21 April 2021

With Covid-19 having sharpened e-commerce appetites, treasurers have responded by optimising their digital payments infrastructure and kept their financial data secure while connecting customers. flow shares key insights the Economist Intelligence Unit in the first of four reports

MINUTES min read

At the start of the 2020s e-commerce was growing at an impressive rate, without any need for additional stimulus. Covid-19 provided one regardless. As many traditional bricks-and-mortar stores found their business severely curtailed or had to shut down completely, consumers moved online to make their purchases.

Many of these new shopping behaviours are here to stay, regardless of when life returns to a post-pandemic normal. An estimated one billion people worldwide made digital payments using a mobile device in 2020 and this figure is forecast to increase to 1.3 billion by 2023. Treasurers in companies ranging from retail to consumer goods manufacturers are being looked to for help in preparing a seamless omnichannel shopping experience so customers can, for example, either discover a product in-store and order online or make the purchase online and collect the item from a store.

As firms have begun to develop their e-commerce platforms or adapt business models in order to sell directly to consumers (D2C), their treasuries have been closely involved in expanding their companies’ digital payments infrastructure, managing the risks arising from the strong growth of online and cross-border transactions and addressing data security concerns relating to the use of digital payment service providers (PSPs).

Tech investment growing

A survey of 150 senior corporate treasurers across North America, Europe, the Middle East and Africa (EMEA) and Asia-Pacific, conducted by The Economist Intelligence Unit (EIU) and supported by Deutsche Bank, reflects the speed of transformation. The research was conducted between February and April 2021, thus around a year after the Covid-19 pandemic first struck.

Companies expanding their e-commerce platforms depend on application programming interface (API)-connected platforms and cloud technology for real-time access to data, and on artificial intelligence (AI) for predictive analytics. With technology regarded as central to business continuity – and possibly even survival – companies are stepping up their tech investment, despite the fall in global sales in 2020 when most of the world’s economies saw growth contract.

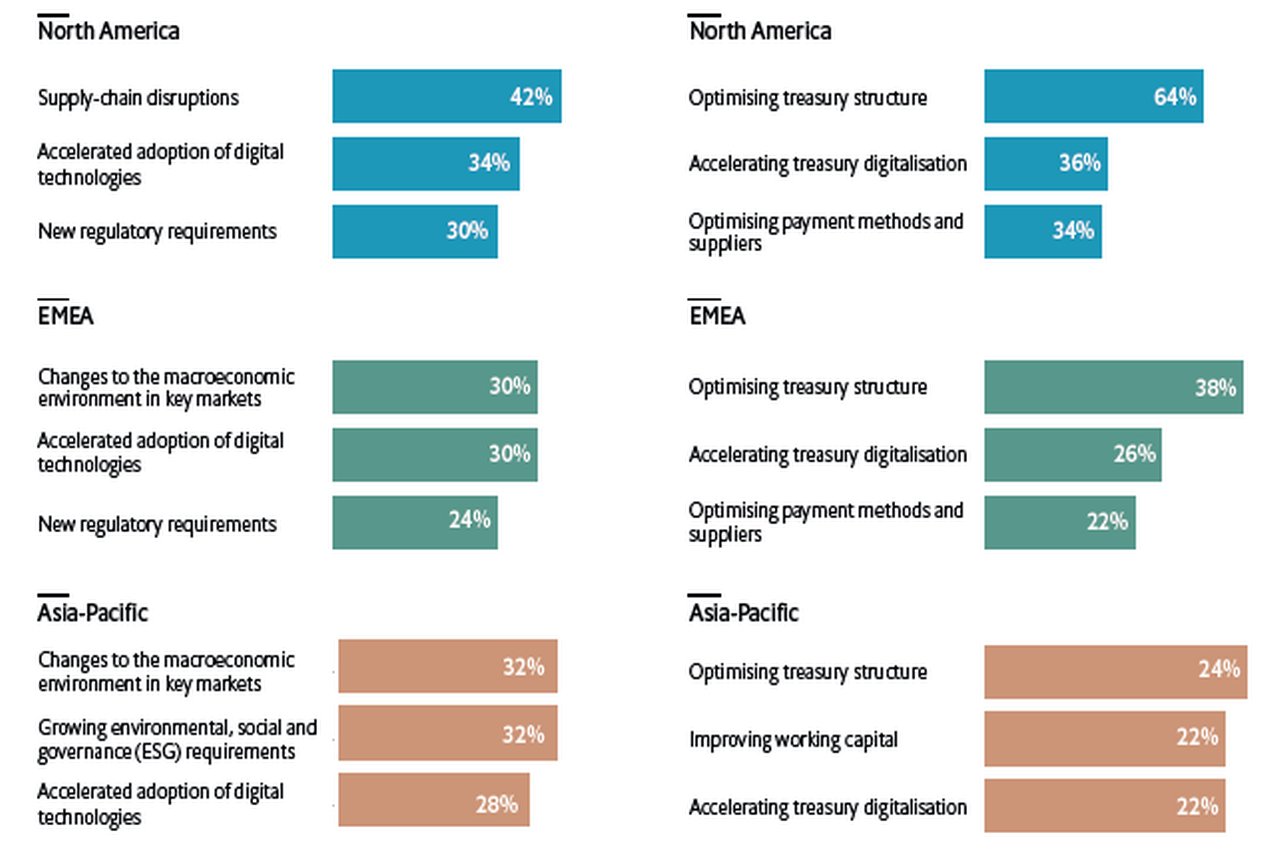

Figure 1: Factors affecting treasury most and treasury priorities, Feb-Apr 2021

Source: Economist Intelligence Unit survey, February 2021.

As highlighted in Figure 1, the survey found that treasurers believe the “accelerated adoption of technologies” will have the greatest impact on the treasury function and this factor was cited by 31% of respondents.

Of those respondents surveyed in EMEA and Asia-Pacific, nearly one in three believed changes to the macroeconomic environment in key markets will have the most impact on treasury in the months ahead. In Europe, the duration of the pandemic and the sluggish pace of the anti-Covid vaccine rollout are weighing on expectations for the speed and strength of economic recovery. In Asia-Pacific, China’s speedy return to growth is offset by a more subdued performance in countries such as South Korea and Japan.

By contrast, treasurers in North America anticipate that supply chain disruptions will have the biggest impact; they were cited by 42% of respondents against 14% in EMEA and 12% in Asia Pacific. The survey was conducted shortly after reports in January 2021 of congestion at America’s ports, while US firms have also had to reconfigure their supply chain strategies due to sporadic lockdowns that disrupted trade in raw materials and finished goods as well as closing retail outlets.

Globally, respondents anticipating that supply chain disruptions will impact most on treasury are also more likely to be optimising their treasury structures (59% of respondents in that group versus 41% across the group as a whole). This reflects, the EIU suggests, the treasury transformation triggered by the shift to e-commerce. Supply chain disruptions have meant treasurers adapting their cash management strategies, such as financing a shift in the distribution model from retail stores to flexible warehousing, managing a greater frequency of returns and refunds and setting up in automated payments for scheduled product replenishment.

This has seen a more strategic relationship emerge between treasury and the supply chain function. As treasurers gain the ability to harvest payment data flows, they gain a more accurate picture of the supply chain and can identify its strengths and weaknesses. With e-commerce becoming a bigger component of B2C companies’ business models, treasurers must adapt to managing old issues, such as FX risk through a “new lens of high-volume, cross-border online sales”, which they believe they can make the most valuable contribution.

Growing pains

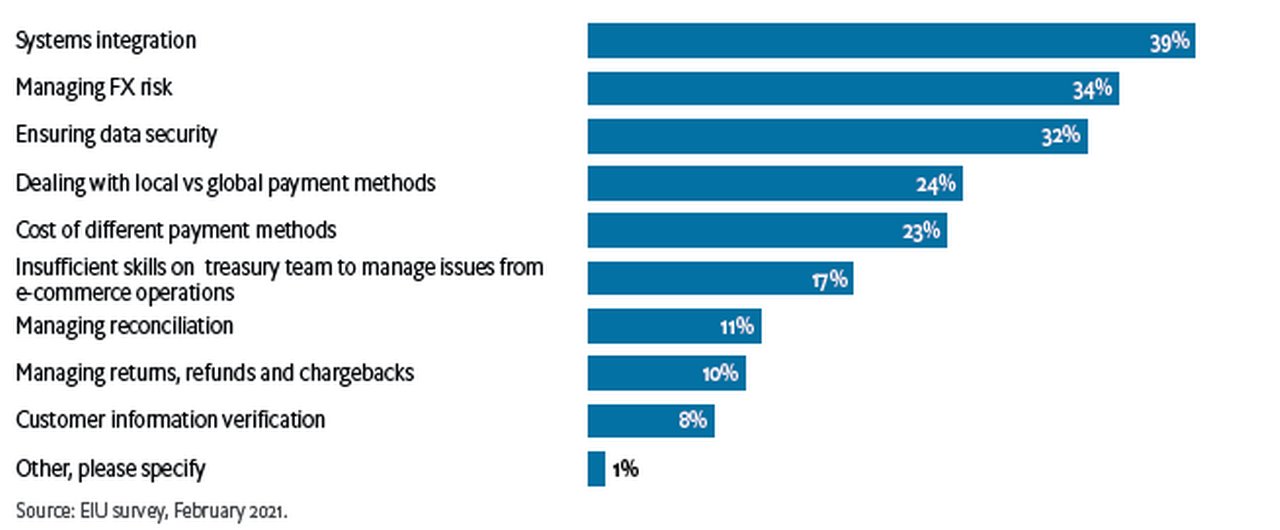

As companies expand their digital payments infrastructure, systems integration is regarded as treasury’s biggest challenge. It was cited by 39% of survey respondents overall, as per Figure 2, although by region the figure jumped to 66% for North American respondents against 28% in EMEA and 22% in Asia-Pacific. A company whose systems are not well integrated with payment service providers (PSPs) is vulnerable to processing and payment delays which, in turn, can lead to higher fees and lost transactions.

As Stephen Hogan, Vice President Regional Treasury Asia Pacific at international logistics firm Deutsche Post DHL commented, the system’s front end might look good, but the lack of standards for the interface of a variety of different payment methods presents challenges for back end reconciliation.

“Treasurers need to get out from behind their spreadsheets and understand what their commercial and operational teams need, and also what consumers want”

While managing FX risk scored 34%, ranking it the second-biggest challenge across all respondents, it was top of the list for those in Asia- Pacific (38%) and also scored highly with North American treasurers (40%). Only for those in EMEA (24%) was it a lesser concern.

Figure 2: Treasurers’ top challenges when expanding their digital payments infrastructure

Source: EIU survey, February 2021.

As the report notes, while treasurers have long managed FX risk the e-commerce era has increased the challenge as consumer brands increasingly bypass retailers and sell direct to consumers via their websites. So they incur a higher volume of smaller transactions, while multinationals also face tasks such as pricing in the local currency and managing FX fluctuations if the checkout process is unduly lengthy. Payment providers such as PayPal are addressing these problems, through solutions such as holding FX rates steady for up to 24 hours.

The challenge of safeguarding consumer data within digital payment systems was cited by 32% of respondents, but in EMEA its 34% score made it the top challenge. While the stringent enforcement requirements of the EU’s General Data Protection Regulation (GDPR) has focused attention on data security in the EU, it was cited by almost as many in Asia-Pacific (32%) and North America (30%). In both regions many companies are working towards GDPR compliance, despite not being required to do so.

Dealing with local versus global payments was cited by nearly one in four respondents (24%), but a higher percentage in North America (30%). Multinationals with a global presence are particularly likely to cite this challenge. PSPs responsive to consumer demand for payment methods they can access locally include Boleto Bancário in Brazil, PayPal in the US, Klarna in Germany, Alipay and WeChat Pay in China. They are able to minimise the number of customers who switch to rivals and can also generate a higher conversion rate (the percentage of transactions approved).

Some companies choose to integrate with payment platforms such as Stripe or Wellpay, which can manage the variety of local payment methods for them.

Treasury’s role in e-commerce

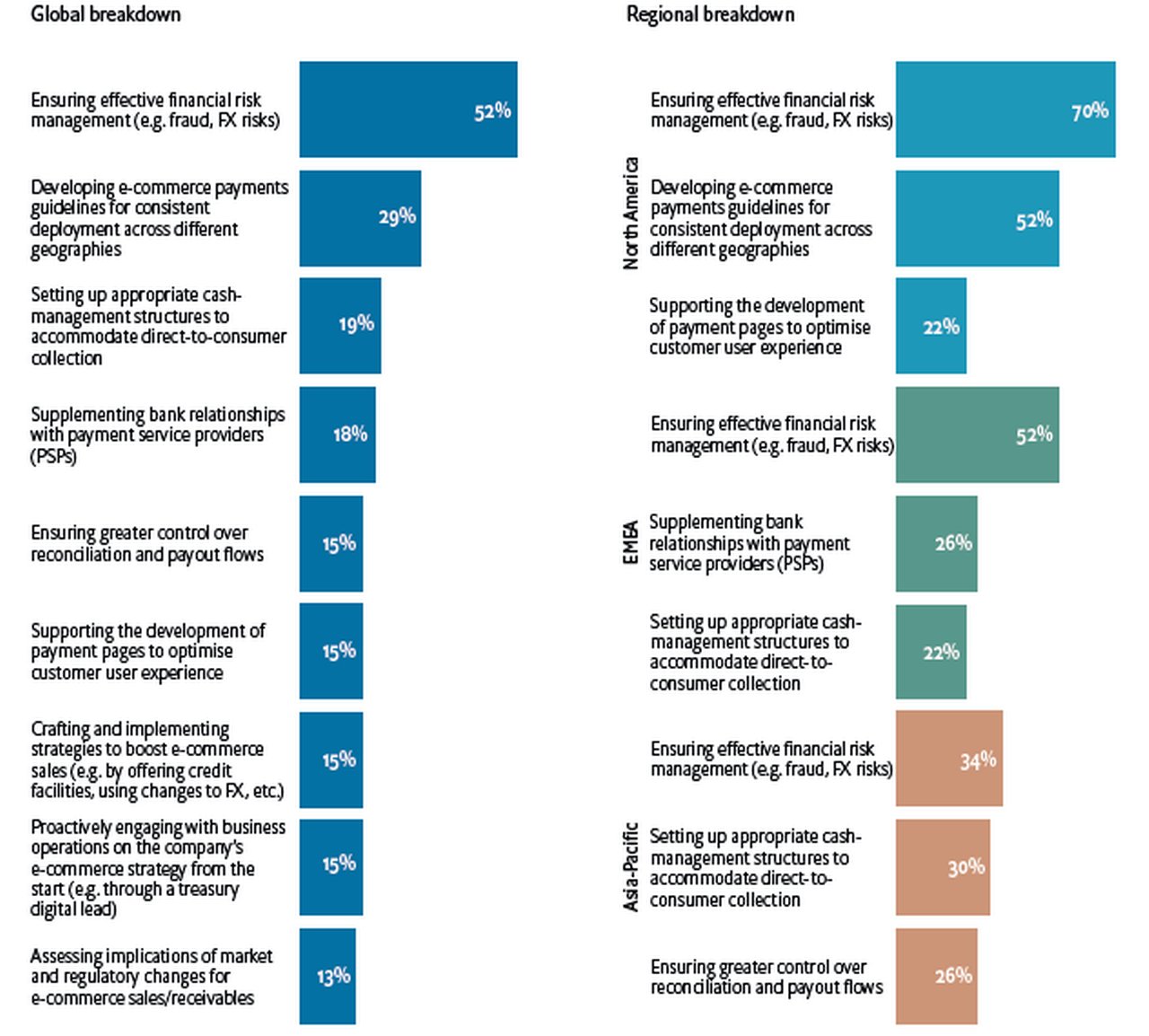

Amid the transformation of business models and treasury team structures, treasurers remain focused on one of their core activities, financial risk management. As per Figure 3, more than half (52%) of treasurers surveyed believe that ensuring effective financial risk management will remain their top priority as their companies move further over to e-commerce.

Figure 3: Most important aspect of treasury’s role in their company’s shift to e-commerce

Source: EIU survey, February 2021.

Again, the average figure comprises considerable regional variation. Financial risk management is more important to North American treasurers (70%) than their peers in EMEA (52%) and Asia-Pacific (34%). This could reflect the maturity of the e-commerce industry and also the use of digital payments in the US, where the real-time payments (RTP) network was launched as recently as 2017, nine years after the UK pioneered the Faster Payments service.

Seen as the next most important aspect of the treasury function’s role, developing e-commerce payment guidelines was cited by 29% of respondents – although among treasurers who also found it challenging to deal with local versus global payment methods, that percentage increased to 44%. According to Grégoire Toussaint, director at digital payments consultancy Edgar, Dunn & Co, companies expanding into new markets and working with a plethora of local payment providers “can end up with something very fragmented related to payments within [their] organisation”. That makes it “highly relevant to develop a payment acceptance policy document”.

For Asia-Pacific treasurers, setting up appropriate cash-management structures to accommodate D2C collection is considered the most important function; being cited by 30% of respondents in the region versus 22% in EMEA and just 6% in North America. With more than 50 different currency regimes in the region, far more than in Europe or North America, and different regulation across its markets, managing cross-border e-commerce revenue in Asia-Pacific can be more complex – much depends on whether settlement takes place locally and whether payments are made to a single bank account or to multiple accounts, among other factors.

The report concludes that any successful transition to e-commerce depends on engaging the treasury function at the outset. As companies expand their online presence, treasurers are being looked to in establishing best practice for the seamless deployment of payment systems across geographies and demanding greater standardisation of PSPs in order to achieve better systems integration. But most importantly, treasurers must keep customers front and centre.

This article is extracted from the Economist Intelligence Unit (EIU) survey and report, How treasurers can drive a seamless e-commerce expansion, the first of four EIU reports to be published during 2021.

Find out more by visiting the EIU ‘Treasury Connected’ microsite.

Download The EIU report 'TREASURY CONNECTED: Connecting customers', supported by Deutsche Bank

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

CASH MANAGEMENT

Resilient treasury factors in a lengthy pandemic Resilient treasury factors in a lengthy pandemic

Rapid changes to treasury strategy introduced in response to Covid-19 appear likely to endure as companies adjust to the pandemic having longer-term impact, the latest Economist Intelligence Unit survey suggests

TECHNOLOGY, MACRO AND MARKETS {icon-book}

AI in motion: Tracking the smart money’s journey AI in motion: Tracking the smart money’s journey

Deutsche Bank Senior Strategist Marion Laboure takes a closer look at the explosion in artificial intelligence (AI) commercial applications by examining patent growth areas

CASH MANAGEMENT

EBAday 2020: Turning point in payments EBAday 2020: Turning point in payments

The European Banking Association’s EBAday 2020 addressed the ongoing payments transformation as the pandemic accelerates digital payment appetite. Delegates at this rescheduled virtual event agreed that Covid-19 has also sharpened resilience in financial services, reports flow's Graham Buck