September 2020

Rapid changes to treasury strategy introduced in response to Covid-19 appear likely to endure as companies adjust to the pandemic having longer-term impact, the latest Economist Intelligence Unit survey suggests

Treasurers expect the fallout from the Covid-19 pandemic to persist over the next five years and shape the “new normal” for corporate finance globally, suggests the latest report from the Economist Intelligence Unit (EIU).

Titled ‘The Resilient Treasury: Optimising strategy in the face of Covid-19’, the report, supported by Deutsche Bank, is the latest in EIU’s studies of strategic change in the treasury function. The 2020 edition is based on a survey of 300 senior corporate treasury executives conducted in April and May this year, after lockdown measures has been imposed on many regions of the world.

As the EIU report notes, treasurers had only just started to implement strategies for 2020 when the economic picture for the year changed irrevocably, due to the speed with which the pandemic spread across the globe. Treasury plans were quickly and dramatically altered as the treasury function was obliged to shift to a remote working environment. The focus shifted away from long-term cash forecasts in favour of shorter-term, more regularly interrogated forecasts to get an accurate picture of cash and liquidity.

Key findings

The new edition drew a third of its respondents from companies with an annual revenue of at least US$5bn and the executives polled were from three regions: North America, Asia-Pacific and Europe, the Middle East and Africa (EMEA) and a wide range of industry sectors.

The 2020 survey includes findings from the five previous EIU corporate treasurer surveys in the series, covering 2015 to 2019.1

Among the key findings this year are:

- Macro risks are expected to drive change within the treasury function and specifically the way in which its strategy is defined.

Survey respondents said that pandemic risk driven by Covid-19 will have the greatest impact on corporate treasury, both in the short term (43%) and also in the medium term (27%).

Other pandemic-related risks that treasurers cited as top of their agenda in the medium term were global economic growth concerns (31%) and geopolitical risks (25%). - The current climate of uncertainty means that treasurers plan to diversify investment portfolios. The survey results show that the pandemic has pushed a variety of risk management techniques to the fore.

Liquidity risk, foreign exchange risk and mitigation of interest rate risk have become vital in navigating increasingly volatile markets.

Meanwhile, a focus on counterparty risk is critical for supply chain management as the sudden economic downturn impacts on smaller suppliers.

Treasurers say that over the next 12−24 months they plan to increase their investments in long-term instruments (55%), bank deposits (48%), local investment products (48%) and money market funds (47%). - The replacement of the traditional benchmark London Interbank Offered Rate (LIBOR) for lending and borrowing, and other Interbank Offered Rates (IBORs), is regarded as the most challenging regulatory initiative for treasury. The transition away from LIBOR is understandably a pressing concern given the anticipated deadline at the end of 2021 and lack of clarity around an industry standard replacement rate; 38% of the 2020 survey respondents consider it to be the main challenge for their function.

Other regulatory initiatives whose impact they believe will need to be managed include General Data Protection Regulation (GDPR, cited by 32%, up from 29% in 2019), the OECD’s initiative against base erosion and profit sharing (BEPS, 31% versus 18%) and the Markets in Financial Instruments Directive (MiFID II, 30% versus 7%). - Digital transformation has been accelerated by the pandemic and continues to impact the corporate treasury, with a growing reliance on technology day-to-day. Treasurers are increasingly seeing new technologies as a way to bridge data issues such as the “Know Your Customer” (KYC) process.

The majority of treasurers (74%) have identified the use of new technologies as the most useful action to improve the KYC process, against 58% in the 2018 survey. - As corporate treasurers become more involved in data strategy concern over data quality has grown, with 78% of treasurers either very or somewhat concerned about the quality of data against 69% in the 2019 survey. Internal data issues stem from having to link up numerous systems and software. Externally, the lack of standardisation on electronic bank account statements is particularly problematic.

- Future treasury priorities will be shaped by macro risks, regulatory changes and emerging technologies. The utmost priorities on the treasury agenda in 2020 are managing relationships with banks and suppliers and collaborating with other functions in the business (both 32%).

Covid-19

The pandemic has also influenced treasurers’ short-term concerns about the outlook for the macro global environment and the likely consequences. Non-core treasury activities such as sustainable finance, which were a priority at the start of 2020, have become less important since the onset of the pandemic.

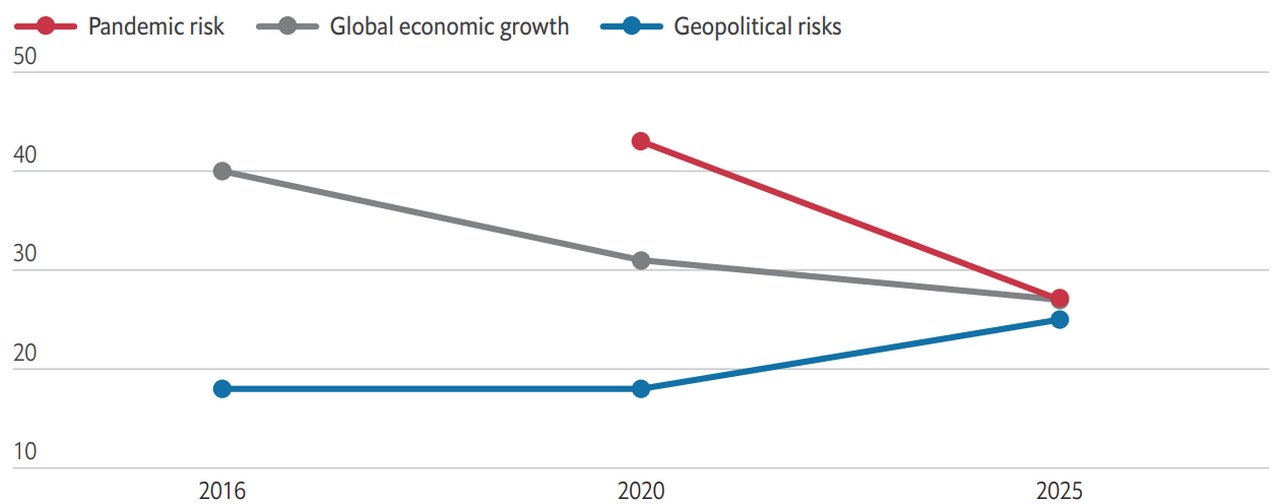

Top macroeconomic and financial risks to corporate finance 2016-25

Source: Economist Intelligence Unit surveyEIU’s 2020 survey suggests that “new normal” for corporate finance globally will be shaped by Covid-19. The top three risks to a firm’s finances cited by respondents all have ties to the disease: pandemic risk (43%), global economic growth (31%) and inflation/deflation risk (23%).2 This will necessitate robust forms of risk management by the treasury function.

Pandemic risk is also top of mind for treasurers in the medium term to 2025 (27%) alongside concerns about global economic growth (27%) which will, in turn, impact cash flow and liquidity forecasting.

Corporate treasurers interviewed by EIU for the report corroborated this view. “Our chief financial officer has requested that we really build up our cash forecasting capabilities,” says Anita Polzhofer, Head of Treasury at UK-based multinational engineering consultancy Arup.

The need for liquidity buffers will be no less pressing in the short term, states Rando Bruns, Head of Group Treasury at German pharmaceutical manufacturer Merck. “The impact on our strategy mirrors what we always do in crisis times: we have a closer look at liquidity, whether we need more of a liquidity buffer and whether markets are available in those times for refinancing and similar actions.”

Covid-19’s impact will also be felt over the long term, adds Charles Cao, Group Treasurer at Ant Financial, the online payment services provider and credit payment firm. “The pandemic will have an impact on our treasury strategy in the next five years. The most fundamental change will be on treasury infrastructures, particularly around payments and bank account management.”

Macro risk implications

The 2020 report suggests that corporates are becoming more concerned about the global economic fallout from Covid-19 than the virus itself, reflecting the level of uncertainty about the post-pandemic outlook for developed and emerging economies.

However, while the level of concern over global economic growth is cited by 39% of treasurers in EMEA as a critical risk for managing their firm’s finances, only 24% of APAC respondents agree. They are also concerned by geopolitical risk, with 22% citing it compared with 17% in North America and 14% in EMEA.

“We already have a trade war under discussion. As the pandemic starts to fade, will that amplify the trade war? That is a worry,” comments Cao. “This could lead to some weaker economies having even bigger trouble, which will then have a knock-on effect for corporates that have invested in these markets. Certain countries already incur some currency restrictions. If that further strengthens, it will be a big concern.”

As shown in Figure 1 above, in 2016 EIU reported that 40% of treasurers cited concern over the outlook for global economic growth as the top risk to their firm’s finances . In the 2020 survey it ranks second at 31% and is some way behind Covid-19.

The pandemic has overtaken other risks on the corporate agenda: environmental, weather and climate risks were only treasurers’ sixth most pressing risk for 2020, despite being cited by 19% of respondents versus 10% in 2016. Even in the medium term, environment and climate related risks are cited as the fourth biggest risk (25%).

Environmental, social and governance (ESG) factors also lie outside the top three aims of treasury strategies, according to the 2020 survey. “I think ESG has been put on the back burner a little bit given the more immediate focus that we have to have on cash and liquidity,” says Arup’s Polzhofer.

While European treasurers have become accustomed to negative interest rates since 2014 when the European Central Bank (ECB) first lowered its policy rates into negative territory, they now also appear to be a possibility in markets such as the UK and US as central banks struggle to prevent a major and long-lasting recession after covid-19. “Even though a lot of people say that it is impossible for the dollar to come into negative interest territory, corporate treasurers need to be prepared for that,” says Cao.

Treasury’s future priorities

The 2020 report concludes that as the treasury department continues to grow and evolve it has an increasingly onerous array of challenges to navigate, including those around regulatory changes and emerging technologies. On a positive note, the skills and tools exist within treasury for the function to continue to protect company cash while also extending insight and strategy to support corporate growth.

The pandemic has drastically altered business plans in 2020, placing a certain level of strain on treasury processes. Yet in many ways the challenge presented Covid-19 has been managed by traditional treasury skills – by gaining visibility over cash and ensuring access to lines of liquidity. While the pandemic risk will clearly be on the treasury checklist for several years to come, it is one of many risks the department faces and will continue to manage.

The survey forming the basis of the report suggests that treasury’s data-driven approach will allow the function to become an even more supportive and proactive partner to the rest of the business. By working with banking partners, suppliers and third parties to optimise processes, treasury can collaborate more closely with other business functions to drive corporate growth.

THE RESILIENT TREASURY: Optimising strategy in the face of covid-19 was published by the Economist Intelligence Unit in September 2020 supported by Deutsche Bank. For a helpful summary of the key findings from the research, view the interactive EIU Infographic here

Sources

1 See A Quantum Leap: Building a data-driven treasury at corporates.db.com

2 See Covid-19 and inflation at flow.db.com

Download The EIU report ‘THE RESILIENT TREASURY: Optimising strategy in the face of covid-19’, supported by Deutsche Bank

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

CASH MANAGEMENT

Digital treasury accelerates in Asia Digital treasury accelerates in Asia

Treasury digitisation across Asia was gaining traction even before Covid-19 struck, but the pandemic has accelerated the process. A recent Deutsche Bank webinar provided a progress report

CASH MANAGEMENT

Corporate tips for navigating Covid-19 Corporate tips for navigating Covid-19

COVID-19 has precipitated a global shock that poses significant risk for business. To assist in this situation, Deutsche Bank’s Capital Markets Strategy team provides a detailed checklist for operational, funding and risk management functions