31 August 2022

“Money makes the world go round” goes the song from Cabaret, yet teenagers learn surprisingly little from school about managing personal finance. flow reports on an initiative in Germany that is addressing this education gap

MINUTES min read

Can I afford to buy this new video game with my pocket money? Is it worth putting money aside and if so, what’s the best way to save for old age? Many 15-year-olds struggle to answer questions such as these, an OECD survey on financial literacy, published in 2020, found.

Around 117,000 teenagers from 13 countries took part in a test to evaluate their knowledge and skills relating to money matters. The assessment addressed topics such as dealing with bank accounts and debit cards, understanding interest rates on a loan and choosing between a variety of mobile phone plans. The results were sobering: one in seven 15-year-olds was unable to make even simple decisions on everyday spending. Moreover, on average across OECD countries, only about one in three students had the skills to interpret a bank statement, the report showed.

While Germany did not participate in this test, it is unlikely that it would have scored much better. This is because the country lacks a national strategy for financial literacy, as Dirk Loerwald, Professor for Economic Education at the University of Oldenburg, pointed out in a January 2022 guest contribution for the Association of German Banks.

“Possibly, this reservation is due to the widespread misunderstanding here that financial education is a special form of education that is relevant only for people working at investment banks, in wealth management, at accounting firms or for other financial market participants. But this is a fallacy,” he wrote. According to Loerwald, financial education is “a basic competence” that “allows for a reflected participation in society, economy and politics”.

Talk, don’t teach

This is where the initiative “So geht Geld” (translated as “How money works”) comes in. The project helps young people to acquire financial proficiency and gain a better understanding of economic connections. When invited by teachers, Deutsche Bank employees go into schools to talk to teenagers about the history of money, raise awareness of what affects their purchase behaviour and explain how everything from individual loans to the global financial system works.

“Going forward, we’ll put even more emphasis on the financial education of the next generation,” pledged Christian Sewing, CEO of Deutsche Bank, in May 2021 during his Sustainability Deep Dive. “From this year on we will ask senior managers to liaise with schools of their choice and offer them lessons on financial literacy: 350 of our colleagues in Germany have already registered for our initiatives on financial education – let’s double our ambition to 700 colleagues by the end of 2022 and aim for each of them to give at least one lesson on financial literacy per year.”

“We want to empower teenagers to make suitable financial decisions right now and as adults.”

“A lack of financial knowledge can become a real problem for young people”, adds Suzana Schäfer who is responsible for financial literacy programmes at Deutsche Bank within the Corporate Social Responsibility (CSR) department. “A lax handling of money and credit can lead young people into a debt trap.”

Therefore, Deutsche Bank experts help to organise school lessons that teach pupils how to be responsible with money. To reassure schools and parents of its neutrality, Deutsche Bank has developed the programme in cooperation with the education agency YAEZ which – together with the Association of German Banks – has also prepared the teaching materials. Launched in 2019, “So geht Geld” is aimed at pupils starting from Year 5 at all types of school. Since the beginning of 2021, around 380 lessons took place in Germany.

“It’s great to see how teenagers start to think differently about topics like savings or banks when it relates to their lives,” says Ingo Ottmann, Regional Head Commercial Clients Hessen South, Deutsche Bank. “It’s important to let the pupils talk about topics that matter to them – like buying a smartphone or the latest video game – rather than us doing dull teaching of economic issues.”

Ottmann is one of the 950 Deutsche Bank employees who have signed up to the programme so far. “I believe it is necessary to learn how to deal with money as soon as possible. I have two kids and I recall my own time at school when financial education didn’t really play a role,” he says. “We want to empower teenagers to make suitable financial decisions right now and as adults. Therefore, we need to pick up everyone in their everyday life, show the relevance and implications for their future phases of life. Let it feel like fun to discuss finance issues”.

Having worked in banking for more than two decades, Ottmann struggles with the declining reputation of the industry within society. “By going to schools, I want to show a different picture of what working for a bank could look like.” Ottmann joined Deutsche Bank in the private clients’ business around the turn of the millennium for a dual study programme – at a time when working for a bank was considered a more attractive proposition by young people than it is now.

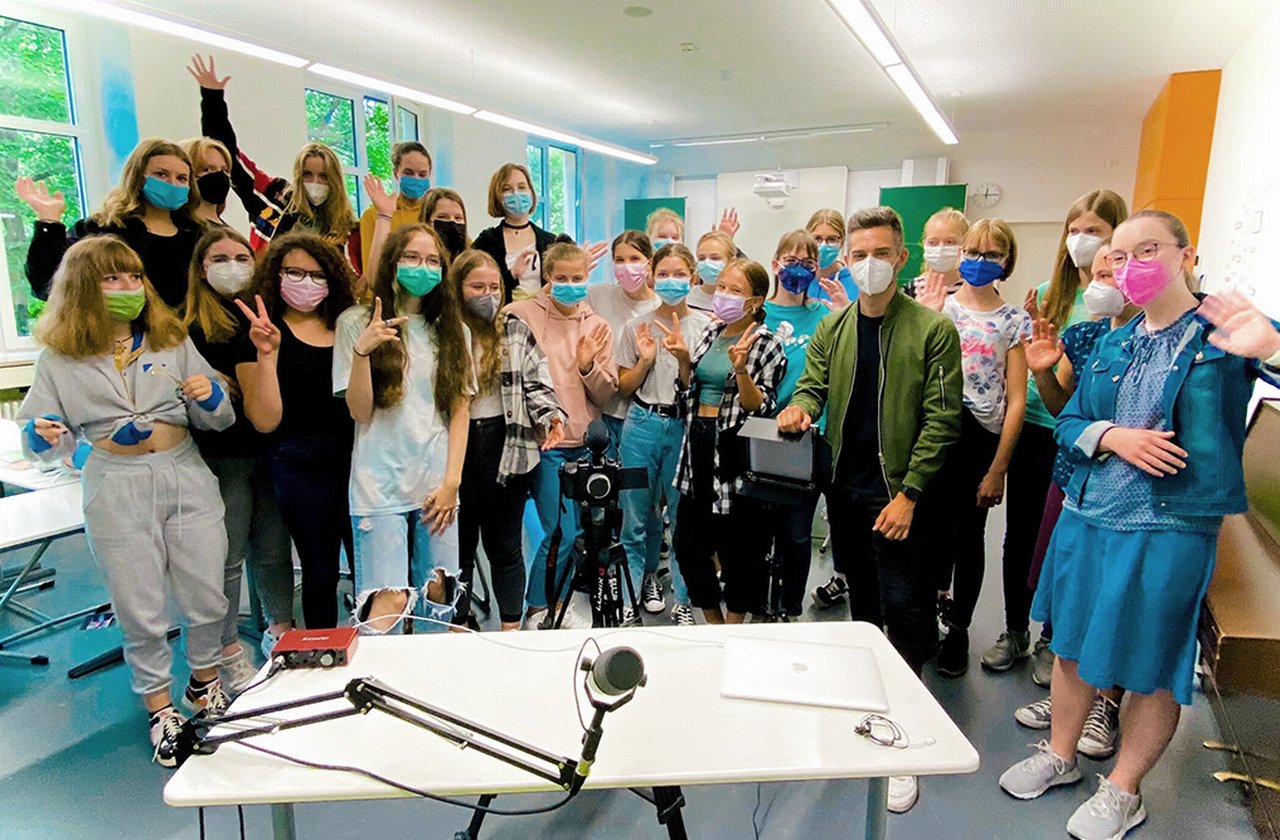

Pupils at an online financial literacy class

Home schooling rethought

Ottmann’s first pupils were a ninth grade class, aged 15 to 16, at a school in Darmstadt, whose teacher had reached out to him via a local business contact. In his main job, Ottmann manages relations with commercial clients in the south of Hessen.

Despite making careful preparations, he faced a challenge from the outset. As his project kicked off in spring 2021 – as the second year of the Covid-19 pandemic began – Ottmann had to give most of the lessons from his desk at home. Together with his colleague Sarah Theuerkauf – a trainee at Deutsche Bank – he made the online classes as interactive as possible by using the Doodle Poll tool, digital point clouds or group work on case studies.

“For example, we asked the pupils what comes to mind when they think about money,” he recalls. In a second step, the teenagers were then asked to consider how their parents and grandparents would have answered this question. “Changing perspectives helps to raise awareness of why saving is important or under which circumstances taking up debt might be reasonable,” Ottmann believes.

However, several topics that were addressed focused less on banking. Ottmann and the schoolteacher also talked to the class about why streaming companies like Netflix, Amazon and Spotify offer part of their products free of charge – explaining the concept of data as a new currency. Moreover, the teenagers were invited to ask all the questions that came to mind. Ottmann recalls one pupil asking whether a marriage settlement would make sense: “I thought this was a pretty pragmatic question for a 15- or 16-year-old,” he laughs.

In general, he was surprised by how informed and enthusiastic many of the pupils were during the discussions. “Yet, it was a challenge to keep everybody on board, given the different social and economic backgrounds of the teenagers”, he says. In total, he gave six lessons spread over two months – with the last class taking place in June 2021 at the school: “After weeks of home schooling, it was great to meet everybody in person.”

For him, the first project was a runaway success, and he is now looking for a follow-up class on “So geht Geld” in Darmstadt: “Some of the kids are still calling me and ask questions, like my top tips for writing a job application.” Two of the teenagers have applied for an internship at Deutsche Bank, and one is even interested in starting a bank traineeship.

Corporate Bank solutions Explore more

Find out more about our Corporate Bank solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

Community, Macro and markets {icon-book}

Democratising finance Democratising finance

Periods of disruptive innovation have always transformed the inequality map. Digital technology has transformed and democratised finance, for example. In her new book, Deutsche Bank Research Senior Strategist Marion Laboure explains how fintech is tackling financial exclusion, and what more can be done

Community

Getting women back to work Getting women back to work

Women, both in the workplace and at home, have been disproportionately affected by the global pandemic. flow shares how Deutsche Bank is partnering with Dress for Success, a women’s support organisation that has evolved into a formidable agent of change, providing services that go far beyond what its name suggests

Community, flow case studies

New ways of working New ways of working

Agile working promises to make companies more dynamic. How? flow’s Desiree Buchholz and Clarissa Dann report on how this is happening on the ground, providing insights from Deutsche Bank Corporate Bank’s own agility journey together with that of the SAP treasury team