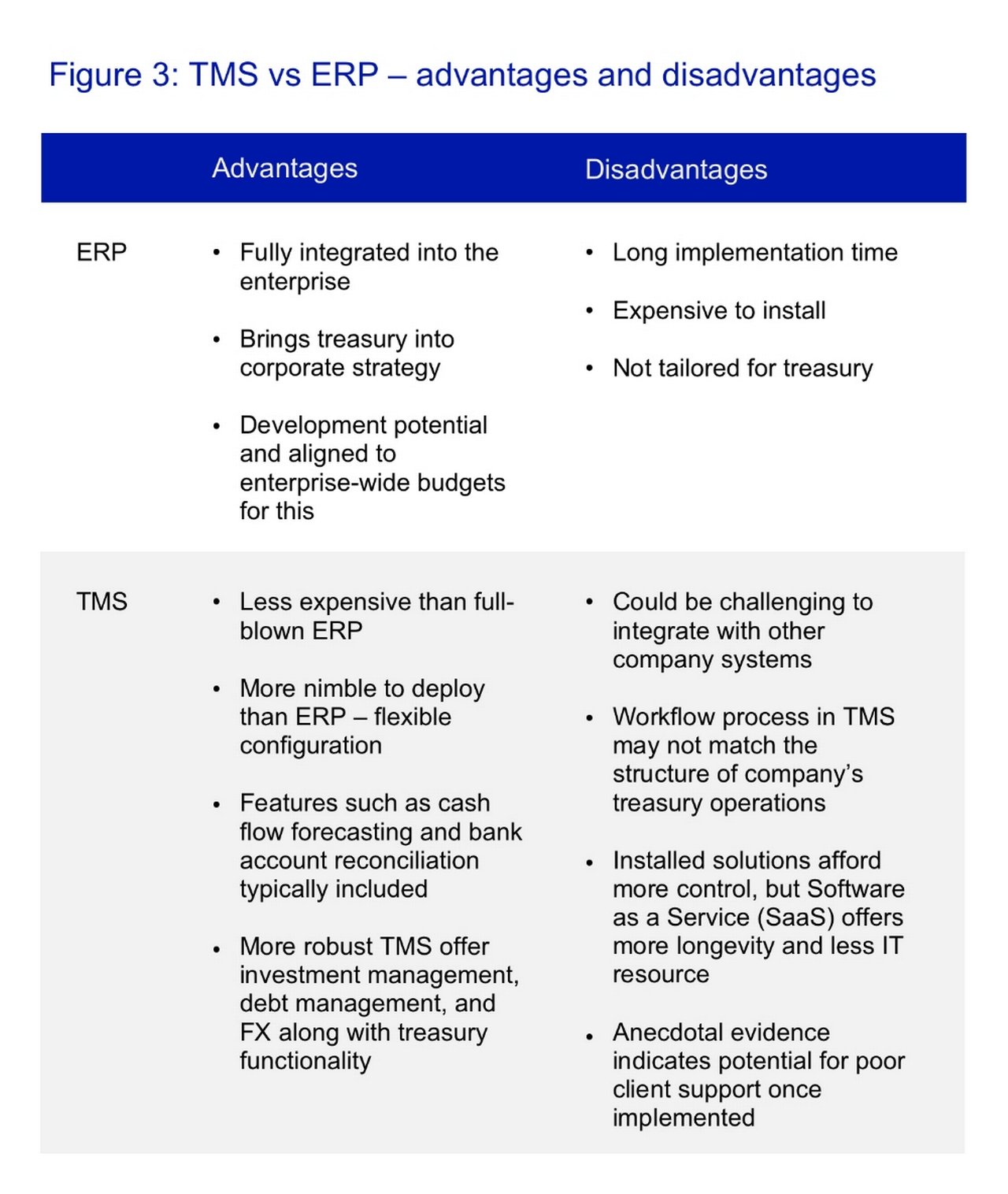

Rationalising account structures, said Beninato, is a big one for many of her clients – large multinationals can end up with thousands of different bank accounts around the world. ERP and treasury management system (TMS) technology can be leveraged to help with this, she reflected. So it was hardly surprising that the next audience poll showed that 33% used an ERP system and a further 35% had both ERP and (TMS) technology in place. Figures 2 and 3 summarise the main differences, along with broad advantages and disadvantages of both options.

Continuous improvement involves the whole organisation and not just treasury – McKay explained. “Finance and treasury are part of a lot of initiatives where the KPIs are not specific to us. Just look at marketing. If we run a digital campaign to enhance the way our customers pay us using digital channels, we want to know the impacts and outcomes of that.” And, she added, “We are constrained by IT resources, so we need to identify the technology we have got and how to reach our goals with it.”

In other words corporates want a direct line from their existing ERP to their banks (so that data entry is just done once and the efficiency of straight through processing captured in the transaction journey). This all needs to involve minimal effort and investment, using standard formats and communication. It took the global financial crisis, said Beninato, to push the banking sector into developing standardisation with SWIFT, so that corporates had the flexibility to move relationships in a bank agnostic environment. “The big trend we see is visibility,” said TMS provider Kyriba’s President, Bob Stark. He added, “Since most treasurers don't have a direct link to SWIFT, they often want the TMW to provide that link.” 5

The Association for Financial Professionals’ Guide to Selecting the Right Treasury Management System has some useful points about building the business case – “list processes that need improvement or don’t add value, understand the cost of time wasted on non-value labour-intensive tasks” and notes that treasurers want “data visualisation, business intelligence and fraud detection capabilities, in addition to the traditional requirements for cash forecasting and payments”.6

Roadmap for improvement

This can only evolve, said the presenters, once you have agreed answers to the following questions:

- What is our current state?

- What is our desired future state?

- What is the time needed to reach our goals?

- What KPIs are needed to assess our progress against our goals and milestones?

- What technologies can we leverage to achieve continuous improvements?

- How can our partners (internal and external) help?

The other crucial part of the journey is the digital strategy. While 60% of the audience said they were reviewing this within their organisations, 40% said they were not – a charitable explanation could be that they had already done a review and were implementing the recommendations. But given that the EIU research confirmed that 43% of its 300 senior corporate treasury respondents did not believe that sector disruption would affect their operational models, 7 one could assume that the webinar audience not reviewing a digital strategy had not started.

McKay believes that banks are her best resources for keeping her appraised of what is on the digital horizon, and Beninato said, “I had a client tell me that she felt that now there was a window where she could call her bank and be more experimental than she had been in the past. ‘Now is a good time to consult banks and ask them what they are doing in terms of innovation and how we can partner.’” Beninato added that the current environment has “forced banks to be more creative, which can only be good for everyone”.

Alongside all of this, pointed out McKay, is the impact on operations, such as staffing for 24/7 service. “Who will be there at 11pm on a Saturday night pushing out wires? What is your ledger cut-off and when do you take an end-of-day balance?”

Millennials, she added are “different from the rest of us” and “that will evolve” as core business hours may have to shift to accommodate them, and industries replace high-walled cubicles with collaborative workspaces. It’s about, said McKay, “how to get people to become more agile and responsive to your customer needs”.

As for managing operational risk when it comes to increasingly virtual treasury processes, control frameworks and governance have to be, as the PWC 2017 Benchmarking Survey put it, “a priority”. The report makes the point that treasury is highly complex, with high value and with few staff involved. “As treasury processes are brought online, application management, workflow configuration, static data management, defining user roles, access and reporting have to be properly addressed,” notes the survey. 8

Monitoring and managing – periodic review of performance

As the webinar drew to a close, the presenters reminded us that, having created the roadmap, leveraged the technology, agreed the KPIs and set the dashboard, you have to keep a constant eye on the actual performance.

McKay said that, depending on the initiative in place, some reviews are weekly and some are monthly. A project will have specific milestones that are assessed. But not everything is predictable. “We always run into things we did not anticipate. Some things worked out well, but other were stumbling blocks.” Communication is also vital, she reflected. “Few things are worse than working in a vacuum. If you have a success story, make sure everyone hears it!” Beninato recalled how a few years ago a client decided to implement SWIFT, deploy a treasury workstation and migrate to SAP all at once – so quite often corporates don’t have the luxury of assessing the success of one project before another begins. Another put into the request for a proposal that the front end of the cash management solution be built with a fintech. Again it is back to agility and keeping an eye on the horizon.

To watch the complete webinar, Is your operational efficiency evolving fast enough, register online at with Treasury and Risk here

Sources

1 See 'The Future is now: how ready is treasury' Economist Intelligence Unit/Deutsche Bank, October 2018, at corporates.db.com

2 See https://bit.ly/3aCOIO3 at deloitte.com

3 See https://bit.ly/2M4MYDc Polak, Robertson, Lind, International Research Journal of Finance and Economics, NO 78, 2011 at deloitte.com

4 See https://bit.ly/37MINEp at mapfre.com

5 See https://bit.ly/3aFzWGr at kyriba.com

6 See https://bit.ly/3mI7xC5 at afponline.org

7 See page 6 of the EIU report at The future is now: how ready is treasury (PDF) at corporates.db.com

8 See https://pwc.to/3mJv6KB at pwc.to

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published published annually and can be read online and delivered to your door in print

You might be interested in

CASH MANAGEMENT

Digital treasury accelerates in Asia Digital treasury accelerates in Asia

Treasury digitisation across Asia was gaining traction even before Covid-19 struck, but the pandemic has accelerated the process. A recent Deutsche Bank webinar provided a progress report

TECHNOLOGY, MACRO AND MARKETS {icon-book}

AI in motion: Tracking the smart money’s journey AI in motion: Tracking the smart money’s journey

Deutsche Bank Senior Strategist Marion Laboure takes a closer look at the explosion in artificial intelligence (AI) commercial applications by examining patent growth areas

CASH MANAGEMENT

Supporting clean mobility Supporting clean mobility

In December, German automotive component producer Continental agreed a €4bn revolving credit facility with a 27-bank syndicate aligned to sustainability performance. flow’s Clarissa Dann on how the company is navigating Covid-19 and a Tesla-disrupted market place