7 July 2022

As economies around the world pledge their commitment to net-zero emissions by 2050, companies need to step up their decarbonisation plans. Deutsche Bank’s Lavinia Bauerochse reflects on how this is changing the role of banks and why transition is becoming a core element in client conversations

MINUTES min read

Tackling climate change is one of the biggest challenges of our generation. Policymakers, companies and individuals need to take urgent and co-ordinated action to achieve net zero emissions by 2050, and the momentum has, encouragingly, ramped up since the COP26 summit in Glasgow held in November 2021. While many companies and market participants have focused on ‘dark green’ activities over the last couple of years, managing the transition is now becoming essential for corporates and financial institutions alike.

The term ‘transition’ refers to the time period during which an organisation transforms its high-carbon business model to adapt it to a low-carbon world. For many industries, this shift to net zero requires fundamental changes and organisations need to act now in order to mitigate transition risks. This is undoubtedly more challenging for high climate impact sectors, such as power, coal mining, upstream oil and gas, auto manufacturing, cement, steel, aviation and shipping, collectively account for approximately 75% of greenhouse gas emissions globally1

Some industries have already started their journey – for example certain oil and gas companies are using their knowledge and experience gained from developing off-shore oil production to create offshore wind energy infrastructures. Others have just begun the walk and require more support in defining a clear pathway towards meeting the goals of the Paris Agreement, that is limiting global warming to well below 2°C, preferably to 1.5°C, compared to pre-industrial levels. Ultimately, every business will be on its own journey to net zero, with specific financing, strategic and operational priorities.

The role of banks

In any case, transition requires unprecedented levels of investment – and innovation. In May 2021 the International Energy Agency pointed out in the report, Net Zero by 2050: A Roadmap for the Global Energy Sector, that by 2050 almost half the CO2 emissions reductions will come from technologies that are currently only at the demonstration or prototype phase. “This demands that governments quickly increase and reprioritise their spending on research and development – as well as on demonstrating and deploying clean energy technologies – putting them at the core of energy and climate policy,” said the IEA2.

However, the responsibility does not just fall to governments and policymakers, the corporate sector and banks will be key – with the role of banks being two-fold: On the one hand, they will act as growth enablers helping to redirect capital flows to a lower carbon economy. On the other hand, they are risk managers and need to make sure to align their loan portfolio according to financial risks that are associated with ESG risks. In this respect, banks are guided by regulatory frameworks and their own commitments to reach net zero CO2.

“It is not that decisive where companies are on their transition path just yet, it is critical that they outline where the journey leads to”

A core part of Deutsche Bank’s sustainability strategy is our commitment to act as a reliable partner in financing and advising clients on the path toward the Paris Agreement on Climate Change. We want to ensure a just and orderly transition to a lower carbon economy without causing unnecessary negative social effects and widening inequality. As a significant milestone towards more transparency, Deutsche Bank disclosed in March 2022 data on its corporate loan portfolio and announced to deploy different levers to decarbonise its financing activities3

. These include:

- Provision of transition financing to clients reducing their carbon footprint

- Rebalancing our loan portfolio towards clients with greater focus on developing decarbonisation plans and on fewer carbon-intensive technologies such as renewables; and

- Reducing exposure to clients with limited capacity or willingness to decarbonise.

By using the International Energy Agency (IEA)’s Net Zero scenario (NZE) as its benchmark, we are developing net zero pathways for our overall loan portfolio, while concentrating on four particularly energy-intensive sectors driven by the following specific metrics:

- Oil and gas: kilograms of CO2e per gigajoule (Gj) of production;

- Power generation: kg of CO2e per megawatt hour;

- Steel: kg of CO2e per tonne of steel produced;

- Automotive: g of CO2/e per vehicle kilometre travelled (Scope 3)

This article shares how this strategy is working on the ground, in day-to-day conversations with clients and in transactions that support their journey. While it is not that decisive where companies are on their transition path just yet, it is critical that they outline where the journey leads to.

Better ESG, better results

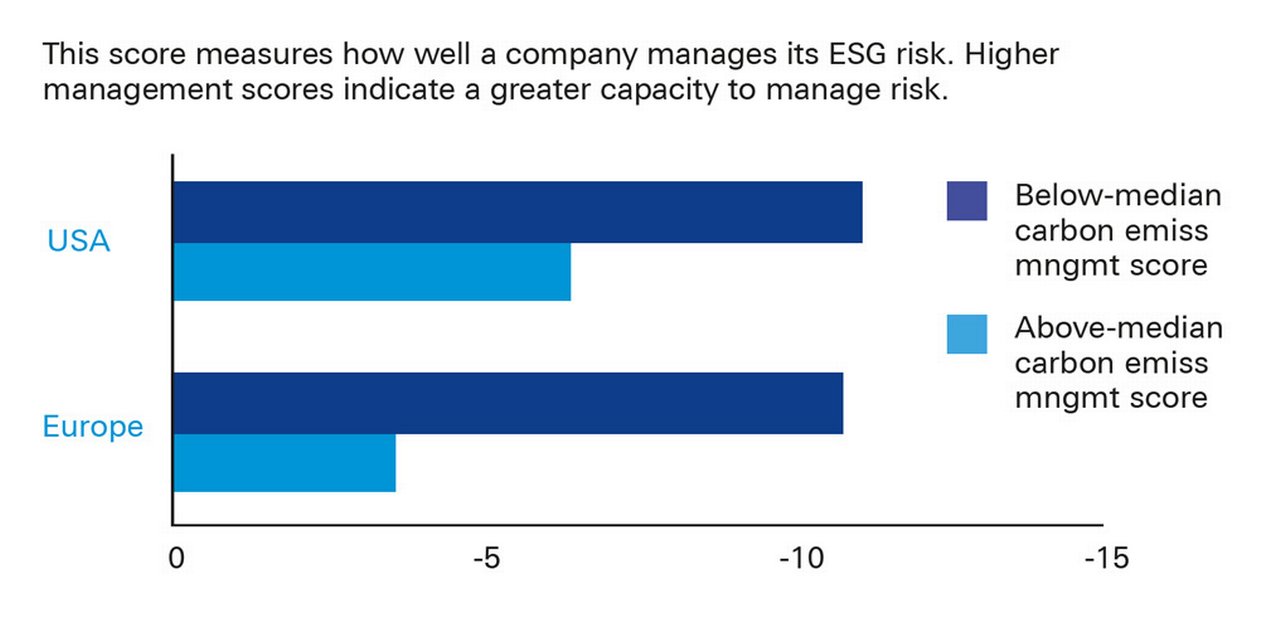

Before we look at how financing structures can help, it is important to remember that there is a clear economic rationale behind steering capital to companies with a better emissions management. Evidence published by Deutsche Bank Research suggests that companies which have put in place a well-working ESG risk management score better results than their peers. In the US, the effect is even more visible (see Figure 1). This score (from 0 to 10) measures how well a company manages its ESG risk. Higher scores on management indicate greater capacity to manage risk.

Figure 1: Median total returns per carbon emissions management score Jan–Apr 2022

Source: Emissions in focus on Earth Day, Deutsche Bank Research (22 April)

But improving the carbon emissions management does not happen overnight. In this sense, every company is different: While some will require transition financing to invest in more energy-efficient machinery and manufacturing techniques, others may be more focused on increasing recycling shares of their end product and managing Scope 3 emissions in their wider supply chains.

Transition infrastructure and commodities

In general, it all starts with energy transition. One angle for Deutsche Bank’s vital contribution is to finance commodities and products that support the overall net zero transition journey. Redeveloping oil and gas assets so that they lead to lower greenhouse gas emissions per barrel at design stage is just one way that we have put this into practice. For example, Deutsche Bank’s Natural Resources Finance Team recently secured a US$1.1m reserve-based lending facility with Norwegian energy producer Noreco, which is a shining example of how good lending structuring made this possible4 .

The race is on to ensure there is enough installed renewable capacity to meet rising global demand for energy without increasing emissions. “Renewables face a range of policy uncertainties and implementation challenges, including those relating to financing, permitting, social acceptance and grid integration. Current increases in commodity prices have put upward pressure on investment costs, while the availability of raw materials and rising electricity prices in some markets pose additional challenges for wind and solar PV manufacturers in the short term,” says the IEA. It looks to government ECAs and lenders for the funding needed to overcome this.

The current geopolitical climate is of particular relevance to our clients. The question of how to become more self-sufficient with regards to energy-supplies in light of spiking energy prices is particularly pressing for companies and we’re able to support these efforts.

For example, we recently assisted BASF Group in the acquisition and construction of the world's largest offshore wind farm off the Dutch coast and structured the financing of the complex project. This transaction was groundbreaking in many respects. At a time when energy security is being discussed everywhere, this is the first time that a company has invested significantly in a wind farm itself in order to reduce its dependence on third parties. At the same time, it is an important step for BASF to become climate-neutral by 2050.

Among the renewable energy transactions Deutsche Bank has supported was the export finance partnership with China’s Sinosure for three onshore wind farms in Australia, with installed capacity of around 480 megawatts. As recently as 2016, only 175 of the country’s electricity came from renewable sources, and 22 years ago 83% of its power production came from coal.5

Supply chains enter into focus

When it comes to transitioning towards a net zero economy, supply chains are of particular importance, given that up to 90% of an organisation’s environmental impact lies in its value chain – either upstream (in the supply chain) or downstream (e.g. the product use phase6

). At the same time, the geopolitical environment has done much to concentrate the corporate mind on bringing supply chains closer to home. As near-shore production would also shorten transportation distances this could positively impact ESG alignment of suppliers.

As the pressure for companies to track Scope 3 emissions and decarbonise their supply chains will continue, value chains of global retailers and original equipment manufacturers (OEMs) will get under scrutiny, pushing companies to seek for green products, such as green steel or aluminium. This duty doesn’t end with the environmental considerations – social and governance factors are also moving into the spotlight as the EU plans to hold companies responsible for forced labour, child labour, inadequate workplace health and safety or biodiversity loss in their supply chains.7

This is where Deutsche Bank works with corporates looking to onboard sustainability-linked supply chain finance programmes (SSCF) in order to incentivise their suppliers to enhance their ESG performance through preferential pricing. Therefore, SSCF programmes are a powerful tool to improve sustainable environmental and social practices across the entire client supplier ecosystem.

Yet, monetary incentives only act as a signal: Once the systems are in place, suppliers need to demonstrate how they are or are not achieving the required KPIs – with data providing hard evidence of sustainable behaviour. This allows buyers to cluster suppliers according to their ESG performance and adjust its procurement strategy. Suppliers that are not willing to start their ESG journey may in the future no longer be sourced from.

Partnering with Deutsche Bank, German consumer good company Henkel is one of the first companies that have linked an existing supply chain finance programme to the suppliers’ ESG ratings. By improving their ESG rating, suppliers can reduce financing costs in the supply chain. The prerequisite for this is that they have a corresponding ESG rating. Initially, Henkel suppliers in Europe which are integrated into the existing supply chain finance program with Deutsche Bank can benefit from the new structure. In a further step, the program will be expanded to include suppliers outside of Europe. In addition to the environmental component (“E”), the program also takes into account social aspects (“S”) and good corporate governance (“G”).8

Transition dialogues

However, as the world is stepping up its efforts to meet climate objectives, it raises a further question: what will happen to assets where no transition is possible? In the past, we saw divestment strategies, but given the necessity also get traditionally “brown” sectors onto transition paths, we expect engagement and responsible ownership to play a more important role in public debate this year and going forward.

As such, essential questions need to be addressed: Could divestment alone decrease emissions? Who might be the best owner of harmful assets? Do governments need to intervene? It is a controversial debate, but one that needs to take place. The world might be better off with a responsible run down overseen by transparent reporting and stakeholder pressure.

Supporting our clients in defining clear pathways towards net zero is therefore core to our sustainability strategy which is why we actively engage in transition dialogues with our clients. While we want to learn how their transition strategies look like, our clients want to hear more about how we can support specific sustainability initiatives and empower them to provide transparency to investors. As outlined above, corporates access to capital will be increasingly bound to credible sustainability strategies and measurable outcomes.

In this regard, accurate data will be key for corporate decision-making and imperative for the risk management of financial institutions. So far however, the lack of standardised and consistent ESG data presents a challenge. To tackle this issue, Deutsche Bank has for example teamed up with SYSTEMIQ, TLGG Consulting and SINE Foundation to sketch a potential solution on how to improve access to and sharing of high-quality ESG data along companies’ value chains – which is the foundation of an ESG data commons.9

As a bank, we plan to increase the volume of ESG financing to more than €500bn by year-end 2025, as announced at our Investor Deep Dive in March 2022.10.

In this way, I do believe that Deutsche Bank is making a contribution to fending off environmental and human catastrophe but, on a more immediate note, forging the way towards more sustainable businesses and more resilient communities around the globe.

Sources

1 See https://bit.ly/3NDELjq at ourworldindata.com

2 See https://bit.ly/3P7Ov6L at iea.com

3 See https://bit.ly/3yoZy4O at db.com

4 See https://bit.ly/3R8ddpg at flow.com

5 See https://bit.ly/3OOQVrc at flow.com

6 See https://bit.ly/3P8ekDp at carbontrust.com

7 See https://bit.ly/3nGCJo8 at flow.com

8 See https://bit.ly/3Awphe2 at db.com

9 See https://bit.ly/3yHmn4Q at sine.foundation

10 See https://bit.ly/3yIlaud at investor-relations.db.com

Trade finance solutions Explore more

Find out more about our Trade finance solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

SUSTAINABLE FINANCE

Tackling the lack of ESG data Tackling the lack of ESG data

As more investors steer capital to companies with credible sustainability strategies, corporates need to ramp up their ESG reporting. But accessing the relevant data is difficult, reports flow’s Desirée Buchholz. How can this challenge be addressed?

Sustainable finance, Trade finance and lending

EU tightens the ESG reins in supply chains EU tightens the ESG reins in supply chains

The European Commission has proposed a new regulation to foster sustainability in corporate supply chains. If enacted, companies will be required to ensure that human rights are respected, and environmental impacts are reduced in their own operations and value chains. flow’s Desirée Buchholz examines what this means in practice

Sustainable finance, Cash management, Trade finance and lending

Eight ESG trends to watch in 2022 Eight ESG trends to watch in 2022

As new ESG regulations and reporting regimes come into force, navigating the transition becomes key; but greenflation could undermine the best of intentions. What are the most important sustainability trends corporates need to watch? flow’s Desirée Buchholz reports