As more investors steer capital to companies with credible sustainability strategies, corporates need to ramp up their ESG reporting. But accessing the relevant data is difficult, reports flow’s Desirée Buchholz. How can this challenge be addressed?

MINUTES min read

Making promises is easy but delivering on them is much harder – especially if you don’t know how to fulfil your pledge. This dilemma is faced by almost all companies, when it comes to making credible progress on their net zero commitments1: To achieve this, they need to track greenhouse gas (GHG) emissions within their own operations and their supply chains. But how do you get consistent data to calculate carbon footprints, report on product life cycles and monitor the sustainability performance of your suppliers?

The challenge is that “existing standards and methods leave significant room for interpretation and result in data inconsistency, impeding quality product life cycle emissions accounting”, noted the Carbon Transparency Partnership during the COP26 summit in November 2021. “In addition, data sharing across companies is limited by complex value chains, data collection challenges and a lack of interoperability between IT solutions.”2

The Carbon Transparency Partnership was launched in June 2021 by the World Business Council for Sustainable Development (WBCSD) – a global, CEO-led community of more than 200 of the world’s leading sustainable businesses – aiming to address “the lack of accurate and granular product-specific data on GHG emissions” and “develop a consistent methodology to calculate and allocate GHG emissions at a product level”.3 The initiative is supported by technology companies like CircularTree, IBM, iPoint and SAP.

So, what are the drivers for tackling the lack of ESG data? And what might a potential solution look like?

Sustainability reporting becomes mandatory

First, it should be noted that the task of getting access to high quality data is becoming particularly testing for companies within the EU, as Brussels is ramping up mandatory reporting on environmental, social and governance (ESG) performance. The Corporate Sustainability Reporting Directive (CSRD) will require companies meeting at least two of three criteria – more than 250 employees, net turnover of €40m-plus and/or a balance sheet exceeding €20m, to disclose data on their sustainability performance.4 In the US, the Security and Exchange Commission has recently also announced its intention to make sustainability reporting mandatory.5

Even though, the European Parliament and the Council most recently decided to delay the CSRD implementation timeline by one year, this only partially releases the pressure on companies to get access to high quality ESG data. All in, the number of companies required to report on sustainability information will increase from 11,700 to around 50,000.

- For companies already subject to the existing Non-Financial Reporting Directive (NFRD), the new rules now apply from 1 January 2024 (reporting in 2025 on 2024 data)

- For large companies not currently subject to the existing regulation, the deadline was moved to 1 January 2025.

- For listed SMEs, as well as for small and non-complex credit institutions and for captive insurance companies the new rules apply from 1st January 2026.

Additionally, the EU plans to hold companies accountable for ensuring that human rights are respected, and environmental impacts are reduced throughout their value chains. Here, the potential for decarbonisation is particularly high: an estimated 70% to 90% of an organisation’s environmental impact lies in its value chain – either upstream (in the supply chain) or downstream (the product use phase).6

Measuring the so-called Scope 3 emissions is though also most challenging, as they capture all the GHG emissions that a company cannot control itself. For example, they include those emissions associated with the transportation of raw materials or waste generated in supplier’ operations.

Investors are re-allocating capital

As the list of ESG reporting requirements grows globally, so does the workload for corporates and their treasury teams. In an Economist Impact survey of senior corporate treasurers conducted in Q4 2021, 36% of respondents cited meeting ESG reporting requirements as the top trend impacting their treasury function.7

However, there is no alternative to improving reporting capacities – even for those companies that are not directly affected by the (upcoming) regulatory requirements. This is because over the years ahead, companies’ access to capital will be increasingly bound to credible ESG strategies and measurable outcomes.

As market data shows, investors have begun to reward concrete moves toward sustainability: According to Morningstar, money held in sustainable mutual funds and ESG-focused ETFs rose globally by 53% last year to US$2.7trn, with a net US$596bn flowing into this market segment.8

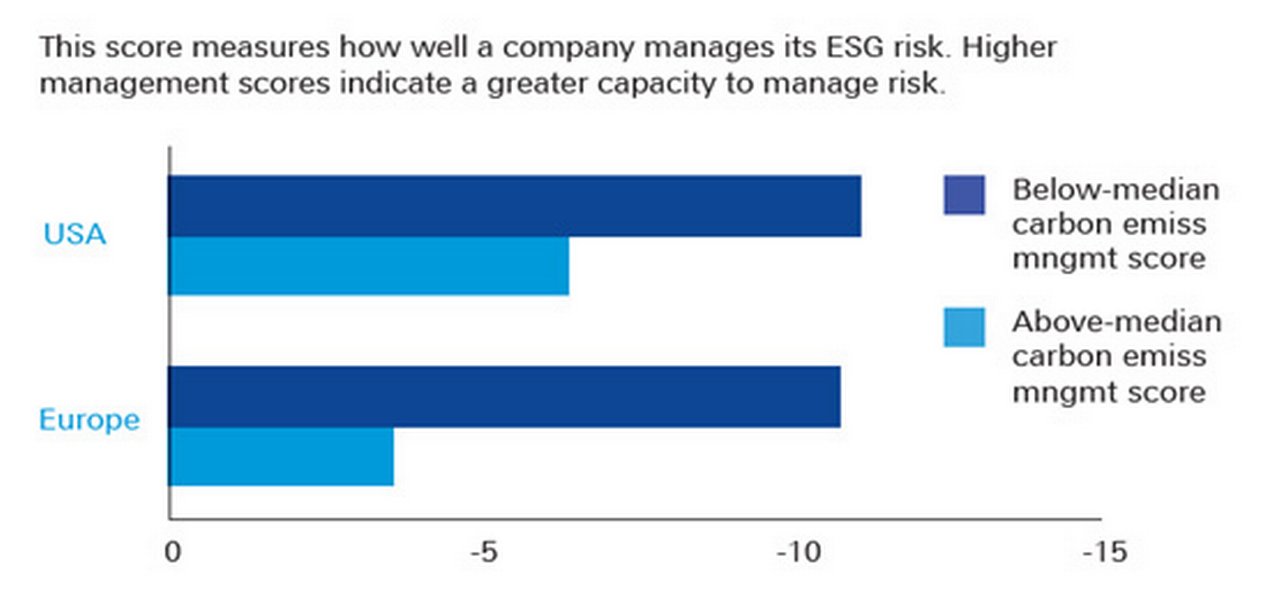

There is a clear economic rationale behind steering capital to companies with a superior ESG performance. Deutsche Bank Research recently reported that firms with an above-median carbon emissions management score have generally seen their results hold up better so far this year (see Figure 1).9

Figure 1: Better ESG performance leads to better results

Source: Emissions in focus on Earth Day, Deutsche Bank Research (22 April)

Will bank’s capital frameworks be adjusted?

Added to regulatory reporting requirements for companies and the increasing investor demand for ESG assets is a third factor – bank regulation – which further increases the need for standardised and consistent sustainability data. Most notably, the Sustainable Finance Disclosure Regulation (SFDR) requires the financial sector to provide detailed information about how they tackle and reduce any possible negative impacts that their investments may have on the environment and society in general.10 This is in turn means that banks need to have access to the respective data.

Moreover, as leading central banks like the Bank of England11 and the ECB12 review their practices of ESG risk management and conduct climate stress tests, this could also have implications for bank capital requirements. The BoE for example has scheduled a conference for 19 October 202213 as a discussion forum on complex issues resulting from adjustment of the capital framework to reflect climate-related financial risks.

“Accurate data will be key for corporate decision-making and imperative for the risk management of financial institutions”

How are banks reacting? “Supporting our clients in defining clear pathways towards net zero is core to our sustainability strategy, which is why we actively engage in transition dialogues with our clients,” explains Lavinia Bauerochse, Global Head of ESG at Deutsche Bank Corporate Bank. In these discussions “accurate data will be key for corporate decision-making and imperative for the risk management of financial institutions“, she adds. “So far however, the lack of standardised and consistent ESG data presents a challenge to creating transparency for investors and other stakeholders – and to identify room for improvement.”

Setting up an ESG data commons

To tackle the lack of high quality ESG data, Deutsche Bank has teamed up with three partners (SYSTEMIQ, TLGG Consulting and SINE Foundation) to sketch a potential solution for improving access to and sharing of ESG data along companies’ value chains. The consortium describes its approach in a recently published white paper “Data Commons for Sustainability”.14

“Data sharing … is key to achieve transparency on ESG datasets, and progress towards net-zero”

“Businesses of all sizes need to know and manage their entire value chains end-to-end, and their products cradle-to-cradle. This in turn requires a cross-sector data collection and cross-sector data exchanges,” the authors write. However, data sharing has yet to become common as companies would run on isolated IT solutions without interoperability and “are wary of lock-ins by the main software providers” because they fear to lose control over competitively relevant data.

To address these challenges, the white paper suggests the creation of a Data Commons for Sustainability. These shared data ecosystems are built among three core pillars, as the authors outline:

- Reciprocity, which means that all connections among stakeholders need to rely on reciprocal relationships and mutual benefits. Stakeholders should have a clear incentive to participate;

- Security, which means that sensitive data must not be exposed at any time. Cryptographic measures are needed to ensure that the data is secure when being exchanged; and

- Openness, which enables new members to join and existing members to leave thereby enhancing scalability of the network.

“Data sharing across multiple companies enabled via privacy and confidential principles that have been agreed upon by the relevant stakeholders is key to achieve transparency on ESG datasets, and progress towards net-zero,” says Shivaji Dasgupta, Head of ESG Technology and EU Chief Data Officer at Deutsche Bank.

“The creation of an ESG Data Commons could help companies to facilitate ESG reporting,” adds Bauerochse. While she agrees that there is no one-size-fits-all solution, the onus is on all companies to find ways that ramp up their sustainability reporting capacities and show measurable results for their decarbonisation plans – now regulators, investors and society all demand it.

Sources

1 See https://bit.ly/3xXuDMy at sciencebasedtargets.org

2 See https://bit.ly/3OvC9W2 at wbcsd.org

3 See https://bit.ly/3OQEGde at wbcsd.org

4 See https://bit.ly/3a36wnO at eur-lex.europa.eu

5 See https://bit.ly/3y017pv at sec.gov

6 See EU tightens the ESG reins in supply chains at flow.db.com

7 See Treasurers are facing key ESG challenges at flow.db.com

8 See https://bloom.bg/39ZLJBB at bloomberg.com

9 See Emissions in focus on Earth Day, Deutsche Bank Research (22 April)

10 See https://bit.ly/3QWEL0H at ec.europa.eu

11 See https://bit.ly/3I3jbn2 at bankofengland.co.uk

12 See https://bit.ly/3y4XmiE at greencentralbanking.com

13 See https://bit.ly/3A9zgWF at bankofengland.co.uk

14 See https://bit.ly/3yrtT3B at sine.foundation

Sustainable finance solutions Explore more

Find out more about our Sustainable finance solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

Sustainable finance, Trade finance and lending

EU tightens the ESG reins in supply chains EU tightens the ESG reins in supply chains

The European Commission has proposed a new regulation to foster sustainability in corporate supply chains. If enacted, companies will be required to ensure that human rights are respected, and environmental impacts are reduced in their own operations and value chains. flow’s Desirée Buchholz examines what this means in practice

Sustainable finance, Cash management, Trade finance and lending

Eight ESG trends to watch in 2022 Eight ESG trends to watch in 2022

As new ESG regulations and reporting regimes come into force, navigating the transition becomes key; but greenflation could undermine the best of intentions. What are the most important sustainability trends corporates need to watch? flow’s Desirée Buchholz reports

TRADE FINANCE, SUSTAINABLE FINANCE

Trade’s sustainability challenge Trade’s sustainability challenge

The majority of world trade is unsustainable, and where it is not, it is a symptom of under-development, says trade economist Rebecca Harding. She shares her methodology for a trade sustainability score and demonstrates why trade policy needs to change