13 January 2022

Meeting the growing list of environmental, social and governance (ESG) requirements is having a greater impact than any other treasury issue, a new survey by Economist Impact reveals. flow’s Desirée Buchholz reports why regulation is a double-edged sword for companies – and what could ease the burden

MINUTES min read

The new year brings a major milestone for ESG regulation in Europe: For the first time, publicly listed companies with more than 500 employees are required to disclose how much of their:

- Revenues;

- Capital expenditure (capex); and

- Operating expenses (opex)

are eligible for the EU Taxonomy.1 For the reporting year 2021, which has just ended for those corporates with financial years aligned to calendar years, companies have to present their share of eligible activities. This is the case if a business activity – such as for example operating onshore wind farms – is included in the delegated acts on climate change mitigation or climate change adaptation.

Yet, eligibility does not say anything about the (un)sustainability of an activity.2 This question will only be addressed for the reporting year 2022, as finance departments will have to report on the actual taxonomy alignment, which requires further tests and screening and therefore goes beyond eligibility.

While this is a first reality check for the EU Taxonomy Regulation, which came into force in July 20203, ESG disclosure is by no means a new exercise for large European corporates. Since the 2017 financial year, the EU has required banks, insurers and capital-market oriented companies to report on ESG aspects of their business under the Non-Financial Reporting Directive (NFRD).4

“However, there were no standards on what activities are actually viewed as sustainable, making it difficult for investors, banks and customers to compare the impact corporate activities have on climate change, biodiversity or pollution,” says Lavinia Bauerochse, Global Head of ESG Corporate Bank at Deutsche Bank.

The taxonomy aims to fill this gap by providing uniform definitions of economic activities that are treated as “sustainable”. To date, however, Brussels has published detailed descriptions for only two of the six environmental objectives – with the remaining four to follow over the course of this year. In the future, the taxonomy might also be extended by a list of socially sustainable activities (social taxonomy) and a classification system for transition paths of companies operating in traditionally brown sectors (transition taxonomy).5

“Over the next two years, companies with more than 250 employees will have to ramp up ESG initiatives and reporting capabilities”

Currently, around 11,700 companies in Europe must disclose sustainability data. Starting with the 2023 financial year, this number will increase to approximately 50,000 as the Corporate Sustainability Reporting Directive (CSRD) replaces the NFRD.6 “Over the next two years, companies with more than 250 employees will have to ramp up ESG initiatives and reporting capabilities,” says Bauerochse.

According to her, these companies should start considering aspects such as energy efficiency or CO2 consumption when investing in new machines or buildings – in preparation for the new regulatory environment as well as expectations from customers, employees and banks.

Treasurers struggle with ESG requirements

While regulatory initiatives aim to prevent greenwashing and support economic transition by helping investors to steer their money towards sustainable activities, complying with this ESG regulation also increases the workload for corporates, new research by Economist Impact suggests.

Its just-published Q4 2021 global survey of senior corporate treasurers identified growing ESG requirements as the top trend impacting the treasury function: It was cited by 36% of respondents – up from 21% in the third quarter. In North America, as many as 52% of participants cited meeting ESG requirements as a key concern, a much higher proportion than for EMEA (26%) or APAC (30%).

At first sight, this is surprising – given that US policymakers have so far followed a voluntary approach to sustainable reporting compared to their counterparts in the EU and Asia. In major Southeast Asia countries like Singapore, Malaysia, Thailand, Vietnam, Indonesia, and the Philippines, ESG disclosure requirements have been around for years.7 And in Japan, companies could be required to report on climate-related risks as early as the current financial year ending 31 March 2022.8

Lake Kawaguchiko in Japan

On the other hand, this could mean that European and Asian treasurers are more accustomed to dealing with ESG reporting requirements, which are to some extent newer for their North American peers – and therefore more challenging.

This interpretation is reinforced by the fact that 60% of treasurers in North America cited “evolving regulation and uncertainty surrounding ESG compliance” as the top challenge to successful implementation of their initiatives. Globally, the share was lower (44%). In Europe, data collection is one of the biggest concerns, cited by 28% of respondents – indicating that European treasurers are already working on fulfilling regulatory requirements.

Is there a chance for a global definition on sustainability?

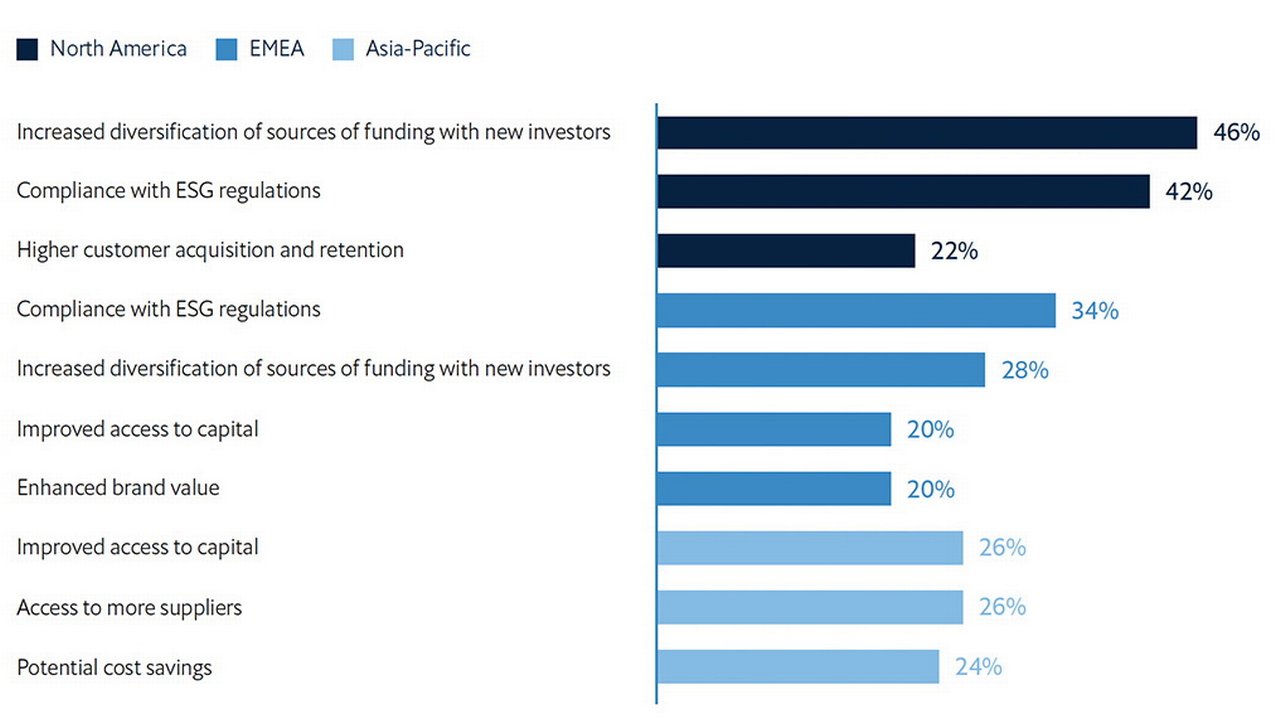

In general, the Economist Impact survey shows ESG regulation to be a double-edged sword for companies. While keeping up with an evolving landscape and uncertainty is named the top challenge, compliance with ESG is also one of the key drivers of treasurers’ growing focus on sustainability initiatives – followed by increased diversification of funding sources with new investors and customer acquisition and retention (see Figure 1).

Figure 1: Primary factors driving treasury functions to focus more on ESG and sustainability initiatives, by region

Source: Economist Impact Survey

“As more and more countries are developing sustainable taxonomies, there is the risk of fragmentation,” says Gerald Podobnik, Chief Financial Officer at Deutsche Bank, Corporate Bank. “This poses a challenge for multinational companies that need to provide ESG reporting in several jurisdictions. Policymakers should try to harmonise their classification systems to provide a clear direction for multinational companies and capital markets.”

He sees the creation of the International Sustainability Standards Board (ISSB) as an “encouraging step”. The remit of the new organisation, based in Frankfurt (Germany), is to define global reporting standards on sustainability.

However, to be effective the body will require a common understanding of which activities are sustainable and which are not, meaning that efforts to align taxonomies such as the Common Ground Taxonomy, which was launched by China and the European Commission at COP26, are also important.9 It covers 61 activities across six sectors, including electricity and gas outlining where there is overlap.

Agreeing on a common understanding of sustainability is not an easy task though – even within the same region, as evidenced by the current debate about nuclear power. The European Commission recently proposed classifying nuclear (and natural gas) as “sustainable” under the taxonomy as these energy sources “facilitate the transition towards a predominantly renewable-based future”, the Commission stated in a press release10 which provoked Austria to announce it was suing the EC on this issue11.

Sustainability will pay off, but investment is necessary

According to the Economist Impact survey, globally the second biggest challenge when it comes to implementing is the additional cost of ESG initiatives. The authors of the study write, “this may indicate that treasurers are unsure about whether or not ESG initiatives will generate cost savings or financial returns”.

“Companies need to think long term but invest short term as part of their transition journey”

“Companies need to think long term but invest short term as part of their transition journey.” Deutsche Banks’ Bauerochse states. Others will run the risk of losing their competitiveness towards customers and employees. For example, investments to increase efficiencies in natural resources – and energy consumption in the production could pay-off soon, given the spark in prices for natural gas and oil.

Furthermore, treasurers should be aware that in the long term, ESG performance will affect financing costs. In a Deutsche Bank Research (db Research) survey published in November 2021, 19% of the 160 corporates surveyed reported that ESG factors have impacted their credit rating over the last 12 months.12

This trend could be reinforced as regulators are starting to include ESG factors into their stress tests. Banks that set up sustainable finance instruments so that clients can benefit from lower financing costs if they meet certain sustainability targets, currently lose margin. Going forward, this might change if the ESG performance of the credit portfolio plays a role – providing even more incentive for banks to make sustainability a key decision factor when it comes to capital allocation.

How are treasurers seeing their role in driving sustainability? What are their strategies for contributing to their company’s ESG goals? To find out more, read the new Economist Impact report – which is supported by Deutsche Bank and can be downloaded here.

Sources

1 See https://bit.ly/3zLkzGZ at assets.kpmg

2 See https://bit.ly/3JYqkpx at sustainalize.com

3 See https://bit.ly/3Gizefg at ec.europa.eu

4 See https://bit.ly/3GhAqQb at ec.europa.eu

5 See https://bit.ly/31NiFJj at ec.europa.eu

6 See https://bit.ly/3faBvx4 at responsible-investor.com

7 See https://bit.ly/3JTzZ0q at sustainalytics.com

8 See https://bit.ly/33hNarf at xbrl.org

9 See https://bit.ly/3GdxCDs at regulationasia.com

10 See https://bit.ly/3fcXweU at ec.europa.eu

11 See https://bit.ly/3rbaXl1 at euractiv.com

12 See Five key facts on ESG finance and investmentat flow.db.com

13 See https://bit.ly/3HYP5jF at ecb.europa.eu

Lavinia Bauerochse

Global Head of ESG Corporate Bank at Deutsche Bank

Sustainable finance solutions Explore more

Find out more about our Sustainable finance solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

SUSTAINABLE FINANCE, MACRO AND MARKETS

COP26: Can companies bear the burden? COP26: Can companies bear the burden?

While governments are making announcements to reduce emissions, the responsibility to make the targets happen falls onto the corporates. flow summarises new Deutsche Bank Research demonstrating why costs are a key concern for some corporates and how finance can support the transition

SUSTAINABLE FINANCE

Five key facts on ESG finance and investment Five key facts on ESG finance and investment

A new survey from Deutsche Bank Research sheds light on what corporates and investors think about ESG and sustainable finance. flow’s Desirée Buchholz identifies five key learning points from the team’s findings

Sustainable finance, Regulation

Journey to green in ESG transformation Journey to green in ESG transformation

As capital pours into ESG investing, how are regulatory frameworks developing to support this growth? flow’s Clarissa Dann focuses on key points from dbSustainability Research analysis