15 February 2022

Azena, an IoT-based security equipment start-up funded by Germany’s engineering and technology giant Bosch, is revamping its digital payment strategy. flow’s Desirée Buchholz reports on its partnership with Deutsche Bank to improve the customer experience and meet the needs of a fast-growing B2B marketplace

MINUTES min read

Where in the car park can you find vacant spaces? Which parts of a shopping mall attract the most customers? How can manufacturing processes become more efficient and secure for workers? All these questions can nowadays be answered with the help of smart video cameras – and the Munich-based start-up Azena is working on delivering to users of security cameras exactly these kinds of analytics. Its customer list includes local transport operators who want to gain insights into passenger flows or retailers studying shopper behaviour to optimise product offering and placement.1

The start-up was founded in 2018 under the roof of the German technology company Bosch, a global supplier of mobility solutions, industrial technology, consumer goods, and energy technology with total revenue of €71.5bn in 2020.2 Among the areas Bosch focuses on are solutions around the Internet of Things (IoT). This is where Azena comes in.

The company has developed an open operating system for security cameras which runs on the cameras of Bosch and other manufacturers such as Hanwha Techwin and Vivotek. Based on this system, Azena launched a marketplace in March 2020 allowing software developers to sell their video analytics applications to the users of these video camera. These for example include the U.S. professional hockey team, the Pittsburgh Penguins, who are using AI to monitor crowding at its stadium entrances.3

“Our app store connects software developers and the users of cameras, and we receive commissions for the sale of software licences that take place on our marketplace,” explains Michael Staneker, Azena’s Project Manager. Currently, the marketplace offers more than 100 video analytic apps from 30 software developers to registered customers in more than 40 countries.

Digital marketplaces require a new payment strategy

Business models such as these are currently gaining traction, as data suggests. Global sales conducted via B2B marketplaces are expected to quadruple from US$1trn in 2020 to US$4trn in 20254, flow reported in its December 2021 article Digital marketplaces – a gamechanger for payments and treasury.

Working area of Azena in Munich

This growth is sparked by several advantages these marketplaces deliver to their participants: While buyers benefit from greater choice, faster delivery and cost reduction, sellers gain access to a larger number of clients at a lower risk. The company operating the marketplace can generate new revenue streams from fees on transaction volumes. These platforms also enable manufacturers to sell directly to the customer, thereby circumventing resellers and increasing their margins.

Yet building a digital marketplace is challenging for several reasons. The benefits outlined above can only be delivered when all relevant industry players are participating. “Among the factors that are decisive for the success of marketplaces is a convenient, safe and cost-efficient payment strategy,” says Victor Winterhalder, Deutsche Bank’s Relationship Manager for Azena. In an extreme scenario, a customer may even stop a purchase they do not find a payment method that fits their needs. “In any case, this would create a bad user experience.”

Replacing the payment service provider

It is for this reason that Azena decided to replace its existing payment service provider (PSP) in early 2021 and migrate to a new payment platform Deutsche Bank has developed specifically for digital marketplaces.

"Our previous payment service provider was unable to fulfil all our requirements"

“Our previous payment services provider (PSP) was unable to fulfil all our requirements,” recalls project manager Staneker. Most importantly, the range of available payment methods was limited. “In the B2B world, it is very common to purchase on account, but this wasn’t supported by our PSP in all countries. However, many of our clients didn’t want to use the methods available such as credit card payments or PayPal.”

The second feature, which convinced Azena to shift payment handling to Deutsche Bank, was “the geographic reach of the bank”, Staneker explains. The start-up is pursuing an ambitious global growth plan for its marketplace, which currently offers more than 100 video analytic apps from 30 software developers to registered customers in more than 40 countries.

“As we expand the marketplace internationally, we will require further assistance – for example when it comes to embedding currency conversion,” says Staneker. “And we feel that there is strong support from Deutsche Bank at this end too.”

Automate the payment process end-to-end

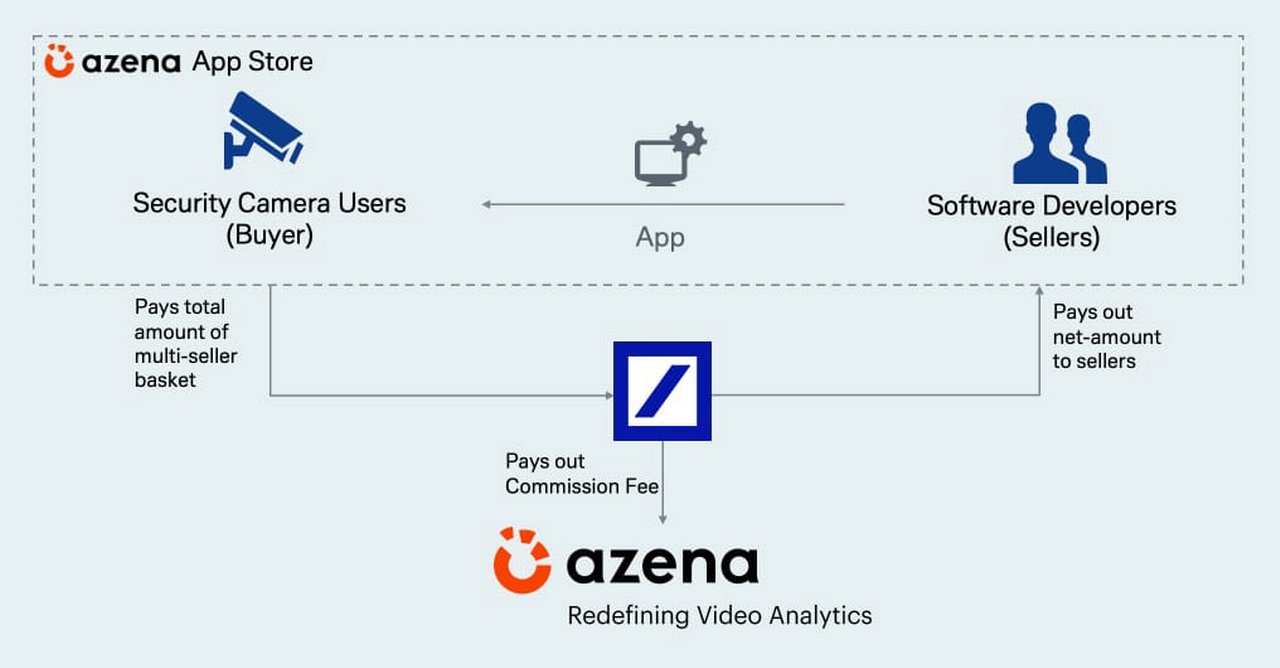

So how does the new payment solution that Azena has implemented with Deutsche Bank work? In a nutshell, this is a platform that was developed specifically for digital marketplaces; allowing companies to automate and integrate the entire payment process end-to-end (see Figure 1).

Figure 1: How the new payment process works

In Azena’s app store users of surveillance cameras can now choose between credit transfers in euro, US dollar or credit card payments when paying for their software purchases – with further options to follow. Customers can potentially buy from multiple app developers in one transaction, thanks to the “’Amazon-like’ check-out process with a single debit for software licences from multiple sellers”, explains Matthaeus Sielecki, Cash Management Structuring at Deutsche Bank. This is possible because funds can be split between different merchants, with charges and marketplace commissions also being deducted in the pay-out process.

Azena also benefits from an automated matching of incoming payments to the respective orders “which makes reconciliation more efficient on our end as well as providing the basis for further internal process automation,” says Jörg Halder, a consultant at Bosch and IT manager for Azena’s payment project.

Deutsche Bank also takes care of regulatory responsibilities, such as onboarding software developers on the payment platform including contracting, risk assessment and KYC. The Bank also assures that software developer funds are protected and ring-fenced on the platform while flows can be traced to create an audit trail for treasury. “All these features will make payments more efficient, secure and cheaper for us and our partners,” Staneker believes.

"For purchase on account there was nothing we could copy and paste from"

What was special about this project was that Azena acted as a pilot client for Deutsche Bank’s new marketplace payment engine. This in turn meant that “we entered new territory together”, recalls Halder. “For purchase on account there was nothing we could copy and paste from, which is why we needed to co-develop and re-iterate to find the best solution.” As the processual and technical features were agreed on, the company started testing by initially sending small payments. “We didn’t simulate in a sandbox but tested on the live system to verify if reconciliation works as expected in across different countries and will cope with high volumes.”

Blueprint for a wider roll-out at Bosch

After a one year’s work, the new payment solution went live in early January 2022 with the existing PSP being gradually replaced. “We are now live in Germany and the US. Once we have gained more insights, we will continue the roll-out to other countries – for example in Asia,” says Staneker.

While his priority is to drive up transaction volume by getting more software developers to join the new payment platform, Staneker already has more plans on the drawing board. This includes the offering of FX conversion services as well as financing solutions such as factoring within the marketplace. “This will help sellers to improve their receivables management and cashflow,” the project manager says, although “this is not urgent but rather something for the future”. When it comes to payments, the next step could be to introduce the feature of recurring payments, which would allow for subscription-based software purchases.

While this will support Azena to grow its marketplace, the project also acts as a blueprint for its funding partner Bosch, which plans to build digital ecosystems around its other product and service offerings. Azena’s experiences with its app store for surveillance cameras could also help other Bosch units to understand the requirements that marketplaces create for finance and payments.

Sources

1 See https://bit.ly/3GJJcph at azena.com

2 See https://bit.ly/3gHd6zT at bosch.de

3 See https://bit.ly/3JmK6d0 at azena.com

4 See https://bit.ly/3pNVK8P at finextra.com

Corporate Bank solutions Explore more

Find out more about our Corporate Bank solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

CASH MANAGEMENT, TECHNOLOGY

Digital marketplaces – a gamechanger for payments and treasury Digital marketplaces – a gamechanger for payments and treasury

Digital sales are booming. While marketplaces provide new business opportunities for buyers, sellers and operators, they also create new challenges for treasurers. flow’s Desirée Buchholz reports on how treasury can define a new payment strategy

Cash management, Technology

E-commerce for treasurers: staying ahead of the game E-commerce for treasurers: staying ahead of the game

No industries are safe from digital disruption and the pandemic has accelerated the pace of change in the world of shopping. At a recent webinar hosted by The Economist, treasurers of a B2B and a B2C company outlined the challenges of expanding e-commerce operations, choosing the right platforms and payment providers, and increasing payments digitalisation to support emerging retail trends

CASH MANAGEMENT, TECHNOLOGY {icon-book}

Reimagining the future of payments Reimagining the future of payments

The pandemic has accelerated the pace of change over the past year and bank-led merchant solutions are among the responses to a huge shift in payment methods and the boost to e-commerce, reports Helen Sanders