25 February 2022

Eliminating duplicative activities is essential for financial institutions seeking to provide added value to clients during the performance of underlying client checks. flow takes a closer look at how the Global Legal Entity Identifier Foundation has come up with a neat solution to address this

MINUTES min read

With financial institutions facing increasing cost and regulatory pressures, many are looking to capitalise on operational synergies. At the same time, these institutions are under pressure to continue augmenting their overall client experience.

It’s a tall order, but customer onboarding – which requires sell-side firms to conduct thorough anti-money laundering (AML) and know your client (KYC) checks on underlying clients – is an area where notable improvements are being made on both fronts, principally through the removal of duplicative activities in the issuance of legal entity identifiers (LEIs).

What is the LEI?

An LEI is a 20-character, alphanumeric code based on the ISO 17442 standard1 and is designed to identify legal entities participating in transactions, thereby improving market-wide transparency.2 Efficiencies are now being facilitated through the introduction of a new Validation Agent Framework within the Global LEI system, a development that could help eradicate many of the pain points historically faced by clients and financial firms during onboardings.

The use of the LEI is supported by the Global Legal Entity Identifier Foundation (GLEIF), established by the Financial Stability Board in June 2014. Headquartered in Basel, Switzerland, GLEIF is backed and overseen by the Regulatory Oversight Committee, representing public authorities from around the world that have come together to drive forward transparency within the global financial markets.

“The LEI could also become a valuable attribute enabling automated transaction due-diligence on the flight of a payment”

By offering access to the Global Legal Identifier Index free of charge, GLEIF brings transparency and trust to legal entity identification. GLEIF explains, “Backed by the Regulatory Oversight Committee, it is the only online source with the potential to capture any entity engaging in financial transactions globally, regardless of who generates these transactions.”3

Five years ago, in 2017 SWIFT’s Payments Market Practice Group published the discussion paper, LEI in the Payments Market on 21 November that had, back then, identified the importance of the LEI in fighting fraud. “Considering the rise in fraudulent activities, the increased regulatory scrutiny and the rising cost of correspondent banking, especially towards compliance-related functions as Know your Customer (KYC) and the increased sensitivity of accurate and reliable data for client identification in payments transactions, the LEI could also become a valuable tool supporting the bank’s efforts in this area,” noted the paper, somewhat prophetically.

However, the potential of the LEI to aid current painful processes isn’t limited to KYC only. Paula Roels, Head SWIFT & Market Infrastructures, Cash Business Architecture, Corporate Bank, Deutsche Bank explains, “Considering the rise in fraudulent activities, the increased regulatory scrutiny and the increased need of accurate and reliable data for client identification in payments transactions, the LEI could also become a valuable attribute enabling automated transaction due-diligence on the flight of a payment. This would significantly reduce the false-positive rate, increase efficiency and improve client experience.”

In addition, continues Roels, “the BIS’s Committee on Payments and Market Infrastructures (CPMI) Cross-border Payments Task Force looked for ways to promote cross-border payments that are faster, cheaper, and more transparent and inclusive.4 The CPMI recognised the potential of the LEI and is expected to start demanding its use in payments globally. The new ISO 20022 standard, due to be deployed in November 2022, anticipates this demand by facilitating a dedicated data element in the payload”.

Optimising LEI issuances

So what precisely is going wrong during the onboarding process? In order to procure an LEI from an LEI issuer, clients must provide a raft of information, including documents relating to their legal status and ownership structure.

In many instances, however, financial institutions – as part of their initial and ongoing customer onboarding exercises – are simultaneously collecting and validating the exact same information their clients are supplying to the LEI issuers. This duplication creates unnecessary costs for all parties involved in the various workstreams. Although financial institutions are not to blame for the duplication (LEI issuances occur independently of them) it can cause some strains, especially during the early stages of a client relationship.

Conscious of the difficulties this is causing market participants, the industry is working on initiatives to minimise duplication during LEI issues and client onboardings. The Validation Agent is one of the solutions being proposed.

Applications

In September 2020, GLEIF announced that global financial institutions can now leverage the Validation Agent Framework. Consequently, financial institutions, acting as Validation Agents, can simplify the client onboarding process, as they will now be able to obtain an LEI for customers (in cooperation with accredited LEI issuer organisations) during the onboarding or standard refresh updates – thereby removing duplication in their AML and KYC checks.5

“Financial institutions engaging in the Validation Agent trials … stand to benefit the most from the broader integration of the LEI into their client lifecycle management”

Aside from helping financial institutions obtain significant cost benefits and enhance their data management capabilities, the Validation Agent Framework could enable financial institutions to expand their use of the LEI beyond just capital markets to encompass multiple business lines, leading to significant client onboarding savings. This could have significant benefits in fields such as trade finance, where huge demand goes unmet due to the cost of onboarding smaller clients. As of October 2021, the Asian Development Bank’s latest estimate of the global unmet demand for trade finance stands at a huge US$1.7tn6 – a figure that mass uptake of LEIs through the Validation Agent Framework could potentially help to tackle.

As client onboardings are likely to be expedited, the time-to-revenue for new customers will also be dramatically shortened. Furthermore, the framework could play an effective role in helping financial institutions future-proof their businesses ahead of digital innovation.

“Financial institutions engaging in the Validation Agent trials are recognised as first-movers in the market and stand to benefit the most from the broader integration of the LEI into their client lifecycle management,” GLEIF’s Head of Business Operations Clare Rowley told flow in 2021. Paul Maley, Deutsche Bank’s Global Head of Securities Services reflected, “The adoption of LEIs allows us to associate an alphanumeric identifier to a client, so we know precisely who we are dealing with. It sounds basic but it enables other benefits around new digital services and improved data management.”7

“Although the Validation Agent Framework will initially appeal to financial institutions seeking to streamline regulatory compliance processes for clients, the role is designed to foster broader appeal among banks and to encourage voluntary LEI adoption outside of capital markets. Validation Agents can leverage the LEI and eliminate manual linking of entity data from disparate and external sources,” said GLEIF CEO Stephan Wolf in various blogs after its launch.8

In October 2019, a McKinsey study estimated that this alone would save the global banking industry US$2bn–US$4bn per annum by improving full-time employee productivity in client onboarding.9

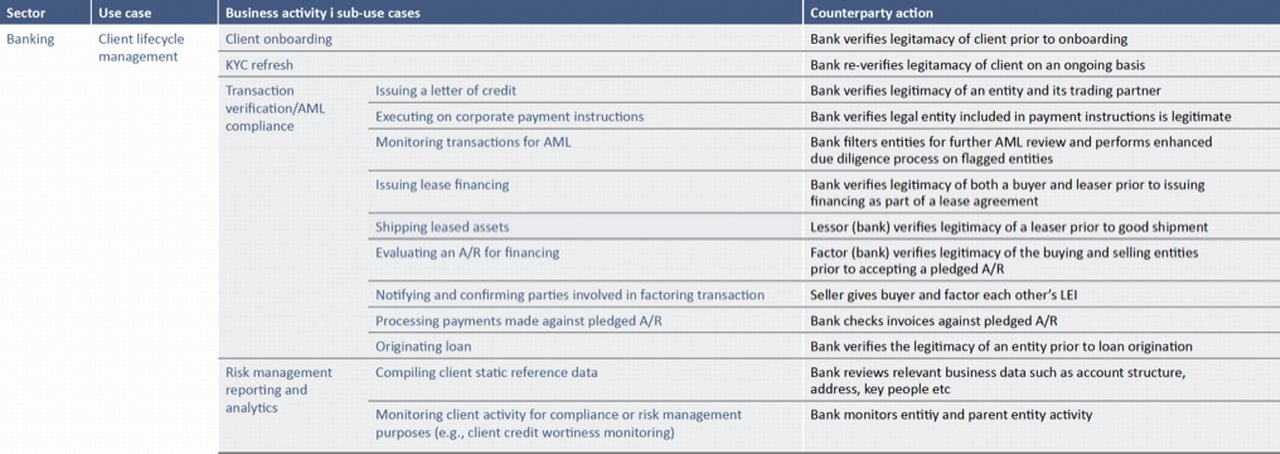

Figure 1 provides a non-exhaustive list of bank processes related to client life cycle management (CLM) that could, according to McKinsey and GLEIF, be “positively impacted by broader LEI adoption, segmented by business activity.”

Figure 1: Bank processes relating to CLM that would benefit from broader LEI adoption

Source: GLEIF

Wolf anticipates that the Validation Agent role is also likely to be assumed by banks seeking to become recognised leaders in identity management, positioning themselves as facilitators of global trade. “By expanding LEI issuance beyond legal entity clients that require an LEI for financial compliance, a Validation Agent can equip its whole business client base with globally recognised identities, which can be used across borders with any legally registered counterparty or supplier around the world. In this way, financial institutions can use the LEI to solve the problem of cross-border trust for clients worldwide,” he explains.

The applications are also interesting for the fields of sustainability and sustainable finance. In a January 2022 article, Wolf outlined how LEIs “can also help to streamline data collection, aggregation and analysis of ESG risks for private unlisted companies, where there is less systematic coverage compared to publicly listed companies.”10 With clear, comparable ESG data still difficult to come by for lenders and investors, particularly when it comes to private companies, LEIs represent a valuable tool in the data-gathering arsenal – particularly as uptake increases.

So where are we in terms of uptake? The latest figures from GLEIF show that adoption continues to grow at a steady pace, with just under two million LEIs issued globally, with 261,000 of those issued in 2021 – an annual growth rate of 15.3%.11

Enhancing the client experience

As clients and financial institutions look to grow their revenues and minimise operating costs, process duplication is a deficiency that needs to be urgently tackled. By acting as Validation Agents, financial institutions can put themselves in a good position to benefit from a vastly streamlined and cost-efficient LEI issuance process for clients, leading to a speedier and more rationalised client onboarding experience. The elimination of duplication will not only generate cost benefits for the financial institutions, but also for clients too.

Sources

1 See https://bit.ly/3vcGsPm at iso.org

2 See https://bit.ly/3LOhonD at getlei.com

3 See https://bit.ly/36B10GT at gleif.org

4 See https://bit.ly/3LWsdE0 at bis.org

5 See https://bit.ly/3BKgFPE at gleif.org

6 See https://bit.ly/33I17PJ at adb.org

7 See https://bit.ly/3LXqYEw at gleif.org

8 See https://bit.ly/3BHzdzS at finextra.com

9 See https://bit.ly/3t1MpMb at gleif.org

10 See https://bit.ly/3h7cLqu at gleif.org

11 See https://bit.ly/34V4xiV at gleif.org

Cash management solutions Explore more

Find out more about our Cash management solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

CASH MANAGEMENT, TECHNOLOGY

SWIFT Go: Low value payments rethought SWIFT Go: Low value payments rethought

The launch of SWIFT Go is a milestone for the cross-border payments space. As the story continues to develop, flow explores how the industry is driving the initiative forward – and how companies could benefit

WHITE PAPERS/GUIDES

Guide to ISO 20022 migration: Part 4 Guide to ISO 20022 migration: Part 4

In September 2020, we released the third in our series of guides to the upcoming ISO 20022 migration. That edition covered a number of changes that had taken place that year, including the revised ISO 20022 delivery dates for SWIFT and several of the world’s major market infrastructures. This meant that 2021, the original year of the ISO 20022 migration, had become the year of delivery. As we edge closer to the finish line, Deutsche Bank team now presents Part 4 of this journey in advance of Sibos 2021

WHITE PAPERS/GUIDES

Guide to ISO 20022 migration: Part 3 Guide to ISO 20022 migration: Part 3

In 2019, recognising the magnitude of the transformational initiative underway in the payments world, we launched a series of guides to ISO 20022 migration. These were designed to help the industry navigate and understand the evolving journey towards a single global payments standard. The Deutsche Bank team now presents Part 3 of this journey in advance of Sibos 2020